Ethereum

ETH Short Bets Soar +500% as $2B Inflows Tease Epic Short Squeeze

Credit : ambcrypto.com

- Hedge funds’ report +500% ETH Shorts collision with $ 2B Ethereum Influx – Market Primed for Huge Swings.

- Excessive brief bets versus institutional accumulation places ETH on edge for an infinite motion – up of down.

Ethereum’s [ETH] Quick positions have risen by +500% since November 2024, which marks the most important bearish wager in opposition to the cryptocurrency ever registered. Up to now week alone, brief positioning has risen in response to +40%, in response to The Kobeissi Letter.

Wall Road hedge funds appear to shorten aggressive Ethereum, even when the value stays comparatively flat.

The height briefly publicity comes within the midst of persistent fears in regards to the underperformance of Ethereum in comparison with Bitcoin. For the reason that starting of 2024, Bitcoin [BTC] Has surpassed the Ethereum nearly twelve instances.

Analysts speculate that hedge funds anticipate a bearish prospect for Ethereum or attempt to suppress the value.

Supply: X

$ 2 billion influx recommend …

Regardless of the overwhelming brief positions, Ethereum noticed $ 2 billion in contemporary ETF influx in simply three weeks, with a record-breaking weekly influx of $ 854 million, in response to the Kobeissi letter.

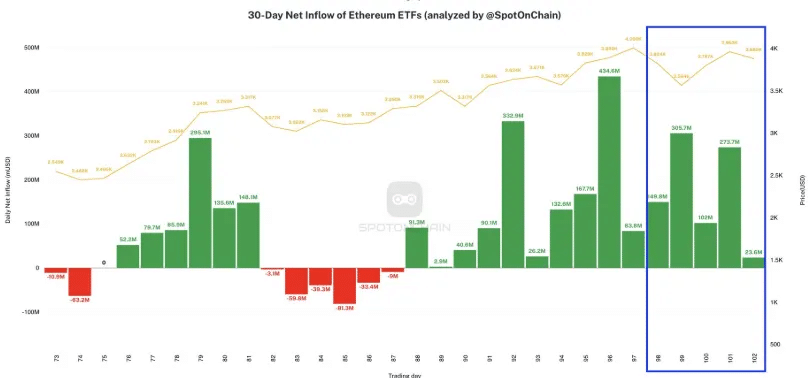

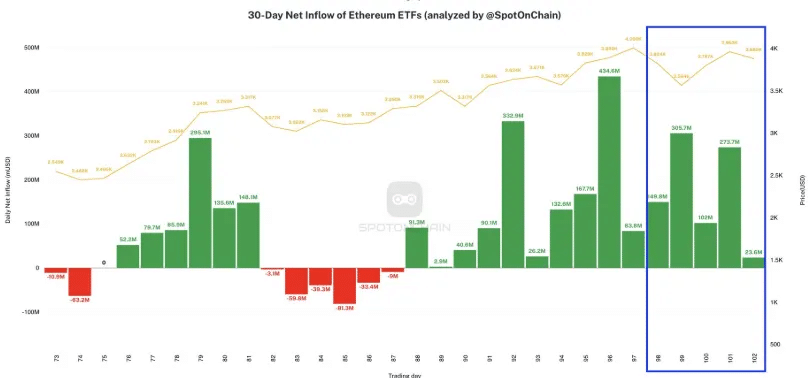

The graph shared per location on the chain confirms this knowledge and emphasizes constant accumulation from the tip of December 2024.

Supply: X

Putting influx was noticed on day 97 ($ 434.8 million) and day 100 ($ 275.7 million), which signifies a robust institutional curiosity on this interval.

The value of Ethereum, nevertheless, has largely remained stagnant, in order that the priority expressed that the inflow of funds could be compensated by heavy scarcity actions.

Analysts discover that this tug of warfare between accumulation and bearish positioning can result in elevated volatility within the coming weeks.

The flash crash has worn out greater than $ 1t

On 2 February, Ethereum skilled a worth lower of 37% inside 60 hours, with greater than $ 1 trillion in Crypto market worth.

It’s exceptional that the flash crash happened with none important information catalyst, which made comparisons with the inventory market “Flash Crash” of 2010.

Supply: X

The Kobeissi letter means that this occasion might have been influenced by excessive brief positioning and skinny liquidity. Quantity peaks had been noticed round vital occasions, such because the crash on 2 February and inauguration day.

This means that enormous gamers can actively place for big market actions.

Can Ethereum be on its technique to a brief squeeze?

