Analysis

Despite BOJ Concerns, Can SOL Price Hold Its Long-Term Support Zone?

Credit : coinpedia.org

The SOL value is once more below strain, however not with out context. After falling from $134 earlier this week, Solana is now hovering close to a long-term assist vary that has traditionally outlined many of the broader development since 2024. With macro dangers growing with the BOJ in focus, merchants are weighing whether or not this SOL/USD zone marks accumulation or vulnerability.

SOL value is at a vital assist vary as we speak

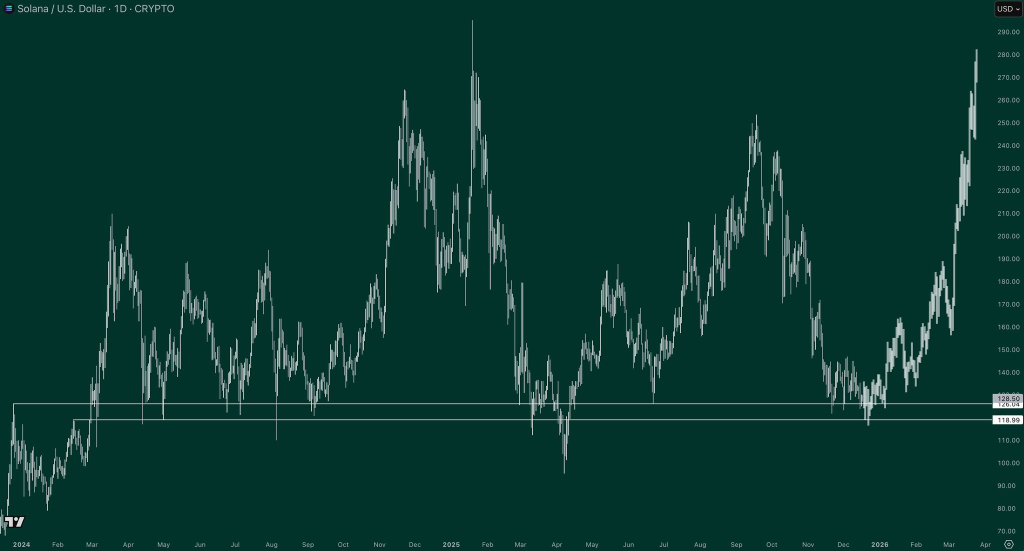

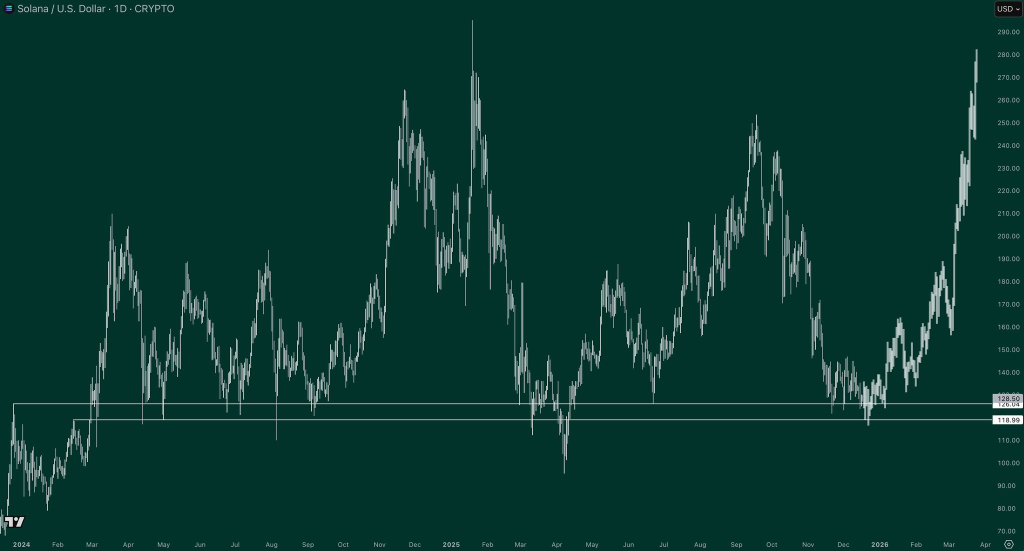

The Solana value chart from 2024 to this point factors to a requirement zone between $119 and $126, which has confirmed resilient all this time.

Now, whereas writing, the SOL The worth is once more hovering round $127 as we speak, which is simply marginally above this key assist space.

