Ethereum

Crypto VC: Ethereum is the ‘simplest, safest 3X’ opportunity now

Credit : ambcrypto.com

- ETH might rise to $10,000 per crypto VC companion at Moonrock Capital.

- There was stable traction for ETH, together with renewed staking curiosity, which might push costs larger.

A crypto VC projected Ethereum’s [ETH] Value might attain a cycle excessive of $10,000 regardless of lagging main cap altcoins and Bitcoin [BTC].

In keeping with Simon Dedic, founder and companion of crypto VC Moonrock Capital, ETH may very well be the ‘safest 3x‘likelihood now.

“In these present market situations, $ETH might be the simplest and most secure 3x alternative nonetheless obtainable.”

Primarily based on as we speak’s worth, that is about $10,000 per ETH. There are rising bullish requires ETH, with asset supervisor Bitwise projecting an identical ETH.contrarian wager‘ outlook in October 2024.

Is ETH’s Slowdown an Alternative?

Regardless of a slowdown in comparison with majors like Solana [SOL] and BTC, ETH has seen a light and stable pattern after the US elections.

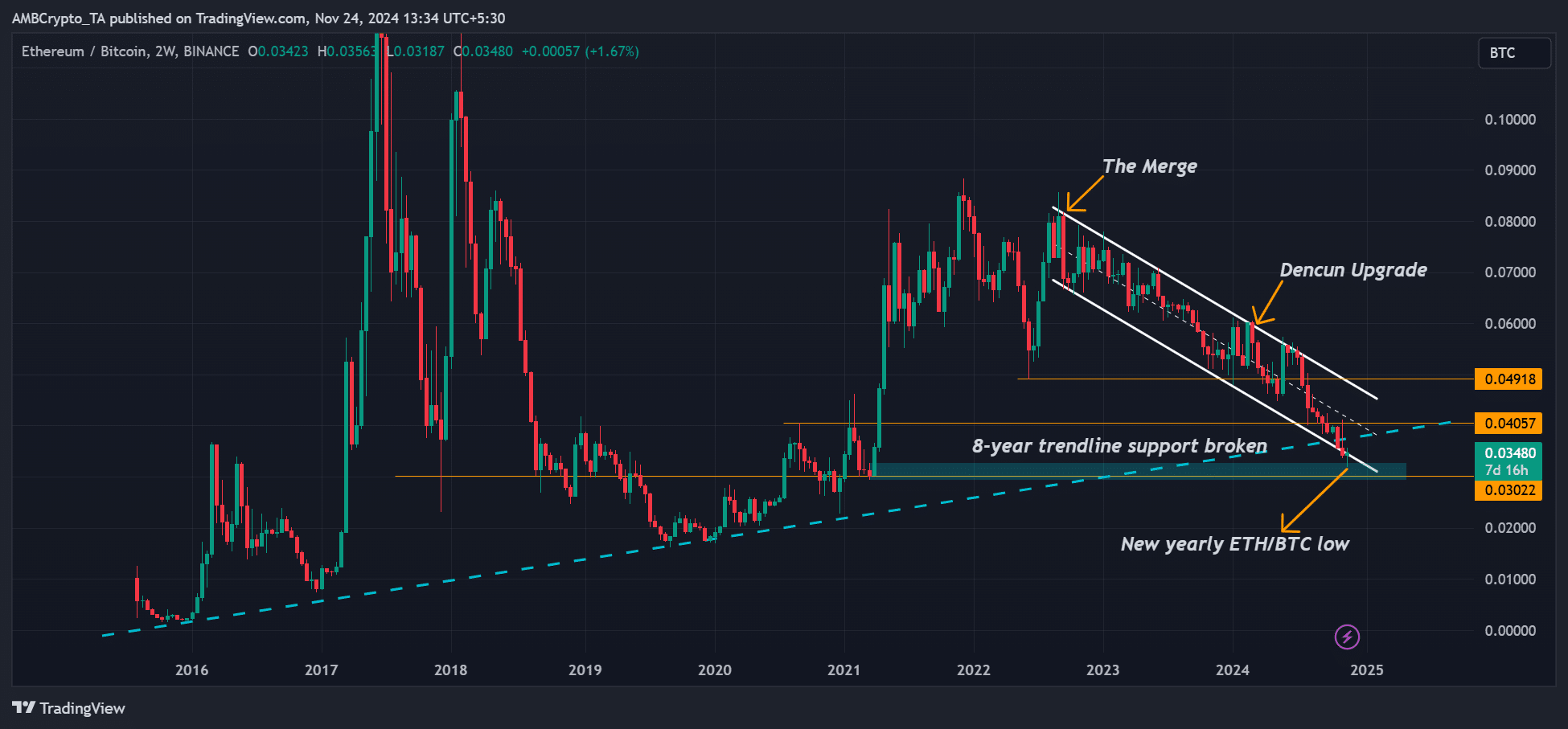

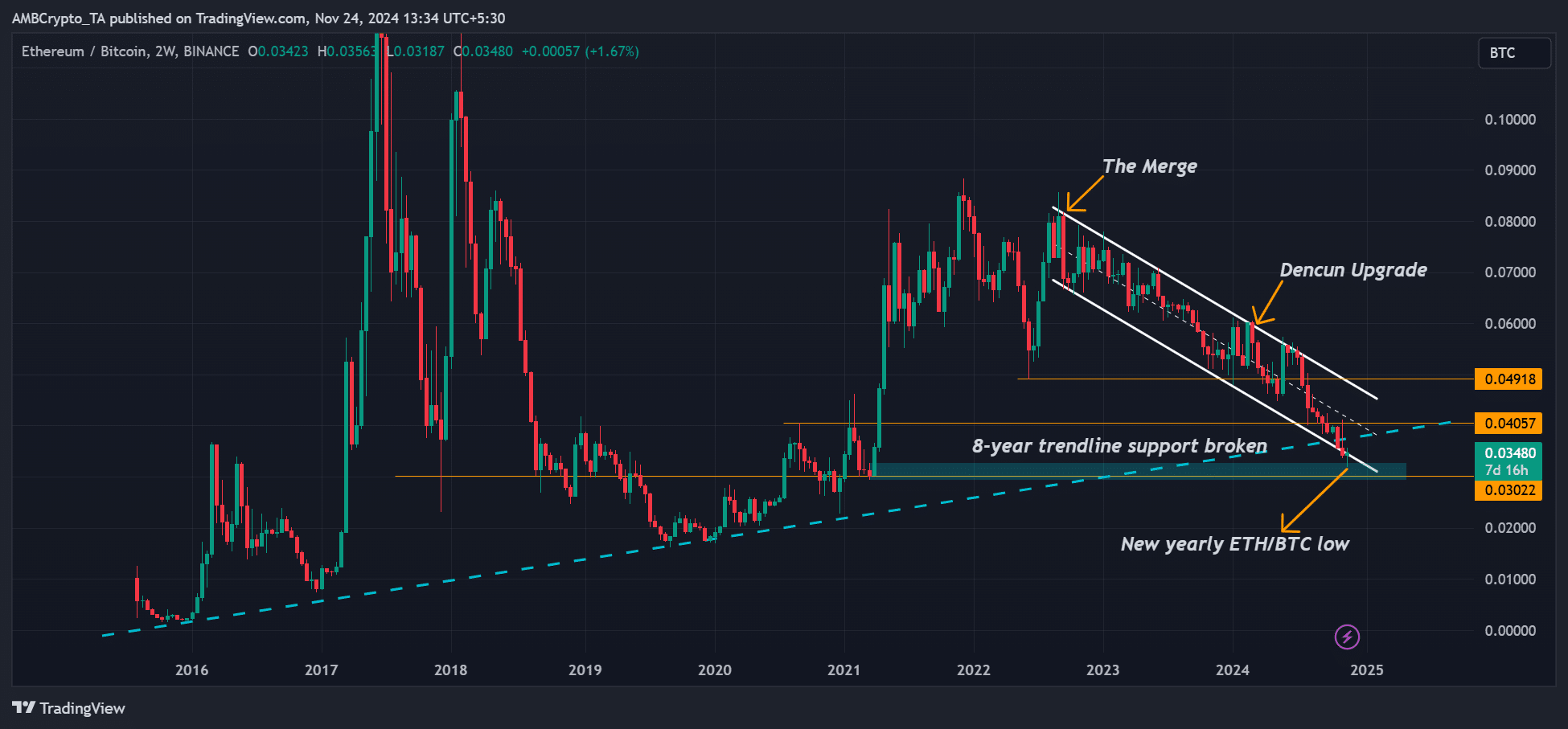

Nonetheless, damaging market sentiment has exacerbated the gradual catch-up, with the ETH/BTC ratio hitting a brand new annual low of 0.031.

