Ethereum

Ethereum active addresses jump 36%: Will ETH break $4000 now?

Credit : ambcrypto.com

- Ethereum lively addresses a 36% enhance, indicating natural demand and strong community exercise.

- Breaking the USD 4,100 resistance might propel ETH to its all-time excessive of USD 4,891.

Ethereum [ETH] noticed an enormous surge earlier this month, briefly hitting the $4,000 mark earlier than coming into a consolidation section. Though worth motion has cooled in latest days, analysts stay optimistic, pointing to sturdy indicators that Ethereum’s bullish momentum is much from over.

Because the US elections on November 5, ETH has seen a exceptional 70% worth enhance, fueled by natural demand, as evidenced by a big enhance within the variety of lively addresses.

This enhance, pushed by actual community exercise, means that Ethereum’s rally could possibly be sustainable, with the potential for continued development within the coming months.

Ethereum Value Motion After the US Elections: A Deep Dive

Ethereum’s worth trajectory following the US elections has been nothing in need of explosive, with belongings up 70% since November 5.

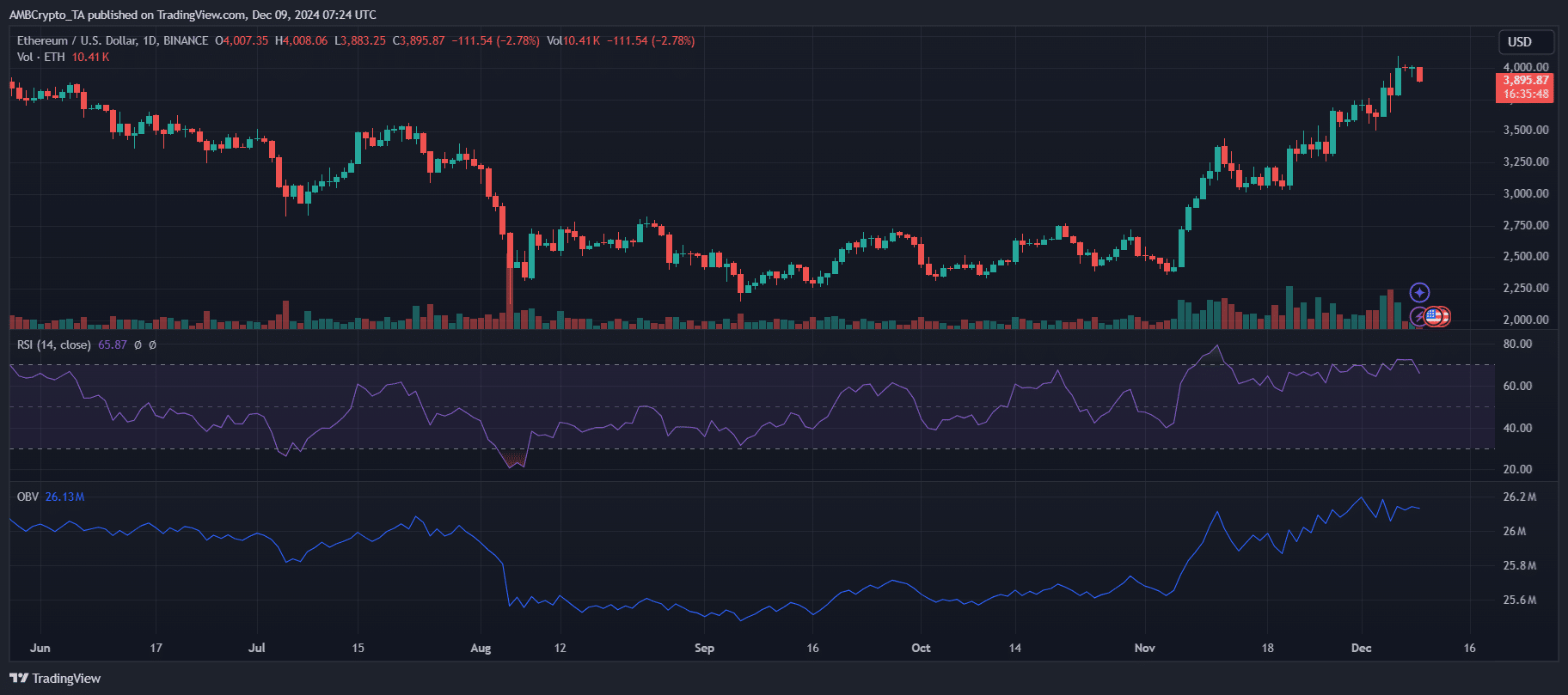

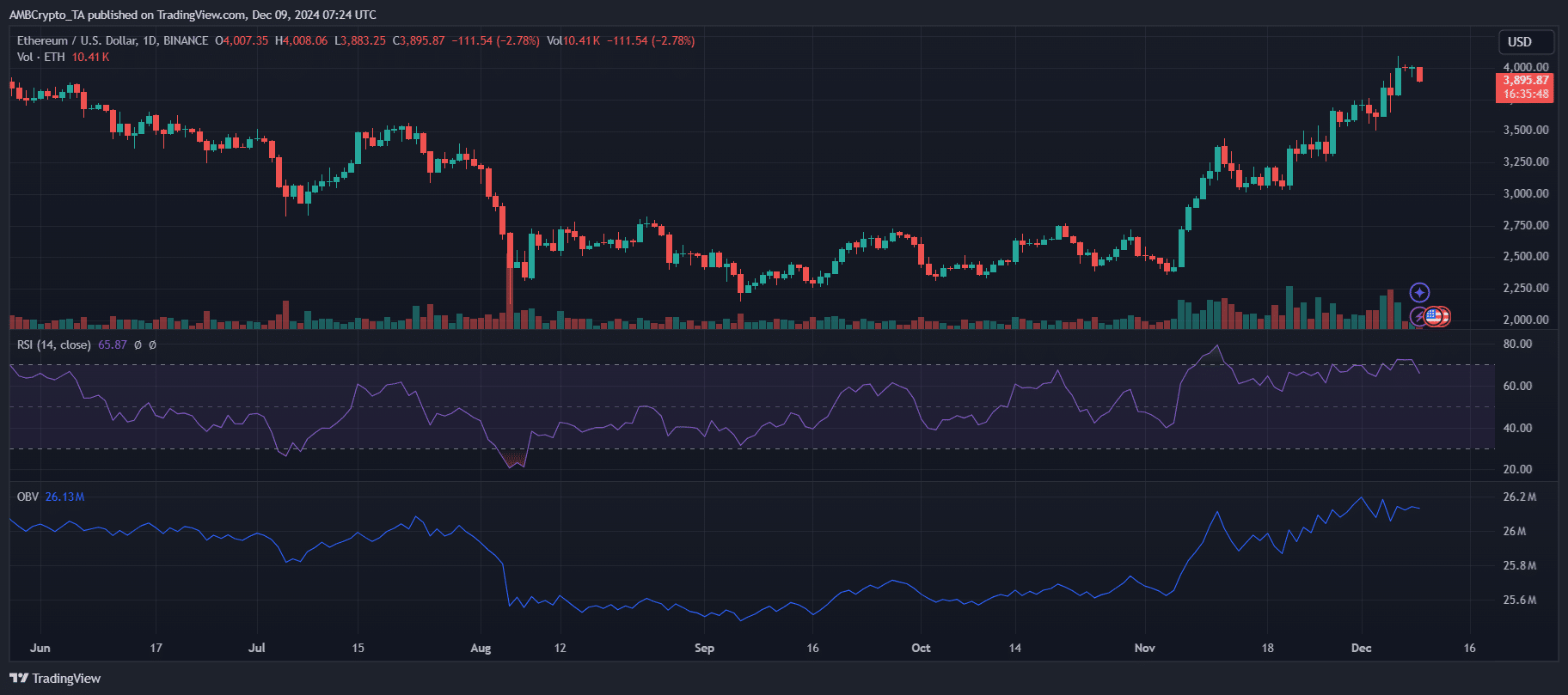

The break above the $3,500 resistance signaled a shift in market sentiment, catalyzed by elevated institutional exercise and the DeFi revival. TradingView information highlights strong quantity accumulation alongside bullish worth motion, evidenced by a rising OBV metric.

Supply: TradingView

This means sturdy purchaser curiosity, and never simply speculative hype. Moreover, the RSI stays under overbought territory, indicating room for continued upside potential.

Analysts attribute this momentum to Ethereum’s dominance in Layer-2 scaling options and its rising function in facilitating decentralized purposes.