Whereas short-term volatility has broken confidence no less than for now, the broader structure suggests otherwise. Solana has been holding out for months on high of a long-term foundation. It has repeatedly acted as a stabilizing zone, and so long as the value stays above it, a deeper collapse has not but been confirmed.

If this week’s turbulence is dealt with with out main harm, circumstances might enhance within the brief time period, whereas the long-term SOL value forecast stays structurally intact.

Macrodruk locations Solana at a crossroads

That mentioned, macro circumstances are actually driving the story extra than simply the charts. The Financial institution of Japan’s upcoming rate of interest choice on December 19 has grow to be a vital danger occasion for all dangerous belongings, together with the Solana crypto.

Since then, Japan has lengthy been a supply of ultra-cheap liquidity by the method of carry buying and selling within the yen. Now, on this fragile world monetary state, an rate of interest hike would probably power all these carry merchants to unwind their positions instantly, and in the event that they do, it’s going to set off monumental promoting strain on world markets. Wanting particularly on the crypto market, it’s clear that Bitcoin USD skilled sharp declines of 20-30% throughout earlier BoJ will increase in 2024 and 2025, and Solana adopted carefully behind.

If such a state of affairs happens once more, SOL value USD might wrestle to defend present ranges. Conversely, a pause or a dovish stance is precisely what the market wants, which may ease strain and stabilize the value.

Likewise, regardless of the near-term uncertainty, the basics of Solana crypto stay intact. Regardless of the short-term consequence, community utilization, developer exercise and ecosystem progress are undeniably robust, which continues to assist the long-term story. If macro circumstances stabilize even modestly, the present state of affairs might favor a restoration moderately than a continuation at decrease ranges.

Rules and Outlook for 2026 Type SOL Worth Forecast

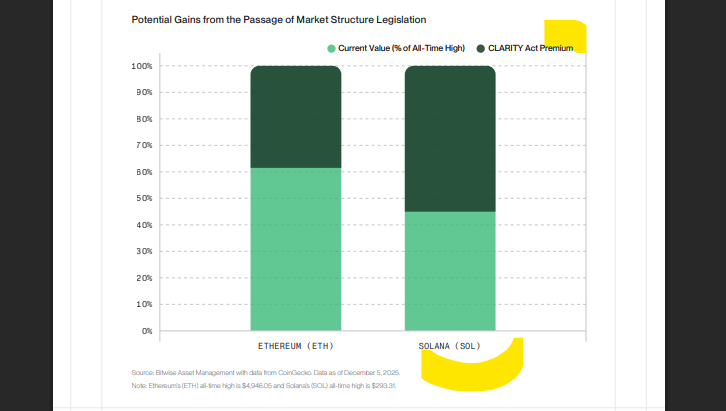

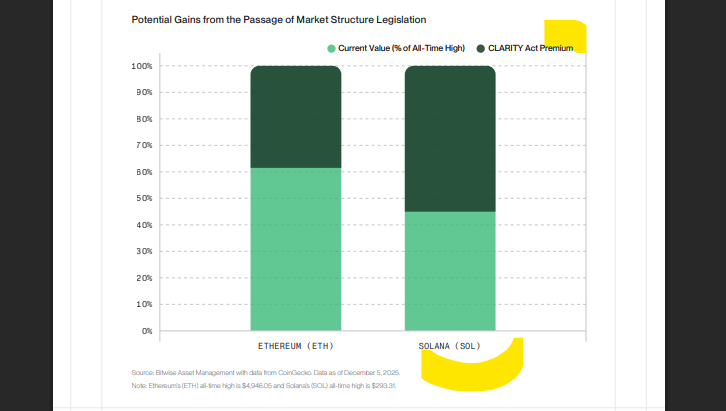

Wanting additional forward, forecasts for 2026 spotlight that regulatory progress could possibly be a decisive catalyst, in accordance with the newest Bitwise report. The CLARITY Act within the US is seen as key to unlocking the subsequent section of progress in crypto.

Report additionally added that Stablecoins and tokenization are broadly seen as megatrends, and Solana is positioned as one of many greatest beneficiaries as adoption accelerates.

If regulatory momentum continues and broader circumstances stay constructive, the SOL value forecast for 2026 will grow to be more and more optimistic.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial pointers based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We intention to offer well timed updates on the whole lot crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared characterize the creator’s personal views on present market circumstances. Please do your individual analysis earlier than making any funding choices. Neither the author nor the publication accepts duty on your monetary selections.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our website. Adverts are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now