Ethereum

Ethereum: Analyzing impact of $14.27M whale action on ETH prices

Credit : ambcrypto.com

- Whale exercise and essential assist ranges prompt a doable value drop out on Ethereum.

- Change reserves lower and liquidation factors meant elevated volatility, but in addition upward potential.

Ethereum [ETH] has not too long ago skilled an essential whale exercise, with giant recordings of enormous exchanges that arouse curiosity out there. A brand new pockets withdrew 7,100 ETH, with a worth of $ 14.27 million, from Gemini.

As well as, substantial ETH transfers happened of Binance, OKX and Kraken, which quantities to tens of millions of worth.

A few of these belongings have been turned off or deposited in mortgage platforms resembling Aave, which might point out Bullish Intentions.

What does the value promotion about Ethereum say?

On the time of the stress, Ethereum was priced at $ 2,030.76, which displays a slight lower of 1.21% within the final 24 hours.

Regardless of this small dip, Ethereum continues to drift above essential assist ranges, particularly round $ 2,000. Whereas whale exercise absorbs, there’s a robust risk that Ethereum may expertise a value change.

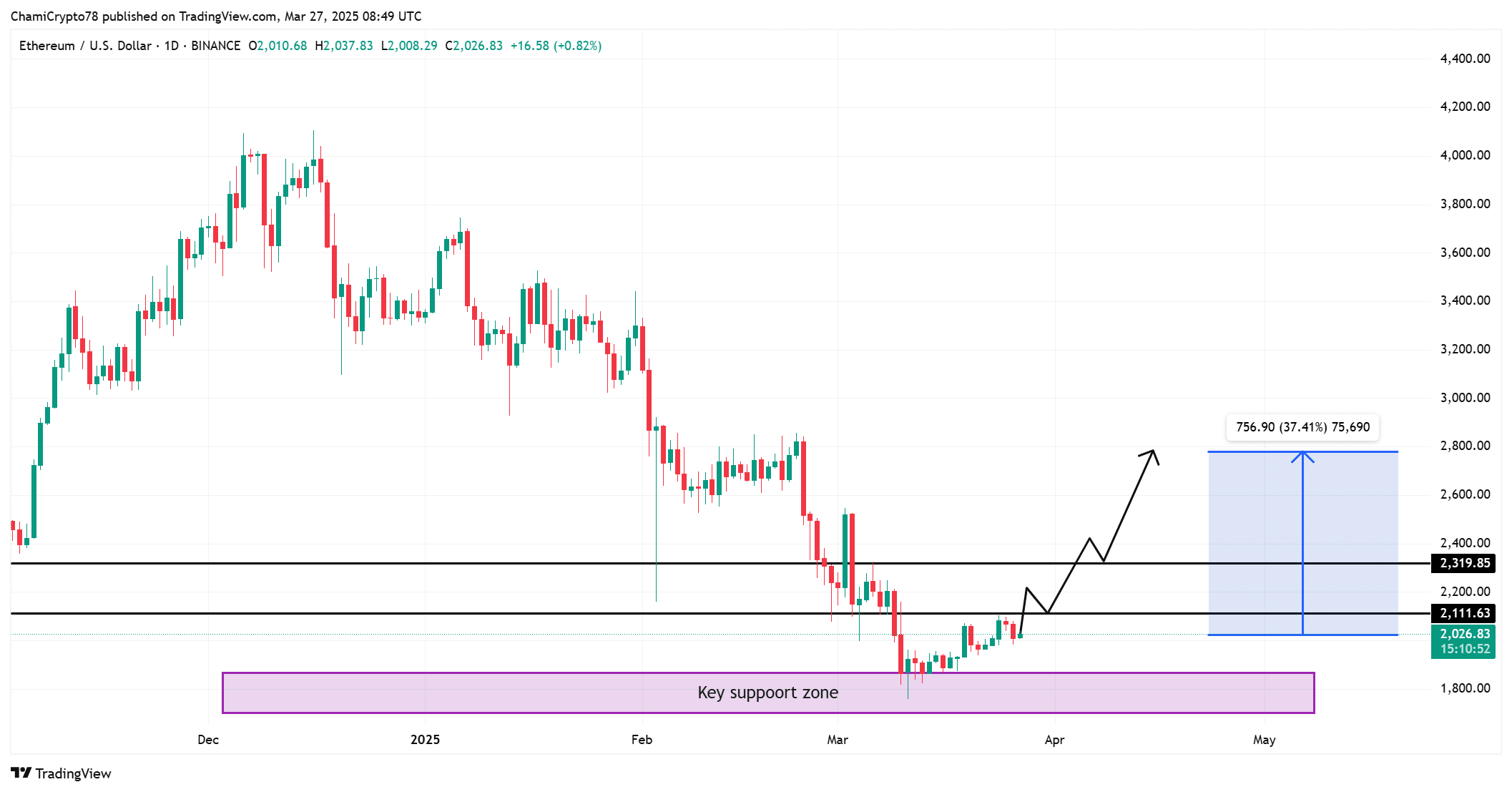

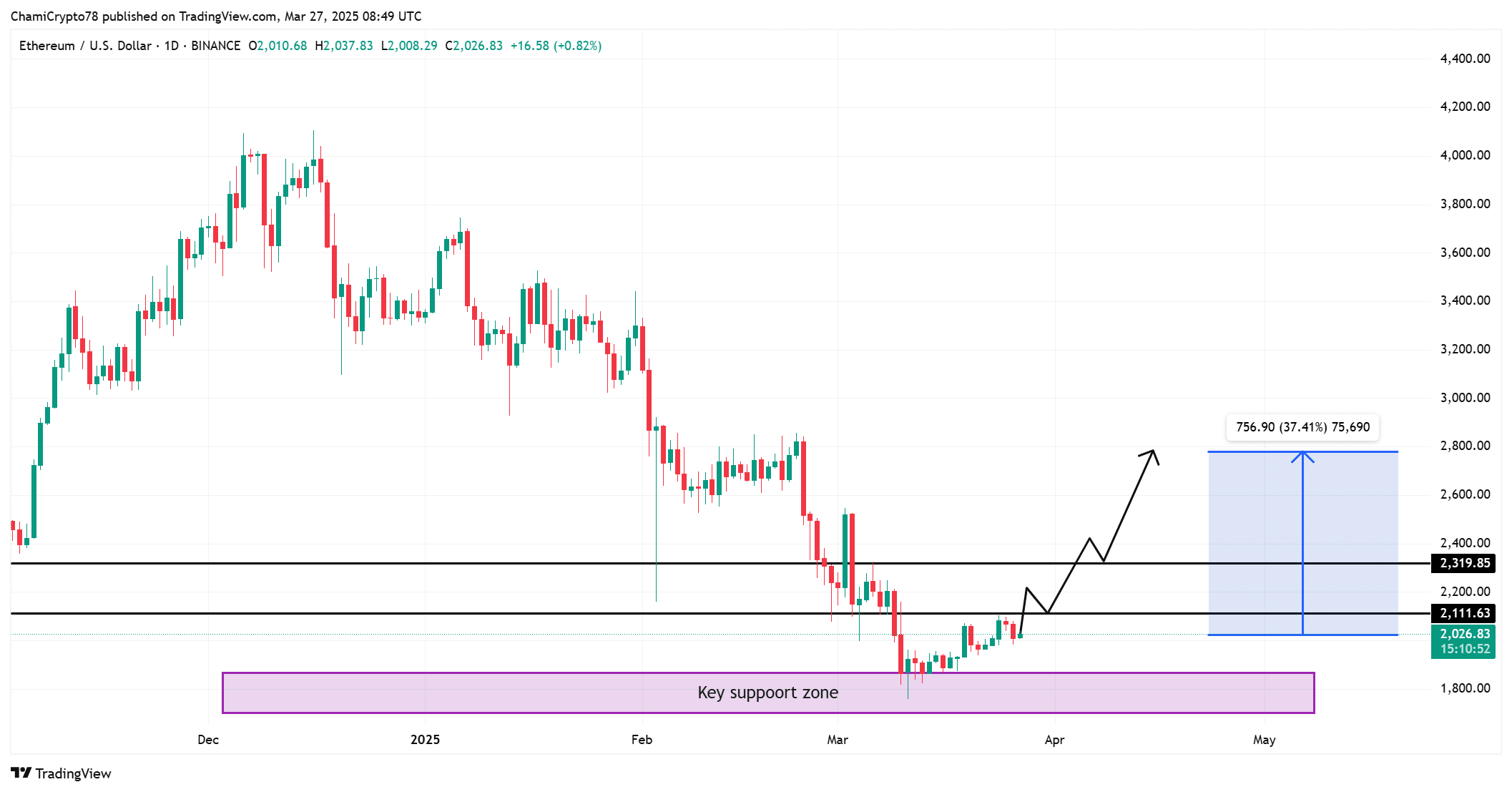

If the value stays above this assist degree, it might probably break previous the $ 2,100 resistance, which can activate a rally.

That’s the reason a motion above this threshold may additional arouse, and the value may even rise by 37percentand strategy $ 2,800.

