Ethereum

Ethereum at $2.4K crossroads: Foundation dumps, whales accumulate – What’s next?

Credit : ambcrypto.com

- Ethereumwalvissen have picked up greater than 1.49 million ETH within the final 30 days.

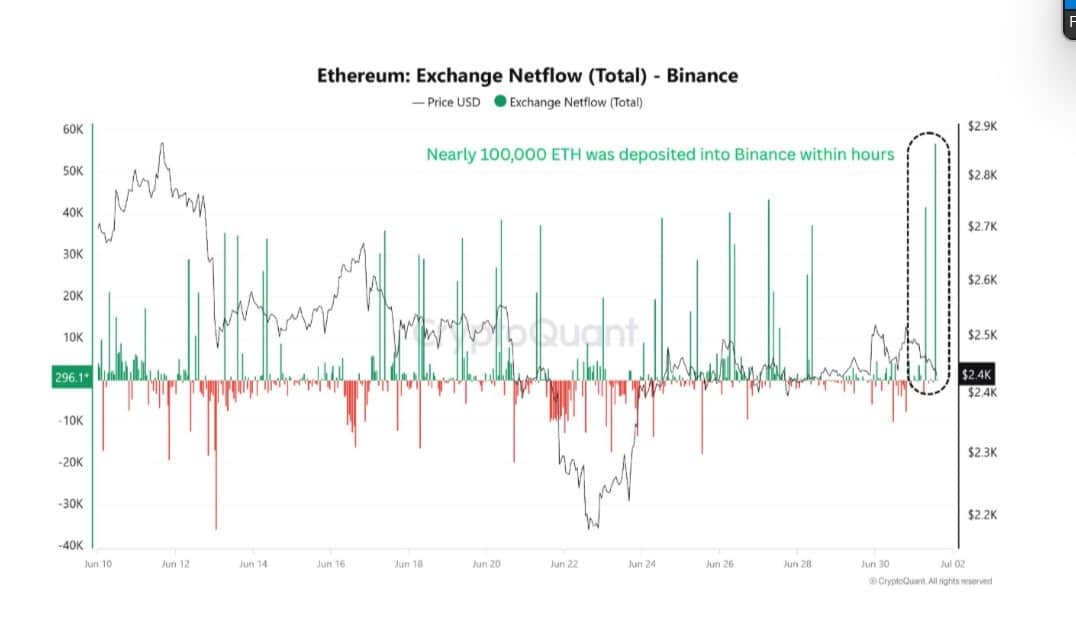

- Binance information 100k ETH price $ 250 million in influx, which signifies aggressive gross sales exercise.

Ethereum [ETH] Between $ 2.4k and $ 2.5k, fluctuated within the final two weeks and struggled to interrupt out after the lower final month from $ 2.8k to $ 2.1k.

This steady worth stagnation led to a wide range of reactions throughout the board, from gathering whales that accumulate to different buyers who shut positions aggressively.

Whales create ETH on the silence

Though Ethereum has not achieved a major revenue previously month, whales took the chance to collect.

Supply: Cryptuquant

Massive holders have collected 1.49 million ETH previously month, which will increase their complete stability by 3.72%. Actually, this was not only a one -off.

