Ethereum

ETH faces sell-off fears amidst increased whale activity

Credit : ambcrypto.com

- ETH faces sell-off fears amid elevated whale exercise.

- The Ethereum dump continues as main holders switch $538.5 million price of ETH.

Ethereum [ETH]the second largest cryptocurrency by market capitalization has lately undergone a average value restoration. On the time of writing, ETH was buying and selling as excessive as $2366, having risen 1.76% prior to now 24 hours.

Earlier than that, ETH was on a downward trajectory, reaching a low of $2150 this previous week. Over the previous 40 days, the altcoin has fallen 11.09%.

Regardless of the good points on the every day charts, ETH remained comparatively low from the latest native excessive of $2820 and down 51% from the ATH of $4878.

Though the altcoin has gained prior to now day, the market continues to be going through sell-off fears resulting from unprecedented whale exercise. As famous by Whale Alert, ETH has seen huge transfers to exchanges.

Ethereum whales are on the transfer

In a collection of transactions Whale alert has found huge ETH transfers to varied exchanges. These transfers whole a whopping $538 million despatched to varied exchanges together with Kraken, Binance, Arbitrum, and Coinbase.

Primarily based on the report, Binance acquired $188.6 million price of ETH, Kraken $127.2 million, whereas Coinbase and Arbitrum recorded $34 million and $188.6 million respectively.

