Ethereum

Ethereum apes Microstrategy’s pattern: What are odds of $14K in 2025?

Credit : ambcrypto.com

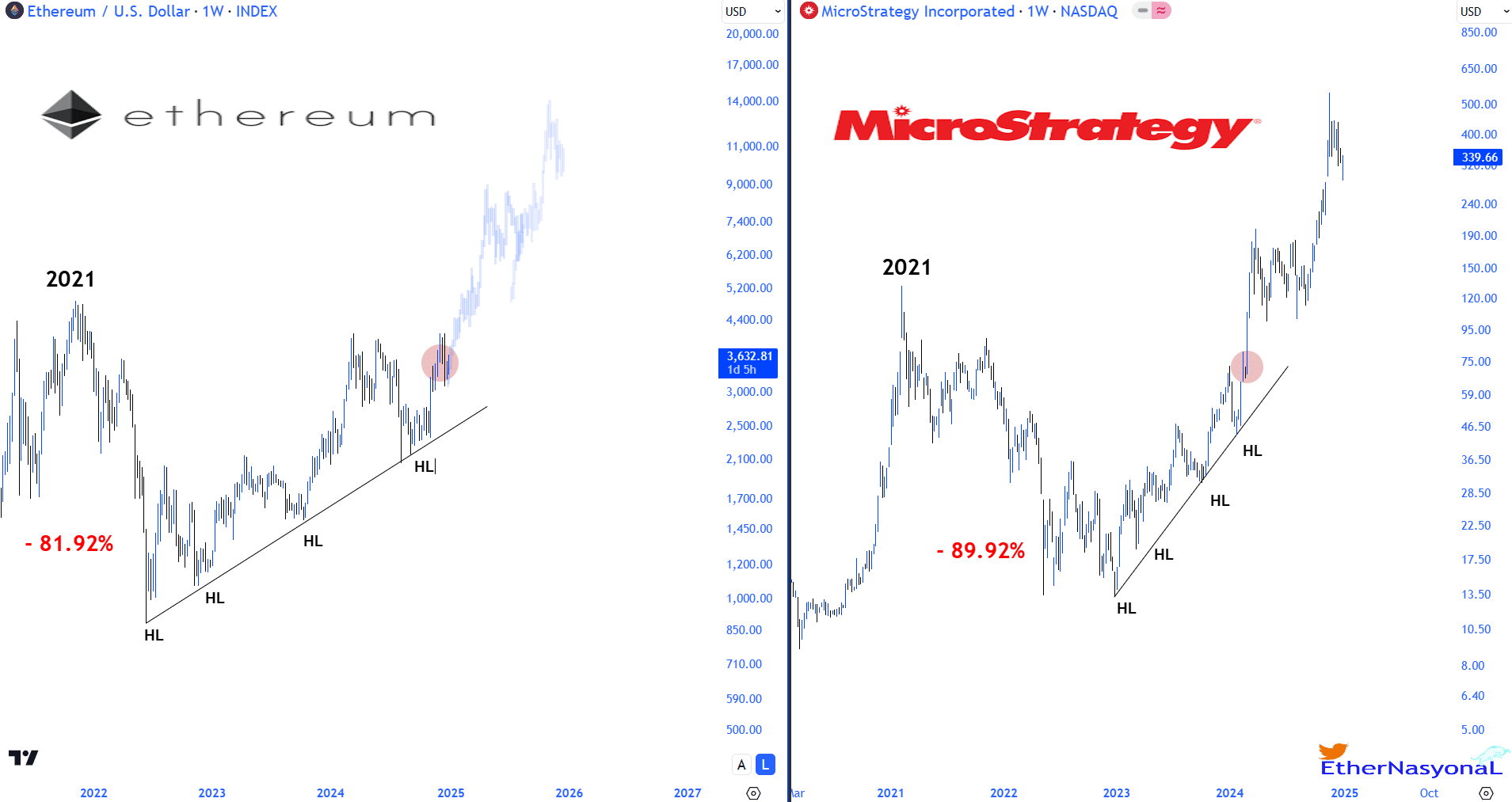

