Ethereum

Despite Ethereum’s recent decline, why ETH can still reach $4.7K

Credit : ambcrypto.com

- Ethereum fell 5.41% in 24 hours as bearish market sentiment continued.

- One analyst was taking a look at a brand new ATH of $4723.

Over the previous month, Ethereum [ETH] has seen a powerful downward pattern. Whereas the broader cryptocurrency markets have seen large swings, ETH has suffered probably the most from the present market circumstances.

Actually, on the time of writing, ETH was buying and selling at $2289. This marked a decline of 5.41% up to now 24 hours.

Earlier than this, ETH has tried to interrupt out of the downtrend and make positive factors on the weekly charts. Nevertheless, losses on the every day charts exceeded positive factors final week.

Regardless of these circumstances, a rise in buying and selling exercise is exhibiting indicators of life for ETH. For instance, buying and selling quantity elevated by 81.42% to $13.67 billion over the previous 24 hours.

If these trades are shopping for, that may imply hope, whereas a whale sell-off would imply the danger of additional correction.

Though ETH has fallen on exhausting occasions, the altcoin’s circumstances have gotten analysts speaking. Fashionable crypto analyst Javon Marks is one among them.

Though ETH is struggling, analysts see ETH rising to $4723.5, citing the 2023 cycle.

What the prevailing market sentiment says

In his evaluation states To notice quoted from 2023 the place ETH gained 165% to rise.

Supply:

Based on his evaluation, present market circumstances replicate the earlier cycle and are reemerging. If the circumstances of the final cycle recur, it is going to result in an upward transfer to $4723.5.

Furthermore, a breakout from that stage will result in all-time highs of $8,100, that means a worth enhance of 2X.

As ETH reached analyst-quoted Go Time ranges, it loved sustained upward momentum for 3 consecutive months to achieve $2717 in January 2024 earlier than falling once more.

Total, the general analyst sentiment may be very bullish, which might result in ETH reaching a brand new ATH.

Is ETH prepared for a rally?

Marks undoubtedly provides a constructive outlook, which might see ETH attain an all-time excessive. Whereas these highlighted historic patterns are promising, present market circumstances have taken the lead in ETH’s restoration.