Supply: Whale Alert

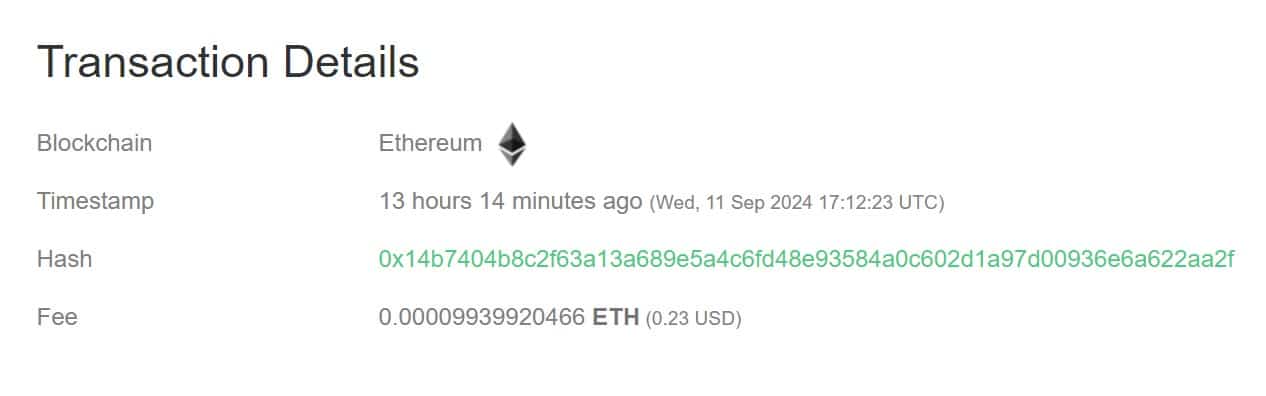

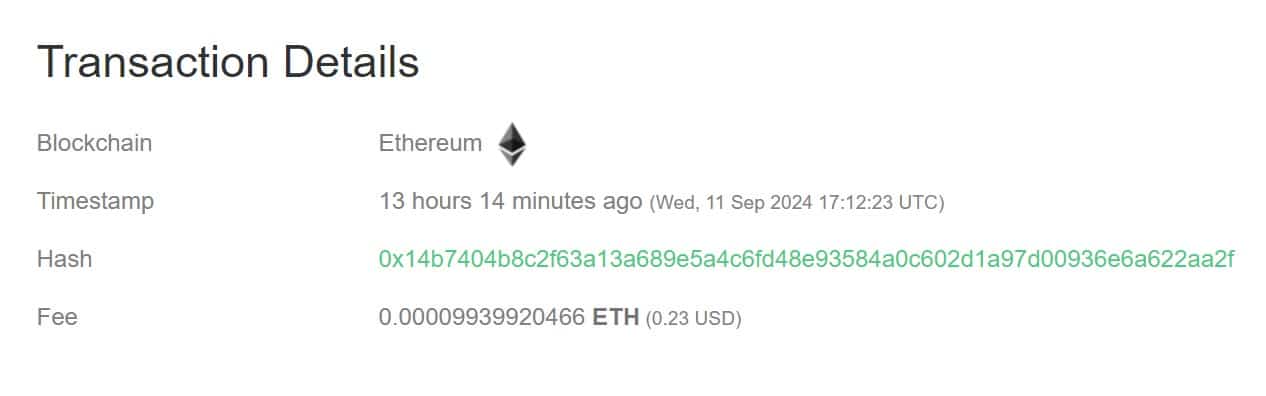

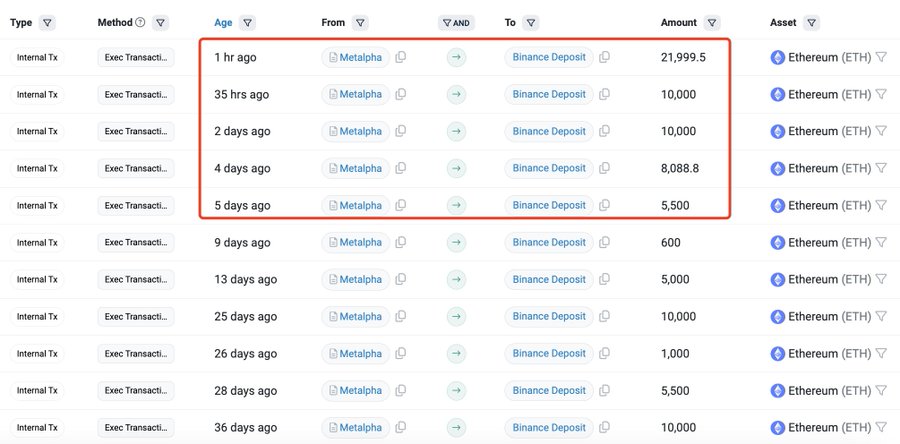

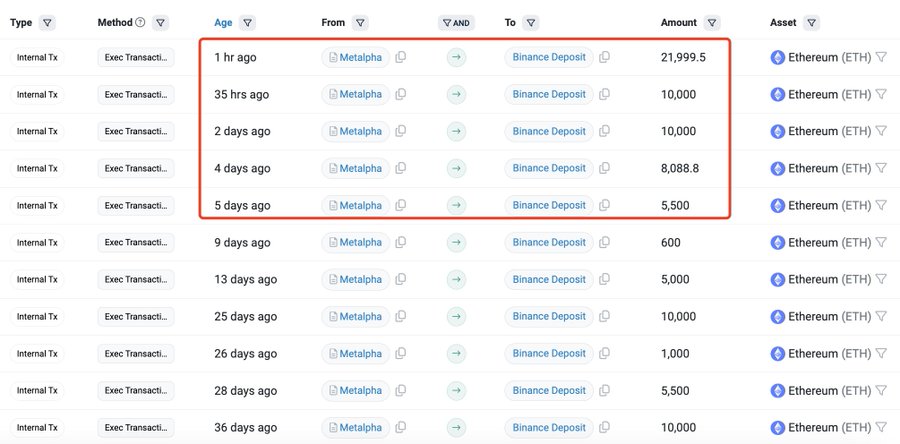

This transaction takes place as a result of Metalpha has additionally been depositing in latest days. In keeping with Look at chainthe Hong Kong-based firm deposited $51.16 million price of ETH prior to now few hours.

Over the previous 5 days, Metalpha has deposited $128.7 million price of Ethereum to Binance.