This implies ETH is underperforming BTC, a pattern courting again to 2022 after The Merge.

Supply: ETH/BTC ratio, TradingView

Put one other manner, buyers favored BTC and different majors over ETH, dampening general value efficiency.

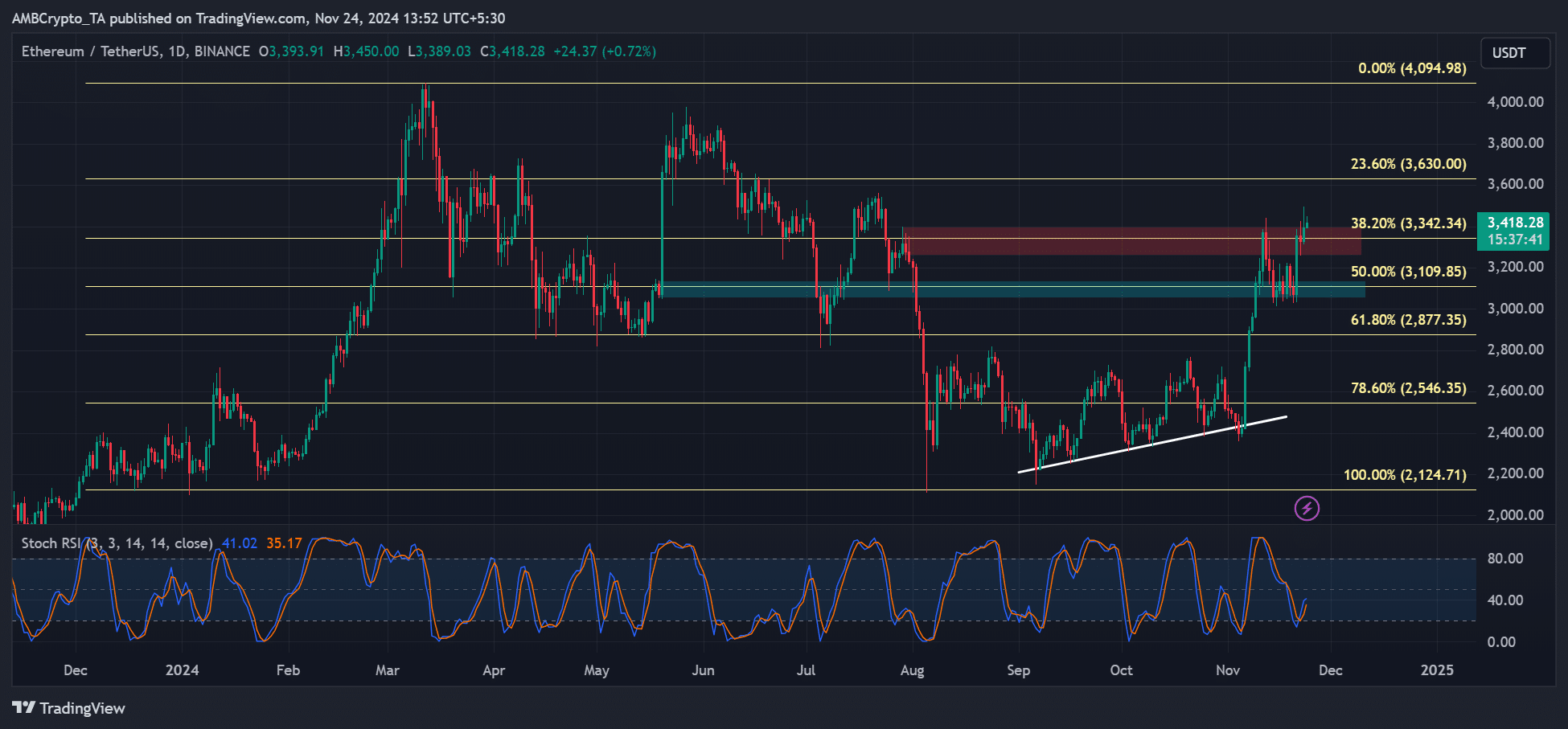