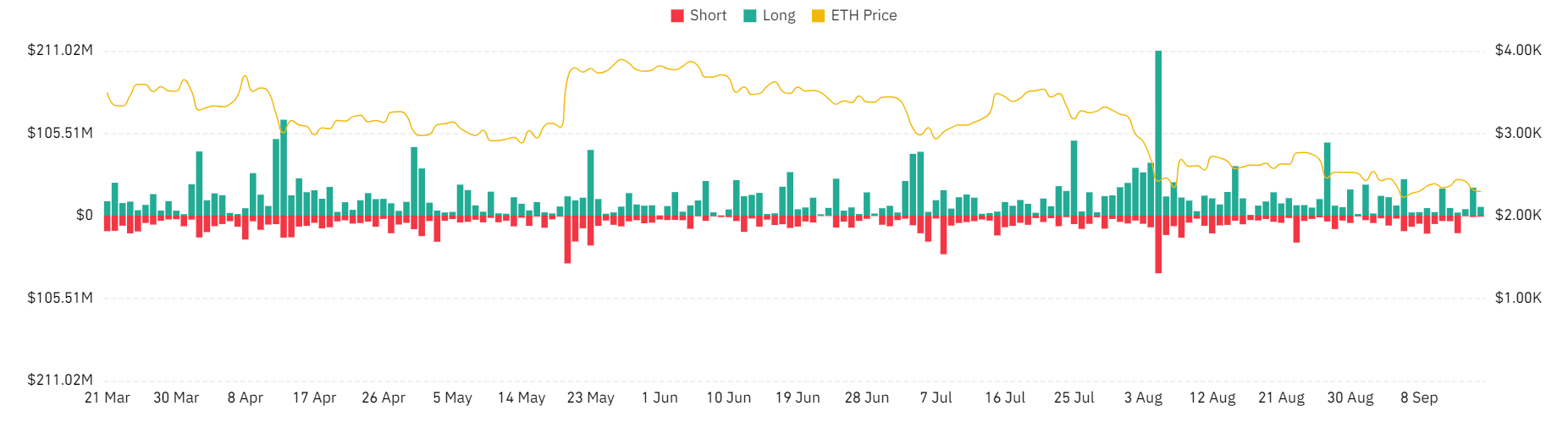

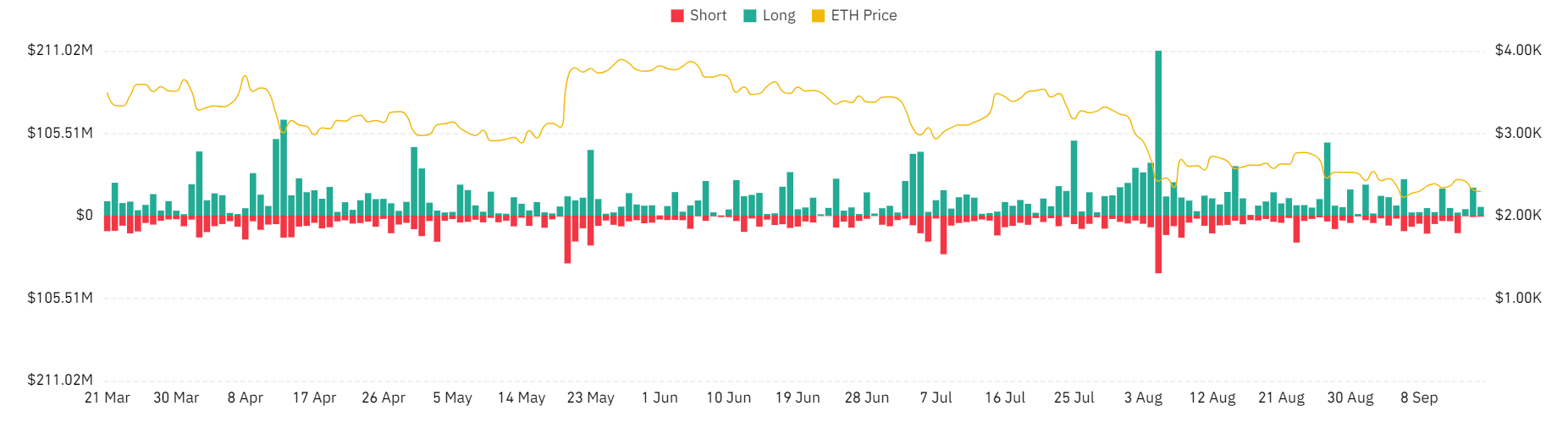

Supply: Coinglass

For starters, lengthy positions price $46.97 million have been liquidated for ETH within the final 24 hours, along with $2.93 million briefly positions.

This huge liquidation of lengthy positions exhibits that buyers who have been betting on a market restoration have been compelled out of their positions.

The truth that buyers are unwilling to pay premiums and keep their positions signifies a insecurity sooner or later prospects.

