Ethereum

Ethereum: As whales buy and retail pulls back, will ETH remain below $2K?

Credit : ambcrypto.com

The graph displays a traditional divergence: whales purchase the dip whereas the retail commerce hesitates.

This conduct usually precedes directional shifts in market momentum – a breakthrough supported by institutional assist or lengthy -term compression if the retail commerce stays offside.

Delevering within the retail commerce and the narrowing lengthy/quick ratio

Retail merchants, as quickly as they’re positioned confidently, withdraw.

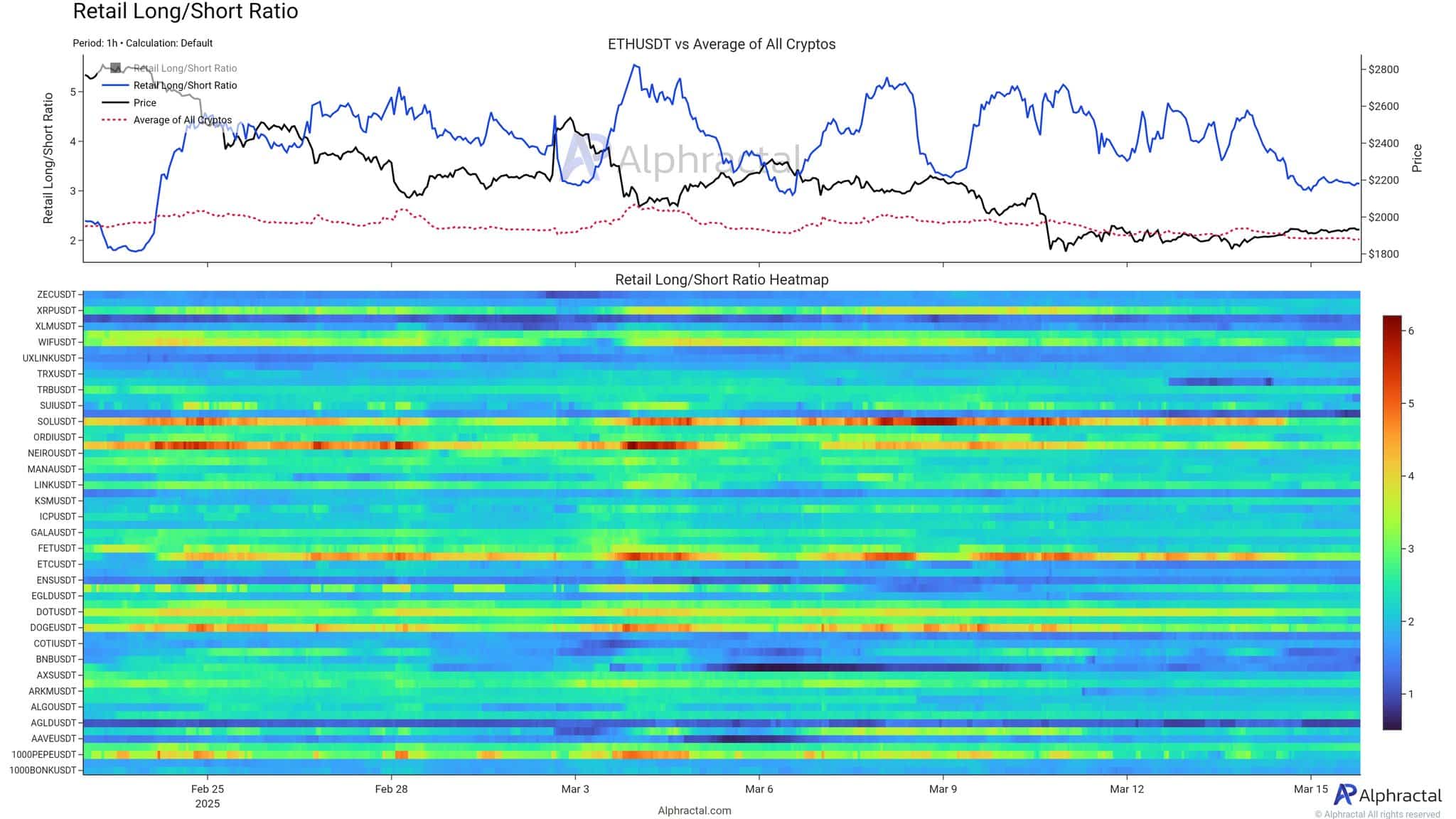

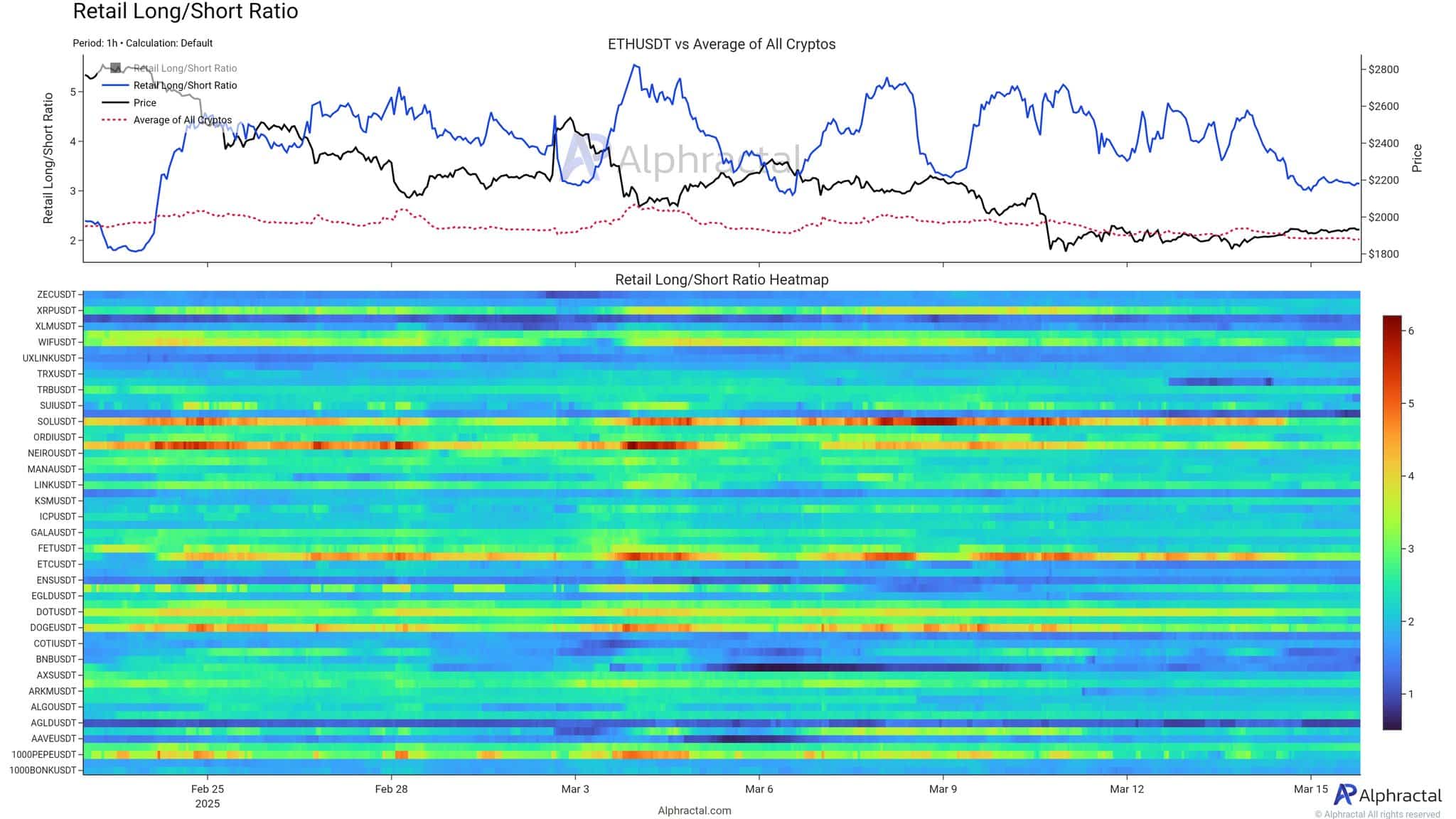

The lengthy/quick ratio for Ethusdt – which reached above 5.5 above 5.5 in the beginning of March – has steadily fallen to round 3, which signifies deleting delenaaging.

Supply: Alfractaal

Because the volatility pale, the passion of the shops did. The decline of the ratio within the course of three suggests {that a} vital a part of the retailers closes positions or undertake a extra impartial angle.

In comparison with the tip of February – when the ratio floated round 2.5 and climbed with a worth momentum – this latest pullback alerts fade that sentence amongst smaller holders.

Though this reset may be wholesome, which relaxes overly aggressively, it additionally emphasizes the dearth of contemporary demand from individuals within the retail commerce.

