Ethereum

Ethereum: $160M in shorts get wiped out – Will ETH’s rally last?

Credit : ambcrypto.com

Vital assortment eating places

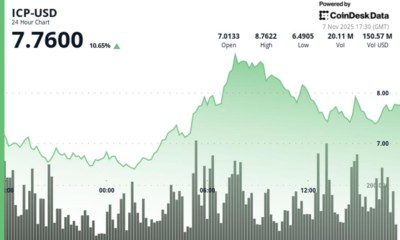

The outbreak of Ethereum above $ 3,700 induced main liquidations, however promoting spot, fading sentiment and bearish futures positioning counsel that the rally could not have any sustainability and might get a short-term correction.

Ethereum’s [ETH] Sharp outbreak above $ 3,700 resulted in additional than $ 160 million in brief liquidations on Binance.

This adopted on an analogous $ 195 million across the stage of $ 3,500, because of aggressive compelled again buy in a excessive leverage atmosphere.

Such rallies pushed by liquidation are inclined to miss sustainability as a result of they aren’t fed by the demand for natural spots. Whereas the worth enhance overwhelmed, the underlying volatility will increase the danger of a fast correction.

Thus, except supported by a robust buy exercise, Ethereum might lose steam and withdraw this rally if wider market circumstances can not strengthen this rally.

Accumulate whales within the quick time period, however is lengthy -term distribution nonetheless a risk?

Nice holder habits paints a blended picture. In accordance with IntotheblockEthereum’s 7-day Netflow rose by 171.75percenton the time of 171.75%. Hintend on renewed quick -term accumulation.

The broader place of 90 days, nevertheless, continued Beararh, with Netflows with -2512.17%, which signifies a persistent lengthy -term distribution.

This divergence reveals that though some whales are available, the broader pattern nonetheless leans negatively.

That’s the reason the present rally headwind can turn into a wider gross sales CVs. Persistent upward impulse is more likely to require a structural shift in lengthy -term accumulation patterns, one thing that ought to not but totally materialize based mostly on knowledge from chains.

Do sellers nonetheless have management of the spot market?

Spotmarkt dynamics displays the stress on the gross sales aspect regardless of the latest worth soar from Ethereum. The 90-day Spot Taker CVD indicated {that a} taker sells dominant habits, which confirms that gross sales orders proceed to surpass the purchases.

This pattern means that merchants use greater costs to go away positions as an alternative of gathering. Though worth promotion can appear to the floor bullish, the rally subsequently lacks conviction of spot contributors.

If the sale of dominance continues to exist about exchanges, Ethereum could expertise a delay or withdrawal, particularly if speculative curiosity decreases and doesn’t translate right into a significant demand for place.

Has the market sentiment already acquired a peak throughout De Kneep?

Ethereum’s crowd sentiment appears to have cooled after the breakout. In accordance with SantimentWeighted sentiment was at +1.48, whereas social dominance was at 10.47%, from writing.

Though these values stay constructive, they’re remarkably decrease than earlier peaks, which reduces enthusiasm signifies.

The drop implies a transition from euphoria to warning, particularly after quick liquidations have pushed nearly all of the profit.

Due to this fact, if the thrill continues to fade with out new tales or catalysts, the upward momentum of Ethereum can weaken.

Merchants can hesitate to return to aggressively, scale back bullish stress and open the door for potential worth consolidation or drawback.

Has the Derivatenmarkt Beerarish reversed?

The derivatives market reveals indicators of bearish herkalibration after the Ethereum assembly. On the time of writing, the lengthy/quick ratio was 0.96, with 51.01% of the positions quick and solely 48.99% lengthy.

This means that merchants are tilted in the direction of the expectations of downward descent and presumably anticipate a reversal after the quick squeeze.

The rising quick positioning additionally means that many are keen to wager towards additional revenue on the present stage.

Due to this fact, if the gross sales stress is in accordance with Bearish sentiment in Futures markets, Ethereum could possibly be confronted with elevated volatility, particularly if bulls are dropping momentum and the not too long ago recovered worth zones don’t defend.

Will Ethereum implement his revenue or admit to printing?

Whereas the rise in Ethereum past $ 3,700 induced stable liquidations, underlying statistics, underlying statistics, paint a warning image.

From a bearish lengthy/quick ratio to persistent spot gross sales and fading sentiment, the rally fog.

Except sentiment improves and whale habits goes again to accumulation, Ethereum could have problem retaining its revenue, making a brief -term correction more and more doubtless.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now