Blockchain

Dapps’ revenue hits $164M in October amid growing adoption

Credit : cryptonews.net

Based on one report Based on Binance Analysis, decentralized functions (dApps) represented 12 of the highest 15 protocols in October, at $164 million.

This means rising adoption of blockchain, fueled by buying and selling bots and decentralized exchanges.

The report highlighted that dApp interactions have steadily elevated in latest months, surpassing the fourth hottest blockchains: Tron, Ethereum and Solana. Collectively, these three networks introduced in $182 million in month-to-month income.

The rising worth captured by dApps alerts a possible takeover by these protocols of the biggest income share at present managed by blockchains.

Hypothesis that drives income

The report highlighted that DEX and buying and selling bot-related dApps had been the highest income turbines as a result of latest improve in speculative buying and selling of memecoins.

Memecoin launcher Pump.enjoyable and buying and selling bot Photon, each Solana-based functions, generated $29 million in income final month.

The record of dApps with the biggest revenues recorded in October contains 4 different buying and selling bots: Trojan, BONKbot, Maestro and Banana Gun. Along with Photon, these functions generated $67 million in month-to-month income, nearly 41% of the entire recorded by dApps.

Uniswap recorded $16 million in income, adopted by PancakeSwap and Aerodrome’s $10 million and $9 million, respectively.

The mixed price worth collected by DEX and buying and selling bots exceeds $100 million, highlighting that customers desire trading-related dApps.

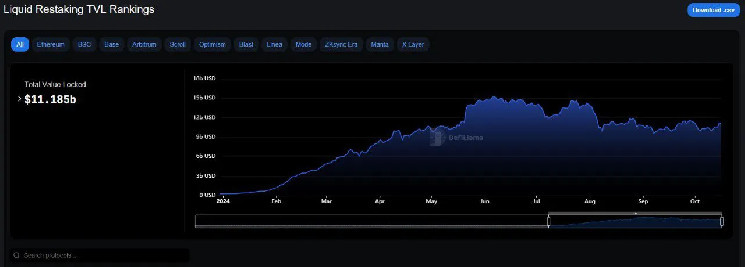

Along with buying and selling functions, the report additionally talked about the Aave and Sky (former Maker) cash markets, which acquired $26 million in charges. Liquid staking protocol Lido completes the record of 12 dApps with the biggest income in October, with $7 million looted.

Overfinancing of infrastructure

The report additionally questions whether or not infrastructure initiatives, corresponding to layer-1 and layer-2 blockchains, are overfunded, given the charges collected by dApps.

Based on Rootdata, initiatives to construct infrastructure within the blockchain trade have been acquired greater than 1.2 billion {dollars} in funding between December 2019 and October 2024. The quantity exceeds the mixed funds dedicated to DeFi, tooling and gaming functions.

Regardless of arguing that these infrastructure investments are important, the report asserted that new functions in search of product market match are basic to attracting new customers and boosting the blockchain trade.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now