Ethereum

Crypto week ahead for Bitcoin, Ethereum: How market sentiment can challenge shorts

Credit : ambcrypto.com

- The crypto market has reclaimed the $2 trillion mark

- BTC and ETH nonetheless management greater than 60% of the market

The crypto market has fallen considerably over the previous week, with the whole market capitalization falling under $2 trillion. This decline was accompanied by an increase in lengthy liquidation volumes, as the costs of the most important cryptocurrencies fell.

Nevertheless, the market is now exhibiting indicators of a turnaround. And the outlook for the upcoming crypto week appears constructive, in comparison with the week earlier than.

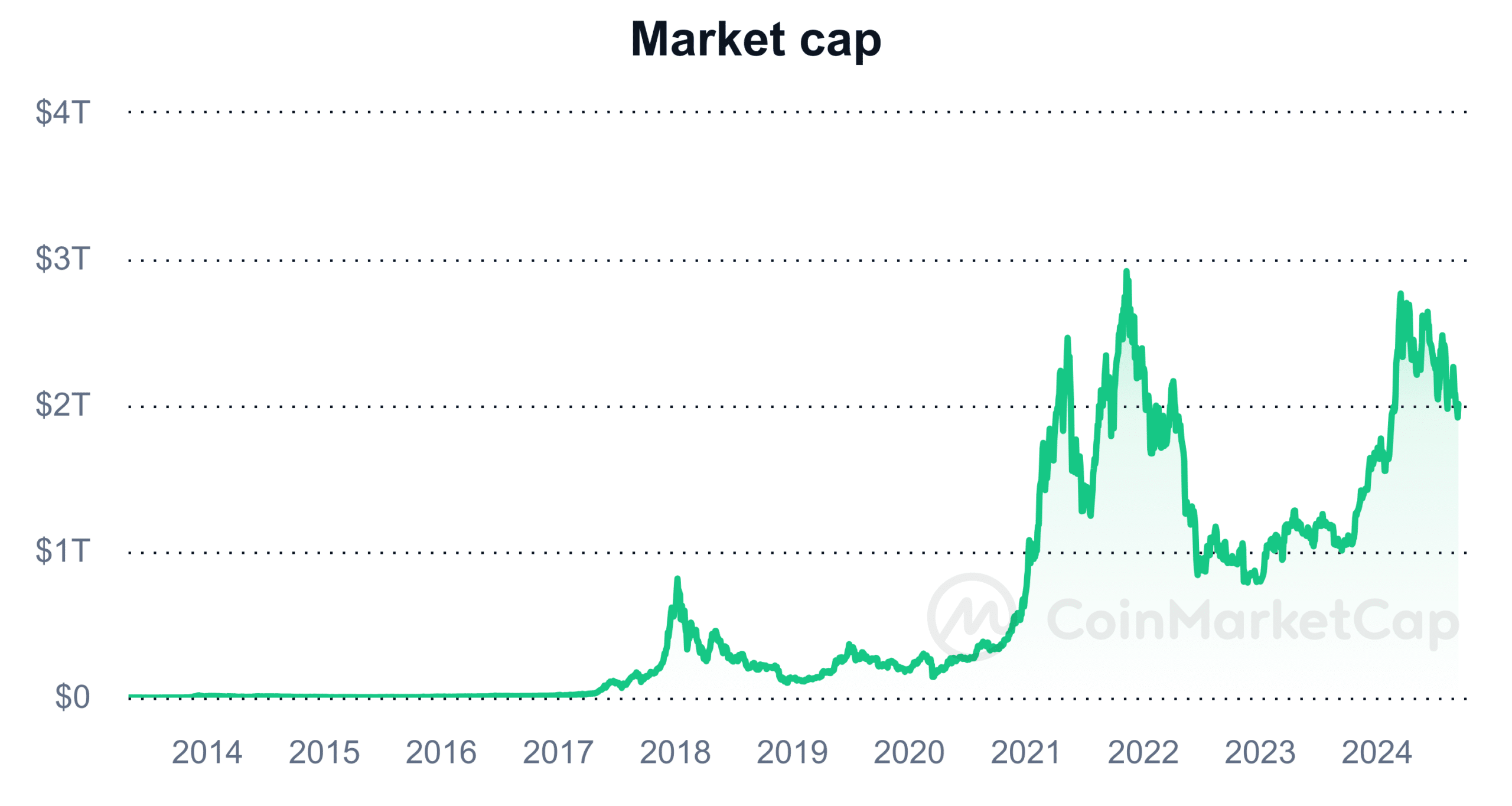

Crypto week forward: market cap

An evaluation of the crypto market capitalization on CoinMarketCap it turned out that the market has skilled intervals of depreciation in latest weeks. Essentially the most vital drop occurred final week, dropping the whole market capitalization to about $1.9 trillion.

