Ethereum

ETH long term holders sells $89.72 million worth of Ethereum

Credit : ambcrypto.com

- Lengthy-term holders of Ethereum offered $89.72 million price of ETH.

- Market fundamentals indicated a potential worth correction as transfers to exchanges spiked.

Prior to now 48 hours, the crypto market has grown enormously, with Bitcoin [BTC] reaching a brand new ATH of $75K. This upswing pushed some altcoins to new highs.

Ethereum [ETH] reached a three-month excessive, creating alternatives for profit-taking. To this extent, most long-term, inactive whales have got down to make a revenue whereas maximizing their income.

Lengthy-term Ethereum whales dumping

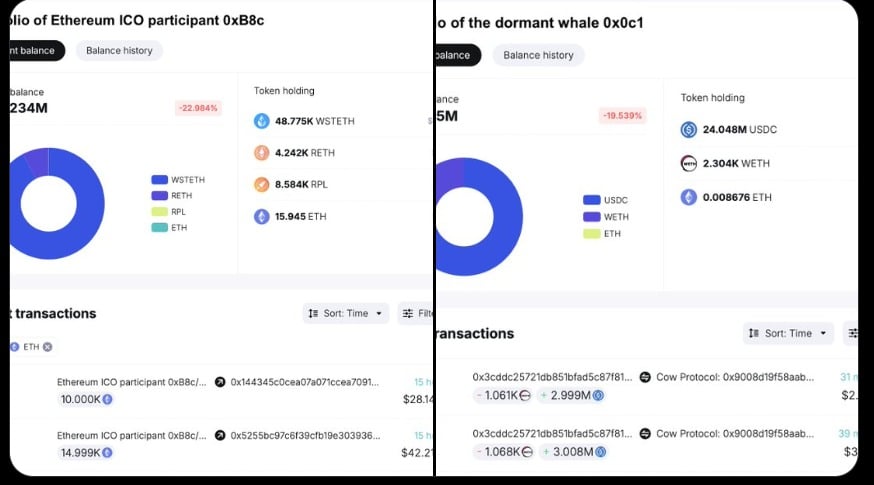

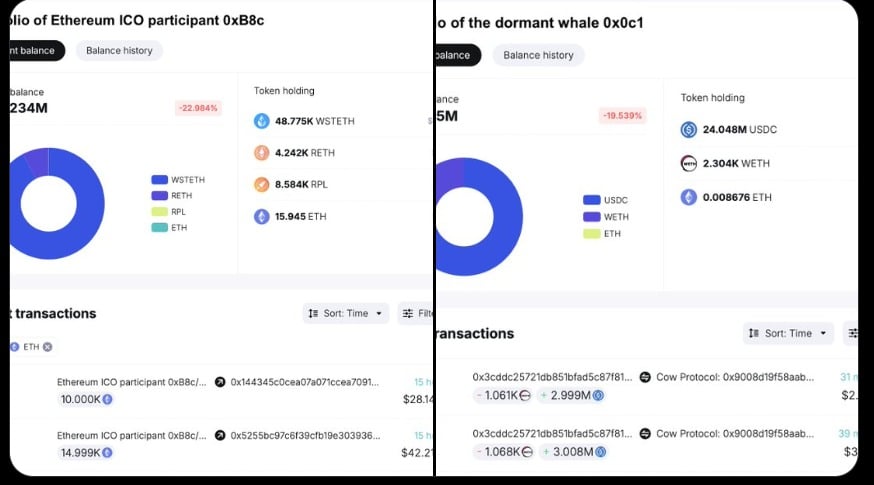

Based on a current report from SpotonChainthree ETH holders have began unloading, following worth will increase over the previous 24 hours.

Supply: SpotonChain

As such, two ETH holders unloaded 33,701 ETH price $89.72 million. This was adopted by a 13.75% improve within the Ethereum worth charts.

On the time of writing, the primary ICO whale despatched 25,000 ETH price $2,627 per token to Kraken, leaving 64,450 ETH.