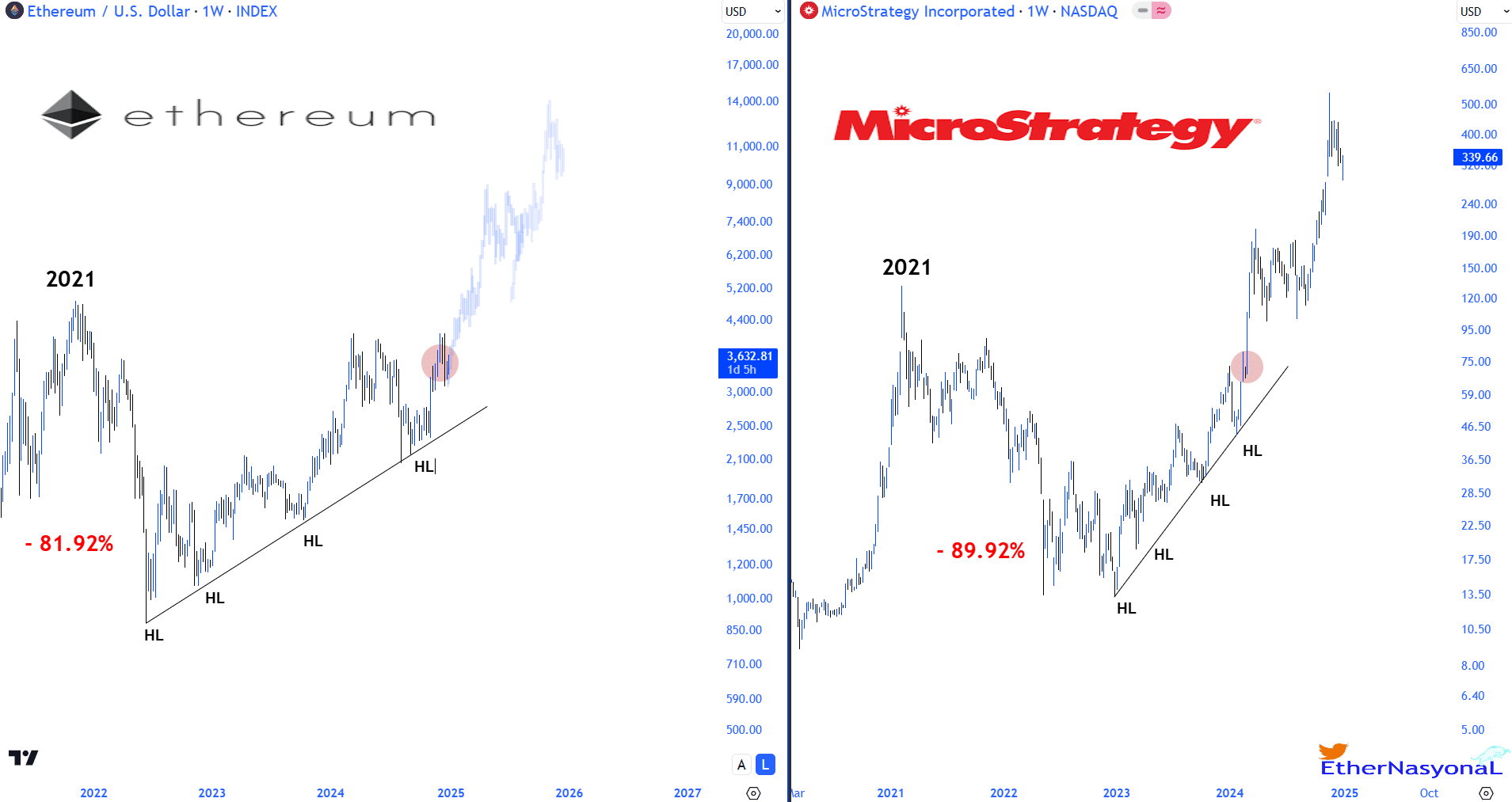

- Ethereum follows MicroStrategy’s sample from 2021 to 2025, suggesting ETH might attain $14,000.

