Ethereum

ETH has declined over the past month. Can it recover?

Credit : ambcrypto.com

- ETH is down 7.95% over the previous 30 days.

- Regardless of the unfavorable market circumstances, one analyst expects a 48% improve to $3,550.

Whereas the crypto market has tried to get well with Bitcoin [BTC] surpasses the $60k degree, Ethereum [ETH] has been left behind. ETH, the second largest cryptocurrency by market capitalization, has been on a powerful downward pattern.

On the time of scripting this, Ethereum was buying and selling at $2,410. This marked a decline of seven.95% on the month-to-month charts.

Since hitting an area excessive of $2,820, the altcoin has failed to keep up upward momentum falling to a low of $2,150.

Prior to those market circumstances, ETH loved a positive place after hitting $3,563 in July amid an elevated ETF frenzy. Since then, the market has been in a downward spiral, elevating fears of additional losses.

Though market circumstances stay unfavorable, analysts stay optimistic. To this extent, well-liked crypto analysts CryptoWZRD have steered an upcoming rally, citing Bitcoin’s breakout.

What market sentiment says

In his evaluation states CryptoWZRD cited BTC’s present market circumstances. In line with this evaluation, if BTC rises, ETH will expertise a 48% improve to $3,550.

Supply:

Primarily based on this analogy, Ethereum’s rally is tied to BTC. So if Bitcoin manages to rise, the altcoin will get well and return to July ranges.

On this context, Bitcoin’s efficiency tends to affect the altcoin markets. When BTC performs, altcoins carry out too. Consequently, a downturn in BTC leads to a decline in altcoins, together with ETH.

Due to this fact, Ethereum will comply with if BTC has favorable market circumstances.

What ETH charts counsel

Whereas the CryptoWZRD evaluation presents a optimistic outlook, different indicators inform a distinct story. Present market circumstances may due to this fact place ETH for additional decline.

