Altcoin

Does Bitcoin Reflect Its Past Market Recovery? VanEck thinks so…

Credit : ambcrypto.com

- VanEck analysts consider that BTC is on monitor for a robust restoration

- Analysts pointed to sturdy community exercise and a decline in funding prices in BTC Futures

That is evident from VanEck’s month-to-month report Bitcoin [BTC]the world’s largest digital asset has proven outstanding resilience of late. In truth, it now displays the earlier market restoration, the report stated.

VanEck’s analysts, Mathew Sigel and Nathan Frankovitz, noted that BTC’s sturdy community exercise and a decline in future funding prices may very well be indicators of a probable sturdy restoration.

“Bitcoin community exercise remained strong with an 83% improve in Ordinals registrations, whereas Bitcoin futures funding prices fell, reflecting the chance urge for food seen in earlier market recoveries.”

BTC’s funding prices mirror the restoration in Could and July

Notably, BTC funding charges – charges paid by merchants to carry perpetual futures contracts – fell to comparable ranges throughout the restoration in Could and July.

“Over the previous 30 days, the annualized price of funding Bitcoin futures has fallen from ~11.6% to ~8.8%, representing a relative decline of ~24%. These ranges point out danger urge for food just like that seen throughout the market restoration following a greater than 20% BTC value drop in early Could and July of this 12 months.”

Regardless of the constructive scenario for BTC, the current decline in August has decreased addresses with earnings by round 9%. Total, the variety of BTC customers with unrealized beneficial properties was 84%, in accordance with the report. The remaining customers with losses have been primarily short-term traders.

Nonetheless, the analysts famous that the current value declines have been regular retracements throughout BTC’s bull markets.

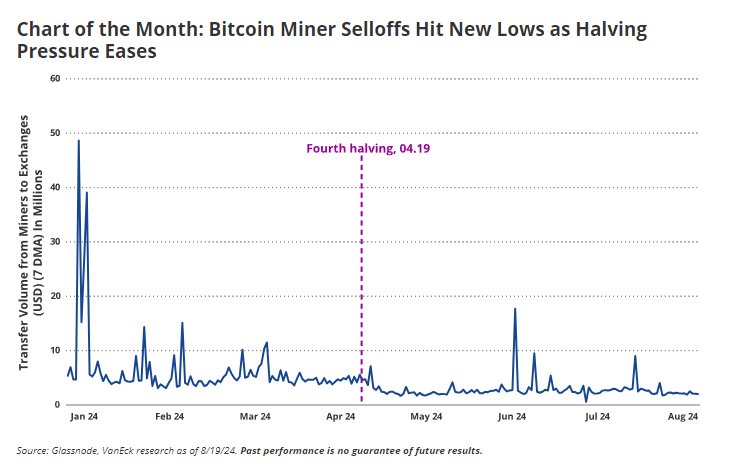

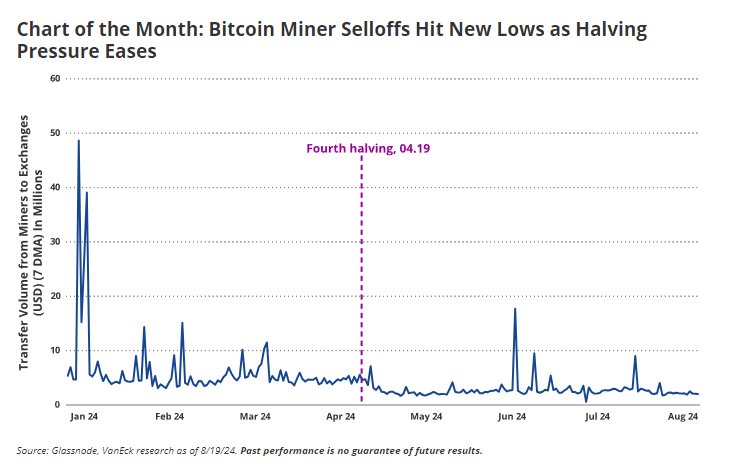

Furthermore, strain from BTC miners has decreased, as evidenced by the decline in miner sell-offs.

“Switch volumes from miners to exchanges have fallen 21% over the previous 30 days, indicating that miners have stabilized after their gross sales rose considerably following the halving in June and July.”

Supply: VanEck

On the time of writing, Bitcoin’s greater timeframe chart was bullish after rising above the short-term provide space at $63,000 and reclaiming the 200-day SMA (Easy Transferring Common).

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2024/08/BTCUSD_2024-08-24_10-22-17.png)

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2024/08/BTCUSD_2024-08-24_10-22-17.png)

Supply: BTC/USD, TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024