After eight and a half years, one other whale appeared and offered 8,701 ETH for twenty-four.05 USDC price $2,764 per token, leaving 2,304 ETH price $6.48 million and making $30.48 million in revenue.

After these two large sell-offs, one other Ethereum whale with 12,001 ETH price $34.1 million ended an eight-year dormancy and began promoting on-chain.

The elevated whale exercise raised fears of a potential sell-off that would push ETH costs in the direction of correction. It’s because large transfers to exchanges and whale promoting create promoting strain, which negatively impacts costs.

Affect on ETH worth charts?

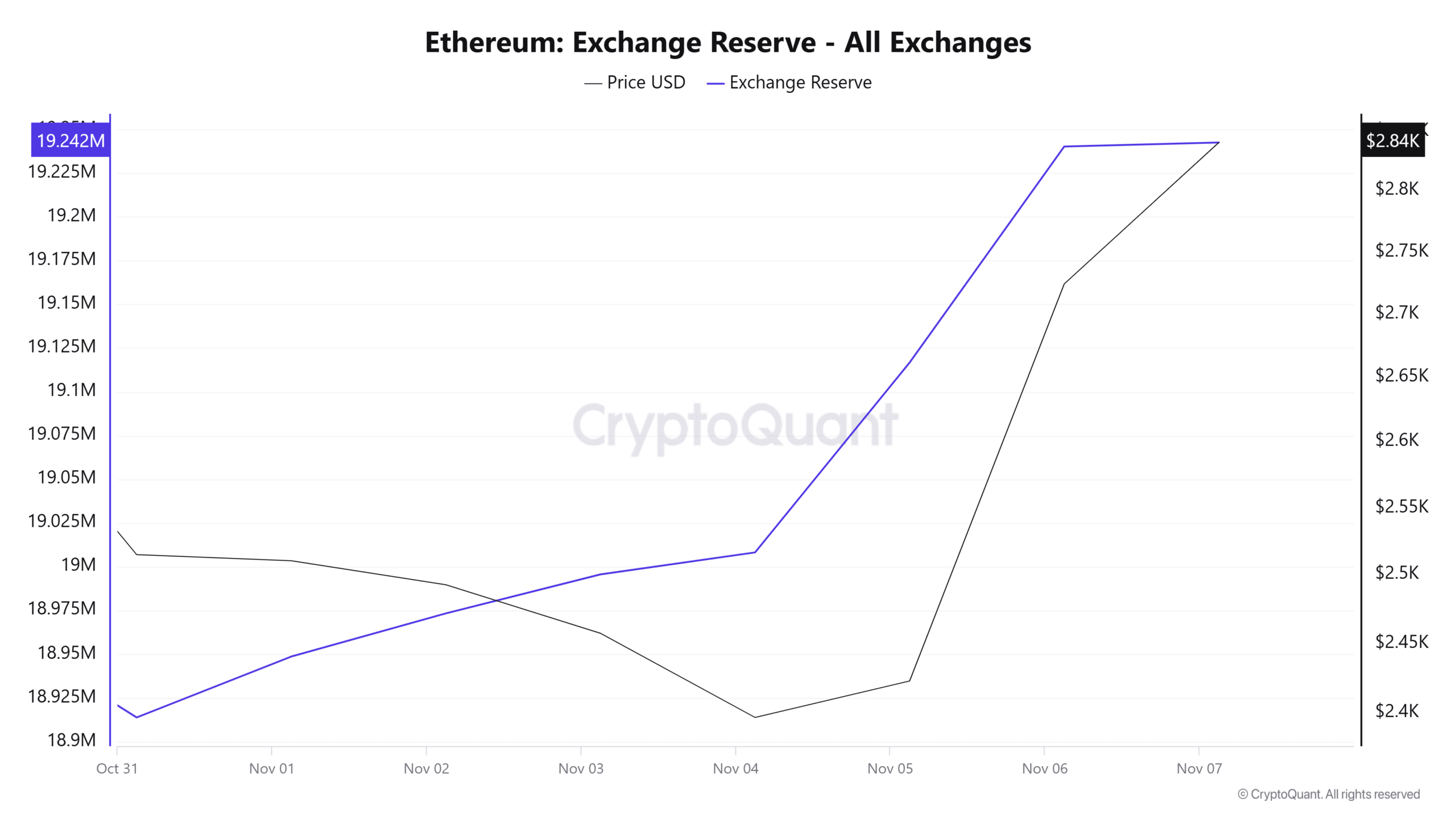

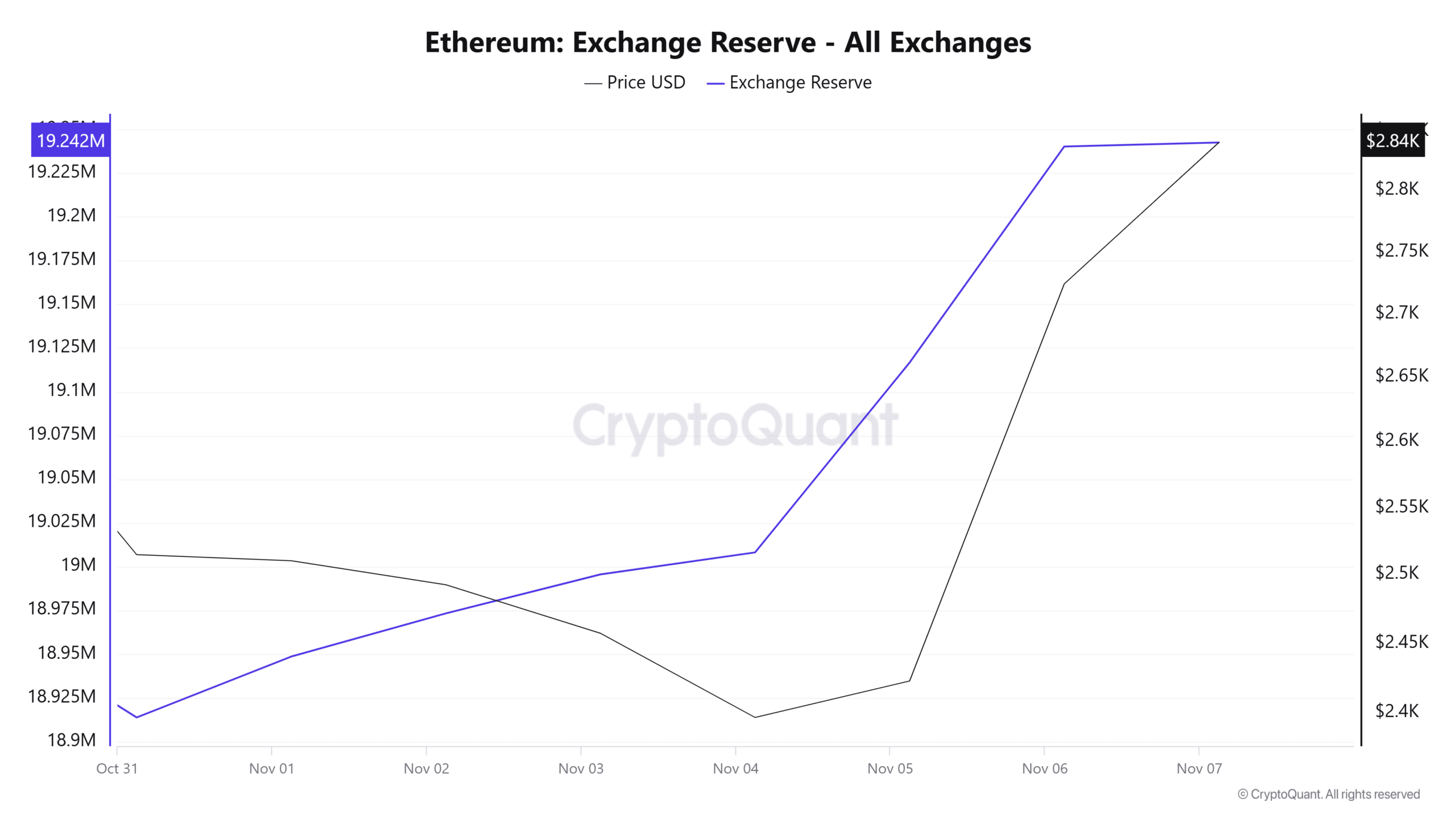

Based on AMBCrypto’s evaluation, ETH skilled an exponential improve in deposits on exchanges. Such a market state of affairs causes elevated provide, which additional threatens worth stability.

