Ethereum

ETC trading activity heats up – Will it be a hedge against a bearish ETH?

Credit : ambcrypto.com

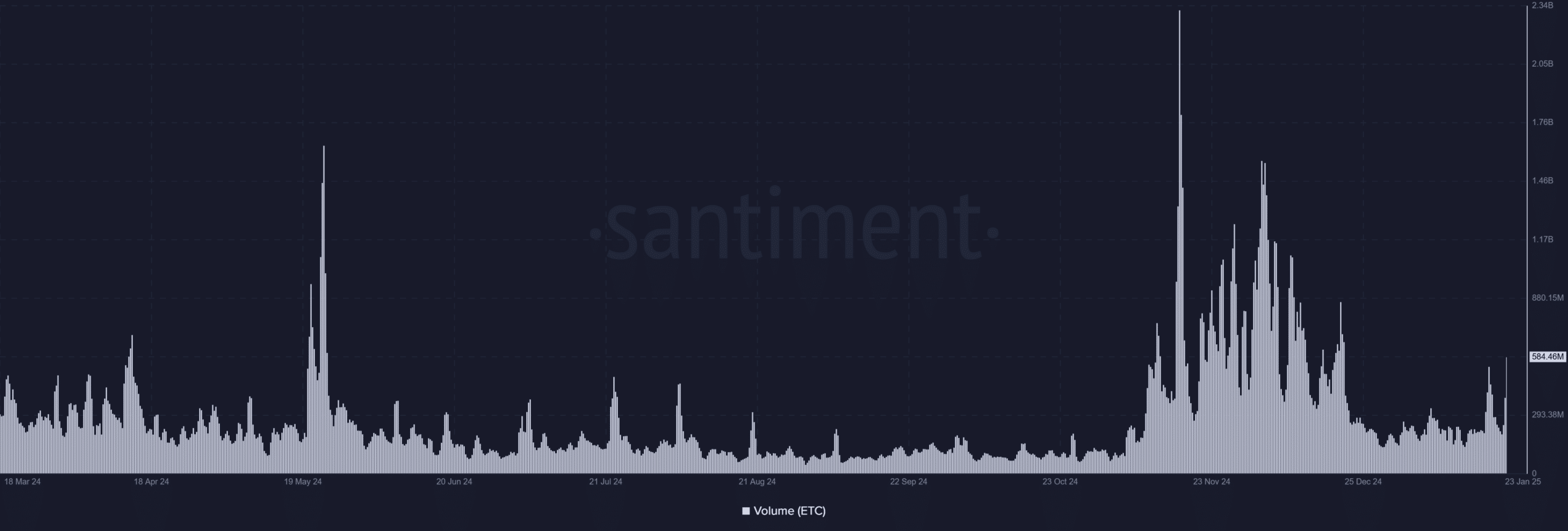

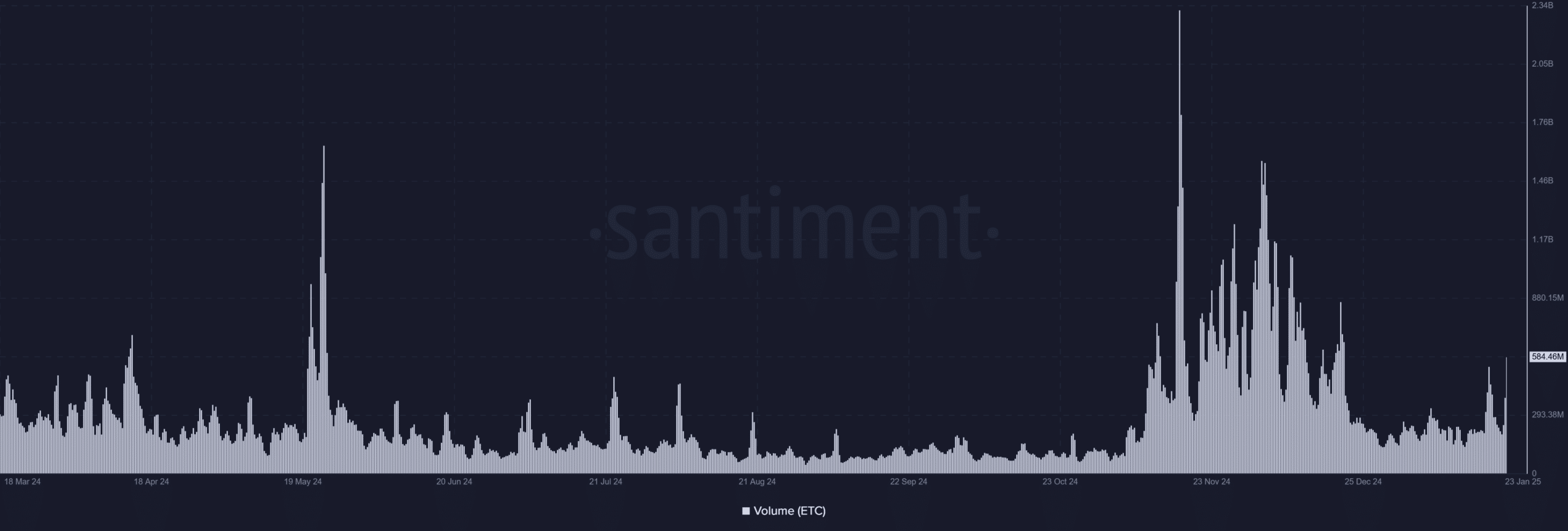

- The commerce quantity of Ethereum Basic rose to 584.46 million, indicating the rising investor’s curiosity within the midst of the falling energy of ETH.

- ETC stored above crucial help of $ 22.50, whereas ETH struggled beneath its 50-day advancing common, which raised questions on market shifts.

Ethereum Basic [ETC] has seen a barely higher development than Ethereum [ETH] Just lately, which ends up in hypothesis that it might take up liquidity that loses the latter.

With each property that present contrasting value actions and quantity traits, buyers surprise if ETC is on the rise as a possible various to ETH.

Worth promotion of Ethereum Basic: a blended development

Ethereum Basic traded at $ 24.54 on the time of the press, which displays an intraday discount of 1.72%.

The worth diagram emphasised that ETC had entered right into a consolidation section after a powerful rally, which was beneath its 50-day advancing common of $ 26.87 and better than the 200-day advancing common of $ 23.15.

The truth that it stays above the 200-day MA means that and many others. continues to be in a long-term upward development regardless of bearish actions within the brief time period.

Supply: TradingView

ETC’s current value promotion is characterised by decrease highlights, which might point out lowering bullish momentum. Nonetheless, help on the degree of $ 22.50 stays robust, which suggests {that a} leap can happen if the broader market stabilizes.

ETH’s loss, and many others. revenue?