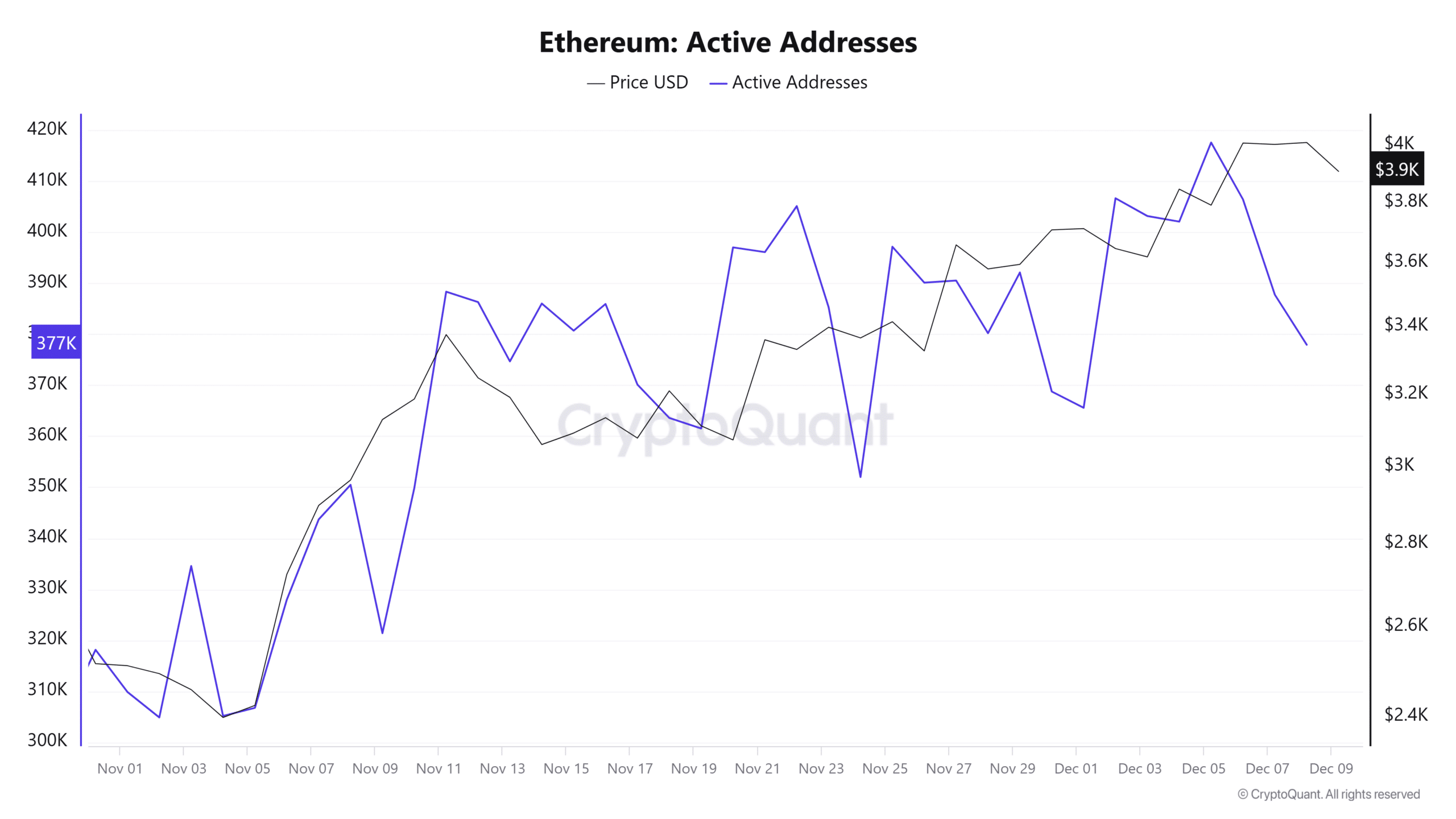

Enhance in lively ETH addresses

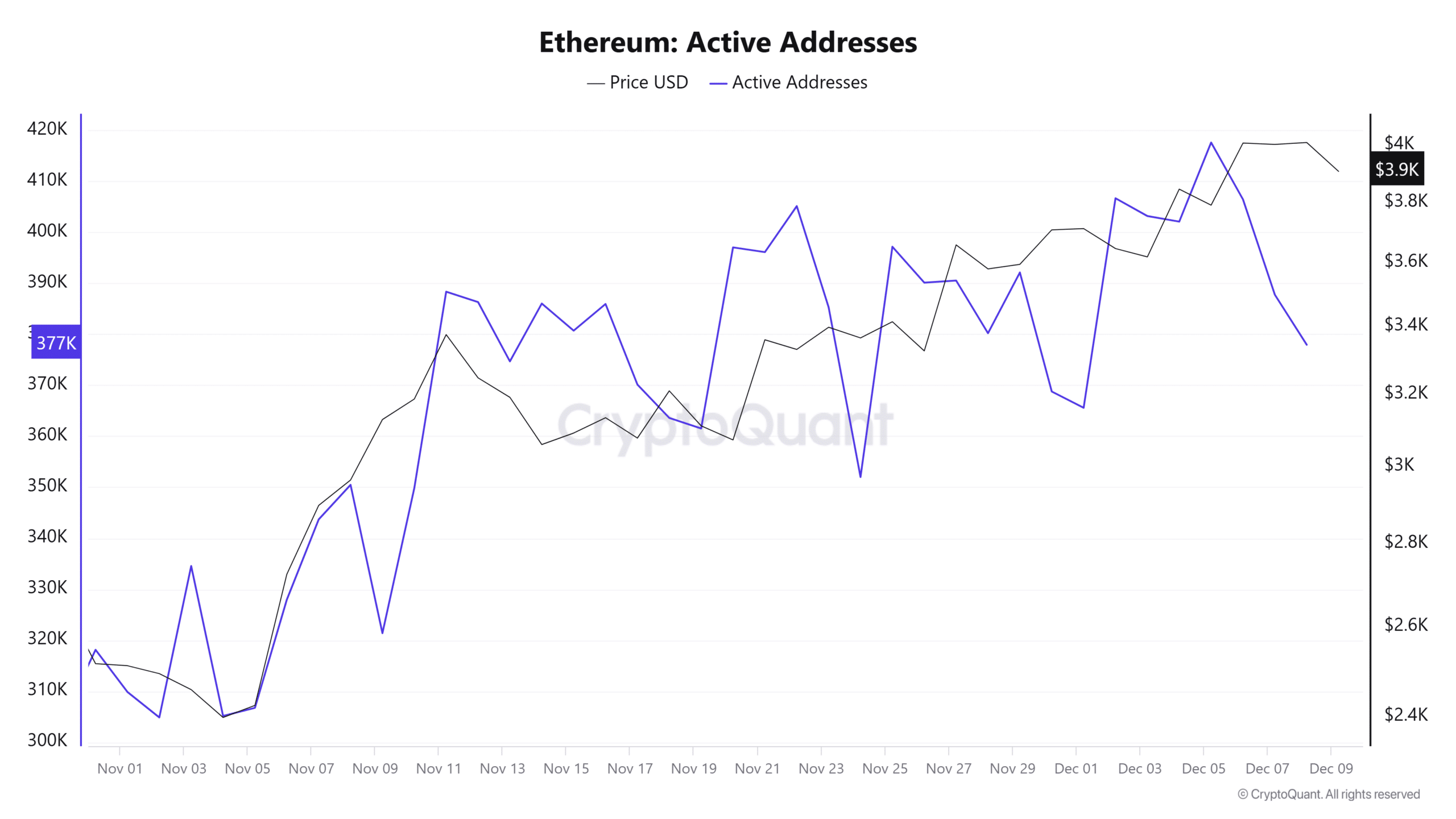

Ethereum community exercise has seen a big enhance for the reason that November 5 election, with the variety of lively addresses rising by greater than 36% to 417,000.

This enhance highlights natural demand fairly than speculative buying and selling, underscoring a “wholesome and sustainable” rally, the report stated CryptoQuant analyst Burak Kesmeci.

Supply: CryptoQuant

The rise within the variety of lively addresses displays elevated investor curiosity and broader use of blockchain. This metric, which is usually thought of a proxy for actual community exercise, lends credibility to Ethereum’s present rally as a result of it’s based mostly on sturdy fundamentals.

Analysts recommend this development might imply a continued upward trajectory, particularly given Ethereum’s rising function in DeFi and NFTs, cementing its place because the main altcoin in an evolving market panorama.

Ethereum’s $4,000 Consolidation: Bullish or Bearish?

Ethereum’s consolidation section at $4,000 brings blended emotions in regards to the subsequent step. Whereas some foresee a attainable pullback, Kesmeci stays optimistic, citing wholesome fundamentals.

In response to him, breaking the $4,100 resistance might push Ethereum to its all-time excessive of $4,891. Key indicators resembling rising lively addresses and continued quantity accumulation recommend that bullish momentum stays intact.

Nevertheless, the $4,100 stage poses a psychological barrier. Analysts additionally spotlight the potential for exterior components, resembling macroeconomic situations or regulatory developments, influencing Ethereum’s trajectory.

For long-term traders, Ethereum stays worthwhile, with positive factors of greater than 39% prior to now month, positioning it as a cornerstone of the altcoin rally.

Learn Ethereum’s [ETH] Value forecast 2024–2025

Ethereum’s rising institutional adoption is clear from rising inflows into spot ETFs, which now have cumulative internet inflows of $1.41 billion.

The timing of those inflows aligns with Ethereum’s latest rally, reinforcing bullish sentiment across the asset.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now