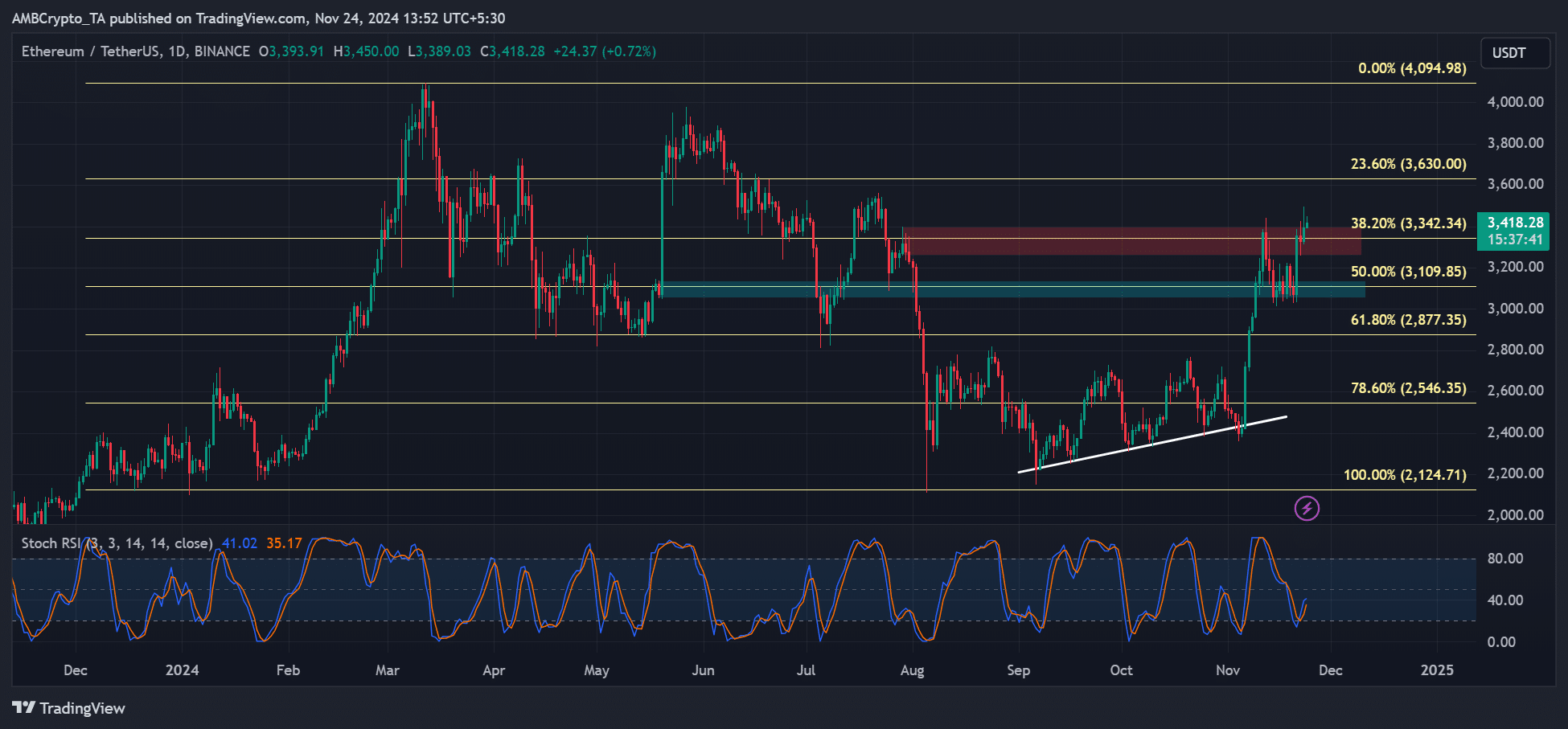

However issues might change for the altcoin king. On the time of writing, ETH has recovered greater than 40% since its November low. It additionally tried to take away the $3.3K roadblock, which was attainable velocity up to larger targets of $3.6K and $4K.