Market neutrality and fatigue of the dealer

All in all, these tendencies sketch an image of broad market neutrality. Purchase whales – however cautious. Retail shouldn’t be bearish – simply disconnected.

For a lot of merchants, particularly on everlasting futures markets, this low motion atmosphere is irritating. Neither the circumstances are neither bullish sufficient to justify aggressive lungs or bearish to justify significant shorts.

The value of ETH has mirrored the broader lower within the crypto-assets (as seen within the crimson dotted strains of each graphs), which strengthens the view that this isn’t an Ethereum-specific break; It’s a part of a wider market that’s cooled.

But such neutrality usually precedes the enlargement of volatility. The market has been cleaned up; The one uncertainty is the course.

Ethereum Worth Outlook

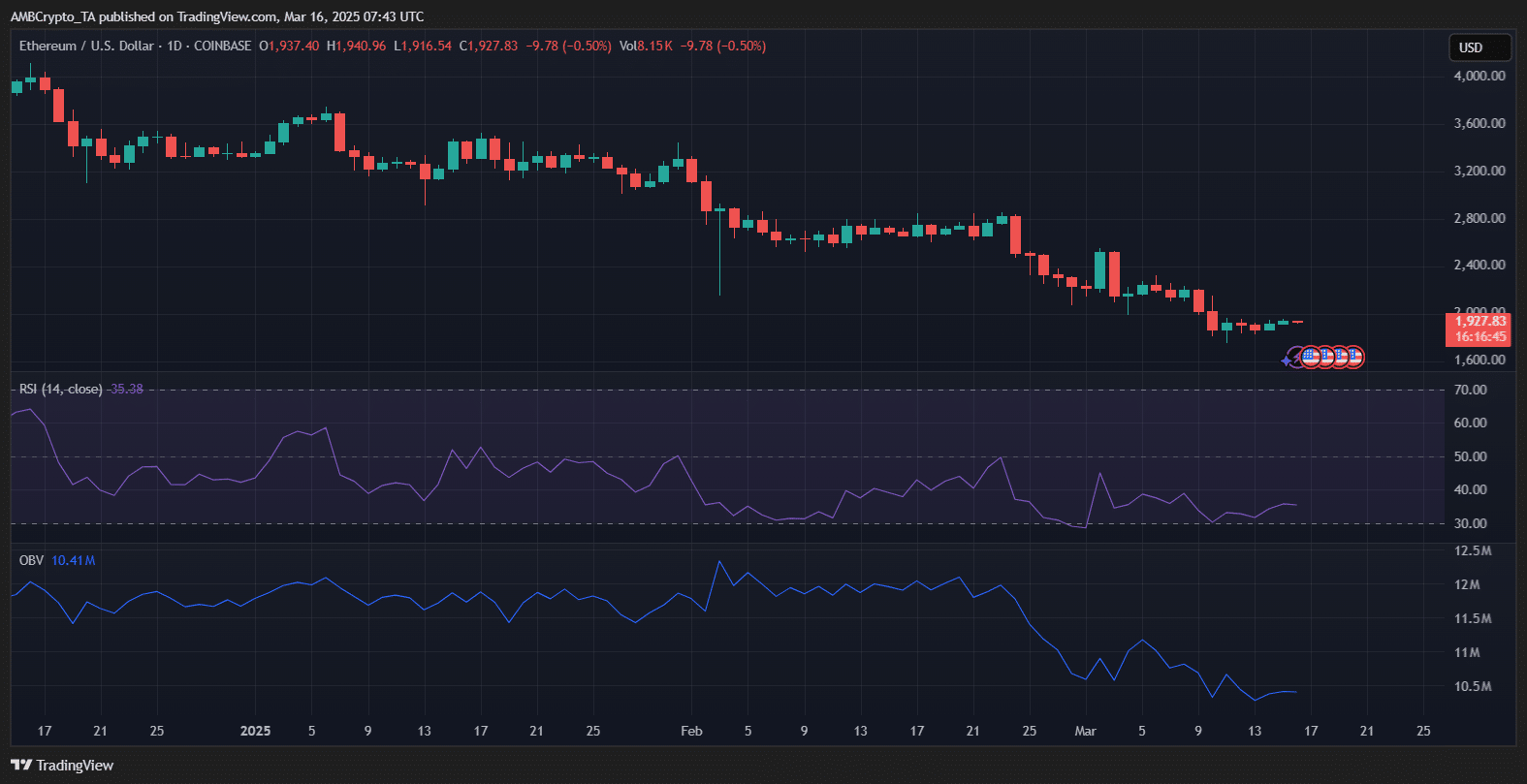

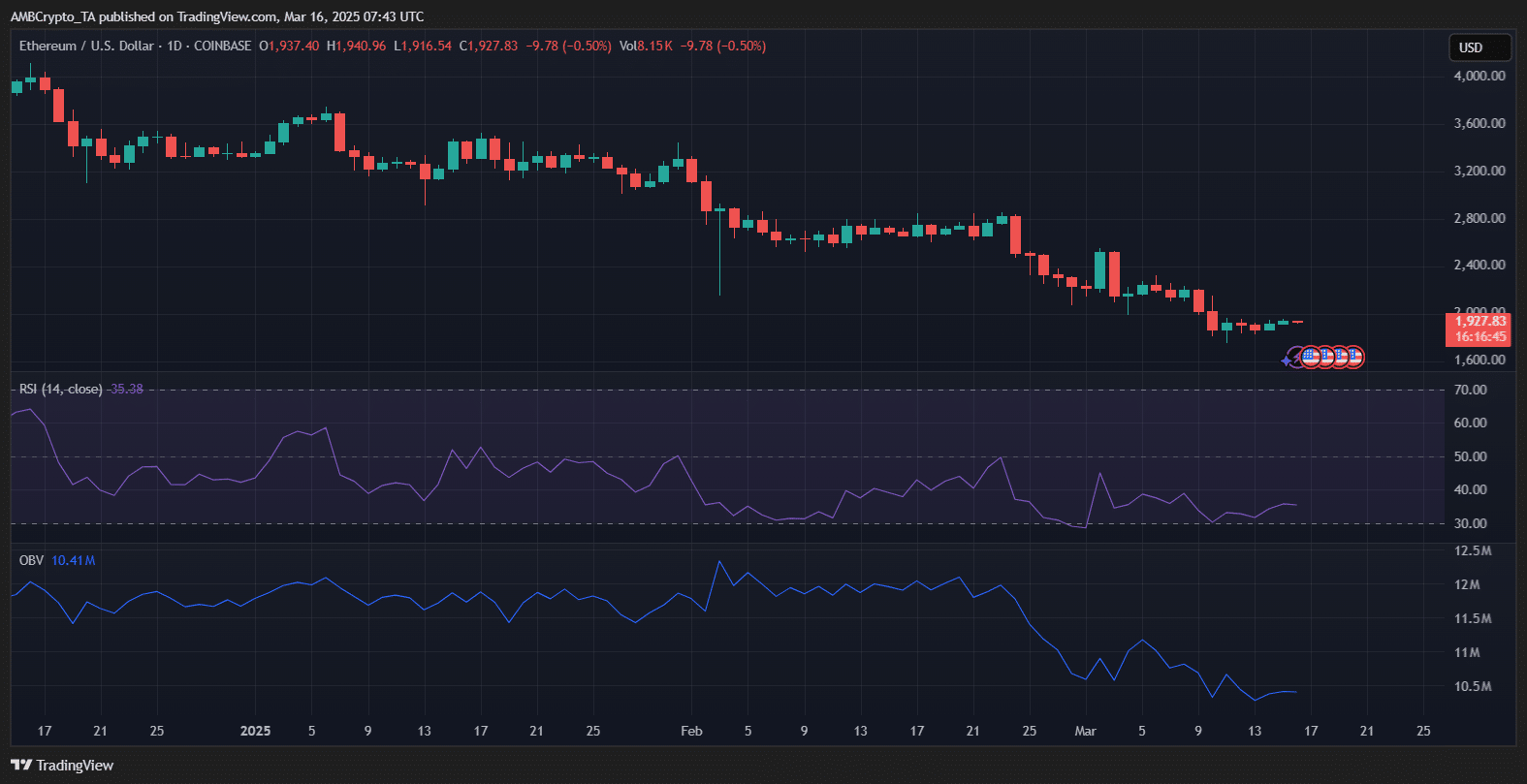

Ethereum reveals indicators of stagnation slightly below $ 2,000. The RSI floats at 35, holds ETH in Bearish territory with out being deeply offered over – which means that restricted upward momentum within the quick time period.

Within the meantime, the OBV continues its downward development, which signifies a weak buying strain regardless of latest worth consolidation.

Supply: TradingView

The falling quantity and muted RSI trace on a steady lateral grind or a small withdrawal, until shopping for exercise. For now, Ethereum misses the technical power for an outbreak.

With no clear catalyst, ETH will in all probability stay reached between $ 1,850 and $ 2,000.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now