Ethereum

Ethereum – All the reasons why ETH’s price might enjoy a bullish December

Credit : ambcrypto.com

- Ethereum ETFs simply recorded their highest inflows in a single day, surpassing Bitcoin ETFs

- ETH could also be on the cusp of a serious rally following will increase in Alternate Reserves and Open Curiosity

The Bitcoin and Ethereum ETF approvals earlier this 12 months have been undoubtedly important milestones for institutional liquidity. Whereas Bitcoin has maintained dominance when it comes to inflows, Ethereum ETF’s every day inflows have simply taken an edge for the primary time in historical past.

In keeping with the latest ETF dataEthereum ETF inflows peaked at $332.9 million on Friday. In the meantime, Bitcoin had ETF inflows value $320 million throughout the identical buying and selling session. It is a notable end result because it was the primary time that Ethereum ETFs outperformed Bitcoin ETFs when it comes to inflows.

Friday even recorded the best influx in sooner or later. Friday not solely recorded the best inflows reported in November, but additionally all through historical past since Ethereum ETFs first started buying and selling.

Is Ethereum on the verge of a serious breakout?

Is the truth that every day Ethereum ETF inflows outperformed Bitcoin ETF inflows an indication that ETH is headed for a serious rally? Nicely, Bitcoin’s dominance has waned, which might clarify why Ethereum has acquired extra consideration from traders. However that is not all.

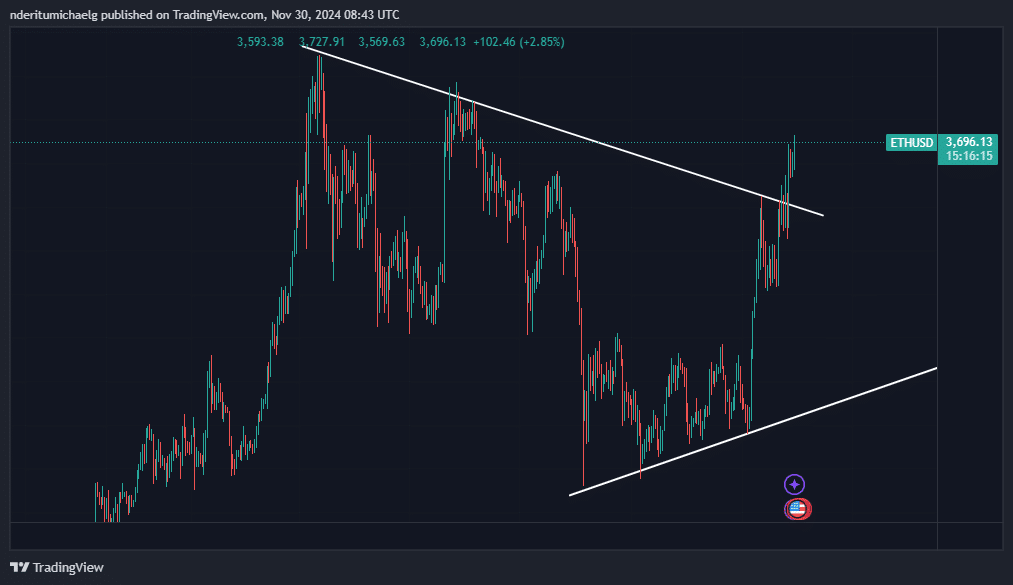

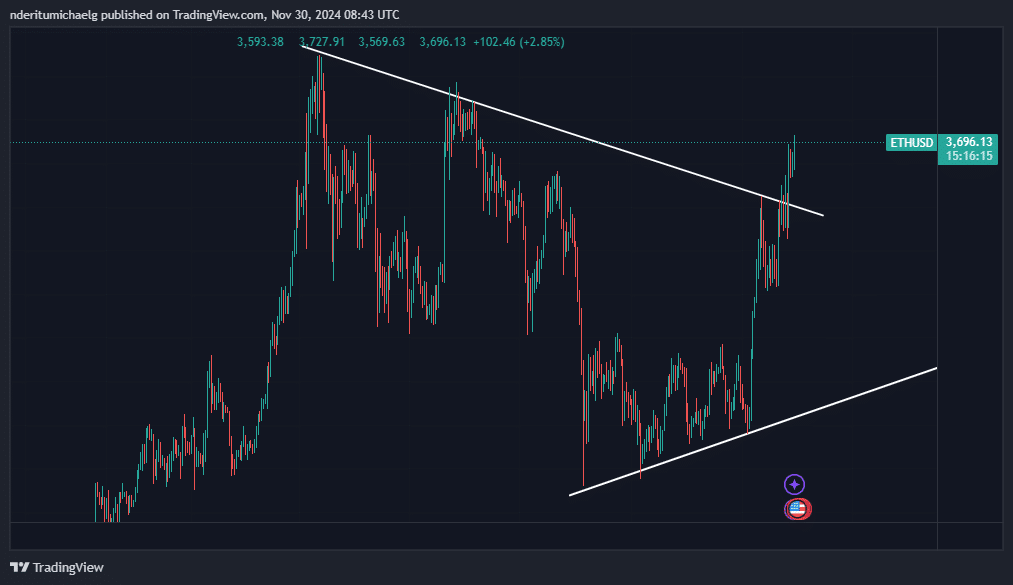

ETH gained plenty of bullish momentum through the week, confirming a breakout from its long-term wedge sample. The identical breakout additionally revealed a long-term bull flag for the cryptocurrency. These components collectively prompt that ETH may very well be on the cusp of a bullish December.

Supply: TradingView

On the time of writing, the altcoin was valued at $3,694. Sustained demand after a break from the falling resistance line may very well be an indication of rising bullish optimism.

Moreover, there gave the impression to be a number of different indicators that have been in step with the above findings. For instance, ETH’s Open Curiosity peaked at $24.08 billion on November 28 – its highest stage ever.

supply: Coinglass

The brand new Open Curiosity document confirmed that there was robust demand for ETH derivatives, along with demand for ETFs.

The Alternate Reserves knowledge additionally confirmed rising confidence amongst ETH holders. In truth, the numbers for this have grown by roughly 750,000 cash within the final 30 days, bringing the overall reserves on exchanges to roughly 19.72 million ETH.

Supply: CryptoQuant

Ethereum’s forex reserves at the moment are at ranges final seen in April 2024. The cryptocurrency has reached two months of constructive forex reserves for the primary time up to now this 12 months.

It is a signal of the altering sentiment amongst ETH holders and will level to the waning ETH promoting strain on the charts. If that’s the case, ETH might quickly be heading for value ranges above $4,000 and past.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now