Ethereum

Ethereum at a crossroads: Key indicators signal turning point

Credit : ambcrypto.com

- Ethereum’s latest worth motion has revealed important help and resistance ranges that merchants ought to keep watch over.

- When ETH broke under the $3,593.46 help, Open Curiosity in Ethereum Futures contracts initially rose.

Ethereum [ETH]the second-largest cryptocurrency by market capitalization, not too long ago fell under a key help stage, elevating considerations amongst merchants.

With Bitcoin [BTC] Ethereum is present process its personal correction and is exhibiting indicators of additional retracement.

Analysts are eyeing $2,809 as a possible accumulation zone earlier than a doable restoration. This setup suggests {that a} deeper correction may happen earlier than bullish momentum resumes.

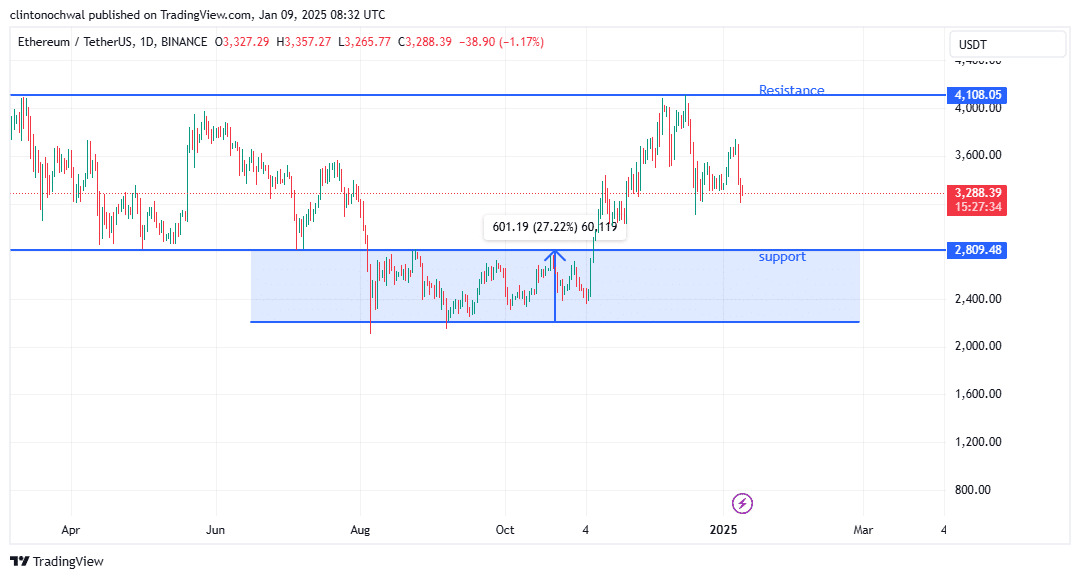

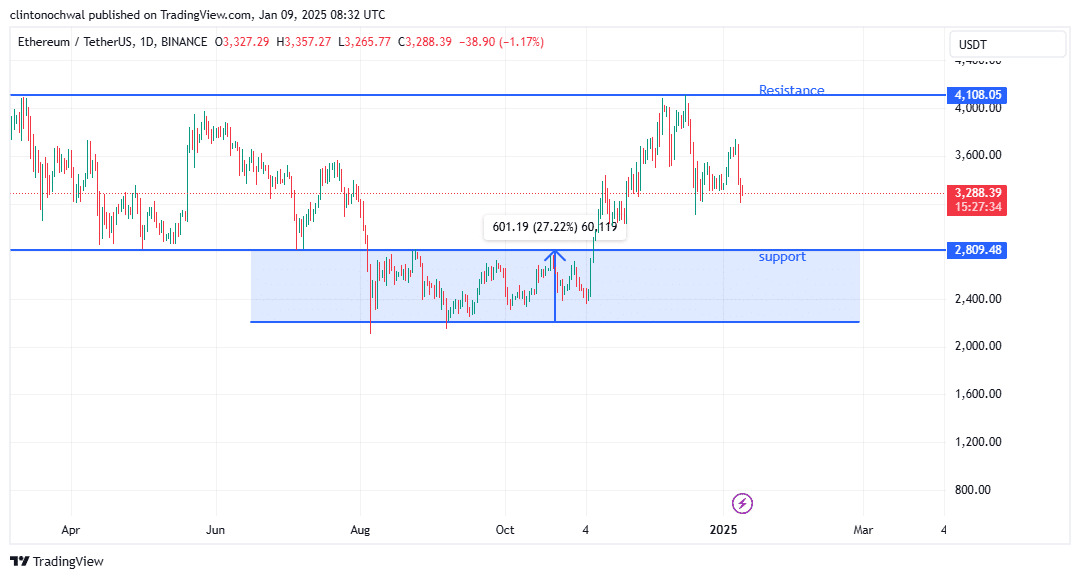

Help and resistance ranges

Ethereum’s latest worth motion has revealed important help and resistance ranges that merchants ought to keep watch over. Over the four-day timeframe, Ethereum’s worth motion remained outlined by key ranges of help and resistance.

It included a important help zone $2,809.48whereas the closest resistance existed $4,108.05. These ranges are vital benchmarks for merchants monitoring potential reversals or continuations in ETH’s trajectory.

Supply: TradingView

The breakdown under USD 3,593.46 has confirmed the bearish momentum, with the value hovering shut $3,297.19 on the time of writing.

This stage was nearer to the midpoint between help and resistance, probably indicating a consolidation part earlier than the subsequent main transfer.

If ETH is the $2,809.48 help and help, this might mark a robust accumulation zone for long-term merchants. Conversely, the lack to carry this stage may result in additional declines, doubtlessly resulting in a broader bearish market.

Hand over bears?