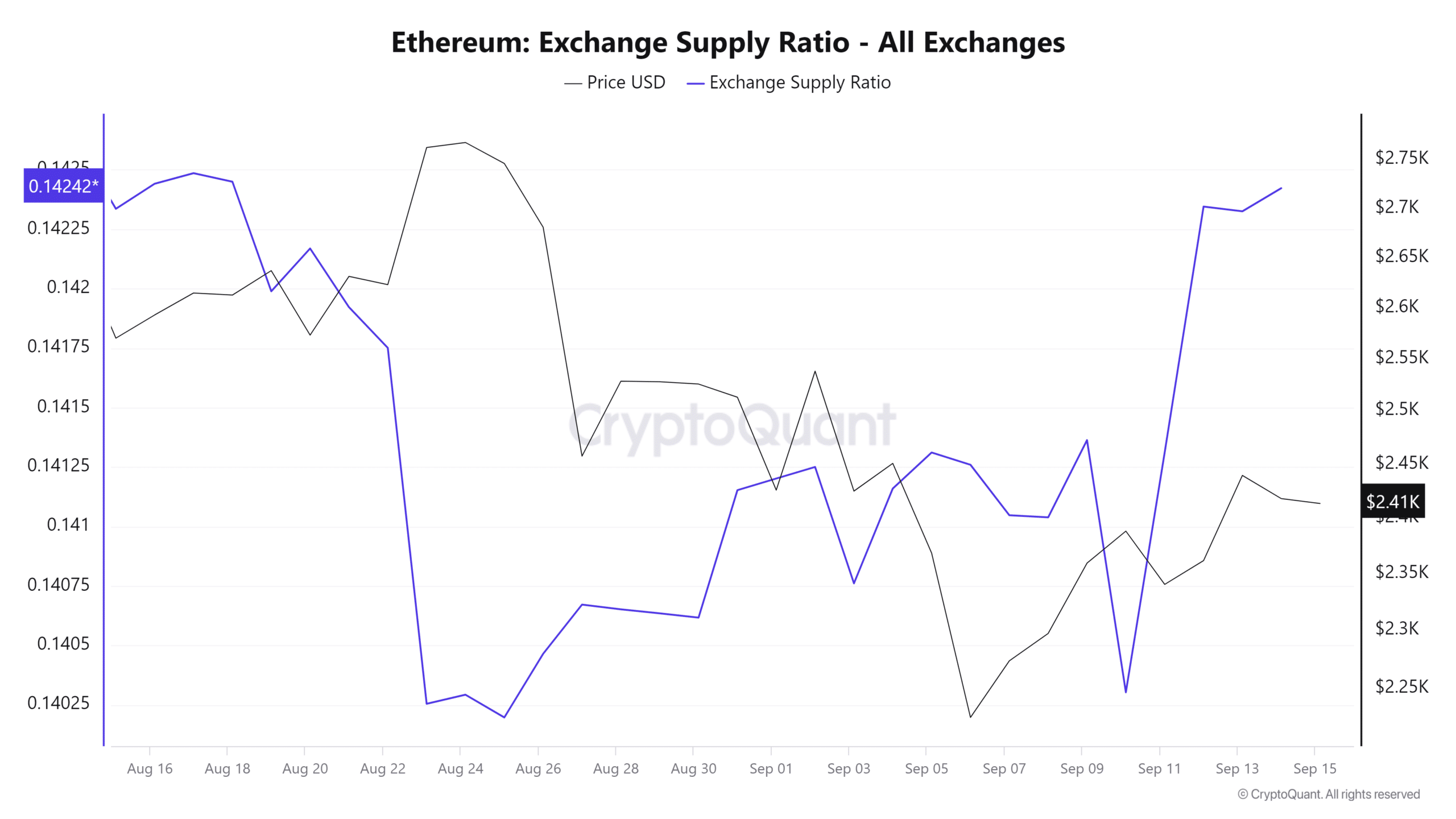

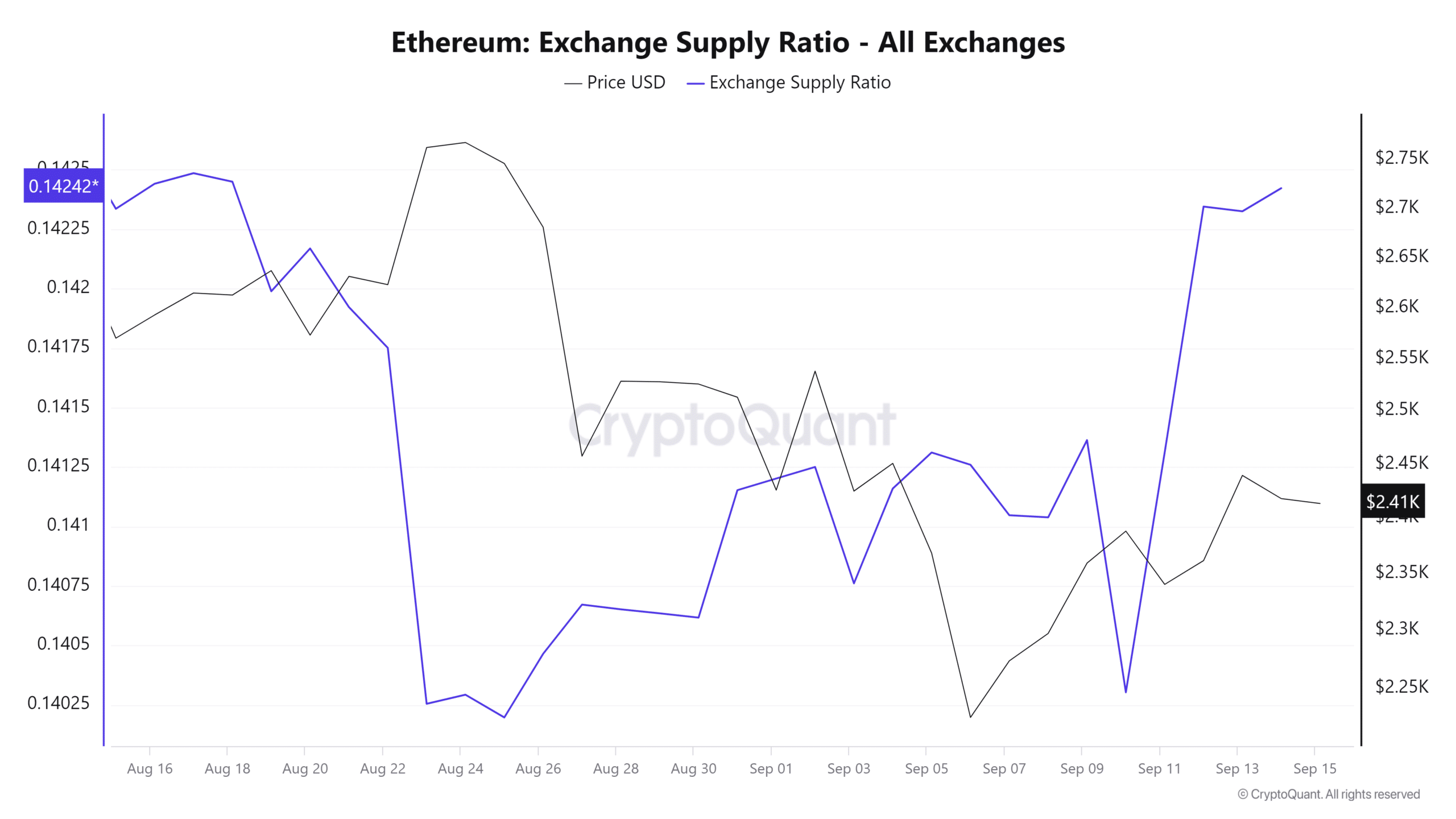

Supply: Cryptoquant

For instance, Ethereum’s trade netflow has remained largely optimistic over the previous month. A optimistic trade internet move signifies that ETH flows to exchanges as a substitute of withdrawals.

This can be a bearish market sentiment as buyers pour their cash into inventory markets to promote anticipating an extra fall in costs. A optimistic internet move signifies promoting strain within the close to future, leading to a worth decline.

Supply: Cryptoquant

Furthermore, the inventory market providing ratio has elevated sharply up to now 5 days. This additional reveals elevated inflows into the inventory markets, indicating bearish market sentiment as buyers put together to promote.