Supply: ETH/USDT, TradingView

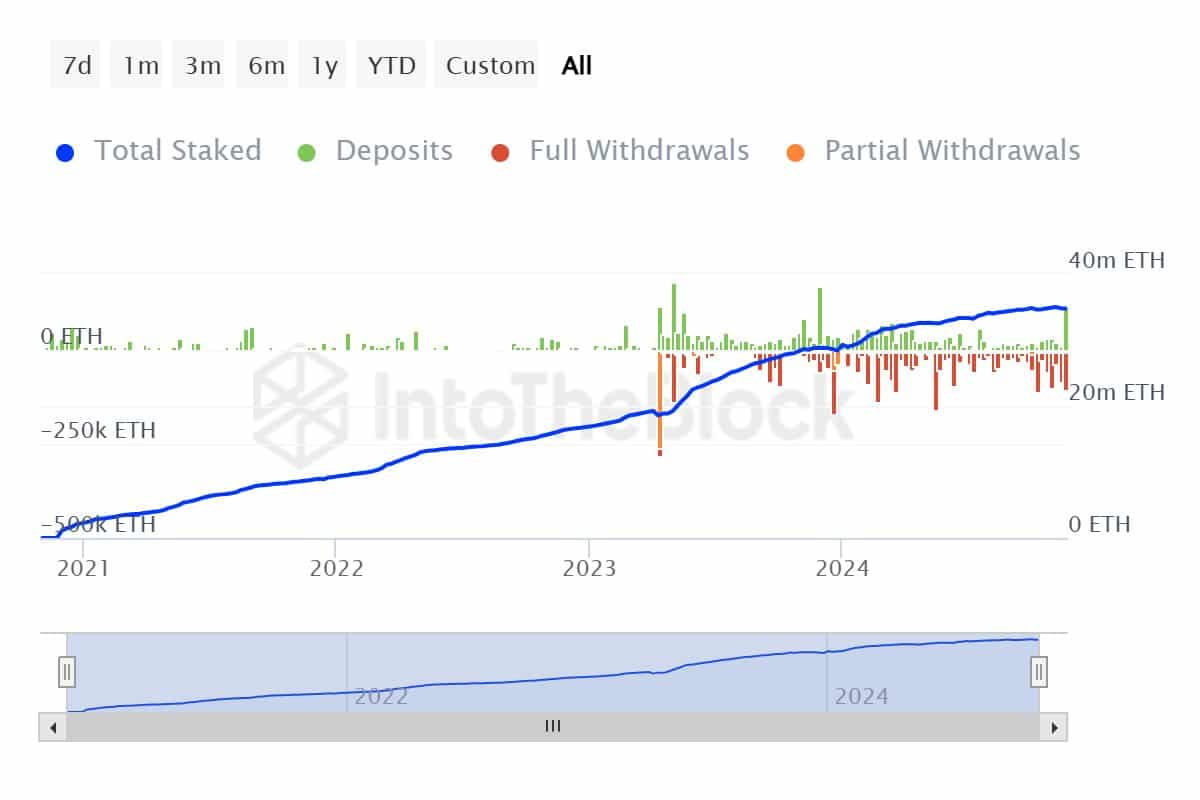

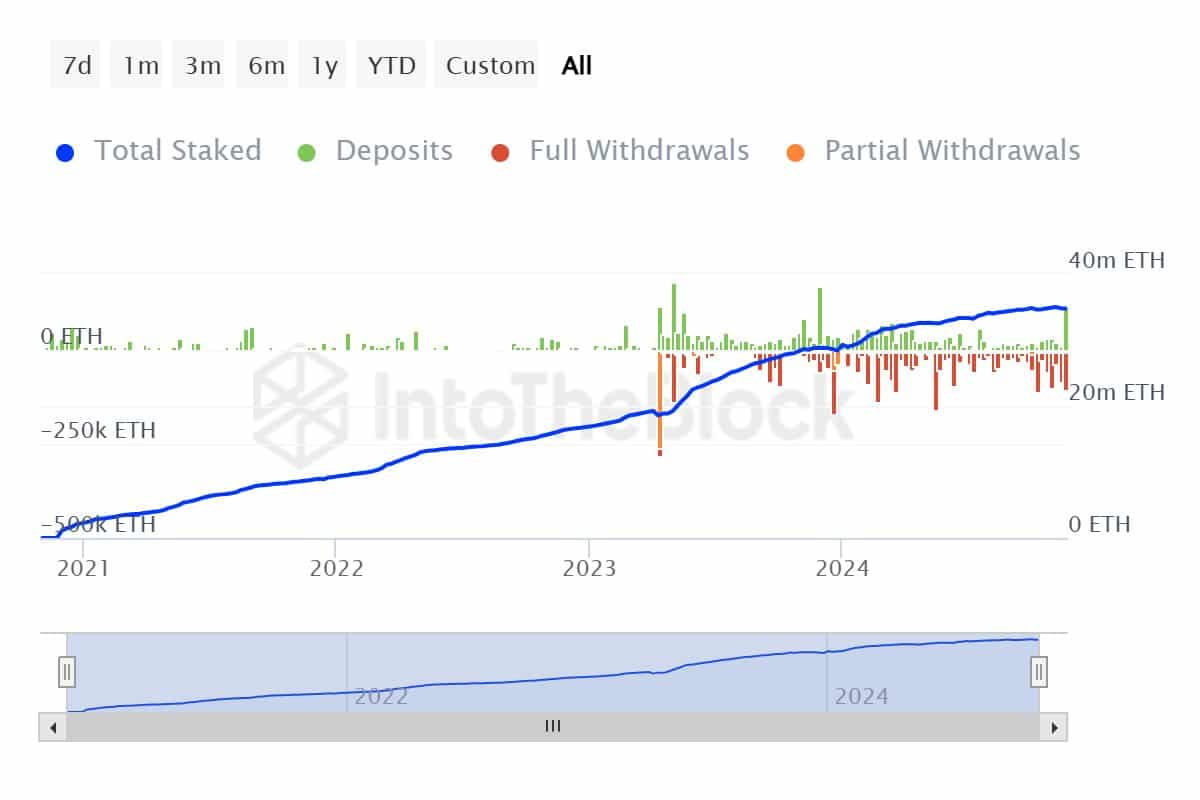

One other bullish sign, like noted by JA Maartunn of CryptoQuant, the stakes of Ethereum had been elevated.

ETH strike recorded highest weekly internet influx for the primary time after months of outflows. Martunn added,

“Over the previous week, Ethereum staking recorded a internet influx of +10k ETH, with 115k ETH deposited and 105k ETH withdrawn. The blue line (complete ETH staked) is rising once more, indicating renewed confidence in staking as a long-term technique.”

Supply: IntoTheBlock

The above pattern, maybe pushed by renewed optimism over the Trump administration’s doubtless approval to put money into US spot ETFs, might trigger a scarcity of ETH provide, which might on stability be optimistic for ETH costs.

