Ethereum

Ethereum analysis: Profitable holders increase despite price dip

Credit : ambcrypto.com

- ETH stays in a powerful bull development, round 56, in line with its RSI.

- The worth fell by 0.73% within the final buying and selling session.

Ethereum [ETH] has proven a slight decline over the previous 24 hours, however technical indicators counsel a bullish shift might happen within the close to time period.

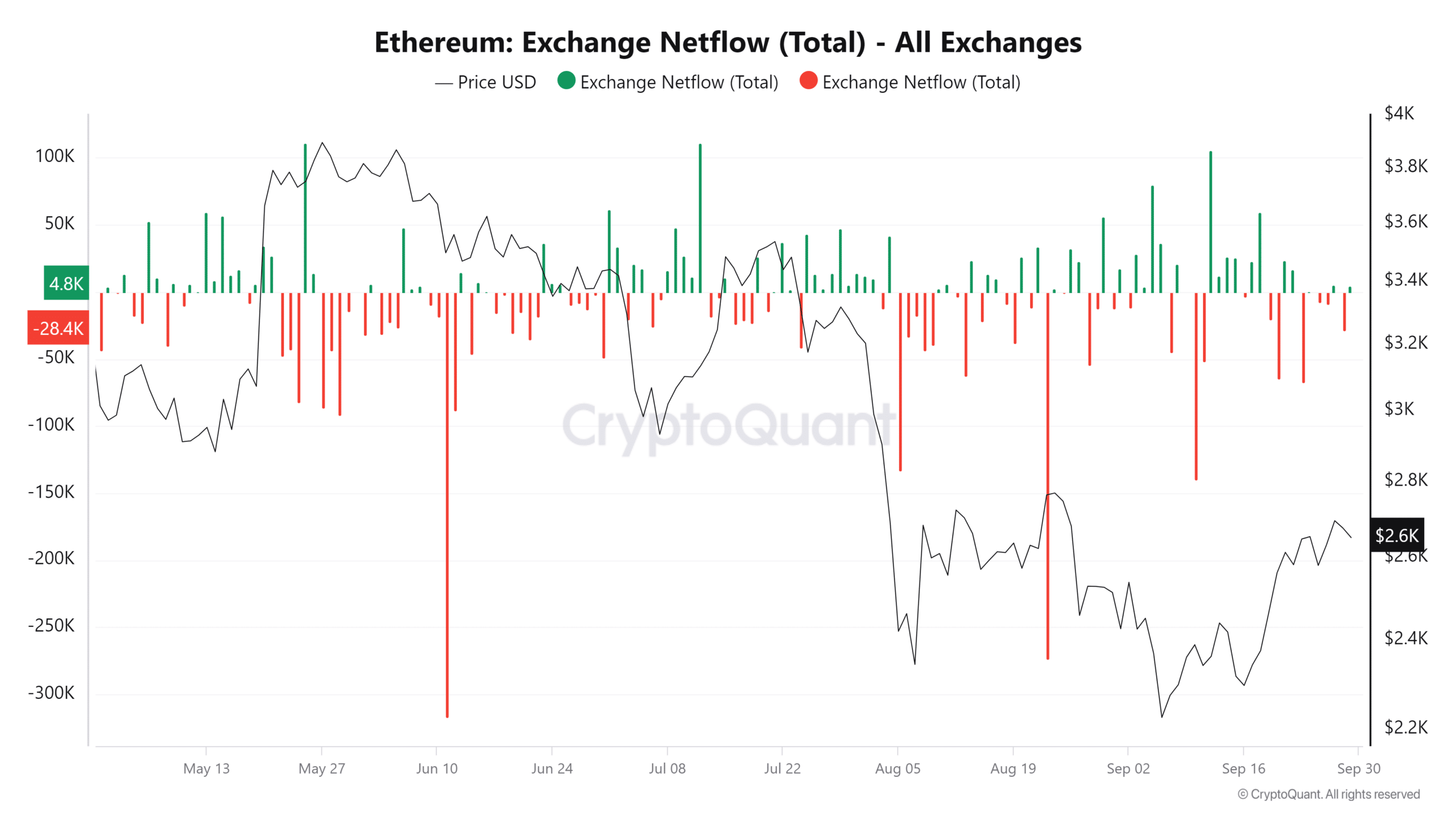

Regardless of the current sell-off, the exchanges’ internet circulation exhibits a dominance of outflows, indicating that extra ETH has been withdrawn from the exchanges than deposited, indicating potential shopping for curiosity and decreased promoting strain.

