Altcoin

ETH/BTC under pressure – will buyers perform this time?

Credit : ambcrypto.com

- The ETH/BTC pair floated near cycle lows, however vital assist for about 0.05 BTC may provide a launch platform.

- If BTC -Dominance decreases, capital can rotate in ETH, inflicting a rebound within the pair.

The US Greenback Index (DXY) has been deposited into new lows, refueling speculation About capital that runs in threat provisions, particularly crypto. Traditionally, a weakening greenback has supported the liquidity influx in Bitcoin [BTC] and Ethereum [ETH].

Trump’s import tax improve intensified the strain on the US greenback and pushes it again to ranges earlier than the elections. The evaluation of Ambcrypto, nonetheless, emphasised an important shift – BTC and DXY have been disconnected, decreasing the reliability of the greenback if a number one crypto market indicator is lowered.

But macro -economic catalysts stay within the recreation. As quickly as US President Donald Trump announced A tariff break, Bitcoin has recovered $ 86k after the actions of under this degree for seventeen days, whereas Ethereum rose previous $ 2k.

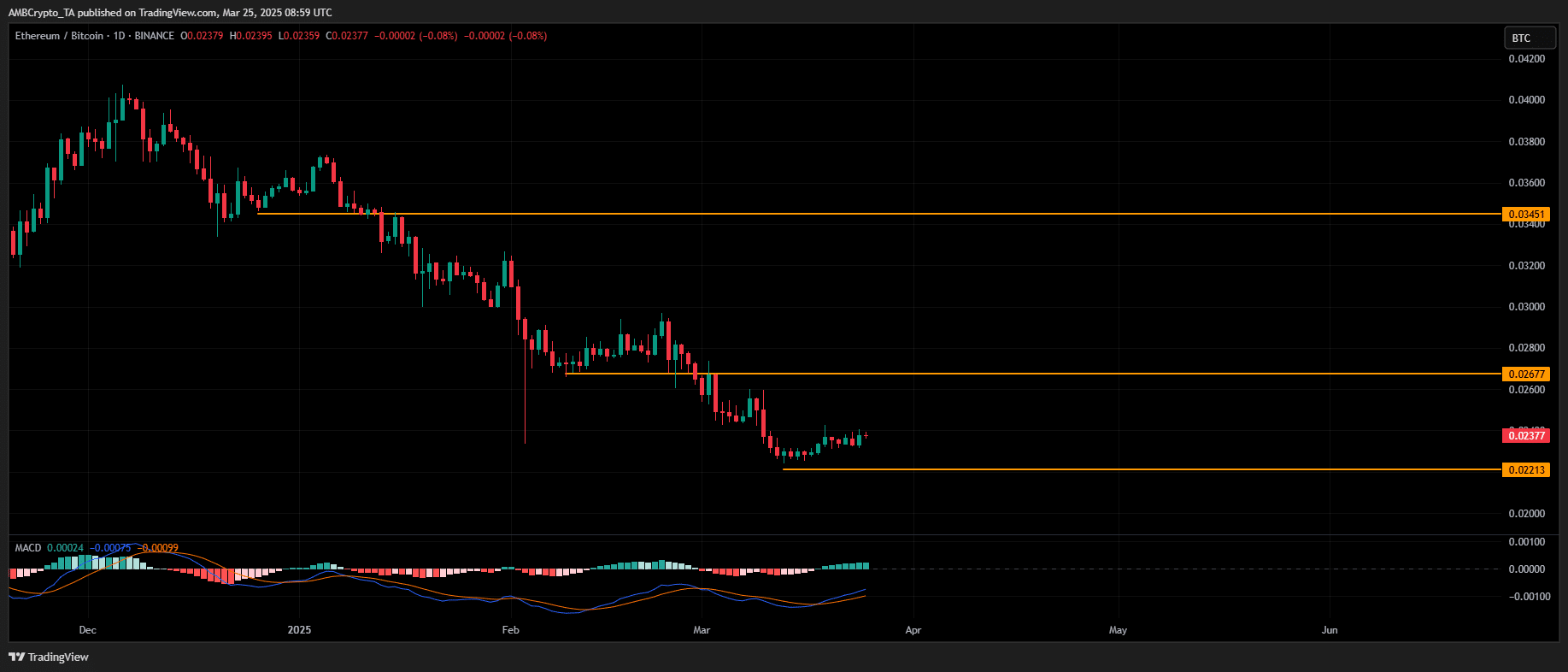

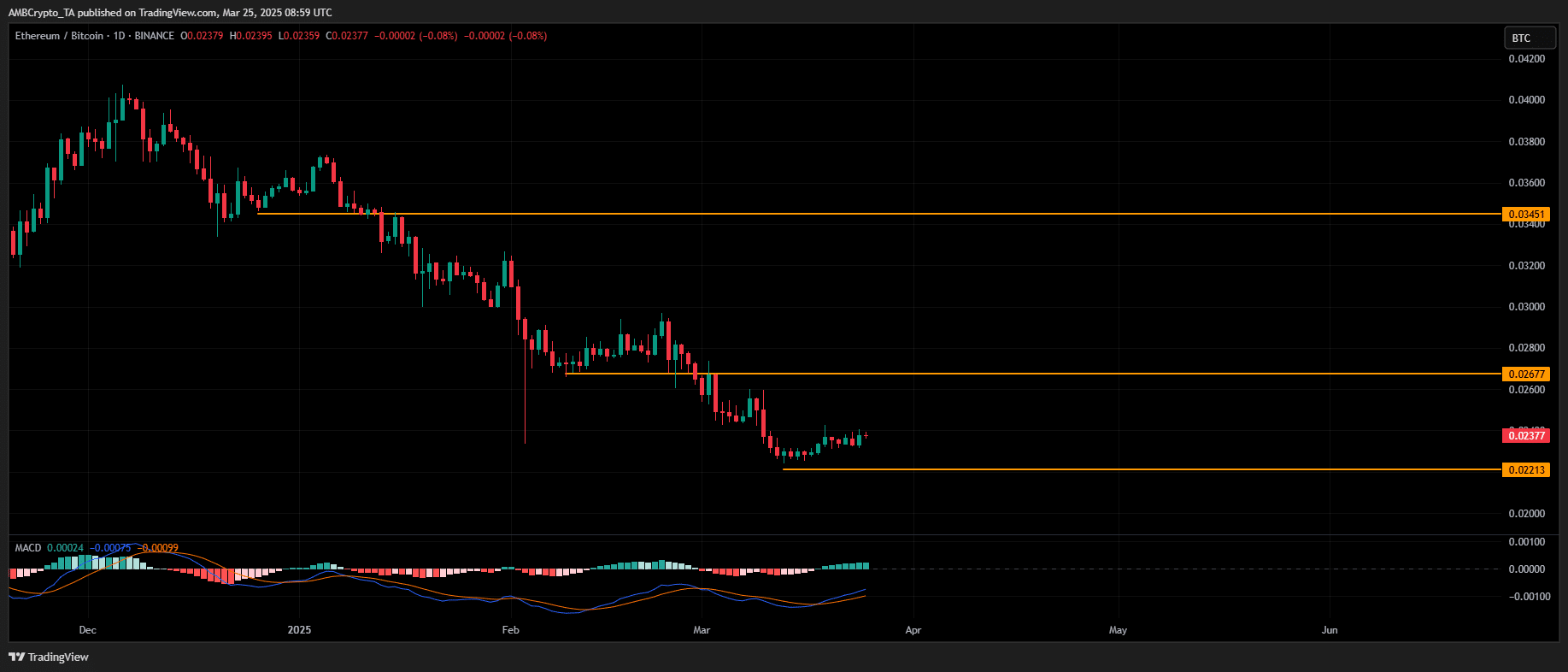

The present non-linear worth promotion of BTC presents ETH with a window to draw capital. The ETH/BTC pair signifies that the momentum is rising whereas the MACD is bulling bullish for the primary time in nearly a month.

A well-defined assist cluster has been shaped, which marks the third compression part in three months-a indication of a possible outbreak and development domination in favor of ETH.

Supply: TradingView (ETH/BTC)

If the breakout construction is confirmed, analysts are analysts project A motion to 0.0019 BTC per ETH, with the couple presently floating round 0.002 BTC.