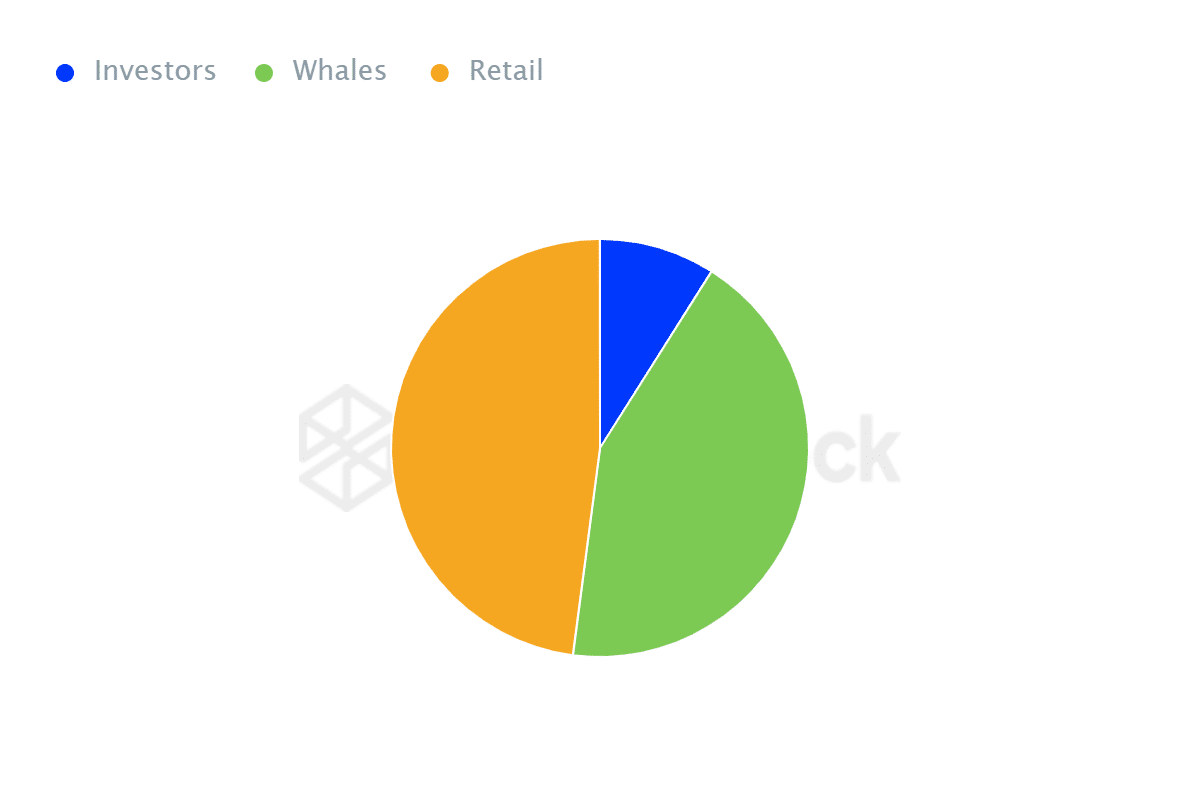

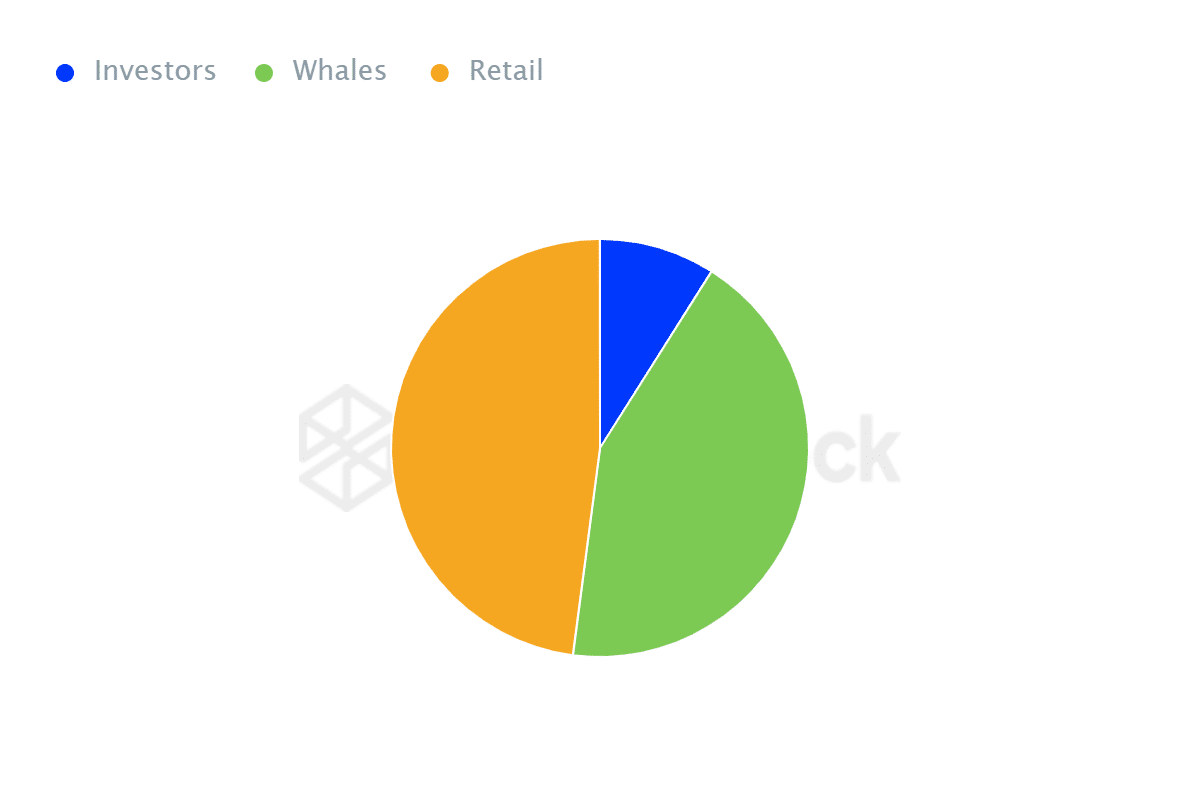

Supply: IntoTheBlock

Lastly, Ethereum’s focus possession reveals that retail merchants personal extra ETH than whales and buyers. In line with IntoTheBlock, retailers personal 47.93%, whereas whales maintain 43.10%.

When retail merchants maintain extra than simply whales, the markets expertise excessive volatility. Small merchants are emotional sellers and would promote primarily based on information in comparison with institutional buyers or whales.

Learn Ethereum (ETH) Value Prediction 2024-25

Whales will maintain out even throughout recessions and accumulate in anticipation of additional good points. Whereas retailers would promote to keep away from extra losses.

Due to this fact, primarily based on the prevailing market circumstances, ETH is experiencing bearish market sentiment. If present circumstances proceed, ETH will fall to $2224. Nevertheless, if this pattern breaks, it’ll rise to $2527.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September