Ethereum

ETH must hold $2264 support level to continue the bullish scenario

Credit : ambcrypto.com

- ETH is up 4.36% over the previous month.

- Ethereum skilled upside momentum, indicating extra features if the $2264 assist holds.

Since hitting an area low of $2309, Ethereum [ETH] has seen a robust upward motion. So latest features have exceeded losses, turning October inexperienced.

The truth is, on the time of writing, Ethereum was buying and selling at $2525. This represented a rise of two.44% in comparison with the day gone by. Equally, ETH is up 4.36% on the month-to-month charts, extending the bullish development with a rise of 1.53% on the weekly charts.

Trying additional, the altcoin has seen a flurry of buying and selling exercise. As such, buying and selling quantity elevated by 35.51% to $12.43 billion.

As anticipated, these market situations have crypto analysts speaking concerning the altcoin’s trajectory. Certainly one of them is the favored crypto analyst Bitcoin guy which has urged that the present bullish state of affairs holds if ETH stays above $2264.

Market sentiment

Within the evaluation, Man of Bitcoin said that ETH is shifting sideways, implying that it’s in a consolidation vary.

Supply:

In response to him, the present actions on the worth charts present weak point, indicating a possible draw back.

Subsequently, the analysts declare that the recognized bullish state of affairs is barely legitimate so long as ETH trades above $2264.

With the altcoin holding this degree, the potential subsequent transfer, utilizing the Elliot wave evaluation, is Wave -C of iii at $3096. This means that the worth vary is inside the third wave, which is the strongest and gives the potential for additional features.

Nevertheless, if the altcoin fails to carry this degree and experiences a disruption, it means Wave -iv is shifting downward.

What ETH charts say…

Man of Bitcoin’s evaluation undoubtedly gives a cautious future perspective. Nevertheless, it’s important to counterbalance and decide what different market indicators suggest.

