Altcoin

Crypto Week Ahead – How US Labor Updates Could Impact Bitcoin and Ethereum

Credit : ambcrypto.com

- BTC retested $66k after better-than-expected August inflation information

- An replace within the US labor market might decide the subsequent market course

Bitcoin [BTC] rose to check $66,000 once more on Friday, following a softer studying of the US Fed’s favourite inflation information: the Core PCE Index (Private Consumption Expenditure). This index tracks US inflation with out the noise of meals and vitality value fluctuations.

August’s Core PCE Index got here in higher than anticipated, up 2.6% year-over-year (YoY). This was opposite to market expectations of two.7%.

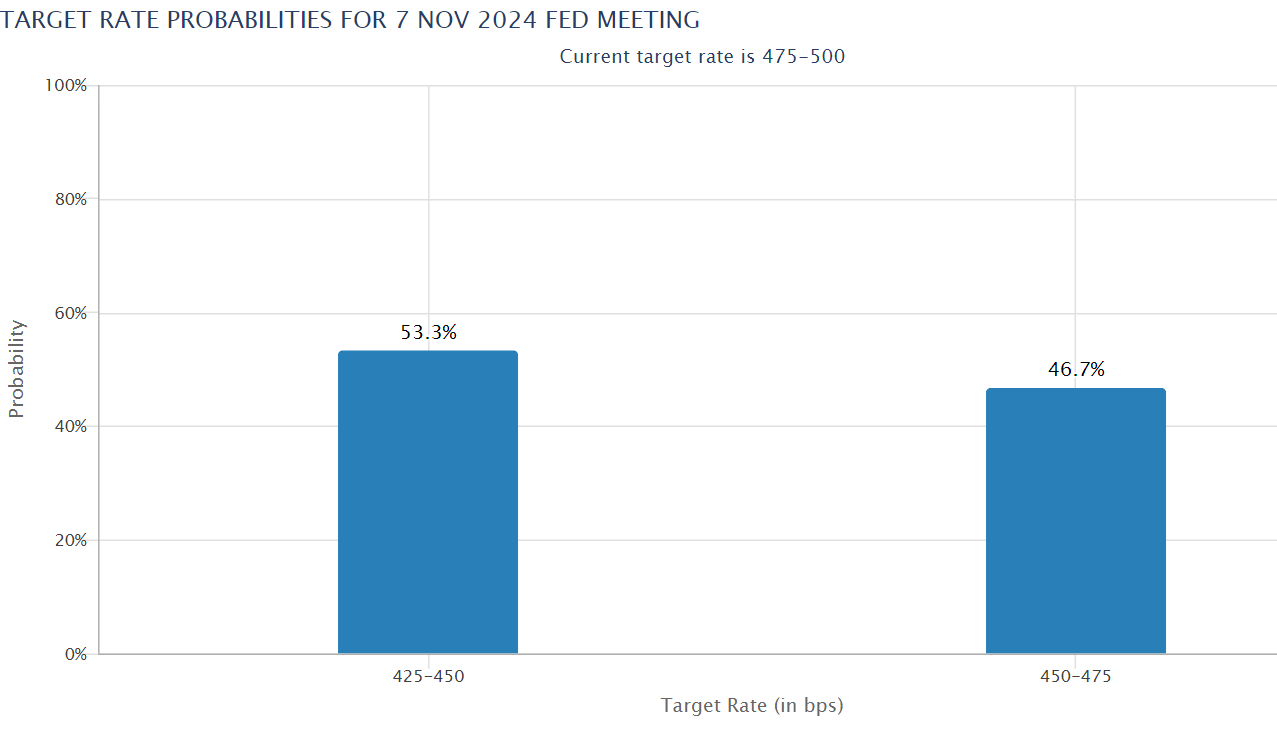

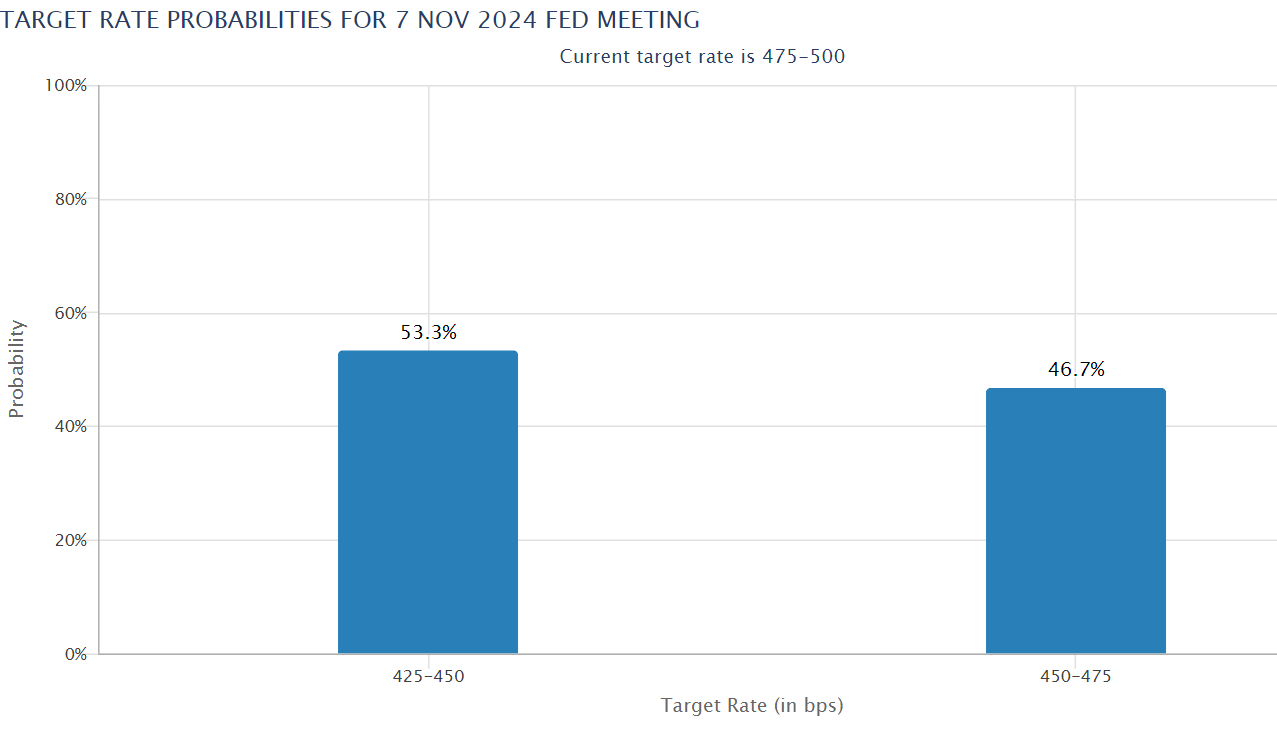

Low inflation charges stimulated markets as speculators charged larger costs chances of one other 50 foundation factors (bp) Fed charge reduce in November.

Supply: CME FedWatch

Subsequent market catalyst

The low inflation charges meant that the Fed would now deal with the standing of the US labor market, particularly the unemployment charge, in adjusting the tempo of rate of interest cuts accordingly.

Ergo, upcoming updates from the US labor sector will affect the market’s subsequent course, buying and selling agency QCP Capital famous.

A part of the corporate’s weekend briefing on September 28 read,

“As we head into subsequent week, the principle focus shall be on the upcoming labor market indicators, together with JOLTs, ADP and the U.S. unemployment charge.”

The important thing updates what it is best to take note of are the JOLTs (Job Openings and Labor Turnover Survey) and the employment state of affairs scheduled for November 1 and 4. QCP Capital projected the potential market influence of the updates, including:

“Sturdy efficiency on these measures might strengthen the case for a 50 foundation level reduce in November, additional boosting danger property.”

If that’s the case, BTC might transfer even larger in the direction of $70,000 after the latest shift in bullish market construction. Particularly after it reclaims the 200-day MA (Transferring Common).

Supply: Daan Crypto/X

The launch might additionally profit Ethereum [ETH]. ETH has even outperformed BTC for the reason that Fed pivot.

Thus, a further macroeconomic tailwind might lengthen ETH’s exceptional restoration on the charts. In line with market analyst Benjamin Cowen, ETH might even rise to the psychological degree of $3000.

Supply: Cowen/X

That stated, prime digital property noticed renewed demand from US traders. This week, US BTC ETFs noticed inflows of $1.11 billion, the biggest weekly inflows since July 19.

Comparable, however restricted, investor curiosity was additionally noticed in ETH ETFs. The merchandise attracted an influx of $84.6 million, the biggest weekly demand since August 9. If the pattern continues, the value targets of $3,000 per ETH and $70,000 per BTC might be achievable.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024