Ethereum

Ethereum Adoption Grows As BlackRock ETF Secures 1 Million ETH

Credit : www.newsbtc.com

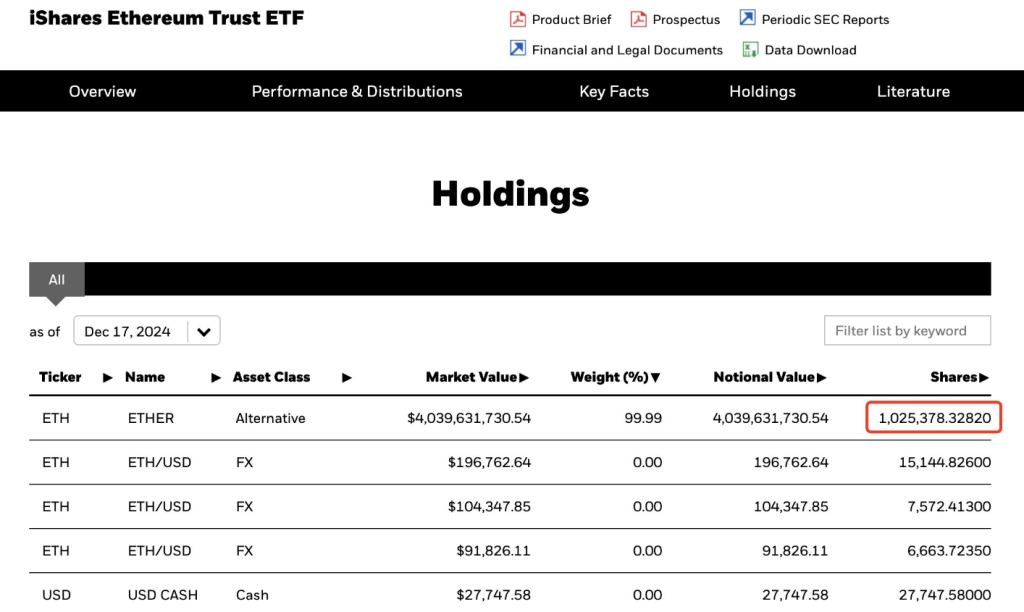

BlackRock’s iShares Ethereum Belief ETF (ETHA) has reached 1 million ETH holdings, price greater than $4 billion. This milestone, achieved on December 18, 2024, is a outstanding achievement for the fund, which was based simply six months earlier in July.

As institutional curiosity in cryptocurrencies grows, this ETF is rising as a frontrunner amongst newly launched ETFs Ethereum merchandise.

Institutional curiosity is rising

BlackRock is rising possessions in Ethereum ETFs are half of a bigger pattern of main firms investing in cryptocurrencies. In 2024, billions of {dollars} have been invested in new exchange-traded Bitcoin and Ethereum funds.

Based on blockchain tracker Lookonchain, ETHA now has 1,025,378 ETH, making it the primary new Ethereum ETF to achieve this milestone. For comparability, Grayscale’s Ethereum ETF holds roughly 476,000 ETH.

BREAK: #BlackRock‘s iShares Ethereum Belief ETF now holds over 1 million $ETHa complete of 1,025,378 $ETH($4.04 billion).https://t.co/sefS6WTlHz pic.twitter.com/kvd7KY24zQ

— Lookonchain (@lookonchain) December 18, 2024

The rise in property beneath administration (AUM) is very spectacular given the preliminary difficulties this firm confronted Ethereum ETFs at launch. Many merchandise noticed minimal inflows as they competed with bigger funds equivalent to Grayscale’s ETHE.

As of September 2024, a considerable shift has taken place. Following political occasions equivalent to Donald Trump’s election victory, market sentiment has improved considerably. Stories point out that internet inflows into Ether ETFs exceeded $850 million final week.

A promising future for Ethereum

Specialists imagine that the rising curiosity may point out a shiny future for Ethereum. Juan Leon, a senior funding strategist at Bitwise Asset Administration, believes Ether will recuperate in 2025. He says the real-world asset market may generate greater than $100 billion in annual charges for ETH, excess of present revenues.

The present inflow of capital into Ethereum ETFs displays the renewed confidence of institutional traders. CoinGlass information exhibits that these merchandise have just lately acquired important funding, with the whole property of a number of Ethereum ETFs exceeding $14 billion. This pattern exhibits that increasingly traders need to acquire publicity to Ether with out the trouble of managing their very own wallets.

Trying forward

The top of Digital Property Analysis at BlackRock warns that it could take a while for Ethereum merchandise to meet up with their Bitcoin counterparts, regardless of this encouraging pattern. Because the market and regulatory setting modifications, the highway forward should be troublesome.

Nonetheless, with rising institutional help and rising curiosity from conventional monetary establishments, the prospects for BlackRock’s Ether ETF and the broader cryptocurrency market seem promising as we enter 2025.

Featured picture of DALL-E, chart from TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024