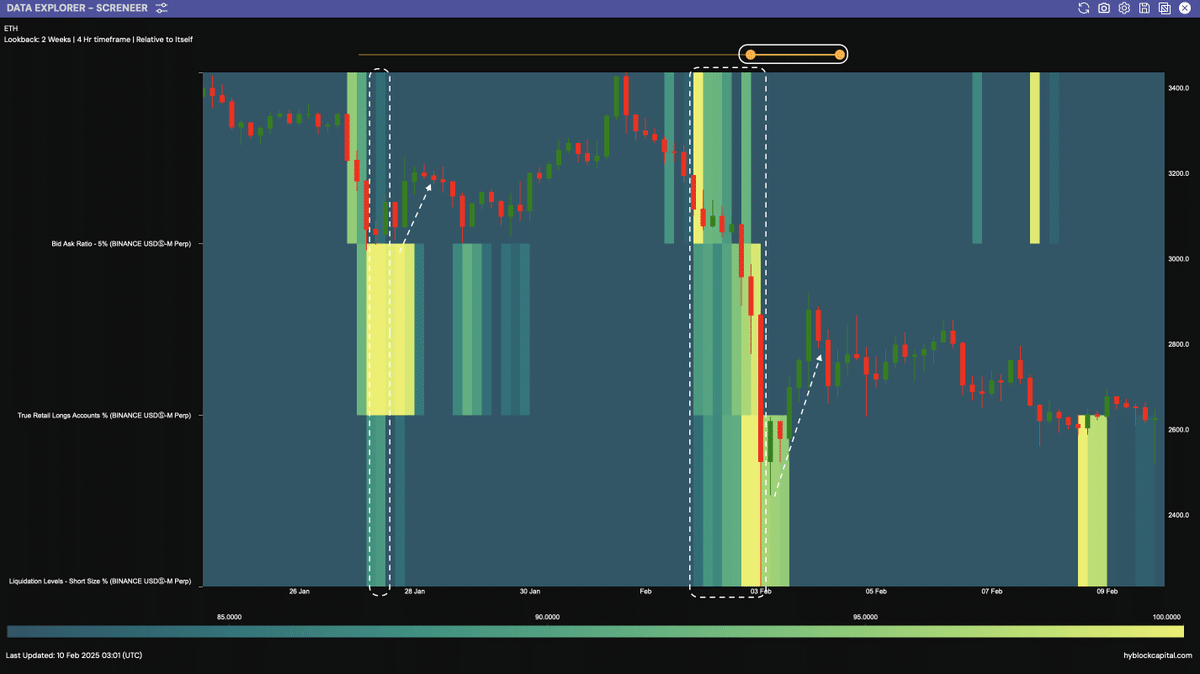

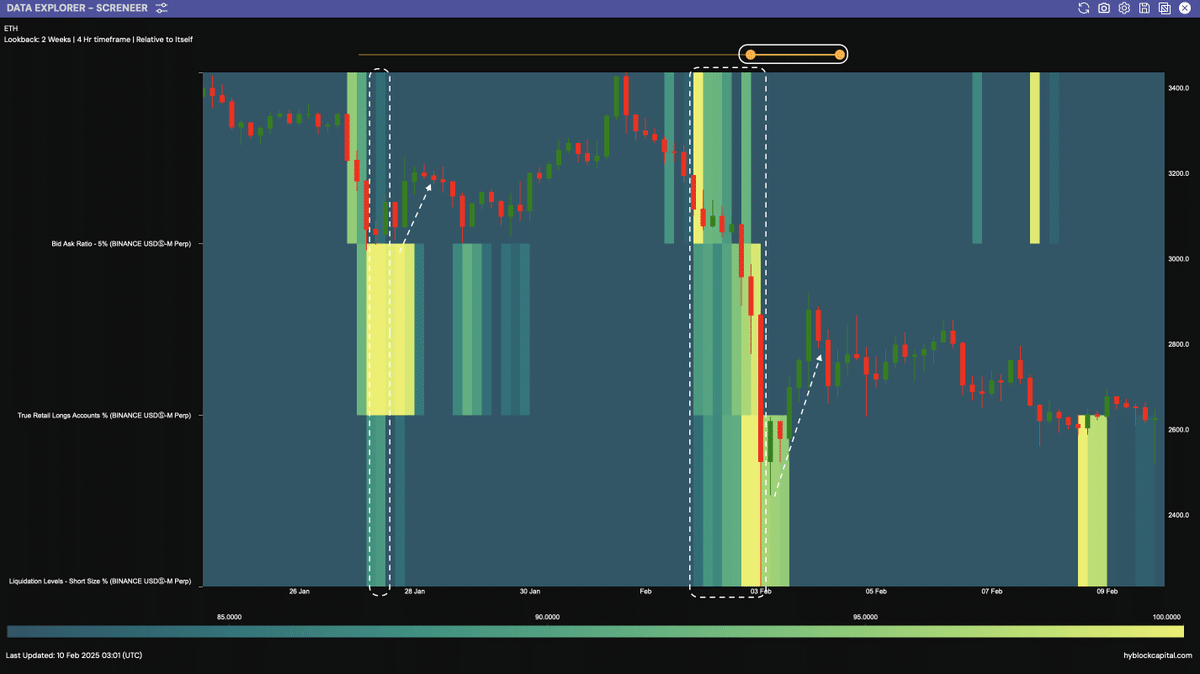

Crypto -analyzed firm Hyblock Capital notes That Ethereum is now approaching ranges, the place a number of indicators coordinate, together with the bid-ak ratio, long-term retail longpercentand brief liquidation ranges.

Traditionally, when these statistics attain extremes, Ethereum went up.

Supply: X

As well as, a TD -sequential buy sign was just lately flashed for Ethereum, declaration A possible worth rebound.

Analysts warn that if the brief positions of hedge funds are incorrectly calculated, a violent brief squeeze may reverse the development.

This might create one of many greatest prizestics that Ethereum has ever seen. The present market dynamics of Ethereum stay a battle between the bearish bets of hedge funds and institutional accumulation, making the subsequent step very unpredictable.

Learn Ethereum’s [ETH] Value forecast 2025–2026

As well as, a TD -sequential buy sign was just lately flashed for Ethereum, A possible worth rebound.

Analysts warn that if the brief positions of hedge funds are incorrectly calculated, a violent brief squeeze may reverse the development, making one of many biggest pricing Ethereum ever seen.

The present market dynamics of Ethereum stay a battle between the bearish bets of hedge funds and institutional accumulation, making the subsequent step very unpredictable.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now