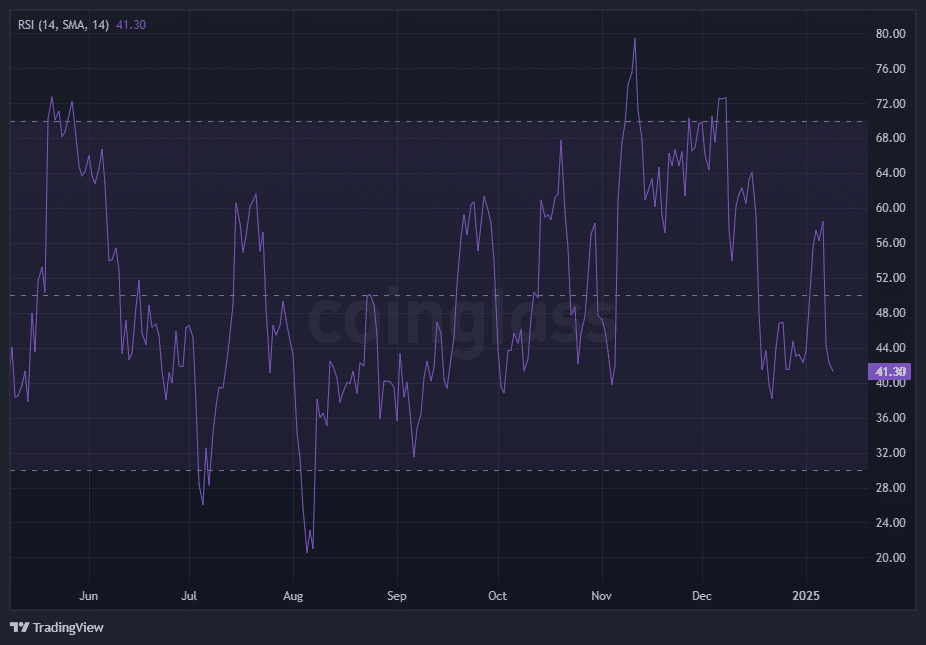

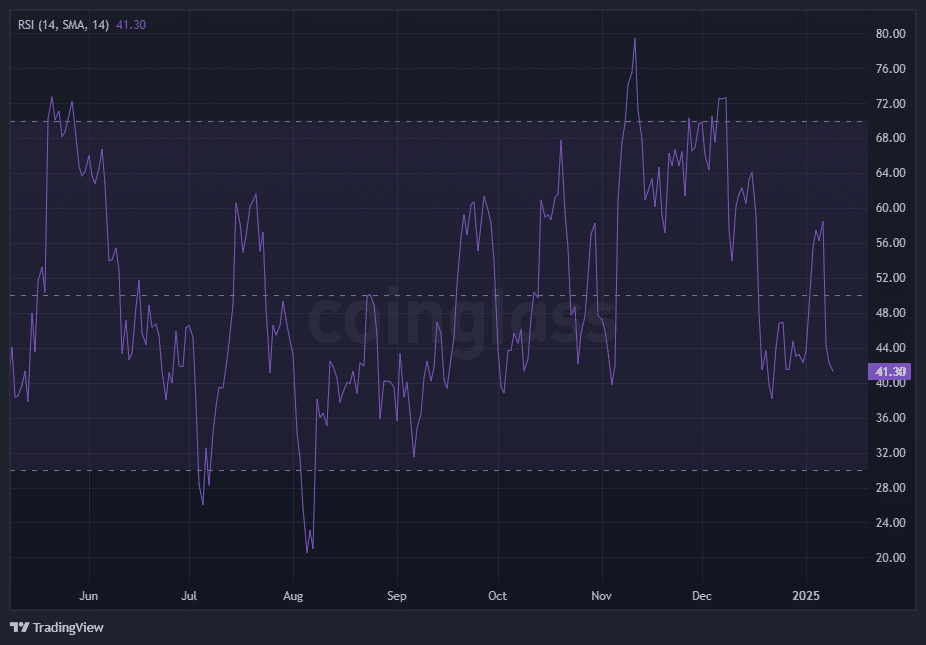

The Relative Power Index (RSI) offers important insights into Ethereum’s present momentum and potential worth trajectory.

As will be seen from the chart, the RSI is trending downward, as a result of growing promoting strain and reducing bullish energy.

Because the RSI approaches the oversold threshold of 30, the market is signaling a doable exhaustion of latest bearish momentum.

Supply: Coinglass

The RSI evaluation stays essential for understanding Ethereum’s momentum. The RSI ranges, which replicate the up to date worth motion, indicated growing promoting strain.

Because the ETH pattern approaches $2,809.48the RSI may fall additional in the direction of the oversold threshold of 30.

This might sign a doable rebound or consolidation, relying on market sentiment.

Merchants ought to look ahead to a decisive restoration within the RSI above 40, which may sign a restoration in step with a transfer in the direction of 40 $4,108.05. Failure to take action may see ETH proceed its bearish trajectory.