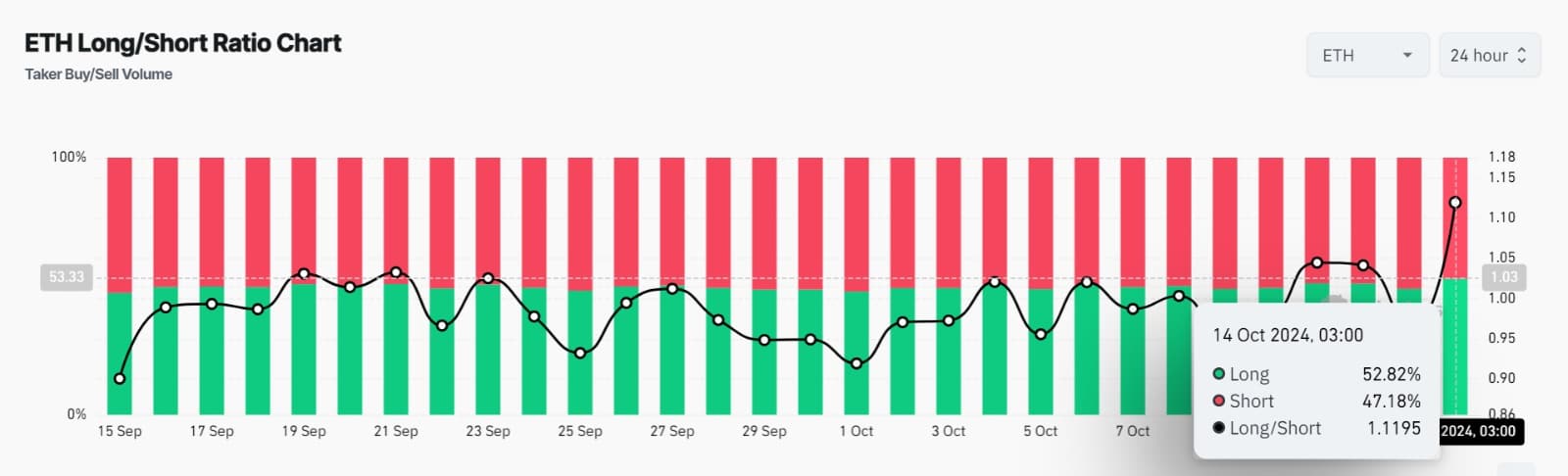

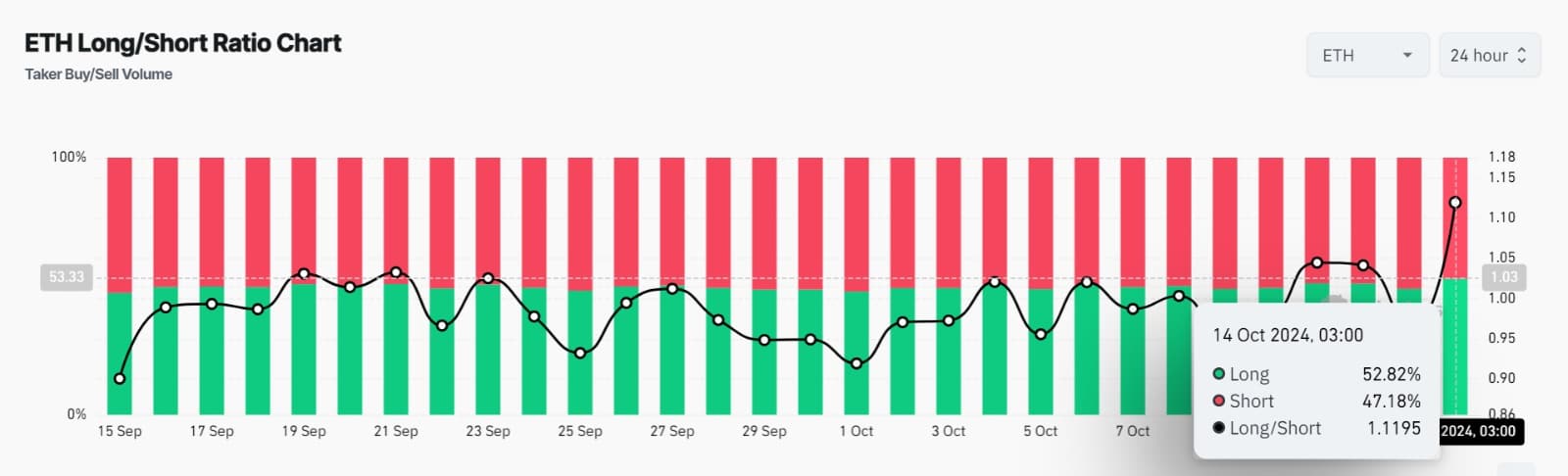

Supply: Coinglass

For instance, Ethereum’s Lengthy/Quick ratio has remained above for the previous 24 hours. On the time of writing, ETH’s lengthy/brief ratio was 1.1195, signaling elevated demand for lengthy positions.

As such, lengthy place holders dominate the market as they proceed to open new trades.