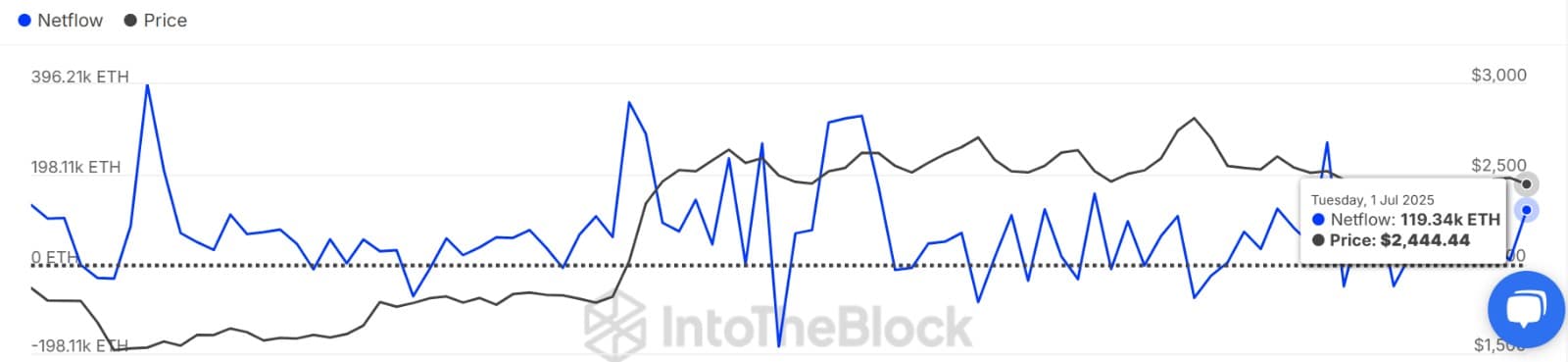

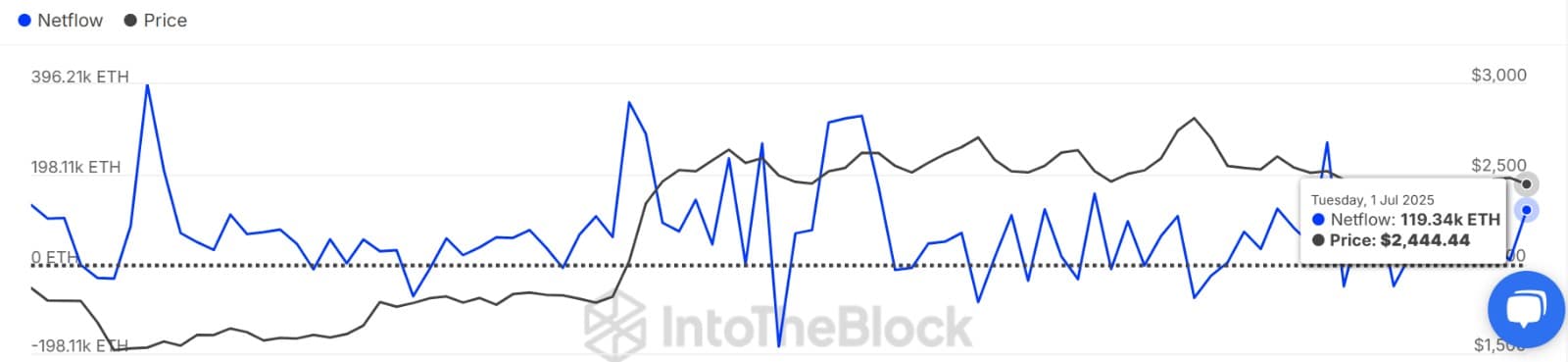

On July 1, whale purchases reached 704k ETH, which surpassed the 585k ETH, which led to a soar within the Netflow of enormous holders from 9.8k to 119.3k.

Supply: Intotheblock

After all, this type of internet influx alerts accumulation. When whales purchase greater than they promote, this usually signifies that they place for a motion.

However wait!

Shocking, whereas whales gather different gamers aggressively, together with establishments and small -scale buyers, promote.

Take the Ethereum Basis, for instance. As reported by LookonchainThe group has transferred 1,000 ETH price $ 2.46 million to Multisig day by day.

To this point they’ve discharged at least 13k ETH price $ 32 million.

This divergence raises an necessary query: is that this simply worthwhile or a cautious shift?

Retail sends ETH to exchanges

As well as, cryptoquant information confirmed a major peak in Ethereum’s alternate instreams. Binance alone noticed 100k ETH price $ 250 million coming in its reserves in sooner or later.

Massive inventory market flows normally counsel a rise in Ethereum reserves which can be held on exchanges. Traditionally, such actions precede the worth drops within the brief time period, particularly if they’re accompanied by a low capital influx.

The 2 contradictory paths for Ethereum

As noticed above, whereas whales accumulate, different market gamers promote. This accumulation ensured a powerful help ground, in distinction to small -scale buyers who’ve made a revenue.

This tug of battle has pushed Ethereum right into a state of indecision.

Supply: TradingView

The RSI Divergie -indicator of the Altcoin floated round 48.62 on the time of the press.

At these ranges, this momentum indicator recommended that markets are in a cooling -off interval, ready for the following catalyst.

That’s the reason the following step is dependent upon whom the battle has ended strongly between the accumulating addresses and the revenue.

If patrons proceed whereas sellers exhaust, the Altcoin will reclaim $ 2548 and control an outbreak to $ 2.7k.

Nevertheless, if sellers weigh heavier than the patrons, Ethereum may lower to $ 2,372, in order that the decrease restrict of consolidation breaks.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024