Supply: TradingView

ETH ‘S Change Reserves: Liquuidity Dynamics at Play

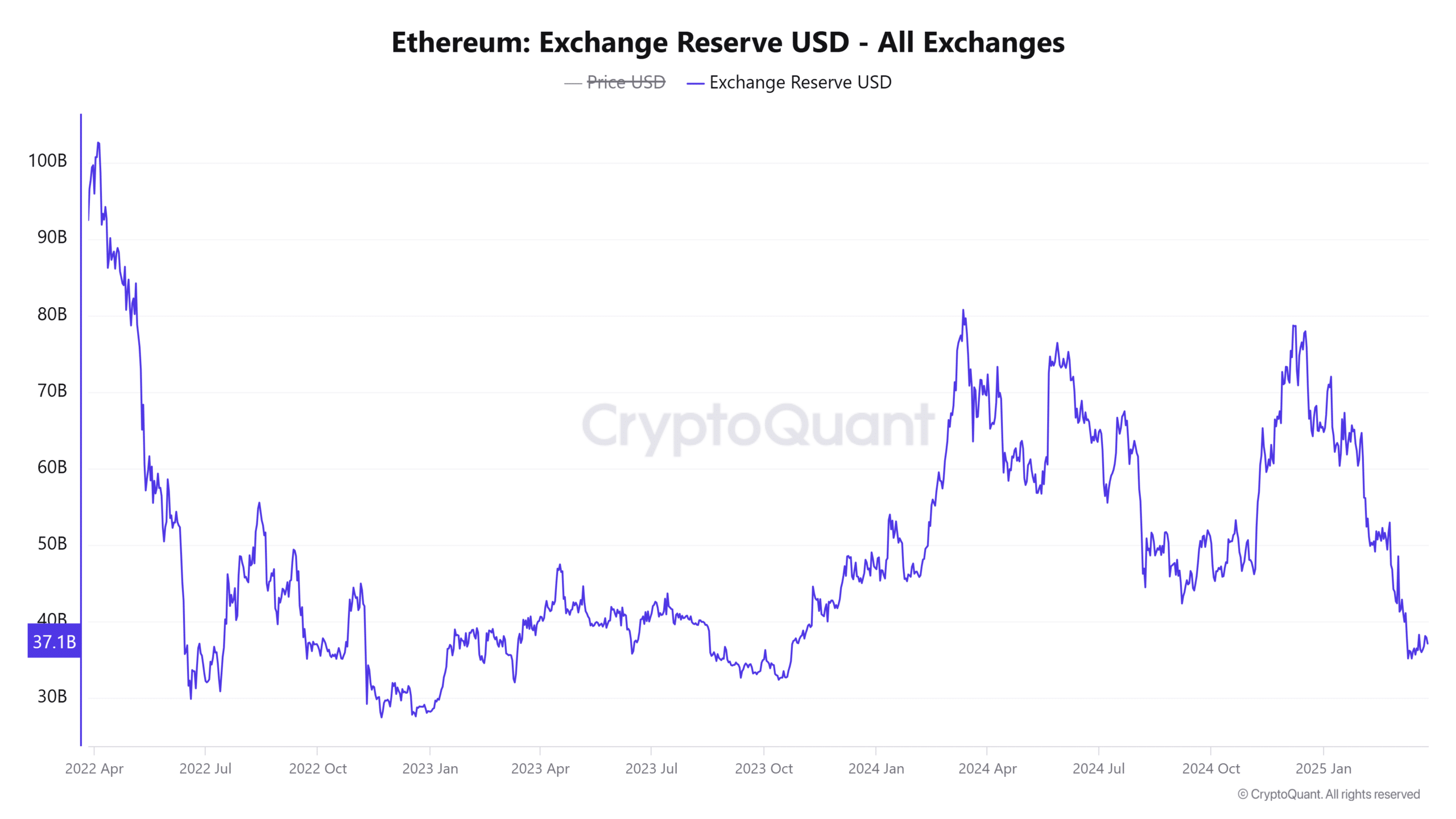

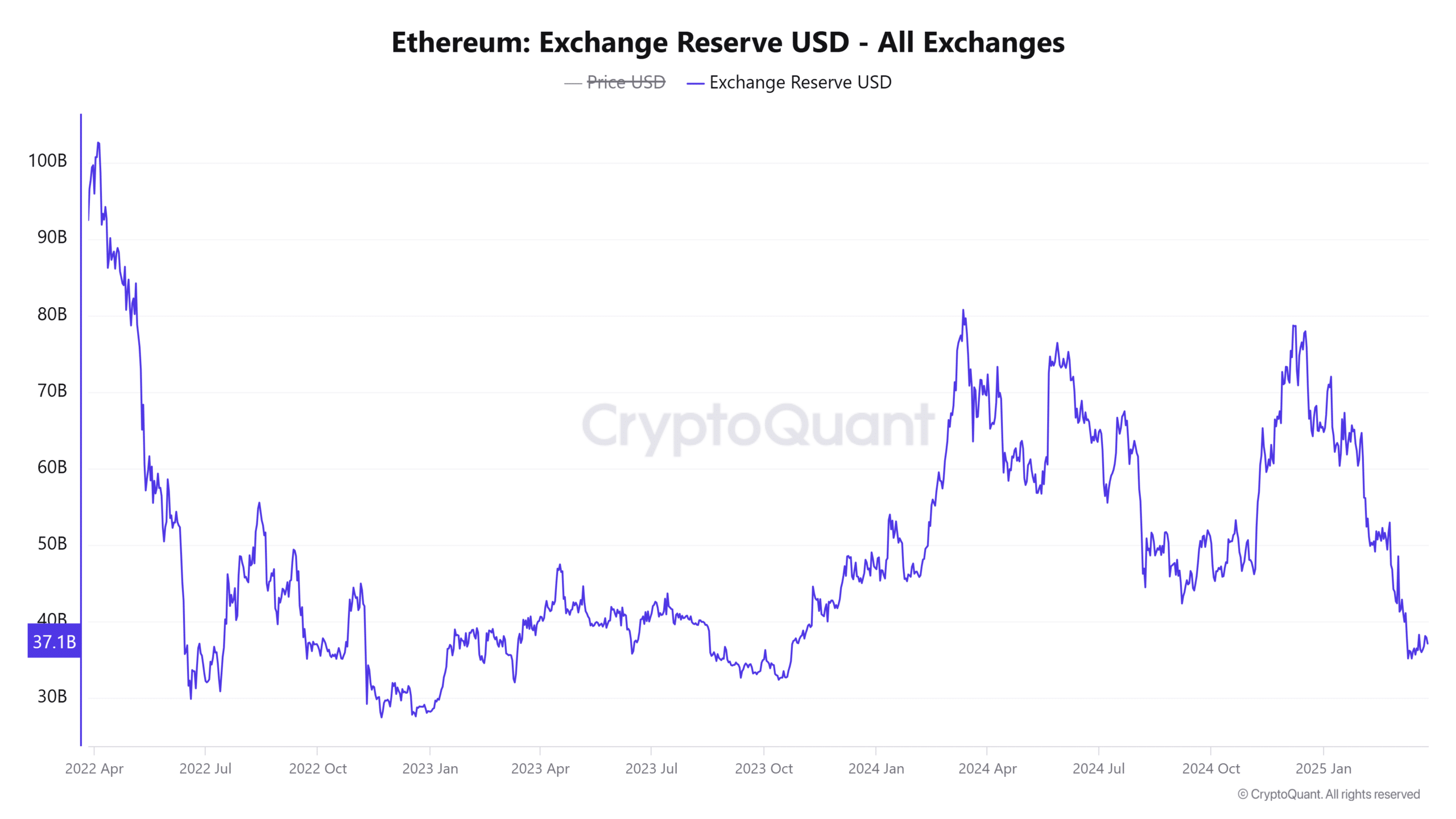

On the time of writing, the Change Reserve of Ethereum was $ 37,1653 billion, which not too long ago confirmed a lower of two.16%. This deterioration means that extra ETH of inventory markets strikes, decreasing the obtainable liquidity for fast transactions.

This shift might point out that buyers maintain their positions or transfer belongings to different platforms for setting or lengthy -term investments.

With a stricter inventory on exchanges, Ethereum can expertise upward stress within the coming days.

The drop in change reserves displays evolving market dynamics and signifies lowered liquidity on the gross sales facet, probably will increase in value will increase.