Solely tech social alone usually are not. In earlier demand zones, consumers couldn’t retain accumulation, which led to liquidity exhaustion and a breakdown right into a low of 5 years.

If historical past repeats itself, the prospect of additional liquidity sweeping stays elevated. In such a situation, ETH/BTC may develop the drawback, which additional weakens the relative energy of Ethereum towards Bitcoin.

ETH/BTC: Breakdown -front or development elimination?

A BTC retracement stays a important set off for a confirmed ETH/BTC.

Present market construction identify $ 89k as an vital resistance zone for Bitcoin, by which an earlier outbreak try failed on 24 March, to strengthen the overhead facility.

If BTC is confronted with persistent rejection at this degree, a corrective motion can unlock ETH/BTC rotation, permitting a possible bid for Ethereum -Dominance.

Bullish conviction, nonetheless, appears weak. Because the rally after the elections, ETH has demonstrated an elevated correlation with the drawback of BTC, which is constantly decrease highlights.

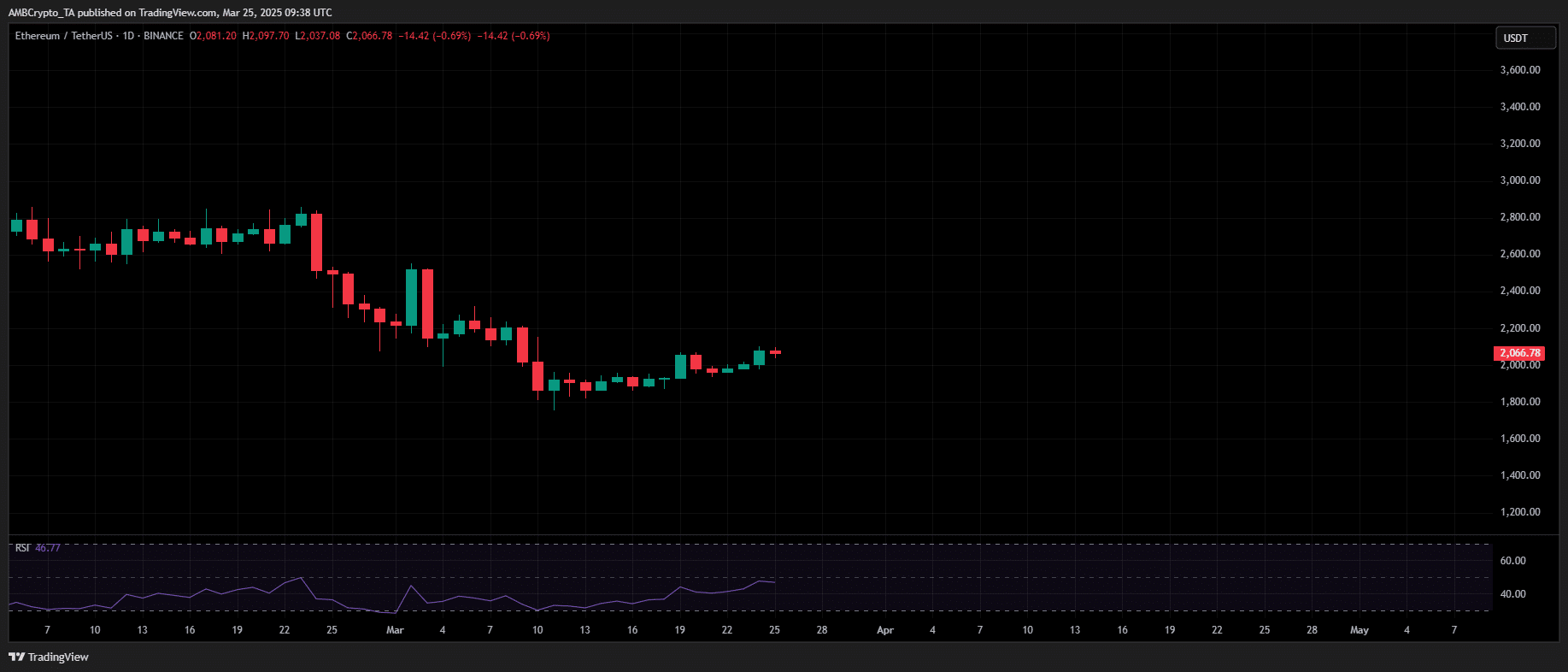

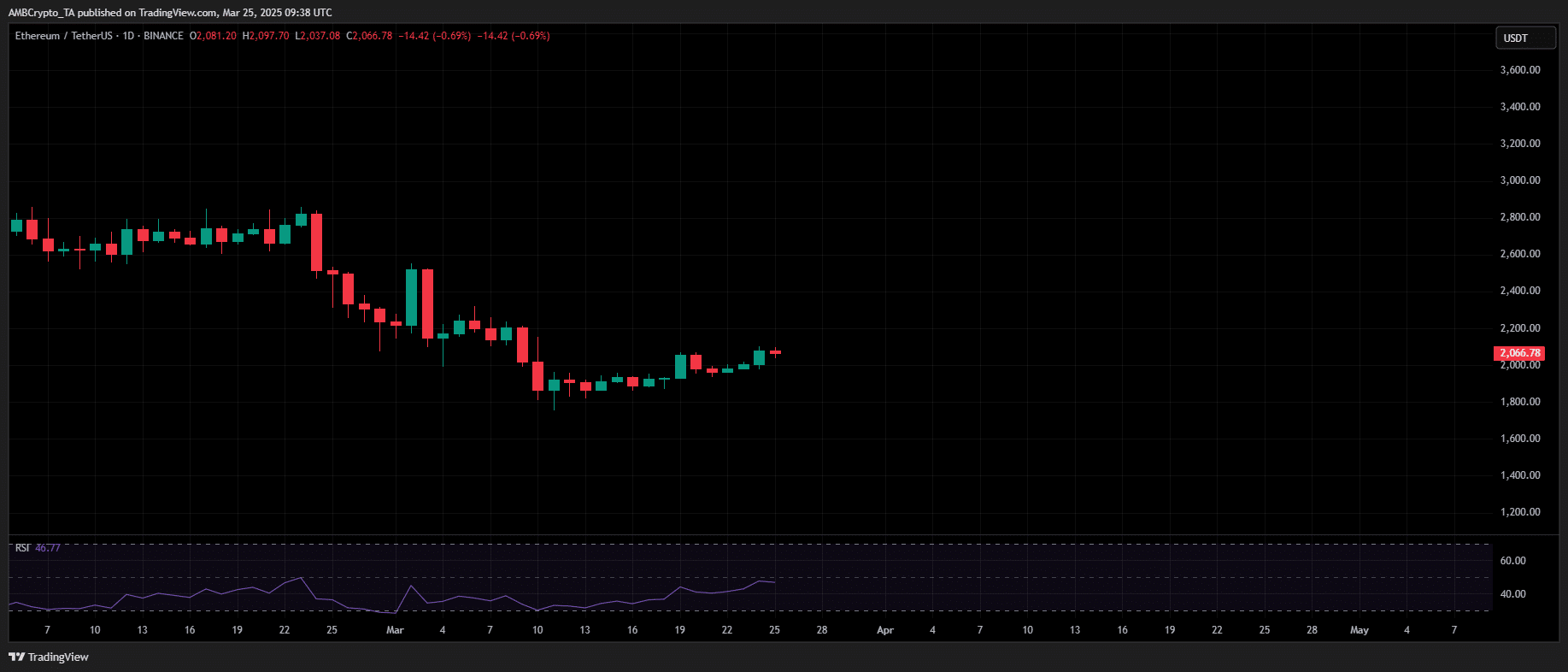

On March 3, BTCs led 8.54% Single-Day drawing to an ETH lower of 14.66%.

Supply: TradingView (ETH/USDT)

This structural shift means that Ethereum is changing into more and more reactive to the drawings of Bitcoin as a substitute of benefiting from capital rotation.

If BTC picks up sharply, ETH dangers to lose the $ 2K liquidity zone, which implies that ETH/BTC could float to contemporary cycle Lows.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?