Altcoin

Crypto Walvis vs. Justin Sun – Will Bitcoin Bulls bring down the biggest shorts of hyperliquid?

Credit : ambcrypto.com

- Rival Crypto -Walvissen, together with CBB and Justin Solar, tried to push the value of BTC up.

- A shock of $ 2.4 million lengthy on Melania suggests hedging or psychological techniques.

The hyperliquid [HYPE] Whale, often called the ‘Eth 50X Massive Man’, is central to intense market exercise after opening a brief place of $ 449 million on Bitcoin [BTC].

This commerce with high-stakes, carried out with 40x leverage, was placed At an entrance payment of $ 83,923. If the value of Bitcoin exceeds $ 85,940, their place can be wound up with violence, making a Cascade of Korte squeezing attainable.

From the second of the press, Bitcoin acted at $ 83,451, which signifies that the whale nonetheless held their place with out liquidation. Their non -realized revenue was $ 4.4 million.

Hyperliquid Crypto Whale avoids liquidation – for now

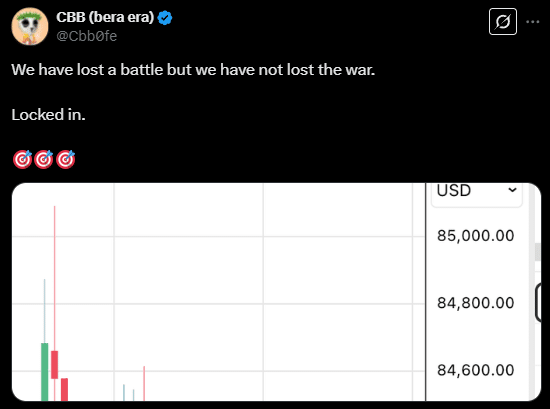

In response to this monumental quick place, influential merchants, together with CBB (@CBB0FE) and Justin Solar, have tried to lift the value of Bitcoin to pressure whale in liquidation.

The primary massive push passed off on March 16, when Bitcoin briefly rose to $ 84,690, which got here dangerously near liquidation.

Supply: X

Nonetheless, 0xf3f4 responded instantly by depositing $ 5 million USDC, strengthening their margin and preserving their commerce alive.

“The Eth 50x Massive Man” takes a daring gamble

0xf3f4 has carried out a number of methods to stop liquidation. Their collateral administration was the important thing as a result of they proceed so as to add margin when the value approaches their liquidation stage.

This step has enabled him to take care of their place, regardless of the stress of reverse merchants.

He has additionally carried out Twap (time weight common value) commerce.

So, as a substitute of closing their quick place in a single transaction, they’ve steadily left in smaller parts, decreasing the market results whereas they lock revenue.

Managing the hyperliquid order books has been one other benefit.

Plainly they’ve positioned a $ 150 million gross sales wall within the vary of $ 83,920- $ 83,925, which signifies that the value of Bitcoin has endured resistance.

On the identical time, they’ve positioned $ 106 million in buy assignments at $ 68,774- $ 68,775, which serves as a take-profit zone if Bitcoin drops.

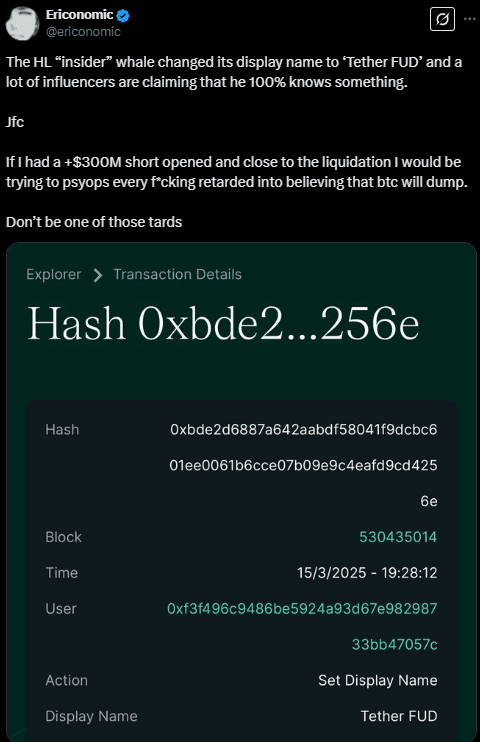

To additional affect sentiment, 0xf3f4 additionally used psychological techniques.

Supply: X

She changed Their show identify to “bind FUD” to unfold worry and uncertainty. By feeding the bearish sentiment, they might attempt to persuade different merchants to promote, which might match their quick place.

Can merchants pressure a brief squeeze?

The market response has been aggressive. CBB, a properly -known dealer, publicly introduced their plan to take away 0xf3f4 by pushing the value of Bitcoin up.

They collected different merchants and revealed that that they had already secured “8 figures” in funds for this effort.

Justin Solar, founding father of Tron, additionally had direct discussions with CBB. Solar confirmed curiosity in participation, which means that additional capital could possibly be used within the battle towards the place of the whale.

Regardless of their efforts, Bitcoin doesn’t have that but infringement $ 85,940 and 0xf3f4 stays management of their commerce.

Supply: X

Apparently, 0xf3f4 has made an sudden transfer by opening a protracted place of $ 2.4 million on Melania -Tokens.

An sudden flip

The explanation for this commerce is unclear, however analysts imagine that it may serve totally different functions.

Supply: Hypurrscan

A risk is overlaying, the place the Melania acts lengthy as a safety in case Bitcoin’s value rises and places stress on its quick place.

One other principle is theory, which means that they may place themselves for attainable income if a brief squeeze happens.

Some additionally regard this as a psychological tactic, geared toward distracting market contributors from their Bitcoin Quick.

Regardless of the intention is, this step signifies that they actively handle dangers by a number of belongings.

Worth

The prices for sustaining this commerce have been excessive.

Financing prices have surpassed $ 391,000, however the whale stays keen to pay them to maintain their place intact.

Supply: HYPERDASH

He has additionally positioned 12 restrict buy assignments between $ 58,664 and $ 69,414, which signifies their plan to take a revenue if Bitcoin falls additional.

This set -up means that they’re anticipating a neighbor, regardless of market efforts to push BTC increased.

Win or loss, this crypto -walvis can be remembered

This occasion is a case research in how a single crypto -walvis can disrupt the market.

If 0xf3f4 is liquidated, this can strengthen the concept that collective motion may even overwhelm properly -funded merchants. In the event that they survive, this can emphasize the effectiveness of threat administration for top -leverage commerce.

In the meanwhile, the market stays sharp, ready to see if Bitcoin will rise and activate a brief squeeze or whether or not the whale will escape with thousands and thousands of income.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now