Learn Ethereum [ETH] Value forecast 2024-2025

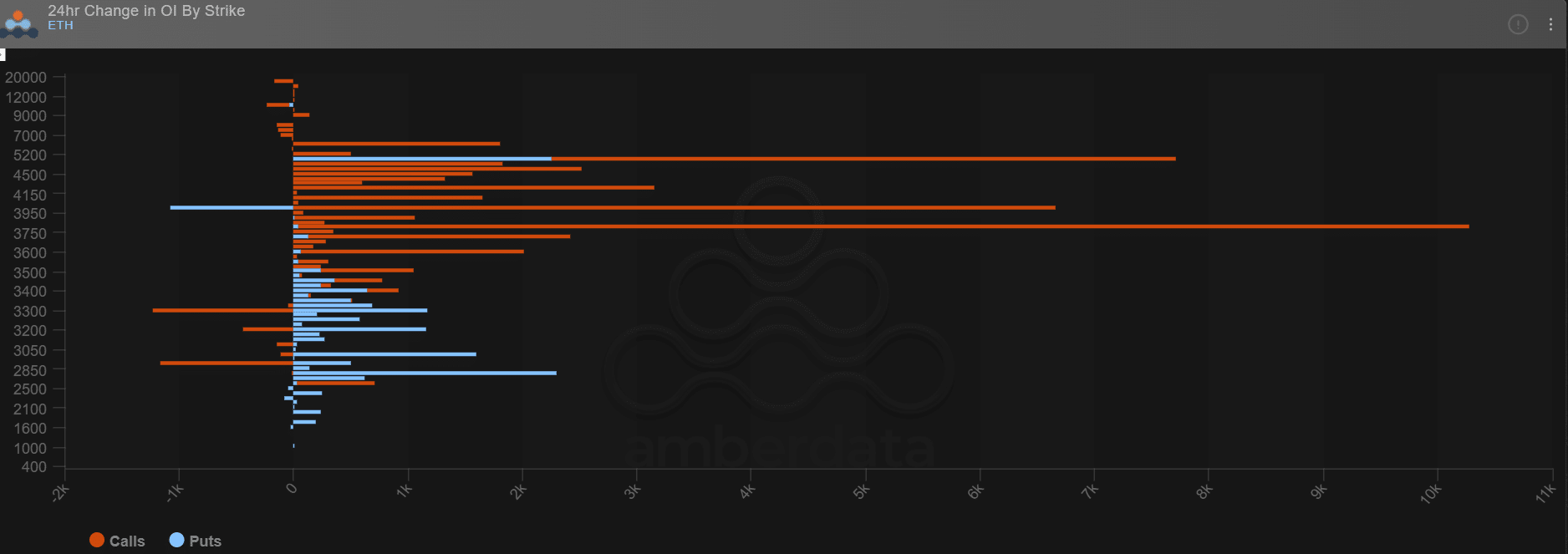

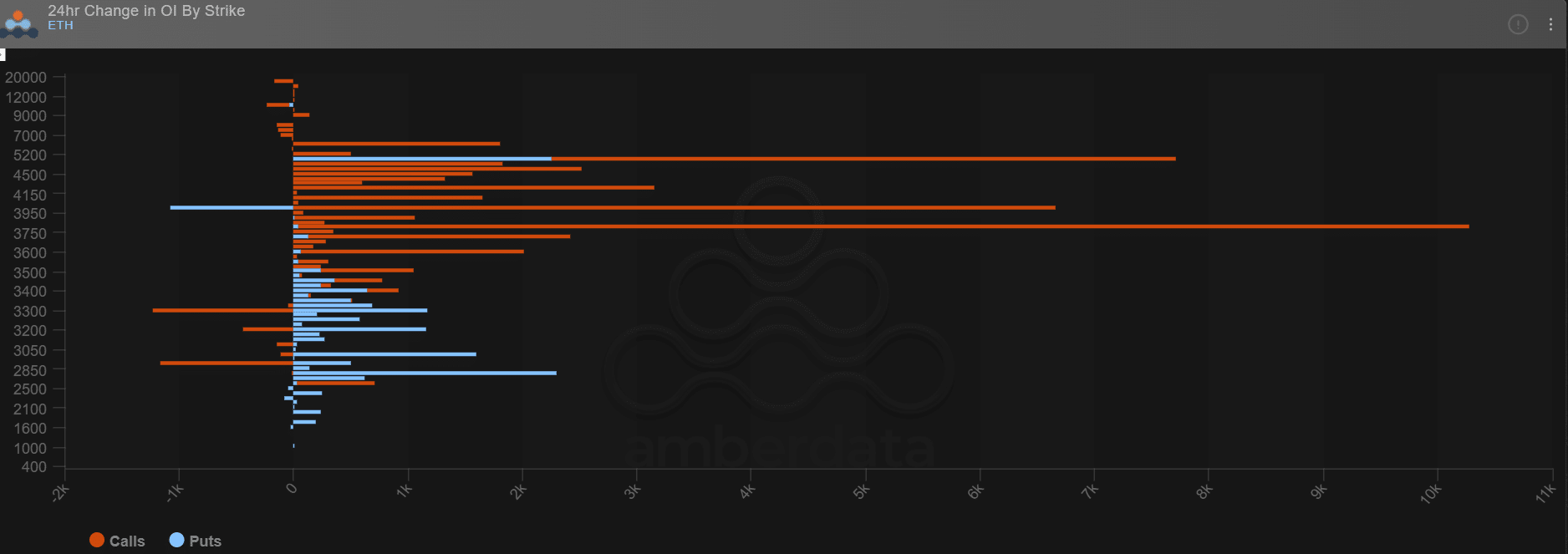

Related optimism was seen amongst choices merchants Deribit. Within the final 24 hours main payers positioned extra bullish bets (open curiosity spike, orange traces) on ETH, hitting the $3.8K, $4K, $5K, and $6K targets.

Nonetheless, they had been additionally ready for a pullback situation with a slight improve in put possibility shopping for (bearish bets, blue traces) in direction of the $3K and $2.8K targets.

Supply: Deribit

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now