Supply: Cryptuquant

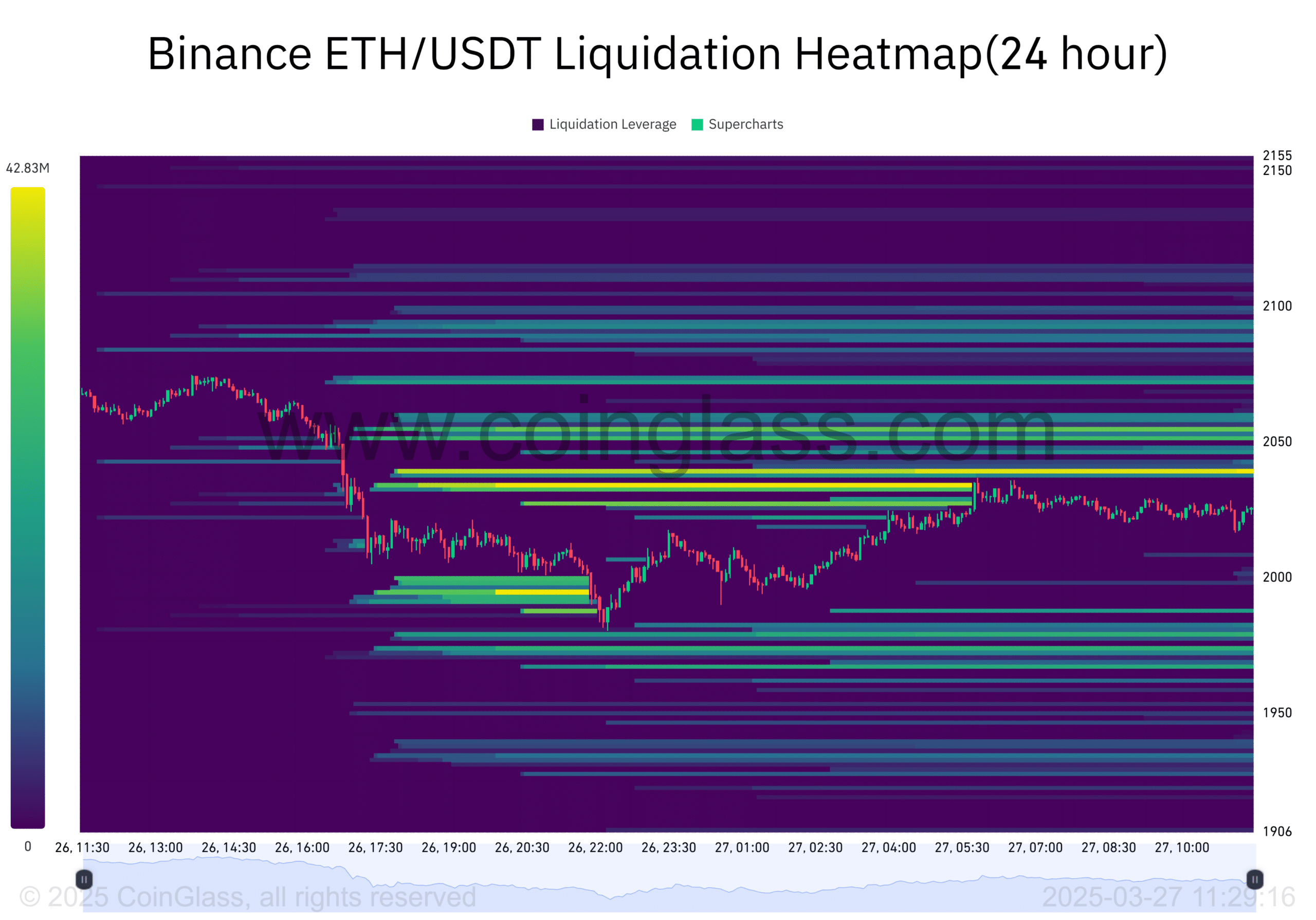

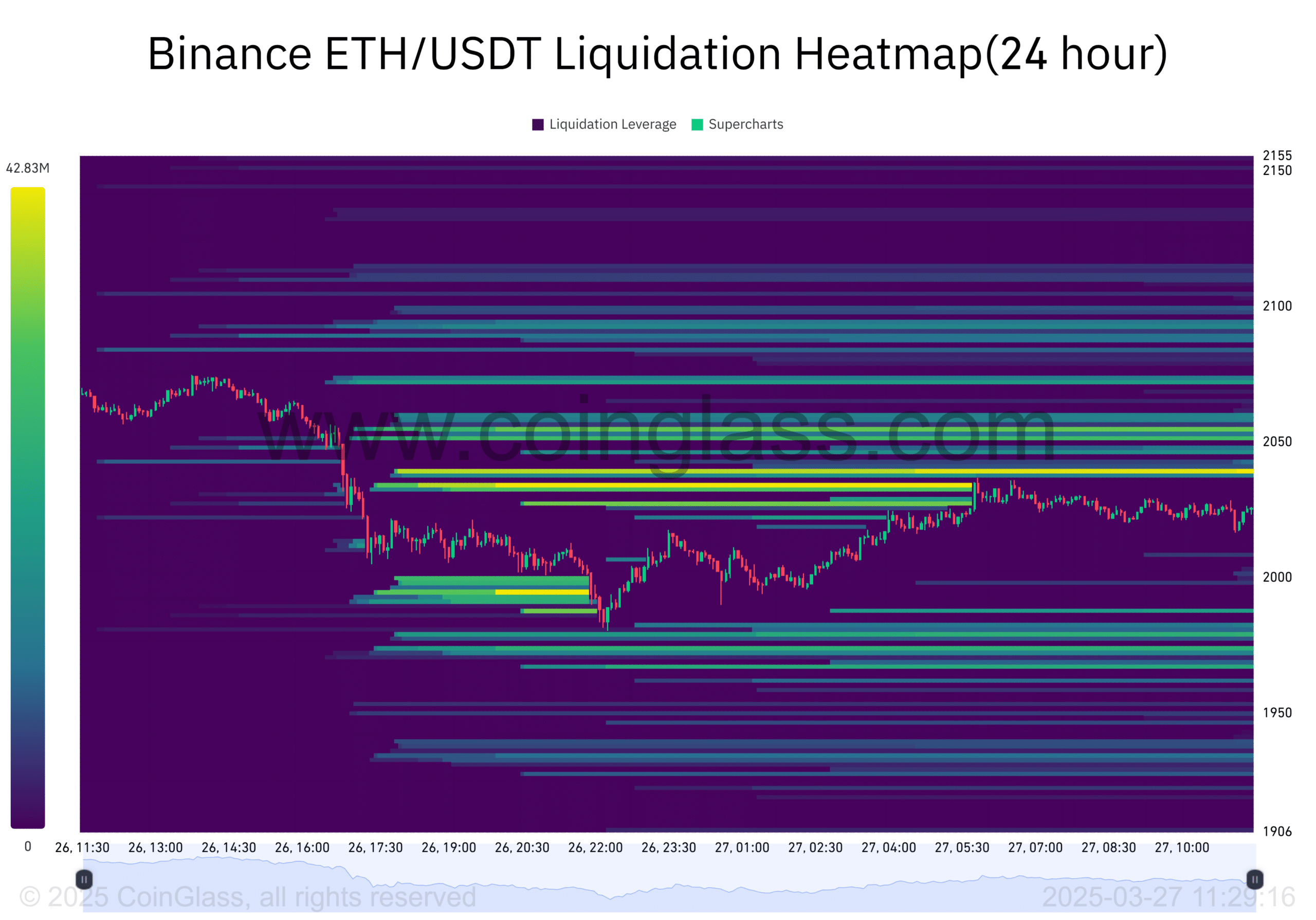

Liquidation Heatmap: How do the liquidation ranges affect the value?

The breakdown of the liquidation of Ethereum of Binance reveals essential assist and resistance zones.

The cardboard reveals important liquidation factors between $ 2,000 and $ 2,100. As Ethereum approaches these ranges, pressured promoting can happen, which will increase market volatility.

This elevated volatility can push the value of Ethereum via resistance ranges or be sure that it’s confronted downwards.

With the excessive variety of liquidation factors, the value of Ethereum is below stress, however may also rise if the market successfully absorbs these liquidations.