Supply: Lookonchain

These huge transactions have caught the eye of the ETH group as transfers to exchanges indicate preparation to promote.

If these holders promote, it’s going to lead to promoting stress, inflicting costs to fall additional as provide on the exchanges will increase.

What ETH charts recommend

Whereas good points on the every day charts could present hope, the latest whale trades have the markets at a crossroads. Such whaling exercise implies a insecurity in the direction of the altcoin, a phenomenon noticed over the previous week.

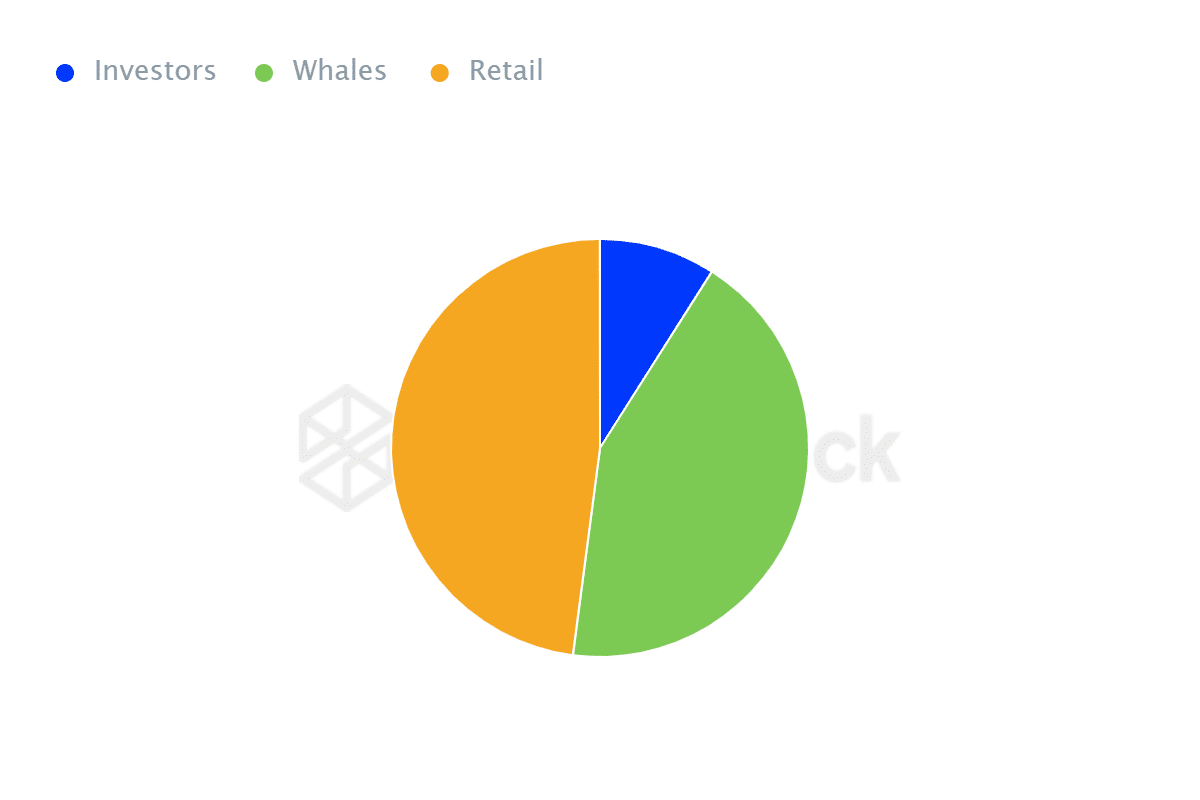

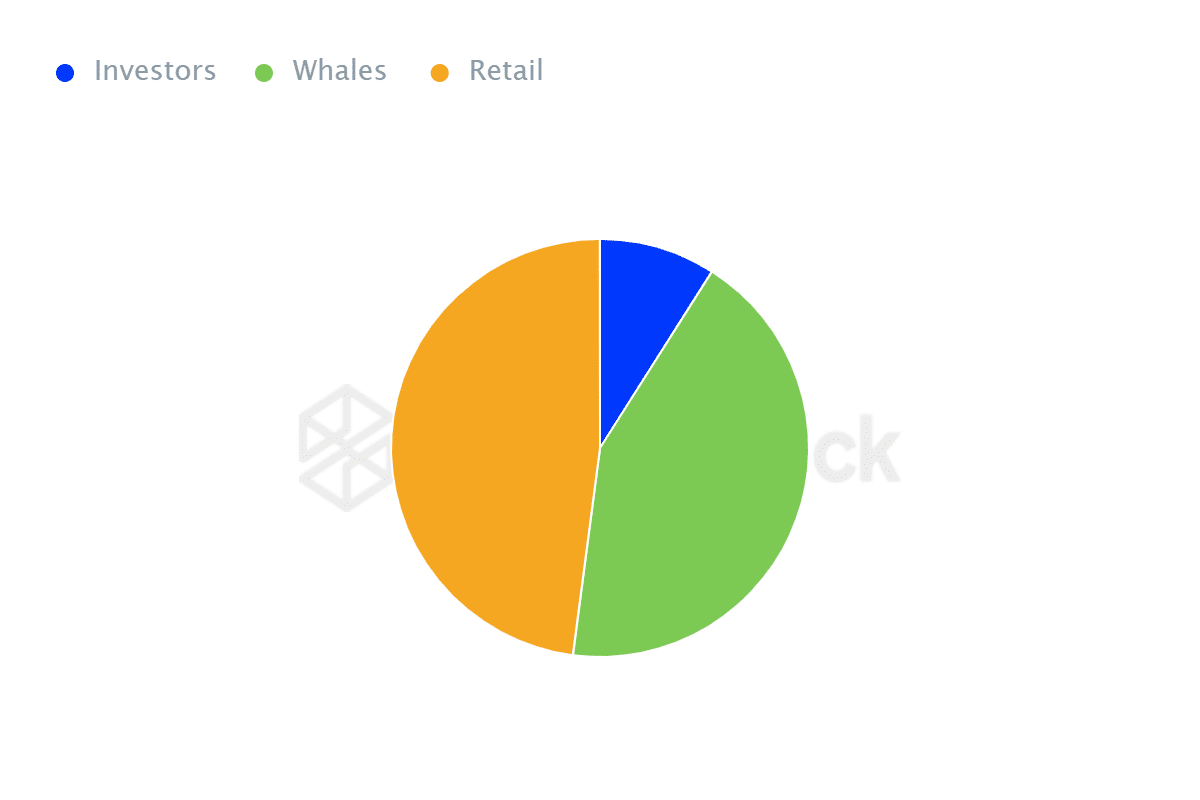

Supply: IntoTheBlock

For starters, Ethereum possession has modified dramatically by way of focus, permitting retail merchants to dominate the market.

In keeping with IntoTheBlock, retail merchants management 47.93% of the ETH market, whereas whales management 43.07%. This ensures that the altcoin will fall additional as whales cut back their holdings as a result of retailers are emotional sellers.

Likewise, a decline in whale possession suggests that giant holders lack confidence within the altcoin’s route.