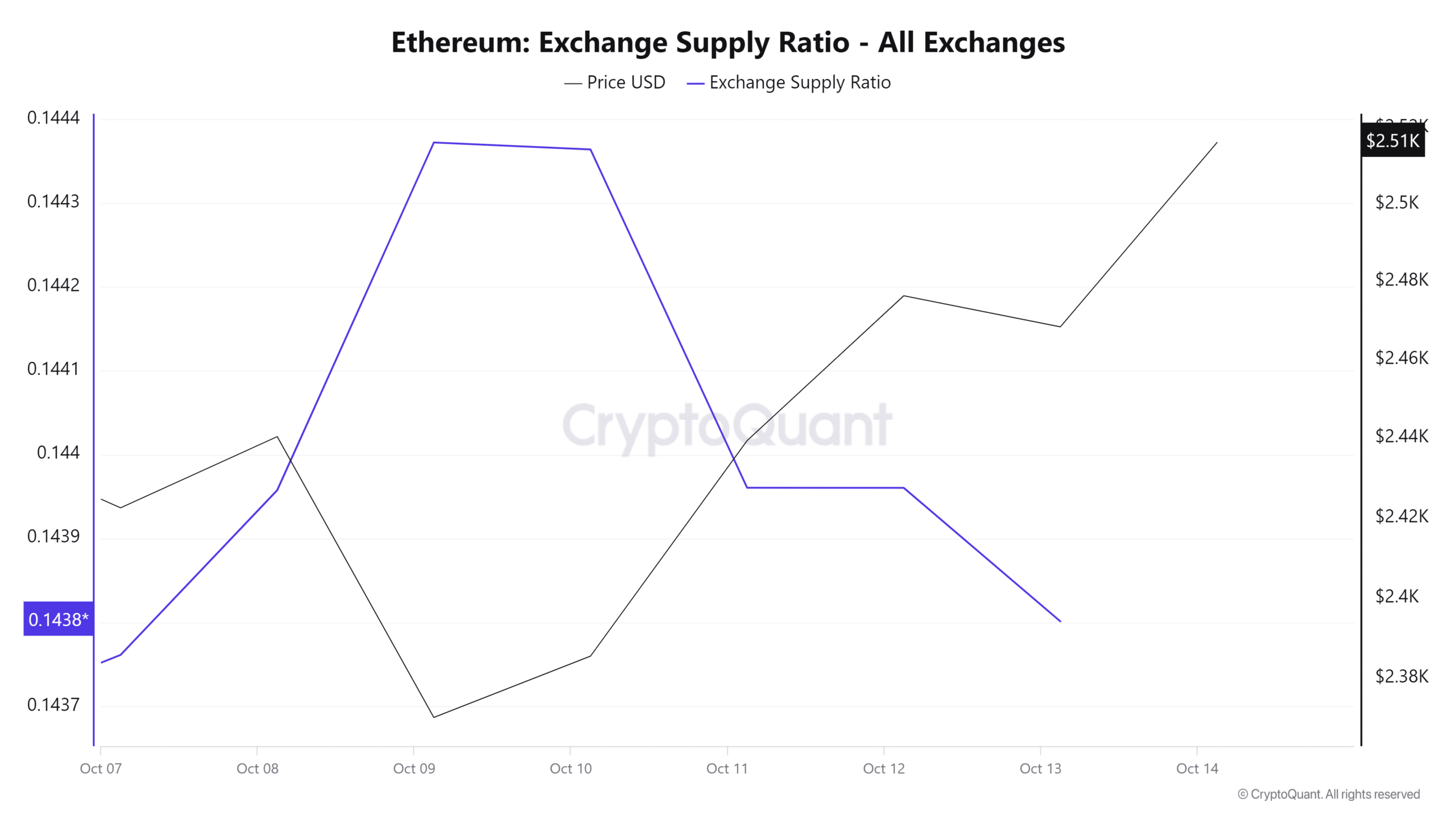

Supply: Cryptoquant

Furthermore, Ethereum’s provide alternate ratio has skilled a sustained decline over the previous 5 days. Reducing provide on the alternate implies that buyers are selecting to carry on to their ETH. This normally reduces the variety of tokens within the provide, leading to a provide squeeze.