Supply: Cryptoquant

For instance, Ethereum’s provide alternate ratio has risen sharply over the previous week.

This implied that traders have been transferring their tokens to exchanges and getting ready to promote, resulting in downward worth strain.

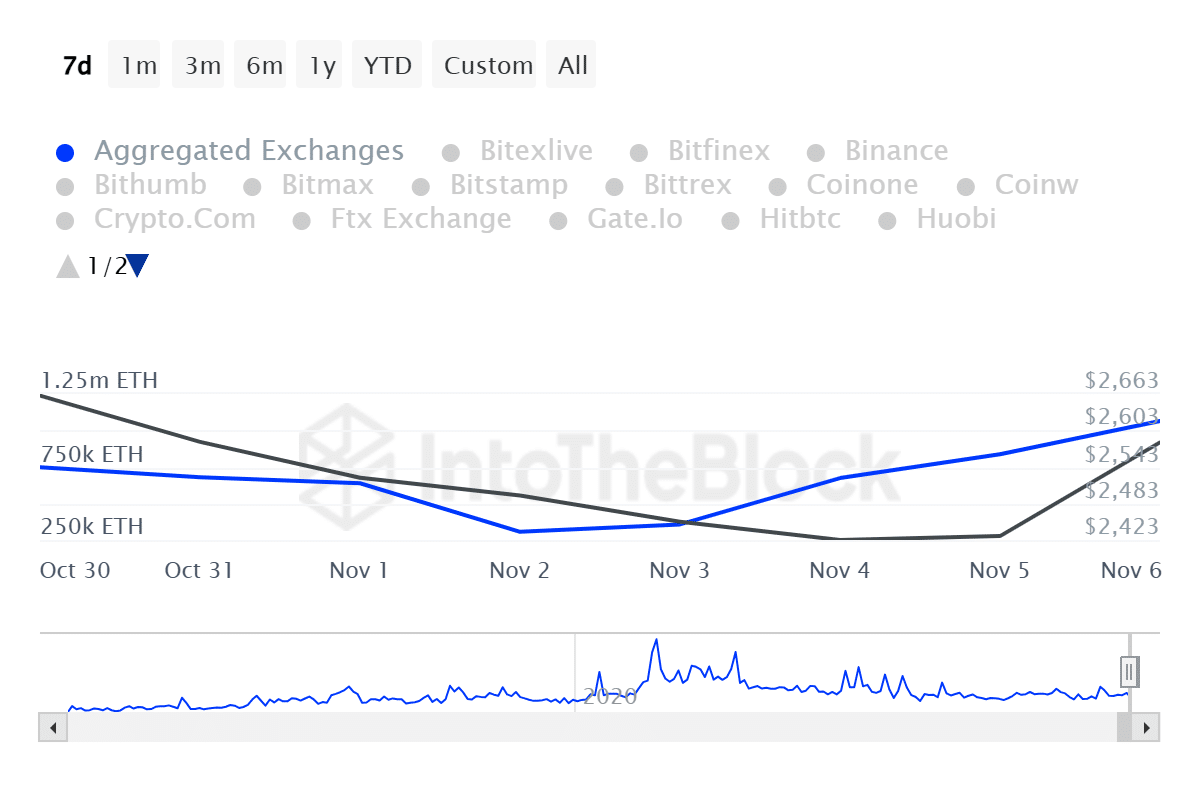

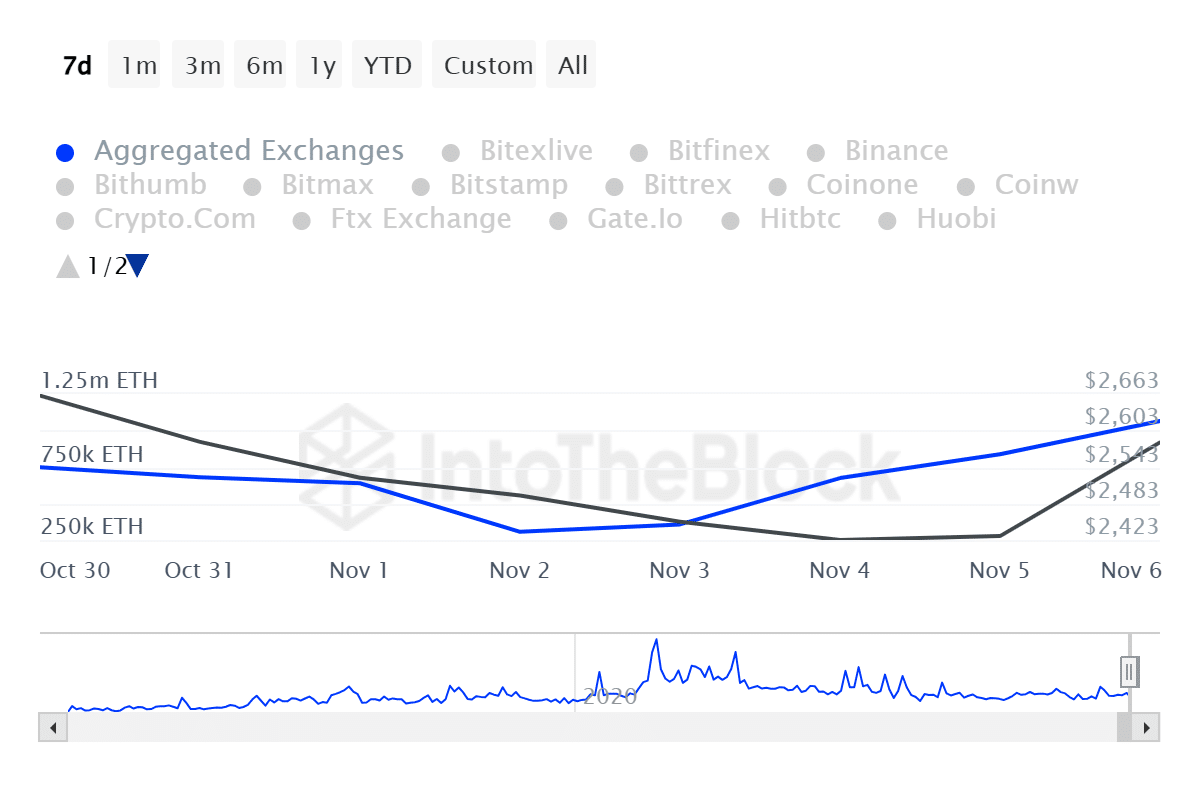

Supply: IntoTheBlock

Furthermore, Ethereum influx quantity has elevated from a low of 306,020,000 to 1.07 million over the previous week.

This urged that now that ETH costs have recovered considerably on the value charts, most traders are getting ready to promote to maximise income.

What’s subsequent for Ethereum?

It’s notable that ETH has skilled a robust uptrend over the previous week.

In reality, on the time of writing, Ethereum was buying and selling at $2804. This marked a rise of 8.11% in 24 hours, with the altcoin gaining 6.31% on the weekly charts.

The current rebound has seen the altcoin attain a three-month excessive, indicating robust upside momentum.

Due to this fact, if the bulls can proceed to carry the market, the altcoin might submit extra positive aspects and attain the $3000 resistance degree.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Due to this fact, to take care of the uptrend, markets should take up the final of the whale gross sales with out incurring larger losses.

Nevertheless, if the current whale dumps have a destructive affect in the marketplace, the altcoin might see a market correction earlier than trying a brand new uptrend.

So if this dump displays on the value charts, Ethereum might drop to $2670.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024