The worth declines of main property akin to Bitcoin and Ethereum have been primarily accountable for this decline.

Supply: CoinMarketCap

Nevertheless, over the previous three days, the value has recovered and reached the $2 trillion threshold once more. Together with this restoration, main cryptocurrencies have proven a constructive uptrend, indicating that the market might submit additional good points within the coming week.

If this development continues, it might begin a extra constructive part for the crypto market.

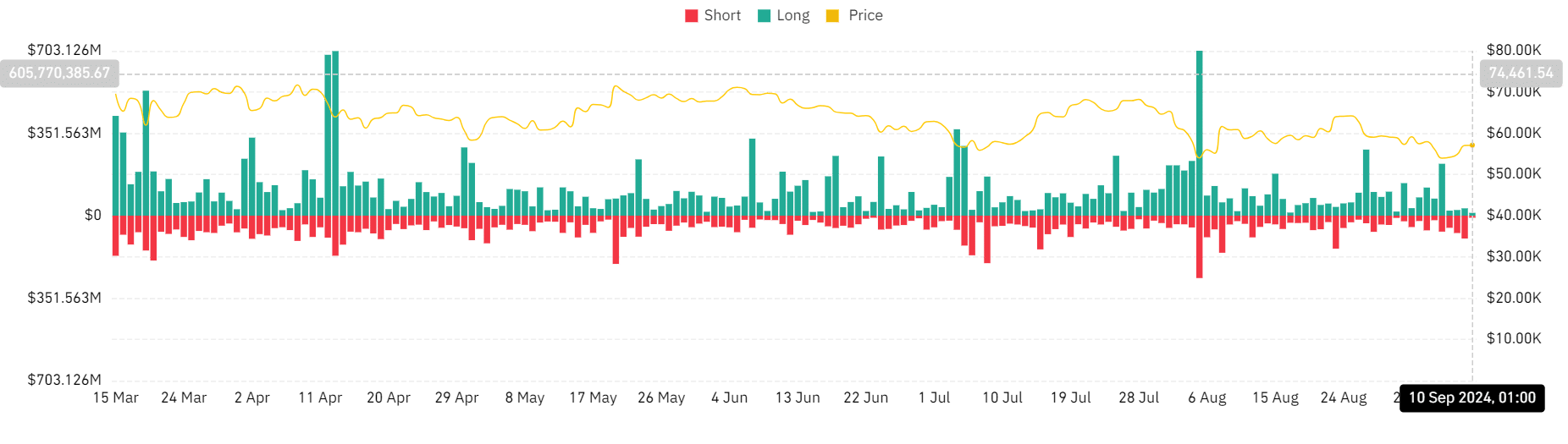

Crypto week forward: market liquidations

An evaluation of the whole liquidation chart on Mint glass revealed that the market noticed an increase in liquidations over the previous week, with lengthy liquidation volumes dominating. This confirmed the noticed decline in market capitalization. The information additionally highlighted that lengthy liquidations totaled greater than $520 million, whereas quick liquidations totaled roughly $223 million.

Nevertheless, because the market started to get well, the variety of lengthy liquidations decreased and the variety of quick liquidations elevated. This shift alerts that the market could also be regaining upward momentum and that quick positions are more and more in danger.

Supply: Coinglass

If this development continues, the approaching week will probably be difficult for brief positions. Particularly since rising asset costs might result in extra quick liquidations. With the market exhibiting indicators of restoration, merchants with quick positions could face rising stress as bullish sentiment returns.

Bitcoin and Ethereum are main the market dominance

An evaluation of the previous seven days confirmed that Bitcoin (BTC) has misplaced greater than 3% of its worth, whereas Ethereum (ETH) recorded a steeper decline of greater than 6%. Regardless of these declines, each property proceed to dominate the cryptocurrency market.

Bitcoin’s market cap on the time of writing was roughly $1.13 trillion, representing 56.5% of the whole crypto market. Ethereum’s market capitalization was $282.9 billion, with a dominance of 14.6%.

These two property stay essentially the most influential within the cryptocurrency area, and their worth actions can have a major impression on the general market trajectory of the approaching crypto week.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now