Altcoin

Despite Solana’s efforts, SOL remains unaffected. Why?

Credit : ambcrypto.com

- SOL staking quantity elevated to roughly $52 billion.

- SOL is heading for its sixth straight day of decline.

The Solana staking panorama has seen some notable developments over the previous 24 hours, with a number of exchanges hinting that new SOL staking options can be launched.

This information initially had a constructive affect on Solana’s [SOL] worth, briefly lifting market sentiment.

Nonetheless, regardless of the preliminary enthusiasm, SOL’s worth ultimately succumbed to a downtrend. Along with the value fluctuations, there was a rise within the quantity of SOL deployed.

Solana strike creates buzz

On August 29, three main cryptocurrency exchanges – Binance, Bybit and Bitget – posted cryptic however related messages on their X pages (previously Twitter).

These posts fueled hypothesis about upcoming Solana strike options.

Binance teased,

“BNSOL… Coming Quickly.”

Bybit hinted at a brand new addition, proverb,

“We welcome a brand new child to the bbSOL household.”

Additionally Bitget shared,

“One thing is coming from BG BGSOL.”

These posts all obtained a response from the official Solana X deal with, additional fueling hypothesis that these exchanges are getting ready to launch Solana staking options.

The posts generated constructive responses from the neighborhood, indicating robust anticipation for the potential introduction of SOL liquid staking choices on these platforms.

Liquid staking permits customers to stake their tokens and earn rewards whereas sustaining liquidity, as they obtain a by-product token that may be traded or used elsewhere.

Solana’s strike quantity is seeing a rise

Based on a latest evaluation, the quantity of SOL staked had elevated considerably by the top of buying and selling on August 29.

This development coincided with developments at Solana, suffering from main exchanges corresponding to Binance, Bybit and Bitget.

The information of Set up rewards signifies that as of August 28, SOL’s complete stakes have been roughly 378.3 million. Nonetheless, by August 29, this determine had risen to over 380 million SOL.

This enhance implies that roughly 65% of complete SOL provide has now been deployed, with the market cap at roughly $52 billion.

Additional information from DeFiLlama confirmed that Solana’s Whole Worth Locked (TVL) on the time of writing was roughly $4.9 billion.

Liquid staking platforms have contributed considerably to this TVL, with Jito for instance having a TVL of over $1.7 billion.

