Ethereum

Decoding Ethereum’s latest moves: Profit-taking vs. accumulation

Credit : ambcrypto.com

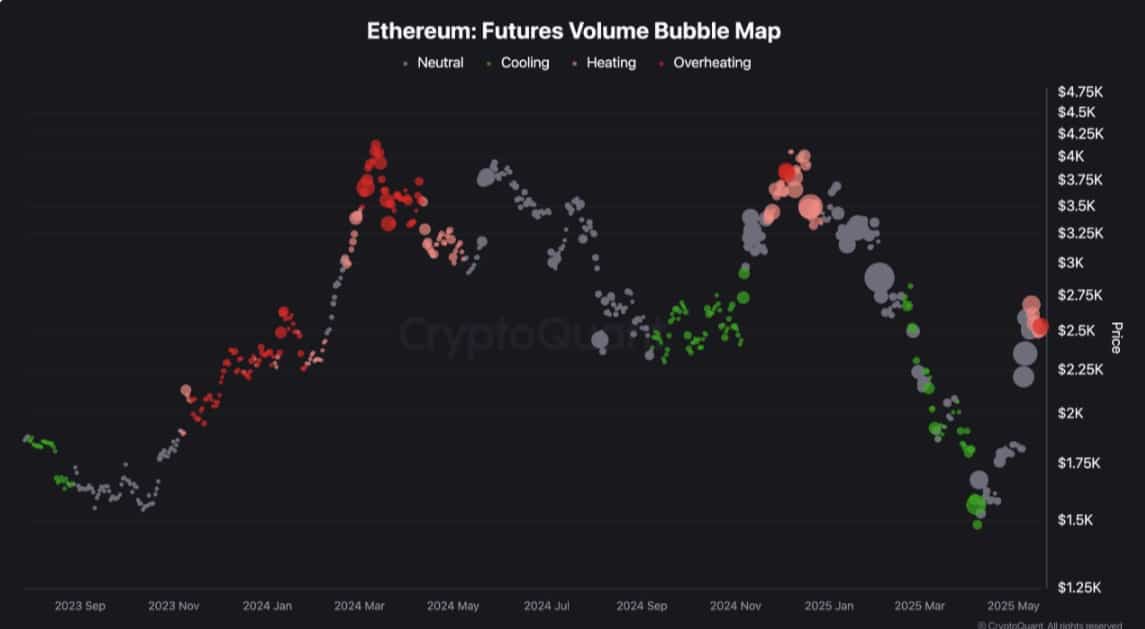

- ETH dangers additional correction as futures quantity bubble bubble sign an overheated state.

- Ethereum -Foundation ideas counsel that the Altcoin is strongly undervalued.

Since since Rally to hit $ 2.7ka weeks in the past, Ethereum [ETH] Has hassle sustaining his rebellion. After reaching these ranges, the Altcoin withdrew and have become a low level of $ 2.3k.

Up to now three days, ETH has caught between $ 2.5 and $ 2.3k.

Supply: Cryptuquant

The failure of breaking out of this attain had strategists speculated in regards to the future trajectory of Ethereum.

In line with Cryptoquant Analyst Shayan, the Ethereum market, is overheated close to $ 2.5k, which signifies a possible short-term correction.

In his evaluation, Shayan famous that the strategy of Ethereum for the crucial resistance stage of $ 2.5k has led to an overheating standing, characterised by a major improve in commerce quantity.

The rise in commerce quantity is normally powered by taking revenue exercise and the presence of resting on this vital zone.

Supply: Cryptuquant

Such circumstances point out a possible market correction, though within the quick time period, whereas the market cools. A cooling is paving and constructing a foundation for renewed accumulation.

This renewed accumulation is confirmed by a persistent interval of unfavorable trade Netflow. As such, the trade of Ethereum has remained inside a unfavorable space for 4 consecutive days.

This habits on the exchanges displays sturdy accumulation, because the burglaries surpass.

Has ETH been set for correction?

In line with the evaluation of Ambcrypto, though the amount has risen to sign overheated ranges, different statistics present a unique story.

Supply: Santiment

In reality, the Altcoin is overly undervalued and the current pullback is a wholesome decline.

Quite the opposite, Ethereum could be very undervalued. Trying on the MVRV Z rating of Ethereum, this metric has remained in a unfavorable space for 4 consecutive days.

Up to now week, the MVRV Z rating of ETH solely achieved a constructive worth for 2 days.

Traditionally, a unfavorable MVRV Z rating for Ethereum coincided with macro soils. These passed off, for instance, in December 2018, March 2020 and June to December 2022.

In earlier cycles, the Altcoin was held on this territory for a brief time period and gives a purchase possibility.

Supply: Santiment

The identical may be stated after we take a look at the long-term holders of Ethereum and the MVRV distinction of short-term holders. Similar to the MVRV, the Altcoin MVRV has stored lengthy/quick distinction inside a unfavorable space.

Though the restoration has signaled, it nonetheless has to transcend the unfavorable zone.

Up to now week, the lengthy/quick MVRV distinction from Ethereum has risen from -41% to -31%. With the Metrice Houd within the unfavorable zone, this implies that LTH performs poorly in comparison with STH.

Holders now earn greater than LTH. With lengthy -term holders normally with a loss, it’s unlikely that they’ll promote. Present market circumstances don’t encourage their positions.

With out enormous discharge from LTH, the market correction predicted above is unlikely.

What now?

Merely put, though the amount has risen, the Ethereum market remains to be not overheated. Quite the opposite, the market could be very undervalued, whereby buyers take this chance to build up themselves.

Within the present circumstances, solely holders promote within the quick time period.

Nevertheless, accumulating addresses soak up the gross sales strain of STH.

That’s the reason Ethereum is anticipated to proceed its consolidation part till the brand new query involves the fore to stimulate an outbreak over the $ 1.5k resistance vary within the meantime.

An outbreak of consolidation will strengthen the Altcoin to leap to $ 1.8k.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September