Ethereum

ETH Struggles Below $4K Amid Supply Shock Signals

Credit : coinpedia.org

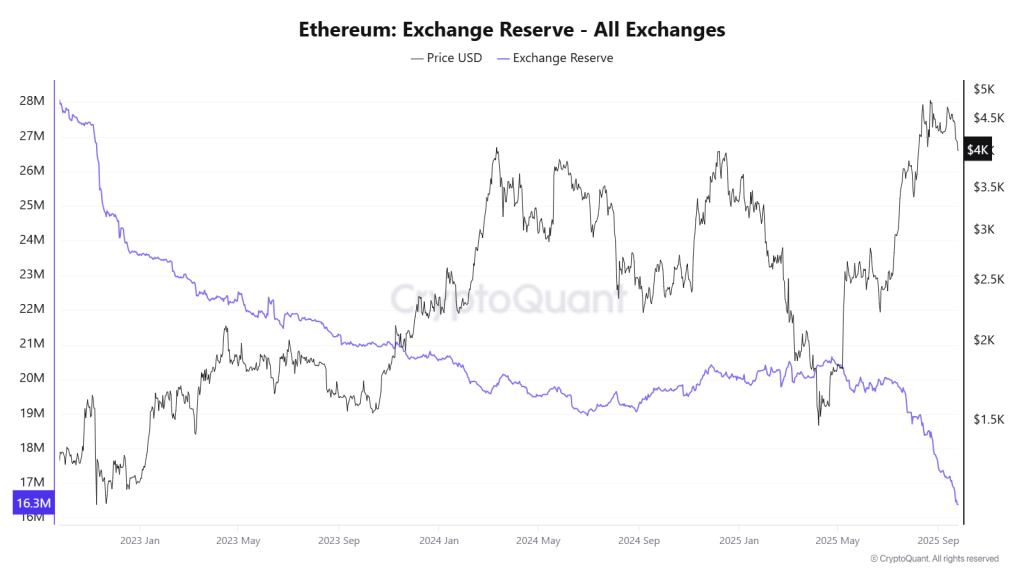

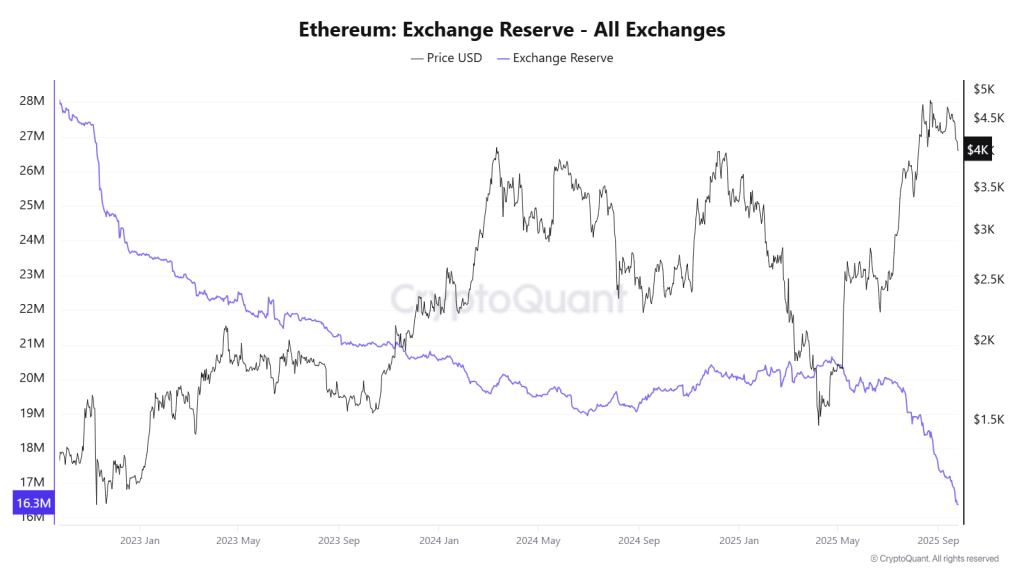

ETH value at the moment navigates turbulent circumstances after a brief fall underneath $ 4,000. Regardless of the short-term stress of macro-economic components and ETF entry delay, change balances have fallen to nine-year lows, which signifies robust accumulation. This dynamic might be the scene for a future provide shock and renewed momentum for ETH Crypto.

Macro components weigh on ETH value

The dip of Ethereum underneath the psychological $ 4K stage was powered by a mixture of technical disruptions, threat sentiment and step -by -step liquidations worldwide. Whereas the American Federal reserve lowered rates of interest in September by 25 primary factors, the transfer can not arouse the anticipated market -wide rally.

Ethereum Spot ETFs have added this month to the cautious vote and registered understated in modestly this month. Web influx in complete round $ 110 million to date in September, far under $ 3.8 billion that was seen in August. This distinction emphasizes how the institutional query is delayed, which limits the speedy upward momentum for ETH value USD within the quick time period.

Civic steadiness falls to 9 -year lows

However underneath the floor, indicators on the chain inform a special story. Ethereum change balances have fallen to their lowest ranges in virtually a decade, which exhibits a decisive development within the route of long-term property. Tens of millions of ETH have been withdrawn from centralized exchanges in current weeks, which is a mirrored image of accumulation as a substitute of panic.

For ETH value prediction fashions, such recordings usually recommend lowered gross sales stress. By giving precedence to self -intersection and deportation, each whales and retail individuals create circumstances that may trigger a provide shock. If the query reinforces whereas the liquidity stays low, the Ethereum value chart can transfer to an accelerated uptrend.

- Additionally learn:

- Will the institutional query stimulate XRP Crypto increased in 2025?

- “

Principal ranges turning resistance to help

On the technical facet, ETH value prediction sentiment improved after it actively recovered a essential resistance zone, making it new help. Earlier makes an attempt at this stage had resulted in rejection, however the current breakout marked a stronger shift available in the market construction.

Every retest often wraps panic in ETH crypto markets within the quick time period. Nevertheless, with help now confirmed, Momentum means that Ethereum might consolidate for an additional leg increased. Merchants regard this set-up as a possible launch path for ETH prize to revive his earlier of all time if shopping for stress continues to exist.

Institutional belief and lengthy -term prospects

Regardless of weaker ETF influx, the umbrella accumulation development exhibits a rising institutional perception in Ethereum’s long-term views. Lowered liquidity on exchanges, mixed with the set of stimuli and capital rotation of stablecoins, reinforces the ETH value prediction. The ETH value at the moment, about $ 4,014, generally is a gathering place for bigger actions as provide circumstances turn into tighter.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, skilled evaluation and actual -time updates on the newest traits in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

The value of Ethereum decreased as a result of a delay of ETF influx, broader Marktrisico-off sentiment and step-by-step liquidations that push it underneath an important stage of $ 4,000.

Though the current ETH spot ETF influx has been delayed in comparison with final month, knowledge on chains present a rising development of long-term property and accumulation, indicating steady institutional convictions.

Regardless of the quick -term volatility, the lengthy -term prospects for ETH is optimistic as a result of important accumulation on chains, falling change cali and rising institutional confidence, all indicating a possible provide shock.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now