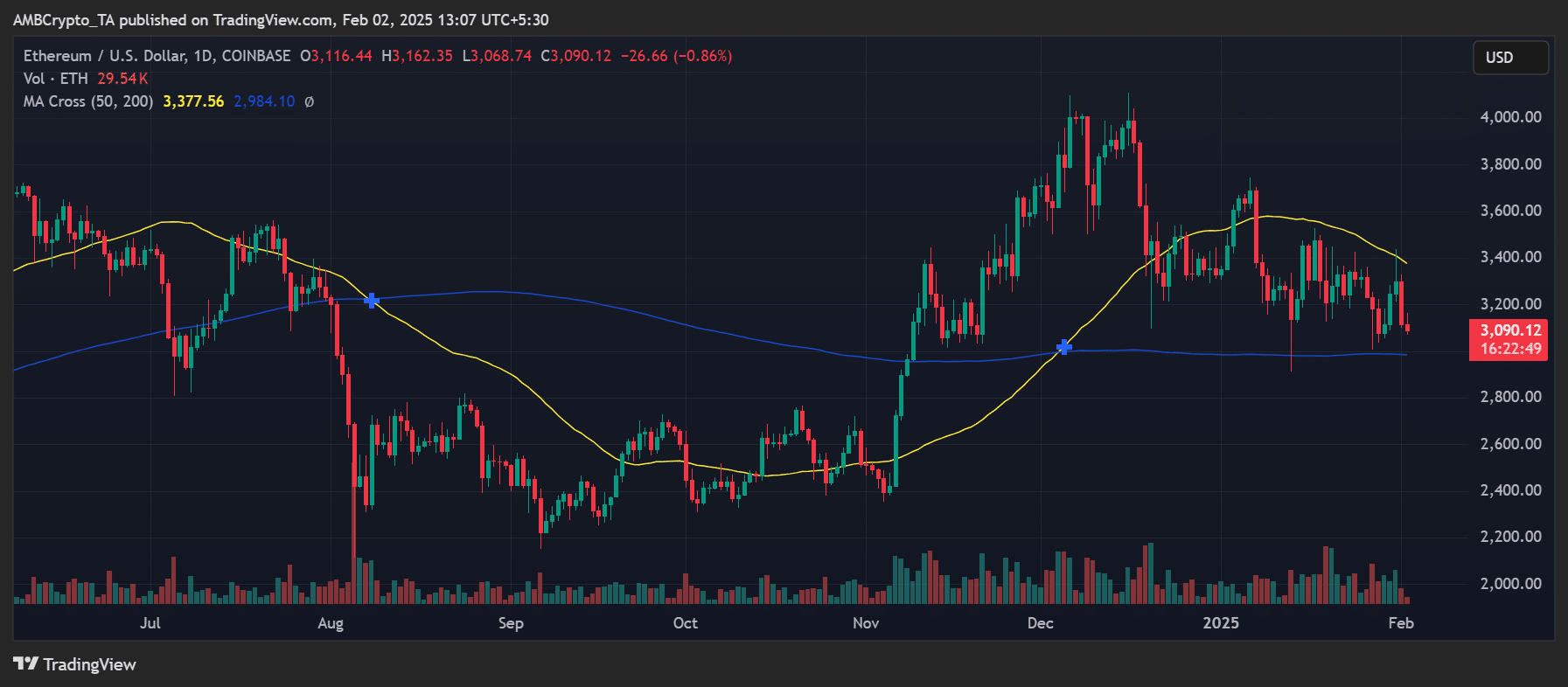

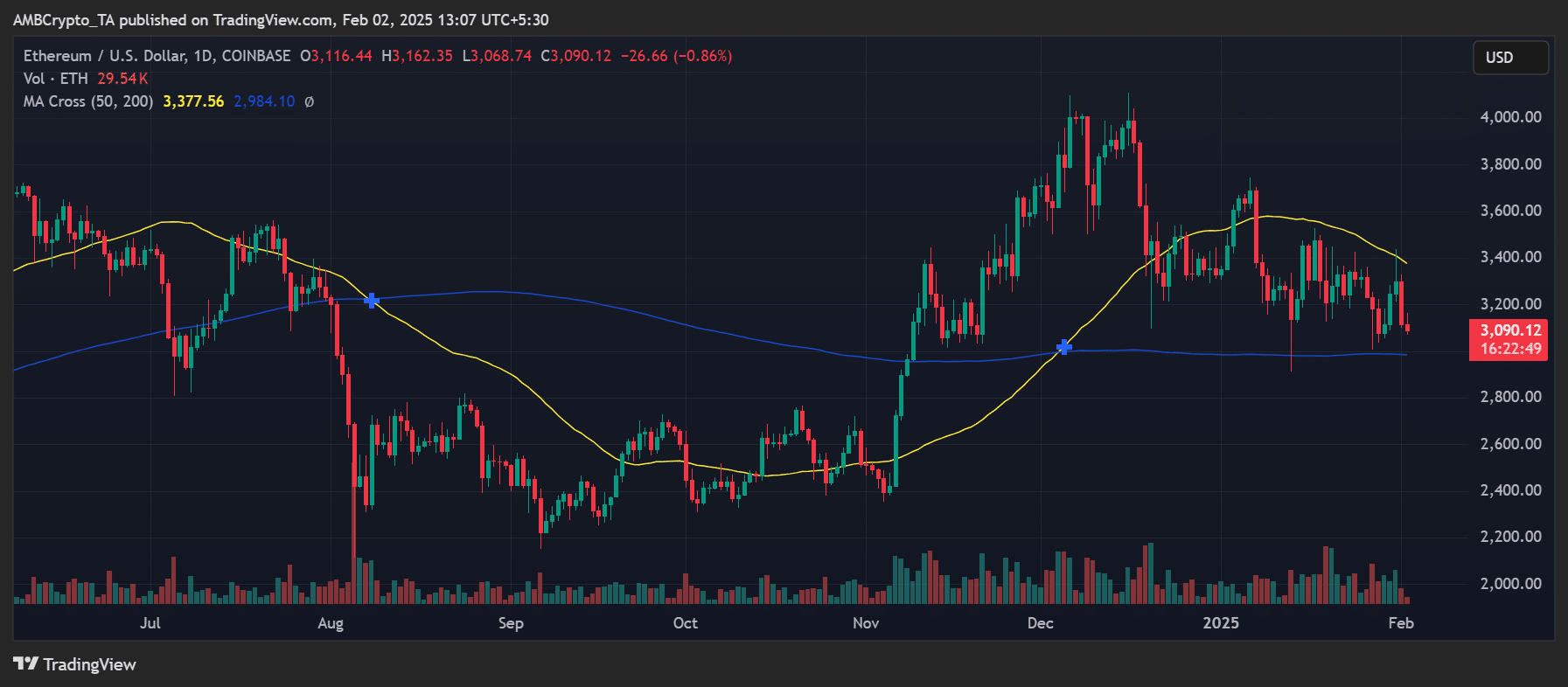

Then again, Ethereum traded at $ 3,090.12 on the time of writing, with a lower of 0.86% for the day. Whereas ETH remained in a wider upward development, it had problem sustaining necessary help ranges.

The progressive common of fifty days was $ 3,377.56, whereas the progressive common of 200 days was $ 2,984.10.

A infringement under the 50-day MA meant a possible lack of short-term momentum, making Ethereum susceptible to additional downward stress.

Ethereum’s commerce quantity particularly has been demolished, through which the amount card of Santiment signifies that decreased participation of merchants signifies.

This weakening curiosity might clarify why some buyers shift their focus to Ethereum Basic, which has demonstrated the next relative energy.

Volumetrends: and many others’s rising momentum

An extra consideration of Santiment Quantity card revealed that and many others had skilled a gentle enhance within the commerce quantity, with a current excessive level of 584.46 m.

This enhance was an indication of renewed investor’s pursuits and rising religion in Ethereum Basic as an alternative choice to Ethereum.

In distinction to ETH, whose quantity has decreased, the liquidity of and many others. remained sturdy, which can point out a switch of market rate of interest.

Supply: Santiment

Quantity peaks on the finish of January 2025 tailor-made to cost actions, which strengthens the concept that merchants are actively working, and many others.

This shift could also be attributable to hypothesis that ETC gives a canopy in opposition to the weakening momentum of Ethereum, or because of the expectations of community developments that can provide desire, and many others.

The following motion of Ethereum Basic

Wanting forward, and many others. should retain its present commerce quantity and hold it above the $ 22.50 help zone to proceed to place itself as a powerful various to Ethereum.

If the weak point of Ethereum persists, there’s potential for and many others to get additional grip. Nonetheless, buyers need to look ahead to resistance close to $ 27.50, the place the gross sales stress has beforehand lined income.

Is your portfolio inexperienced? View the Ethereum Basic Revenue Calculator

On the macro degree, the correlation of Ethereum Basic with Ethereum signifies that wider crypto market traits will play a job in its course of.

If ETH recovers, and many others. also can profit, though the impartial quantity wave means that merchants are more and more treating it as a self -contained as an alternative of a spinoff of Ethereum.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024