Altcoin

Does falling American bonds yield the real reason?

Credit : coinpedia.org

The cryptocurrency market begins its week on a bearish observe, and wipes virtually 4.5% in worth and lots of of billions in market capitalization inside simply 24 hours. Bitcoin led the drop, moved round 3% to $ 112,800 and pulled the broader marketplace for digital belongings decrease.

Though many individuals pointed to a weak momentum and taking a revenue because the trigger, a deeper issue could be discovered within the bond market, which quietly types the worldwide investor sentiment.

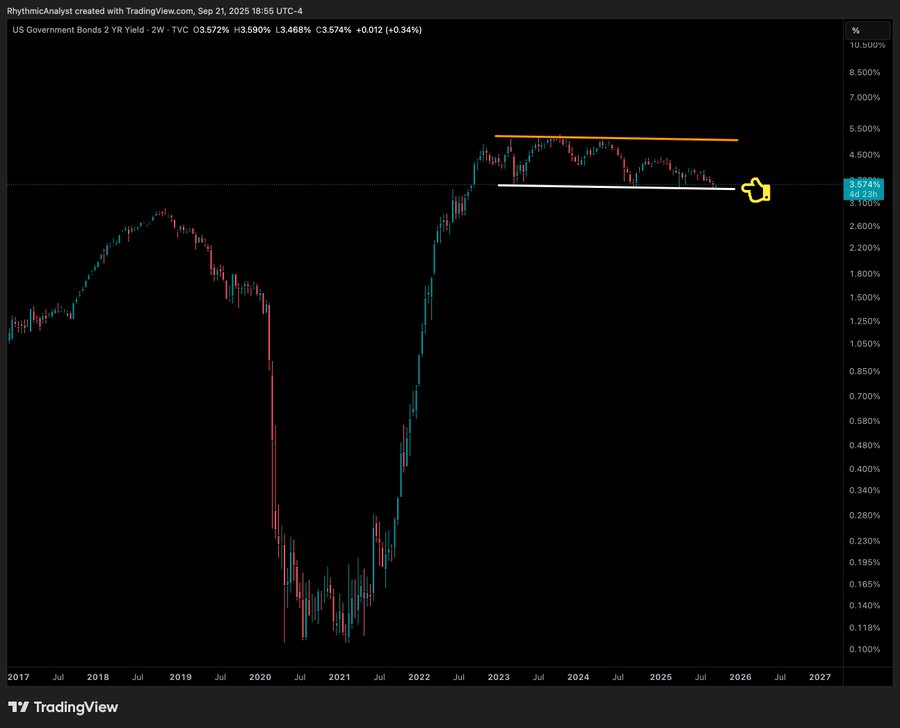

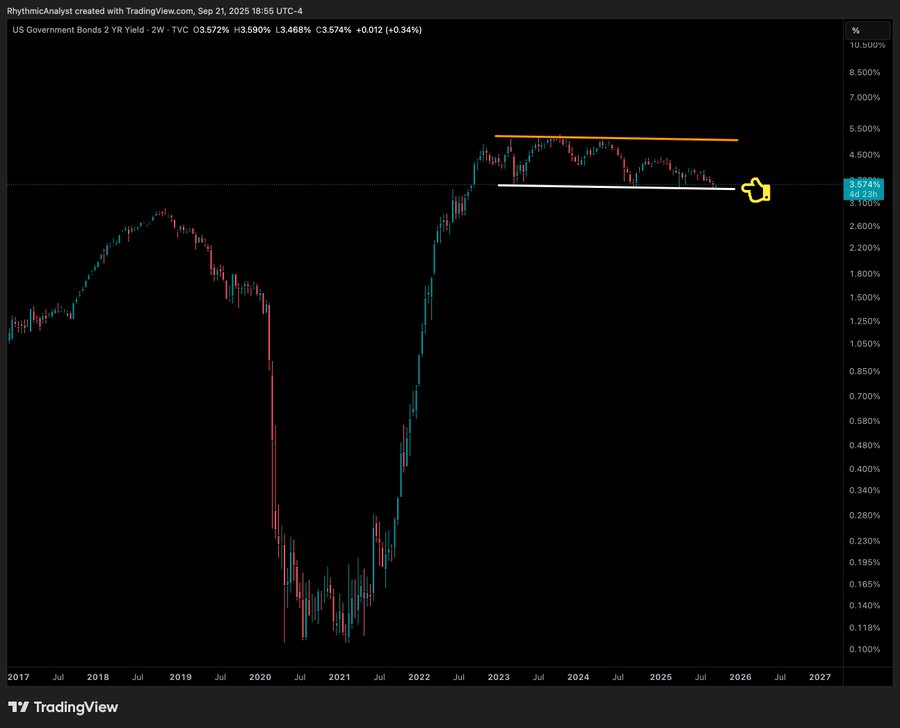

2-year bond returns are low

Bond revenues are extra than simply figures for Wall Avenue, they set the tone for the place cash flows. In response to the Market analyst MihirAmerican treasure districts have develop into one of many strongest indicators for each shares and crypto.

After the period of COVID cash prints, the yields elevated increased, which is a mirrored image of the rising financial uncertainty. For the reason that starting of 2023, 2-year revenues have moved sideways, in order that room for threat belongings equivalent to crypto rises. Nevertheless, rising yields often injury Bitcoin and Altcoins whereas traders select a safer return.

However now they’re at a vital degree of assist and the 2-year-old bond returns have already activated a downward development, it’s simply that no new low level has been made but. In the event that they fall additional, this may shift the worldwide markets.

As Mihir famous that within the coming weeks will reveal whether or not this might be a very powerful motivation for crypto costs.

FED price discount Buzz fades

This bond strain got here simply when the thrill of the latest price discount of the FED started to fade. Bitcoin and Main Altcoins fell on the finish of Sunday, when merchants grew to become cautious about future coverage actions.

FED chairman Jerome Powell described the minimize as a “threat administration” step and hinted that there was no hurry for additional cuts.

That cautious tone contributed to market nerves, resulting in heavy liquidations. Within the final 24 hours alone, 403,784 merchants have been worn out, with $ 1.7 billion In complete liquidations. The most important hit was a BTC commerce of $ 12.74 million in OKX.

Altcoins take an even bigger hit

Whereas Bitcoin struggled, Altcoins suffered even sharper. Ethereum fell greater than 7% to $ 4,190, the bottom in additional than a month. XRP fell by 6% to $ 2.76, a low level of three weeks. Solana fell 7%, whereas Cardano fell 9%.

Even meme cash weren’t spared, with Dogecoin falling 11% and Trump dropped 9%.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now