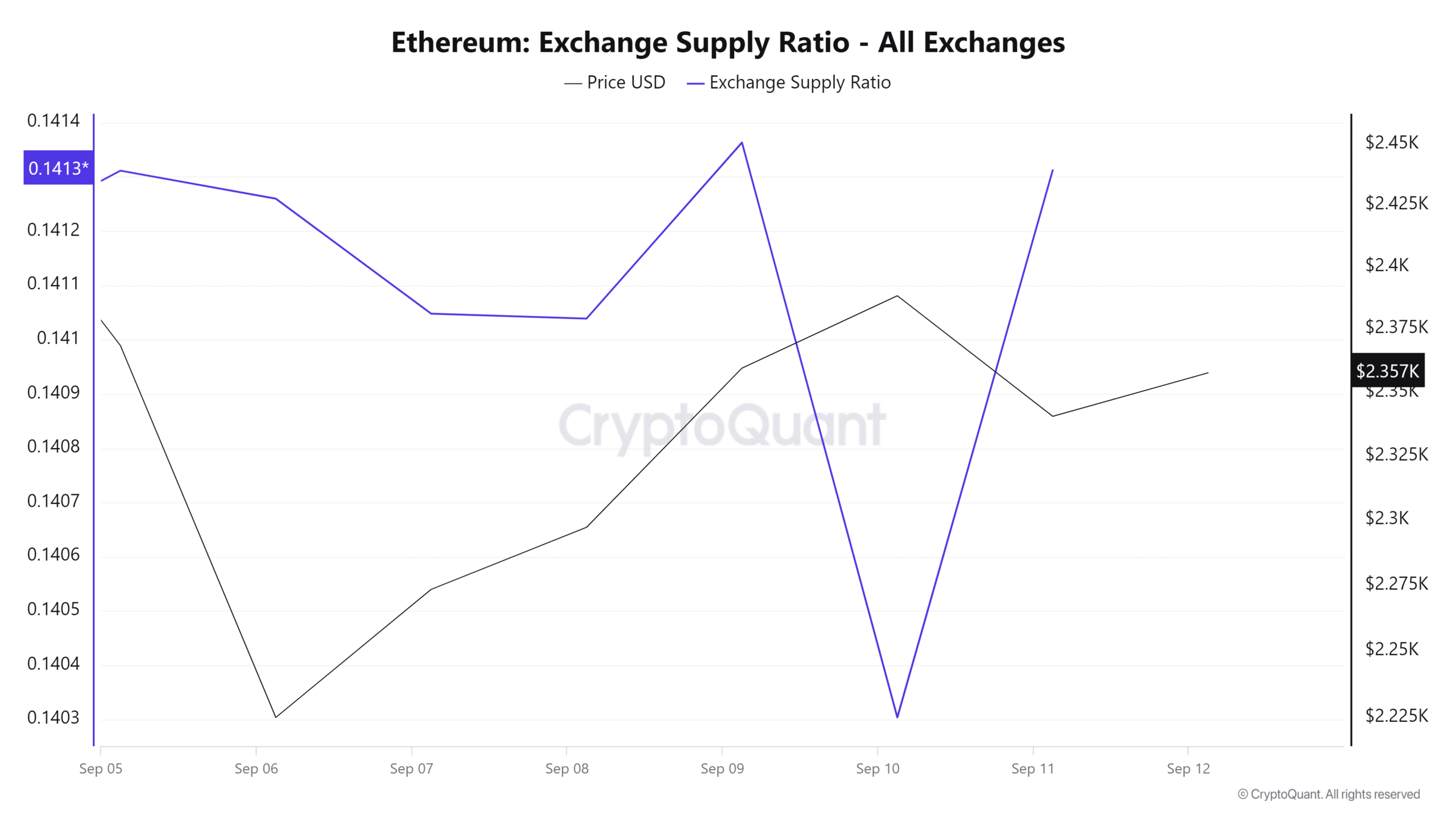

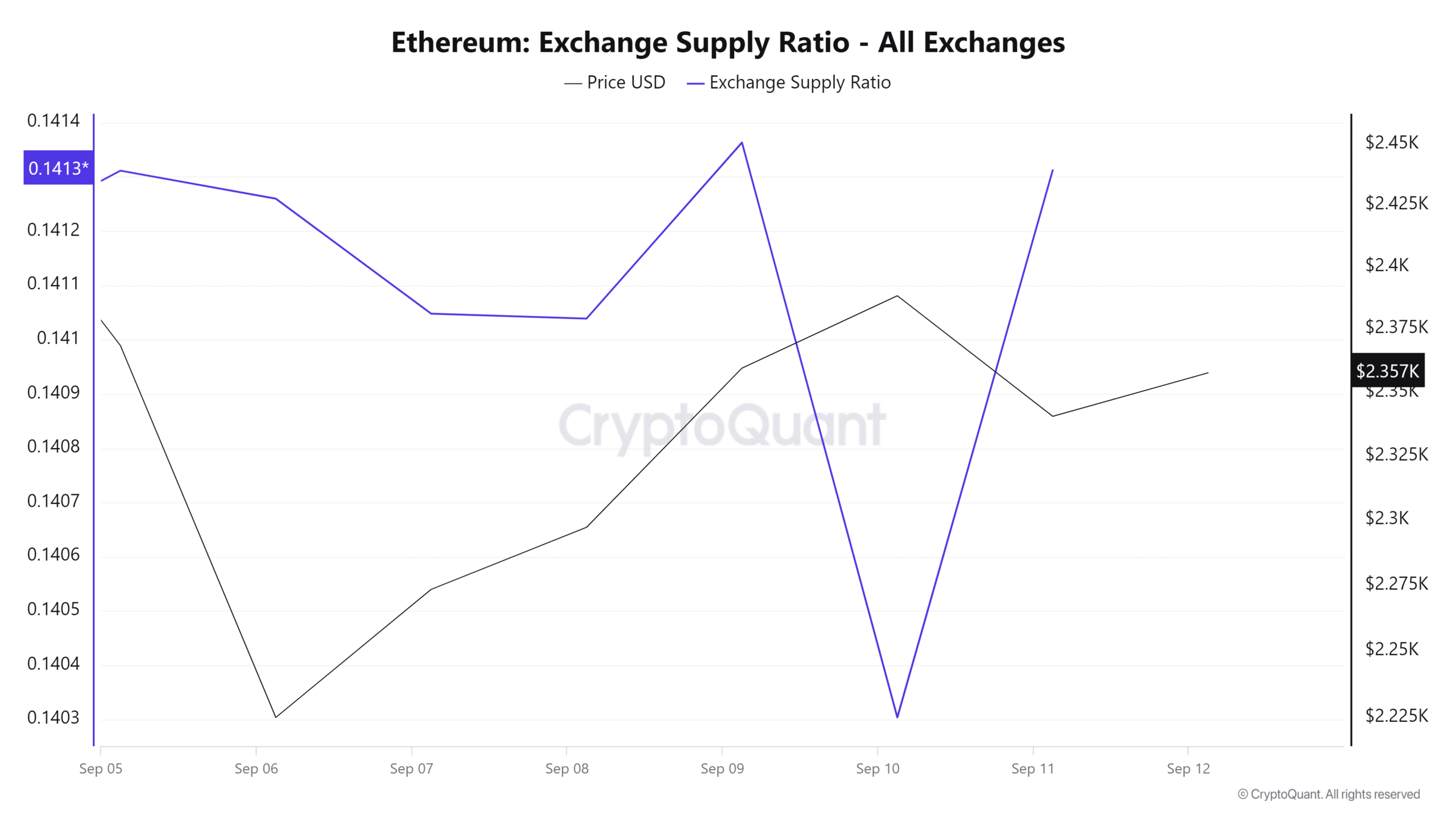

Furthermore, the provision ratio on the change has elevated over the previous day, indicating elevated provide on the exchanges.

Supply: CryptoQuant

When the provision ratio will increase as extra belongings are transferred to exchanges, it signifies that holders are making ready to promote resulting from an anticipated value drop.

Due to this fact, these whale trades recommend that giant holders are making ready to promote, indicating a insecurity in ETH’s future value actions.

If these whales are offered, ETH will face huge promoting stress, sending costs all the way down to an eight-month low of $2114.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024