- The excessive volatility for ETH within the quick and long run stays, creating alternatives.

Ethereums [ETH] worth motion, alongside MicroStrategy’s inventory efficiency from 2021 to 2025, confirmed an identical sample that might point out substantial development for ETH.

In 2021, ETH fell 81.92%, mirroring MicroStrategy’s 89.92% decline over the identical interval. Nevertheless, each charts confirmed a restoration section, with larger lows indicating strengthening investor confidence.

ETH confirmed consolidation and an uptrend from its lows, not too long ago reaching $3,632.81. If ETH continues to imitate MicroStrategy’s restoration sample, the projection factors to a possible rise to $14,000.

Supply: EtherNasyonal/X

This projection was primarily based on the seen restoration tendencies and better lows indicated within the charts. This indicated a resilient restoration in investor sentiment and market worth.

The comparative evaluation indicated the parallel dynamics between a significant company financier of Bitcoin and a number one cryptocurrency, indicating attainable future tendencies.

The variety of Ethereum market orders

Additional evaluation confirmed that ETH had made a crucial breakout from a resistance zone, which had beforehand been created by excessive market order numbers round $3,650. Resistance was examined a number of occasions, marked by spikes in buying and selling quantity.

This breakout, which occurred after a major buildup of orders, pushed Ethereum to the next buying and selling vary, suggesting the significance of those ranges as essential market alerts.

Supply: Hyblock Capital

Subsequent buying and selling exercise stabilized above earlier resistance and now acted as help at $3,450.

This shift in market dynamics might point out additional upside potential, which might result in new peaks if purchaser momentum continues.

Volatility and sentiment

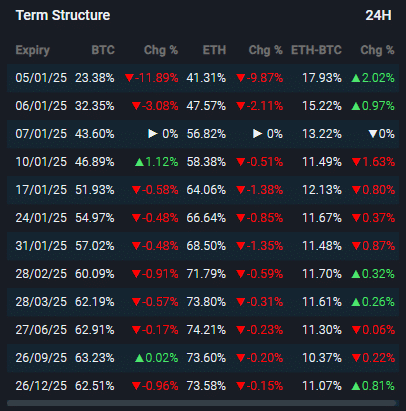

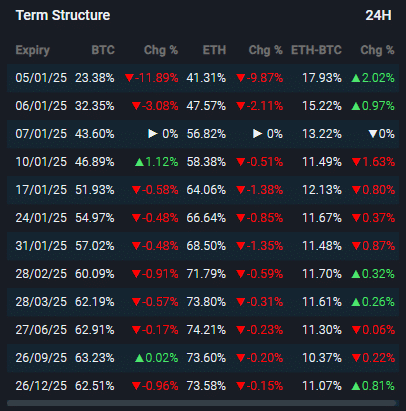

Within the context of the excessive volatility in ETH’s time period construction, the trail to $14K for ETH meant profiting from the sharp worth swings.

The time period construction confirmed proportion modifications, indicating alternatives for high-reward setups amid threat.

Ethereum confirmed a constant volatility sample throughout a number of expirations, highlighting key intervals when dealer vigilance was elevated.

Buyers might use these durations of elevated change, presumably to hedge in opposition to Bitcoin’s extra secure volatility, optimizing entry and exit factors.

This technique, if executed correctly, might feasibly help ETH’s rise to the $14,000 mark, particularly if market circumstances align favorably with bullish sentiment.

Supply:

Nevertheless, the general public and sensible cash sentiment meters had been bearish Market Prophet. The general public sentiment rating was -0.55, indicating delicate pessimism amongst common traders.

Learn Ethereum’s [ETH] Worth forecast 2025–2026

However, sensible cash sentiment, which mirrored the outlook of better-informed or institutional traders, was considerably decrease at -2.03, indicating stronger bearish sentiment inside this group.

These detrimental sentiment values might suggest cautious or bearish expectations for Ethereum’s worth trajectory, doubtlessly impacting short-term market habits.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now