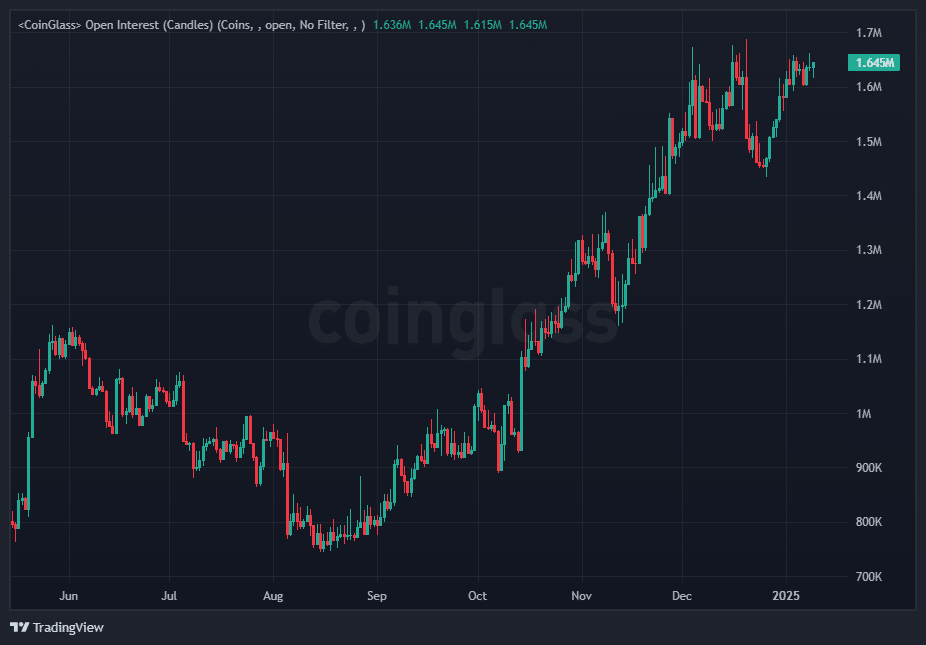

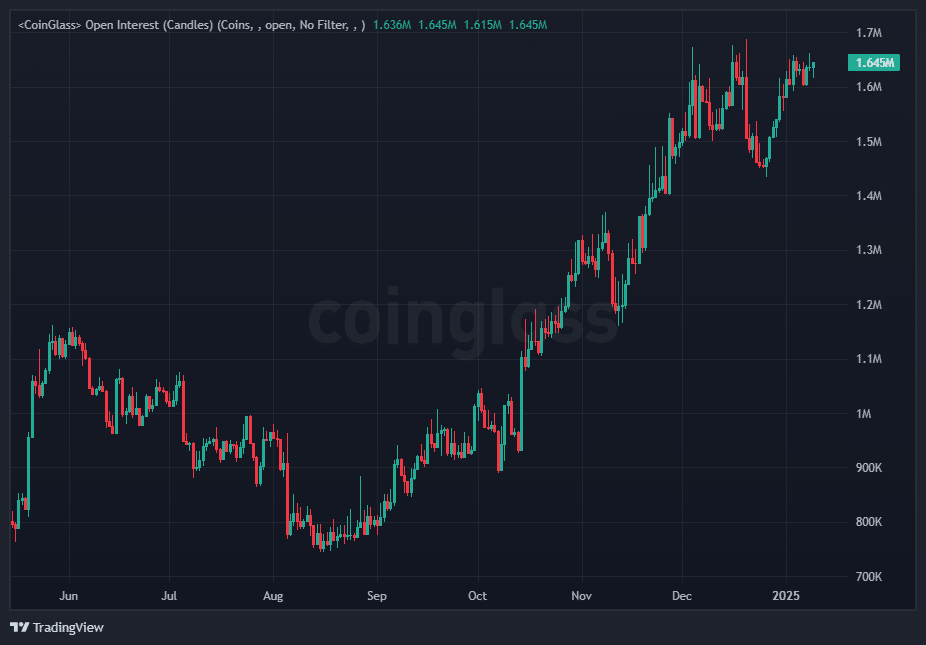

Ethereum: Assessing Market Sentiment

Open Curiosity, which displays the whole variety of excellent futures and choices contracts, serves as an vital metric for measuring market participation and sentiment.

Within the case of Ethereum, the latest worth drop has been accompanied by fluctuating ranges, revealing vital developments.

Supply: Coinglass

When ETH broke under the $3,593.46 help, Open Curiosity in Ethereum Futures contracts initially rose. This indicated elevated speculative exercise as merchants positioned themselves for additional downward strain.

Rising open curiosity throughout a worth decline is commonly an indication that bearish sentiment is intensifying as extra market contributors anticipate continued declines.

Nonetheless, after the sharp correction to $3,318.41, Open Curiosity started to stabilize, indicating decreased speculative strain and potential market indecision.

A major drop in Open Curiosity at this stage may point out a cooling market, with merchants closing their positions and ready for clearer indicators.

Conversely, renewed will increase in Open Curiosity, particularly close to the $2,807.13 help zone, may point out accumulation by long-term buyers or elevated speculative curiosity in anticipation of a restoration.

Learn Ethereum’s [ETH] Value forecast 2025–2026

As exterior components comparable to Bitcoin’s correction proceed to affect Ethereum’s efficiency, merchants ought to stay cautious and hold an in depth eye on these key ranges and metrics.

A rebound from the help at $2,807.13 may reignite bullish momentum, whereas failure to carry this stage may result in deeper corrections.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now