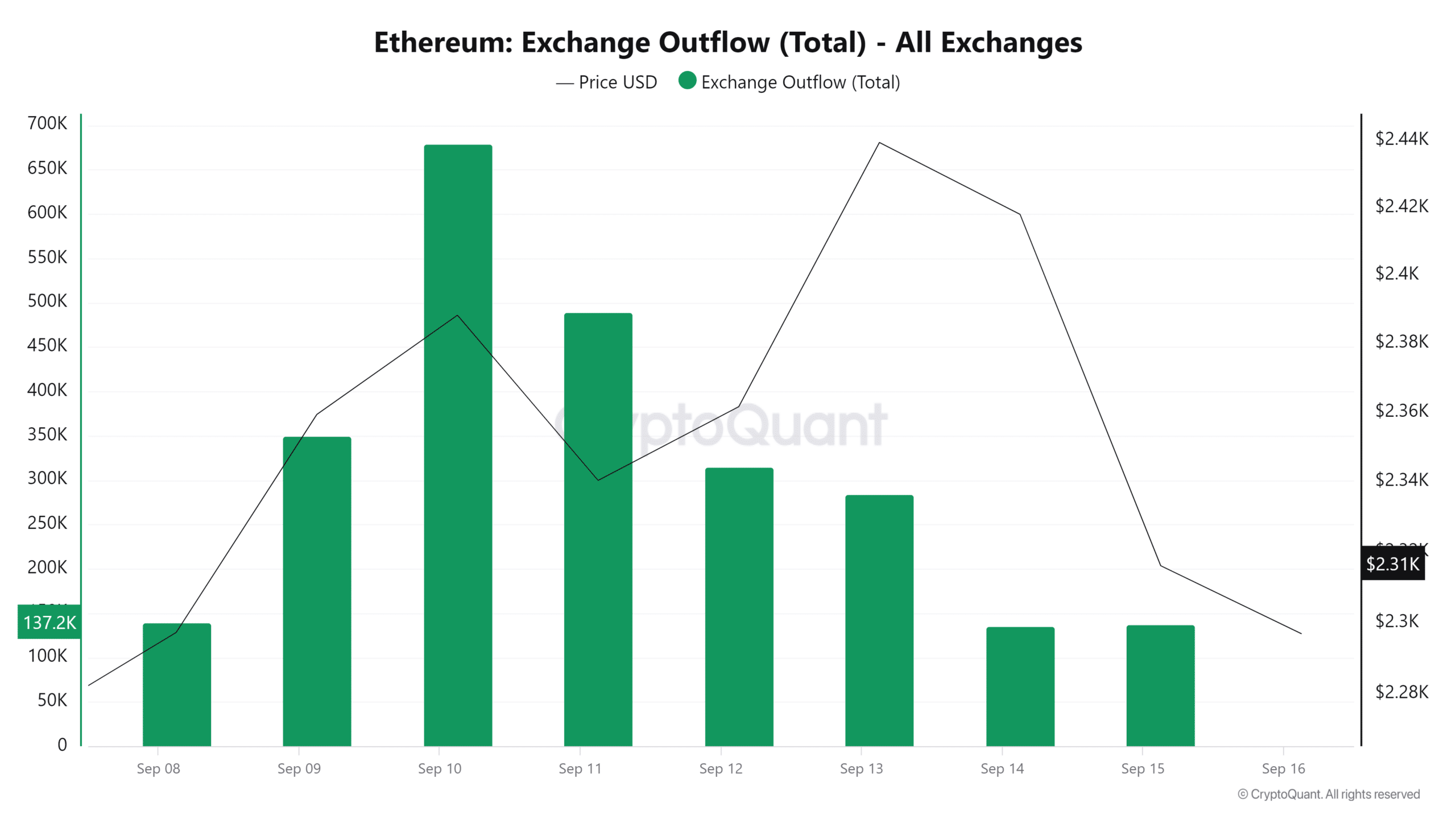

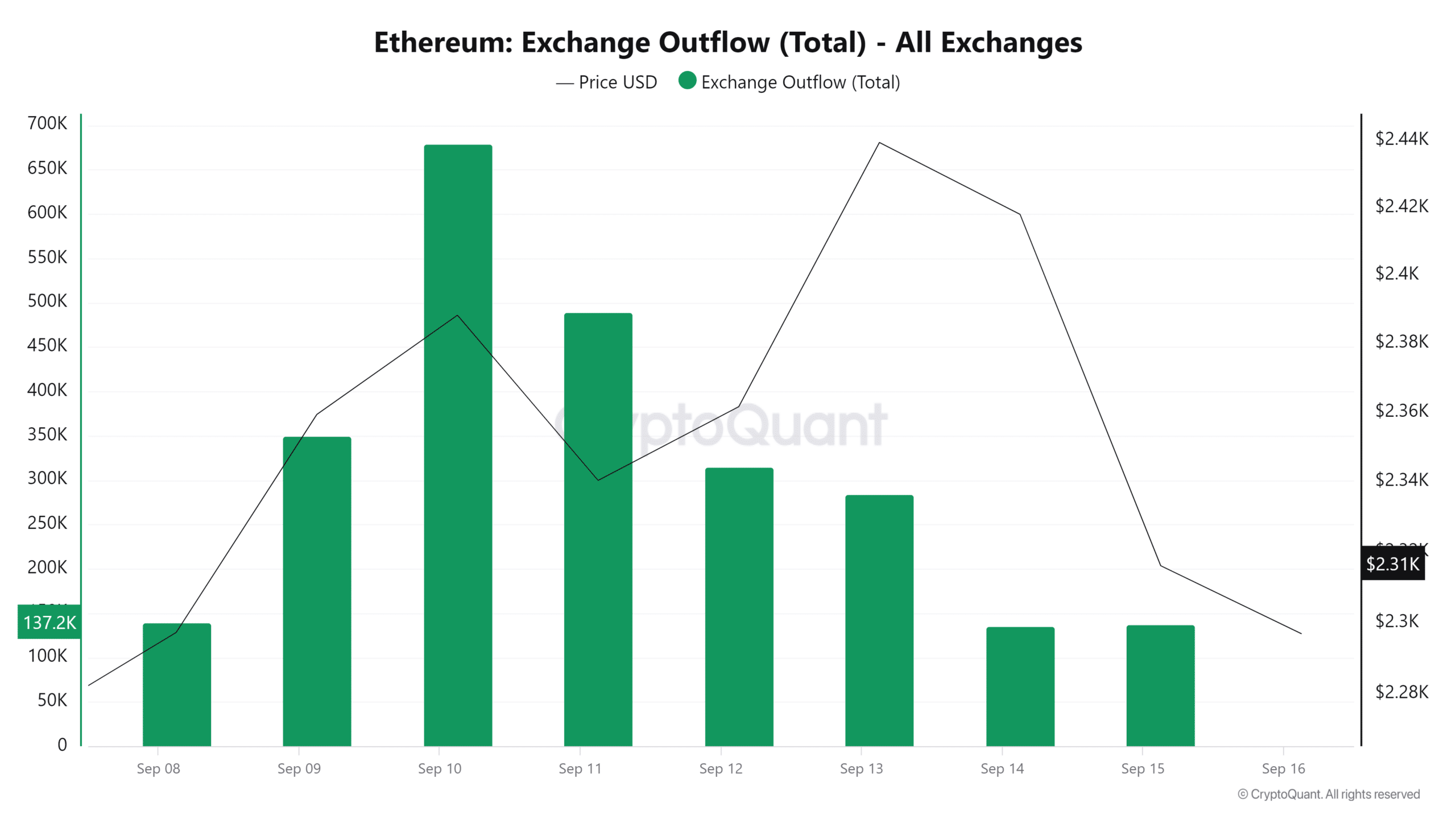

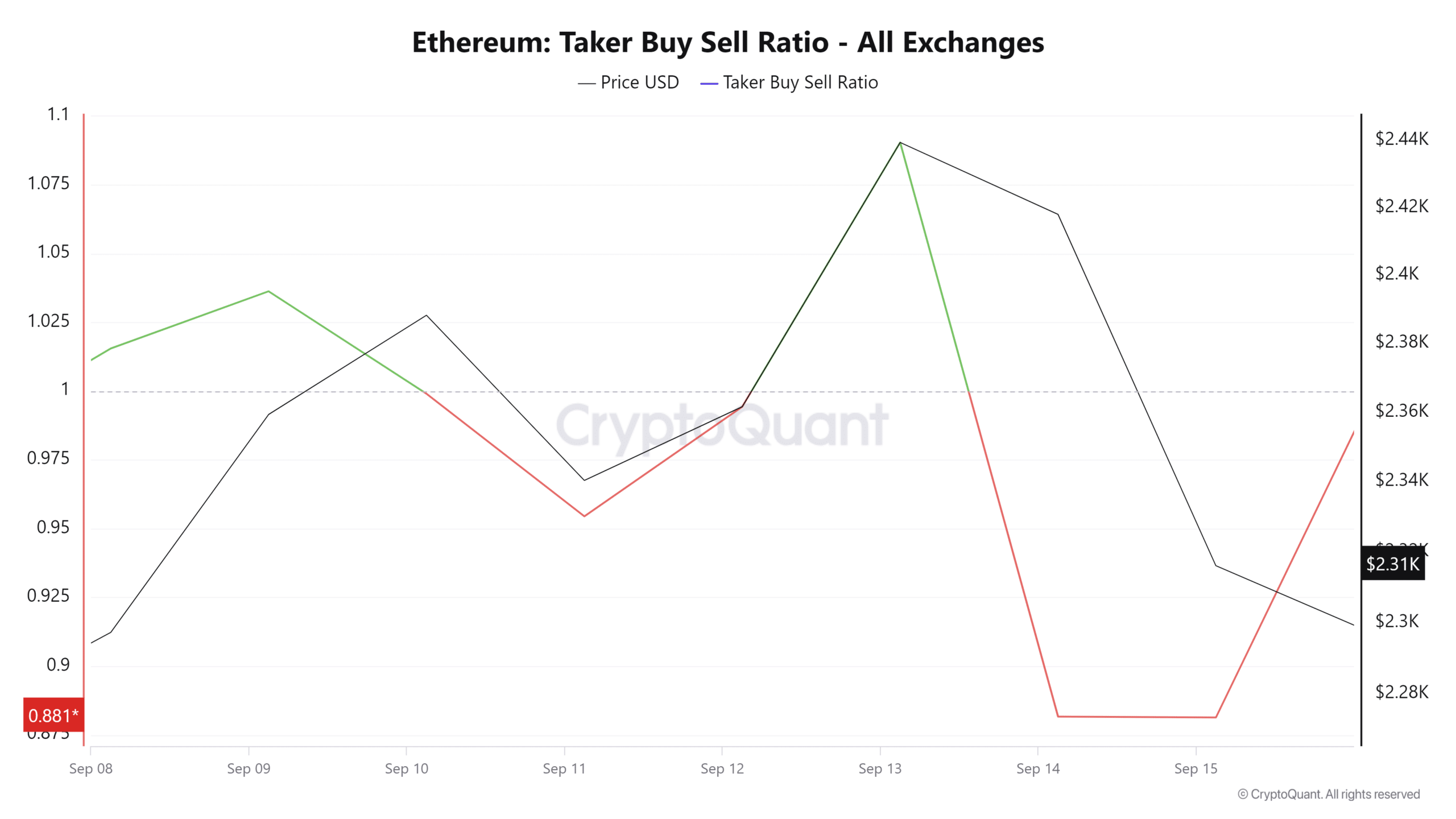

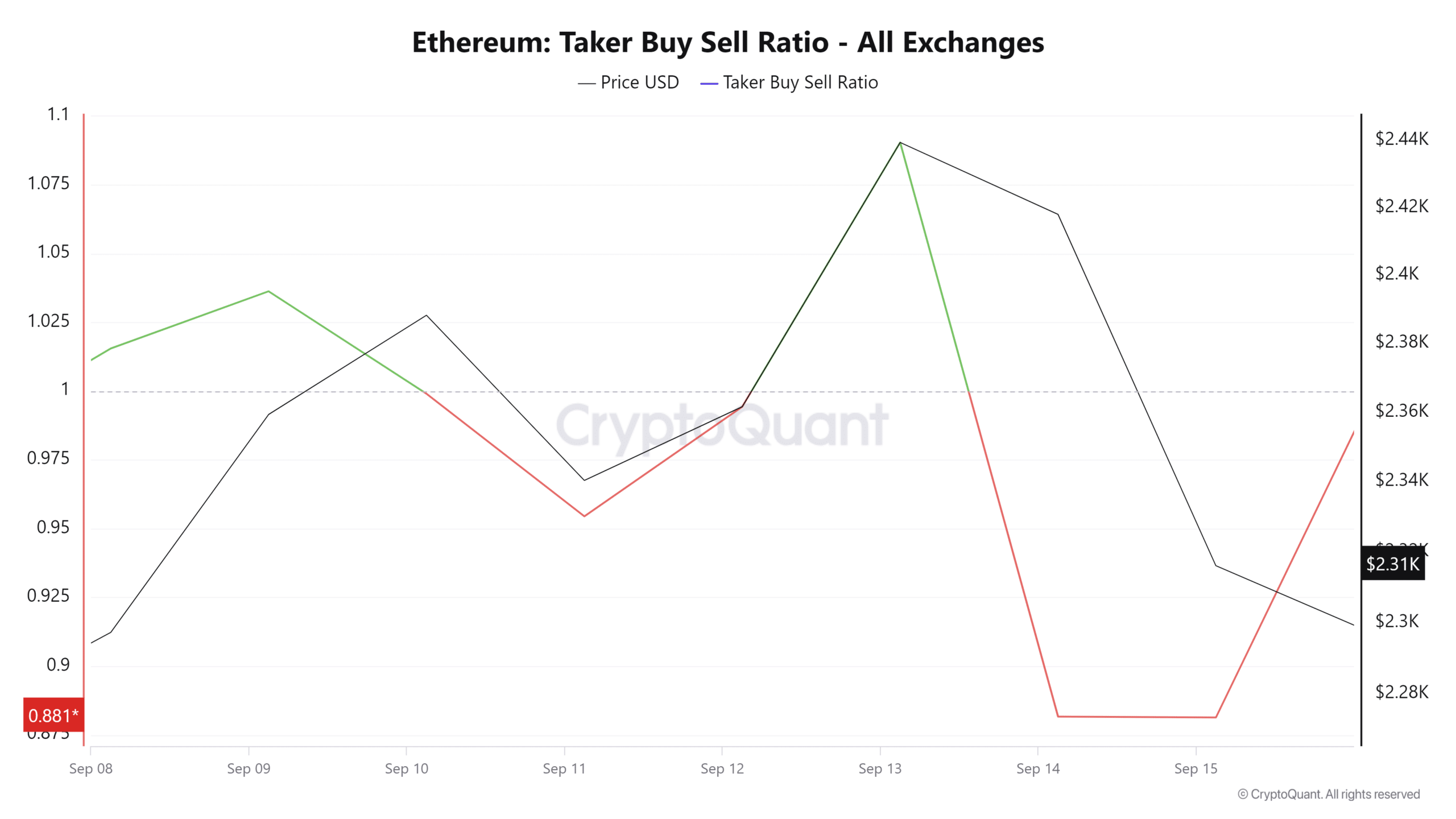

Supply: CryptoQuant

Moreover, Ethereum outflows fell from 679119.6 to 71794.34 over the previous seven days. The decline exhibits much less accumulation by holders, with fewer buyers withdrawing their belongings from the exchanges.

That is one other bearish sign because it exhibits that buyers are ready for a chance to promote slightly than committing to long-term investments.

Supply: CryptoQuant

Lastly, the Taker Purchase Promote Ratio dropped to 0.88 in current days, exhibiting that buyers have been partaking in aggressive promoting slightly than shopping for.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Merely put, present market circumstances don’t help a near-term worth restoration. As indicated by the Taker Purchase Promote Ratio, the current spike in buying and selling quantity signifies elevated promoting exercise.

So if present market circumstances persist, ETH will fall to the following help stage round $2114 earlier than making an attempt one other upward transfer.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now