Bitcoin

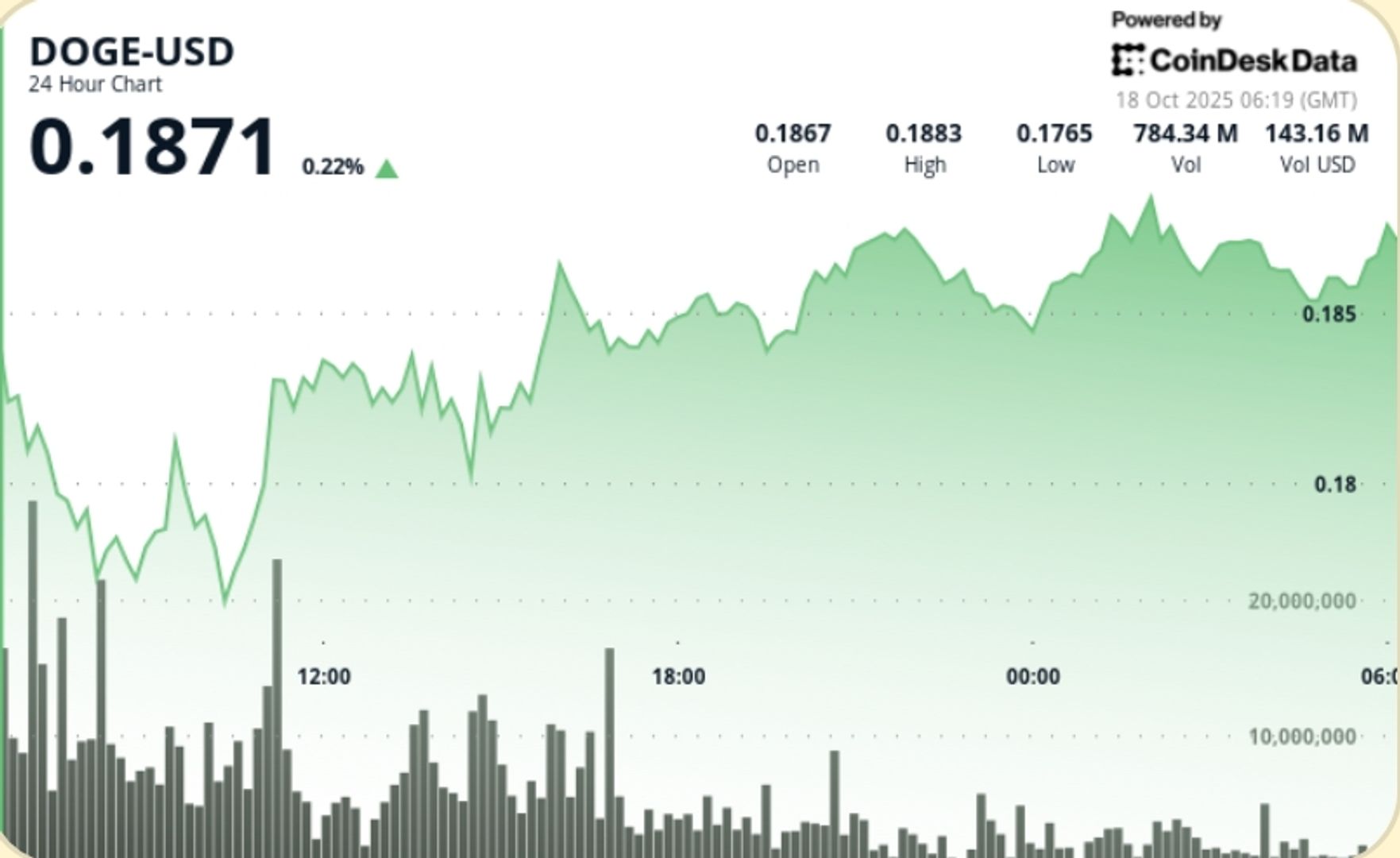

Dogecoin Finds Support After Tariff-Led Selloff

Credit : www.coindesk.com

Dogecoin stabilized on Friday after early volatility noticed the worth drop to $0.176 earlier than recovering to a decent vary of $0.18-$0.19. The 7% swing through the session got here amid renewed macro jitters and stories of main whale liquidations totaling greater than $74 million.

What that you must know

• DOGE traded between $0.176 and $0.189 between Oct. 17 at 6 a.m. and Oct. 18 at 5 a.m., a spread of 6.7%.

• Buying and selling volumes exceeded 1.4 billion through the 07:00–08:00 UTC sell-off, offering sturdy assist close to $0.18.

• Main holders reportedly forgave 360 million DOGE ($74 million), whereas broader crypto markets fell 6% on the tariff information.

• The worth recovered steadily to shut round $0.186, making larger lows through the afternoon classes.

• Futures positioning remained blended as merchants weighed Fed coverage alerts towards inflation dangers.

Information Background

The morning dip adopted weak point in markets following the Trump administration’s 100% tariff declaration on Chinese language imports – a transfer that despatched threat property plummeting throughout Asia. DOGE confronted early liquidation strain however discovered stability as whales and market makers absorbed the providing close to $0.18. Analysts famous a robust focus of bids round that stage, indicating accumulation moderately than capitulation. In the meantime, derivatives rates of interest normalized after a quick spike in brief positioning, suggesting sentiment is stabilizing.

Abstract of Worth Actions

• Sharp drop from $0.188 → $0.176 at 07:00 UTC on quantity >1.4 billion – the capitulation transfer of the day.

• The mid-session restoration helped DOGE recuperate $0.184–$0.187, consolidating for the remainder of the day.

• Final hour (04:22–05:21 UTC): Check of $0.1853 low with a quantity peak of 10.5 million, adopted by a gradual leap to $0.1862.

• Resistance endured within the $0.188-$0.189 zone with a number of failed breakout makes an attempt.

• A decent late session vary ($0.1860–$0.1862) and a declining quantity sign place forward of catalysts.

Technical evaluation

• Assist – $0.175–$0.180 stays a crucial accumulation zone; patrons defended lows with nice conviction.

• Resistance – $0.188–$0.190 marks the higher consolidation band; a breakout may goal $0.20+.

• Quantity – Peak exercise at 1.4 billion; quantity compression within the late session helps equilibrium formation.

• Sample – Narrowband consolidation after a morning flush signifies a volatility spiral.

• Momentum – RSI impartial close to 49; MACD smoothing – not pattern dominant but.

What merchants have a look at

• Affirmation of $0.18 as a short-term foundation previous to weekend classes.

• Renewed whale flows – whether or not accumulation continues after the $74 million elimination.

• Potential rotation into meme property subsequent week, amid ETF optimism.

• Fed commentary on charges and the influence of liquidity on speculative flows.

• Breakout above $0.19 as a set off for retesting the $0.20–$0.21 zone.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024