Supply: Coinglass

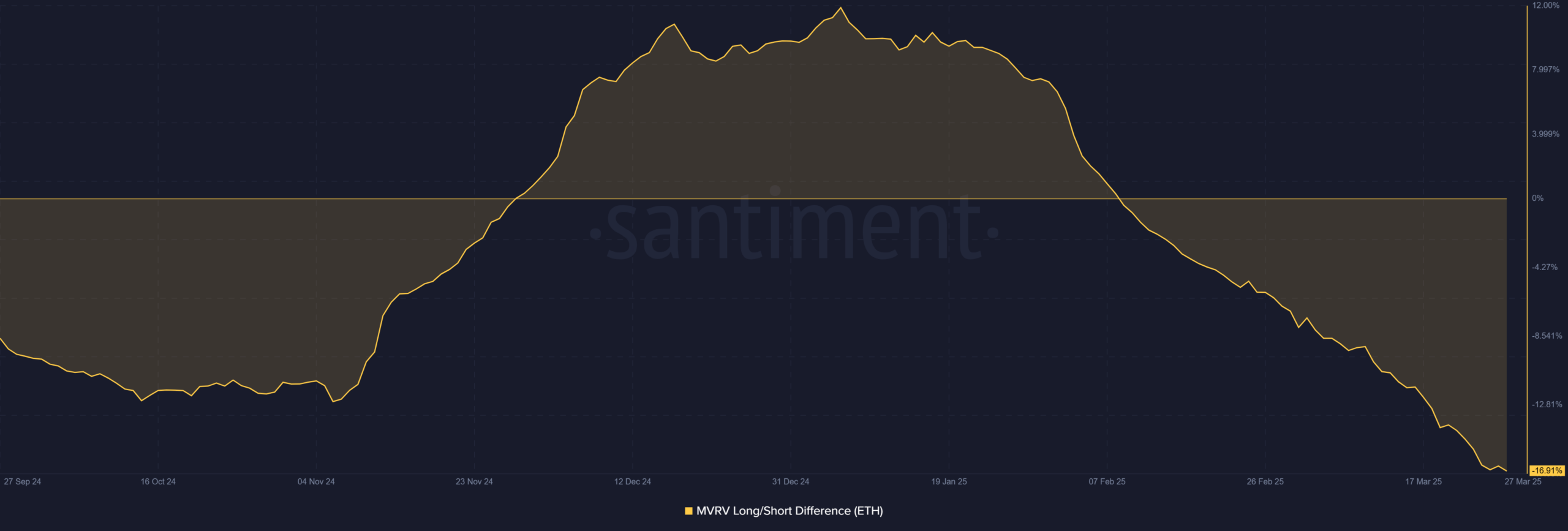

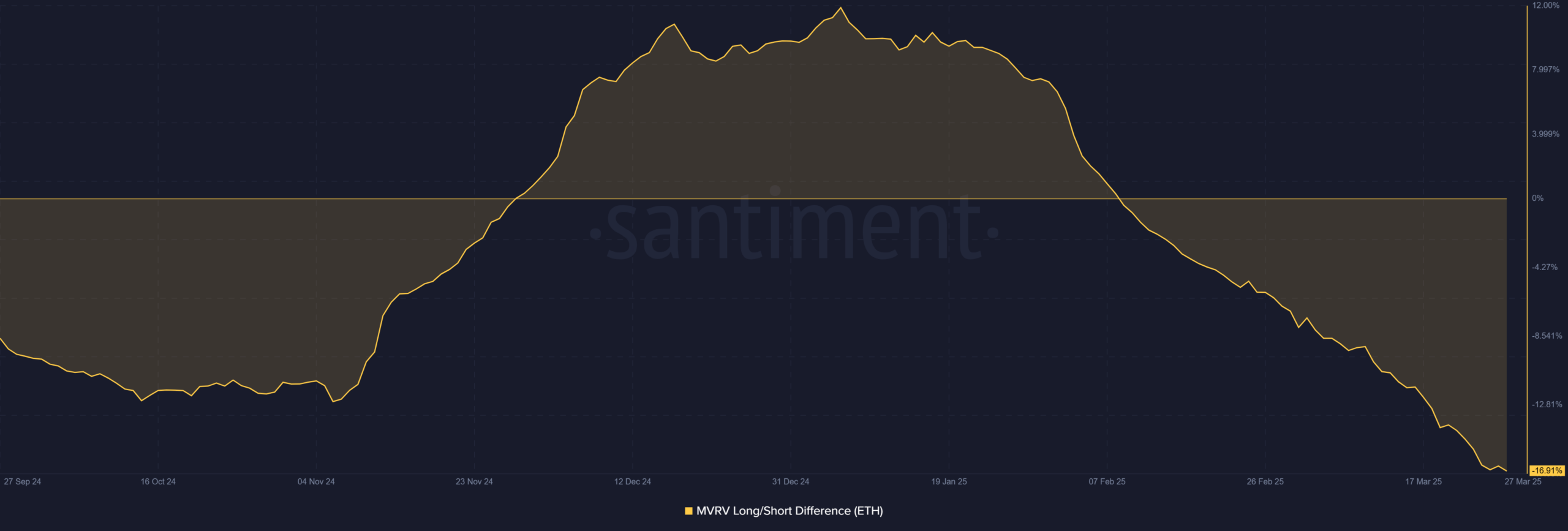

MVRV lengthy/brief distinction: Evaluation of market sentiment

The MVRV -long/brief distinction for ETH was -16.91 %. This unfavourable worth signifies a bearish sentiment at holders in the long run. Nevertheless, such a big divergence means that the market will be bought over.

If merchants regard this as a shopping for possibility, ETH may see a value reverse.

As extra market members begin to benefit from the low ranges, the value can recuperate shortly, including gas to a possible outbreak.

Supply: Santiment

Has ETH been set for an outbreak?

Given the whale exercise of Ethereum, essential assist ranges and market sentiment, it appears possible that ETH is prepared for an outbreak. The mixture of lowered change reserves, rising whale exercise and technical indicators suggests an upward value momentum.

That’s the reason ETH can expertise a substantial value improve if the resistance breaks via previously, which can quickly obtain $ 2,800.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now