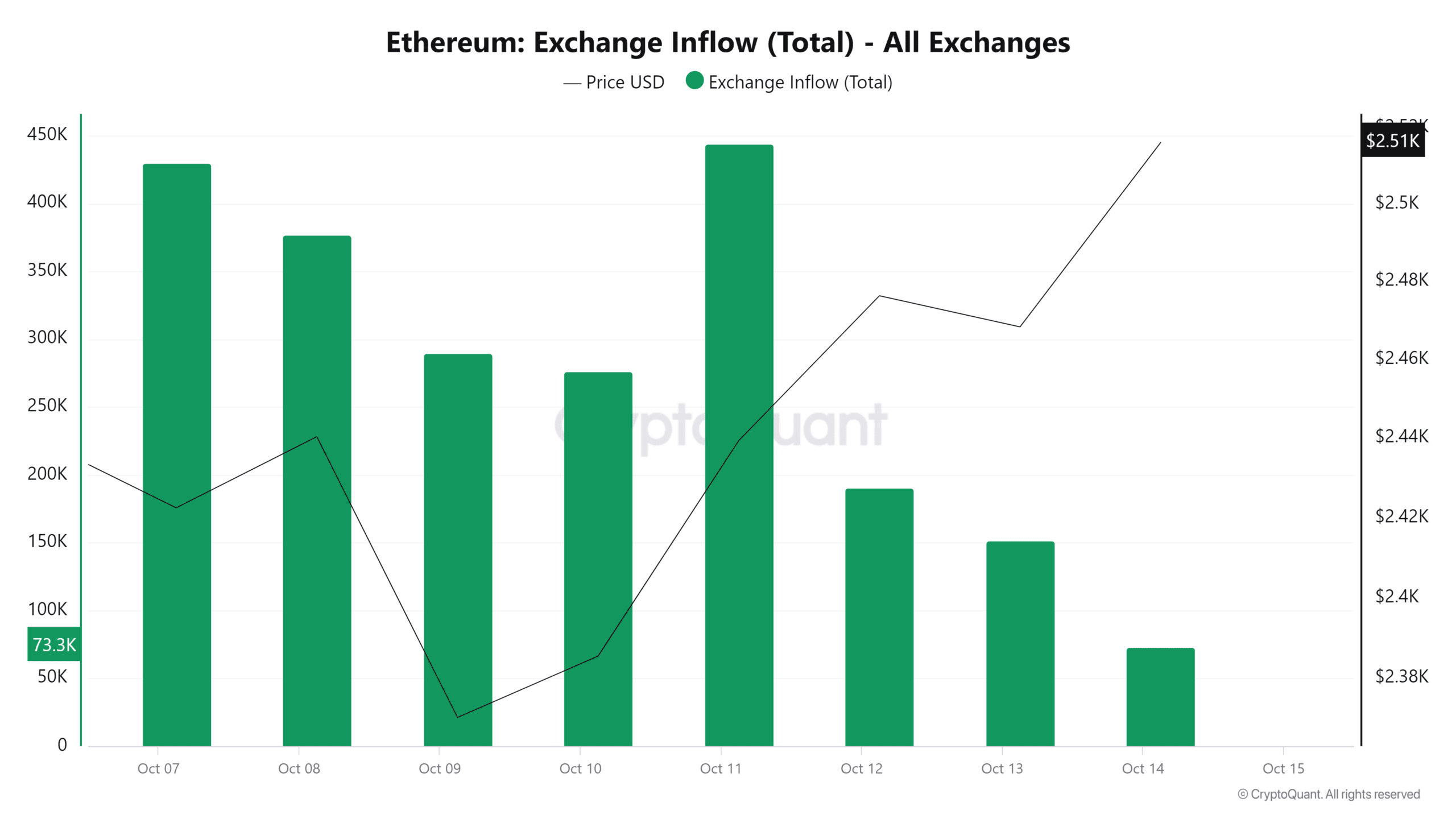

Supply: Cryptoquant

Learn Ethereum’s [ETH] Value forecast 2024–2025

Lastly, ETH alternate inflows have declined over the previous 4 days, indicating a shift in market sentiment towards holding, as illustrated by a decline within the provide alternate ratio.

Merely put, ETH is in a bullish part, and because the analyst beforehand famous, that is legitimate so long as the $2264 assist holds. Subsequently, with constructive market sentiment and investor desire, ETH will try a resistance degree at $2727 within the close to time period.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024