SOL peaks for a second

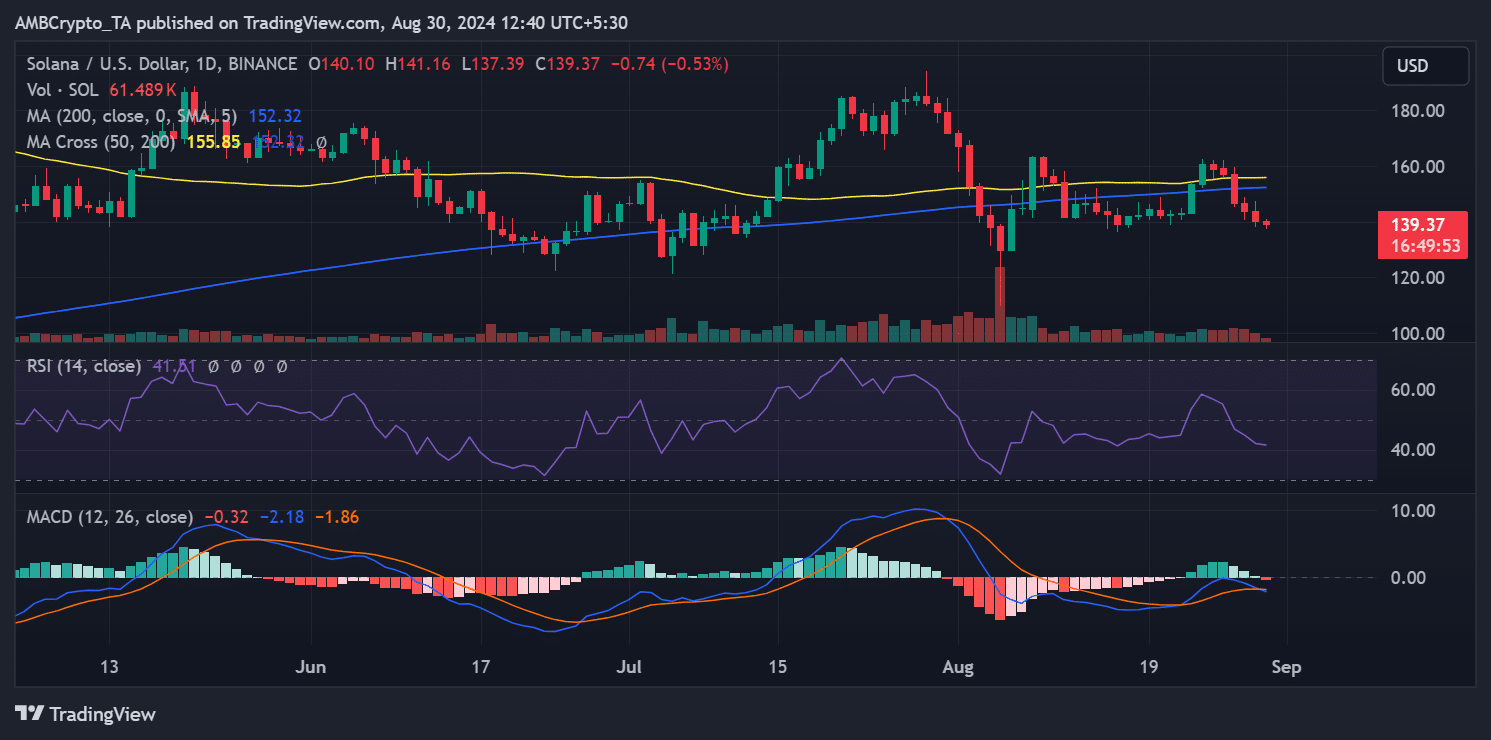

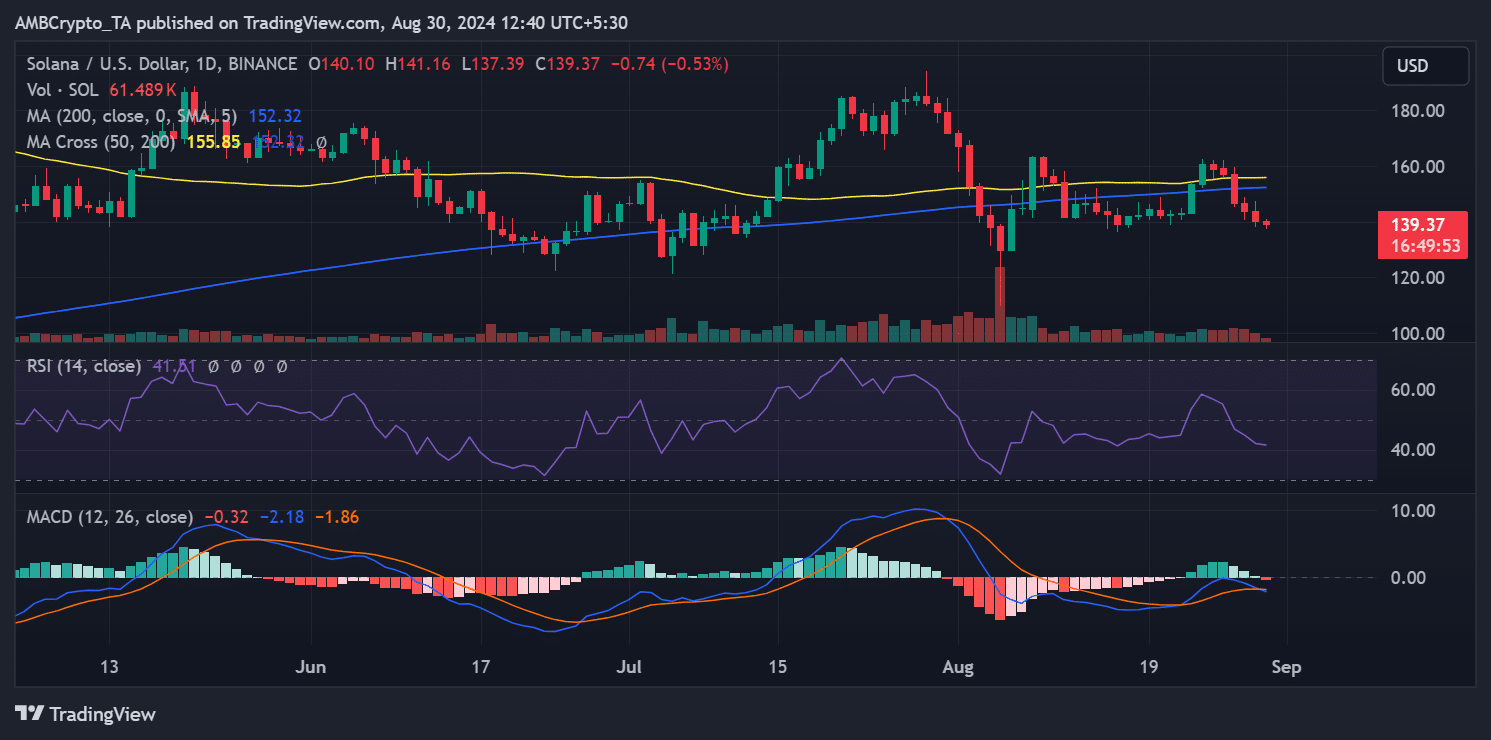

AMBCrypto’s evaluation of Solana’s [SOL] The worth improvement revealed a slight response to the latest strike developments on August 29.

On that day, SOL’s worth opened round $144 and briefly reached a excessive of round $147. Nonetheless, the value couldn’t maintain this upward motion and ultimately fell to round $140.

On the time of writing, SOL is buying and selling at round $139, which represents a decline of lower than 1%.

Supply: TradingView

Is your portfolio inexperienced? View the SOL Revenue Calculator

This decline signifies that the preliminary pleasure across the strike developments was inadequate to take care of an enduring constructive affect on the value of SOL.

Suppose SOL continues to development down in the course of the present buying and selling session. In that case, this can mark the sixth consecutive downtrend, underscoring the continuing bearish stress.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now