Ethereum’s value motion and technical indicators

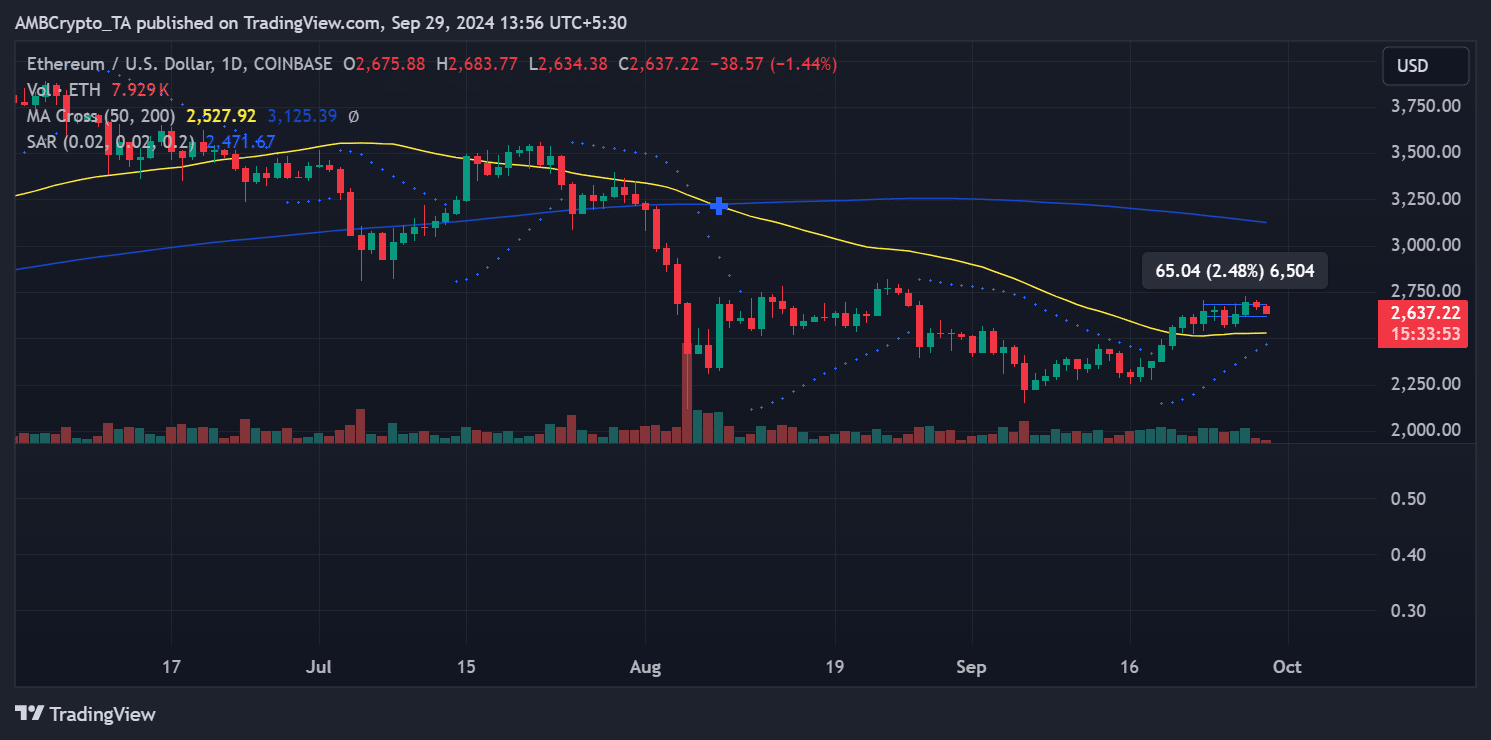

Ethereum was buying and selling at $2,637.22 on the time of writing, reflecting a short-term decline of 1.44%. On the every day chart, the 50-day transferring common (yellow) is at $2,527.92, whereas the 200-day transferring common (blue) stays larger at $3,125.39.

ETH buying and selling above the 50-day transferring common signifies near-term bullish momentum. Nonetheless, the value stays effectively under the 200-day transferring common, indicating that the broader long-term development remains to be bearish.

Supply: TradingView

The Parabolic SAR indicator additionally helps this short-term bullish outlook, with dots under the value. This means that the present uptrend stays intact and patrons are nonetheless accountable for the market in the meanwhile.

Whereas Ethereum is exhibiting indicators of power within the brief time period, it’s dealing with sturdy resistance from the 200-day transferring common, which might stop a breakout in the long run.

Growing Variety of Ethereum Holders in Revenue

Regardless of the current decline, Ethereum’s earlier rally this week had a big influence on the profitability of its holders. In response to knowledge from the Globally in/out of money Within the graph, the share of ETH holders with income elevated from 59% to 68%.

This interprets to over 83 million addresses now holding ETH at a revenue.

However, 29.47% of addresses, equal to 36.17 million, are presently ‘Out of the Cash’, that means they’re making losses. About 2.38%, or 2.93 million addresses, are breaking even.

Alternating present: the outflow dominates

Ethereum’s internet circulation has fluctuated between inflows and outflows over the previous week. Nonetheless, the general development exhibits a better quantity of ETH leaving the exchanges, indicating better outflows than inflows.

This internet damaging circulation is important, particularly given the retail investor and institutional sell-off occasions earlier this week.

Supply: CryptoQuant

On the finish of the final buying and selling session, the online circulation of ETH was over 28,000 ETH damaging, highlighting the dominance of the outflow. This development of ETH being delisted from exchanges means that traders could also be holding on to their cash, decreasing the chance of a right away sell-off.

Learn Ethereum (ETH) Value Prediction 2024-25

Conclusion

Ethereum is presently navigating a blended market with near-term bullish momentum because it trades above its 50-day transferring common and experiences better outflows from exchanges.

Nonetheless, the numerous resistance offered by the 200-day transferring common stays a hurdle to long-term bullish developments.

Furthermore, the rise within the variety of worthwhile holders signifies renewed confidence amongst traders, regardless of the current value decline.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024