Ethereum

Ethereum bags $704 mln in weekly inflows… Yet $603 mln walks out the back door

Credit : ambcrypto.com

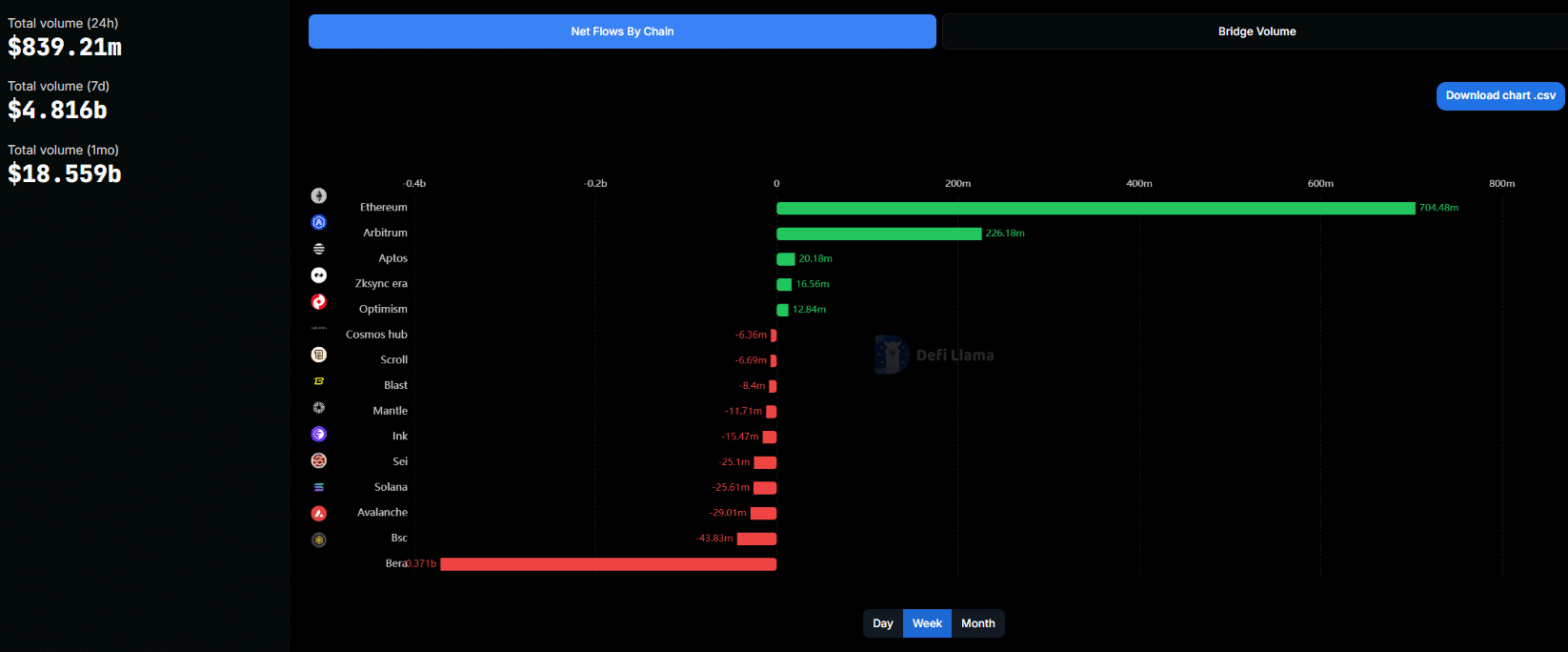

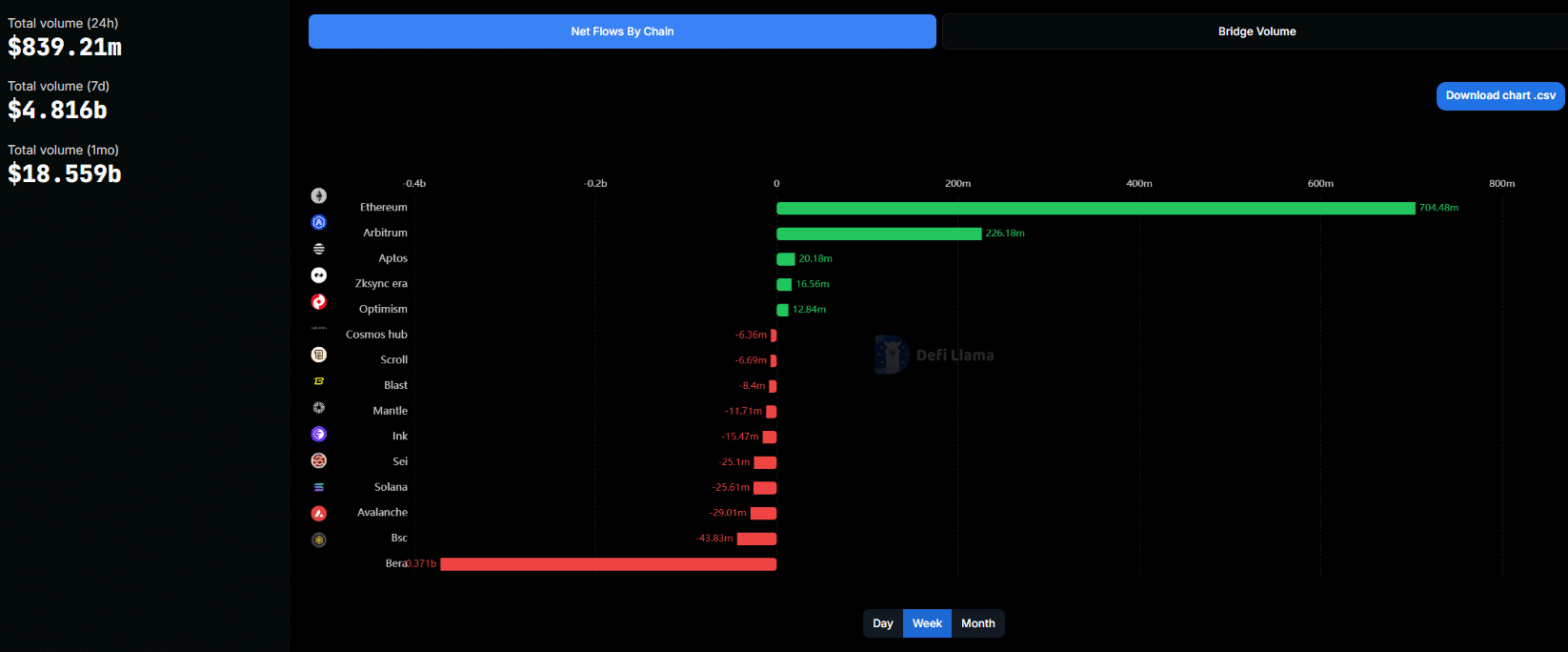

- Ethereum captured 85% of the overall weekly influx and strengthened its dominance in Defi -Liquidity.

- Bridge -volume information present constant weekly outflows that exceed the deposits in Ethereum.

Ethereum [ETH] has once more claimed because the undisputed chief in blockchain capital influx – and with a big margin.

On the time of writing, the most recent Defillama facts makes the photograph unmistakably clear.

This week Ethereum drew a shocking $ 704.48 million in web influx, dwared all different networks and signaled an in -depth desire amongst capital allocators.

Supply: Defillama

After all the divergence doesn’t cease there. Arbitrum [ARB] Strived for $ 226.18 million, a distant second and solely 27% of Ethereum’s consumption.

Within the meantime, smaller enclosure drips into APTOS [APT] ($ 20.18 million), zksync period [ZK] ($ 16.56 million) and optimism [OP] ($ 12.84 million) – All mixed hardly 8% of the overall of Ethereum.

When the tide modifications, leaves others

However, losses had been simply as pronounced.

Binance Sensible Chain (BSC) led the outflow graph with -$ 43.83 million, adopted by Avalanche [AVAX] (-$ 29 million) and Solana [SOL] (-$ 25 million).

All in all, these outputs reveal the rising stress on various low-1 ecosystems, specifically as a result of capital consolidates round high-active platforms.

After all this capital migration will not be in a vacuum.

Ethereum alone accounted for greater than 85% of all constructive web inflow this week, which more and more offered the gravity brushing in a market.

That stated, it isn’t simply the influx that the dialog makes. Additionally outflow paint a revealing portrait.

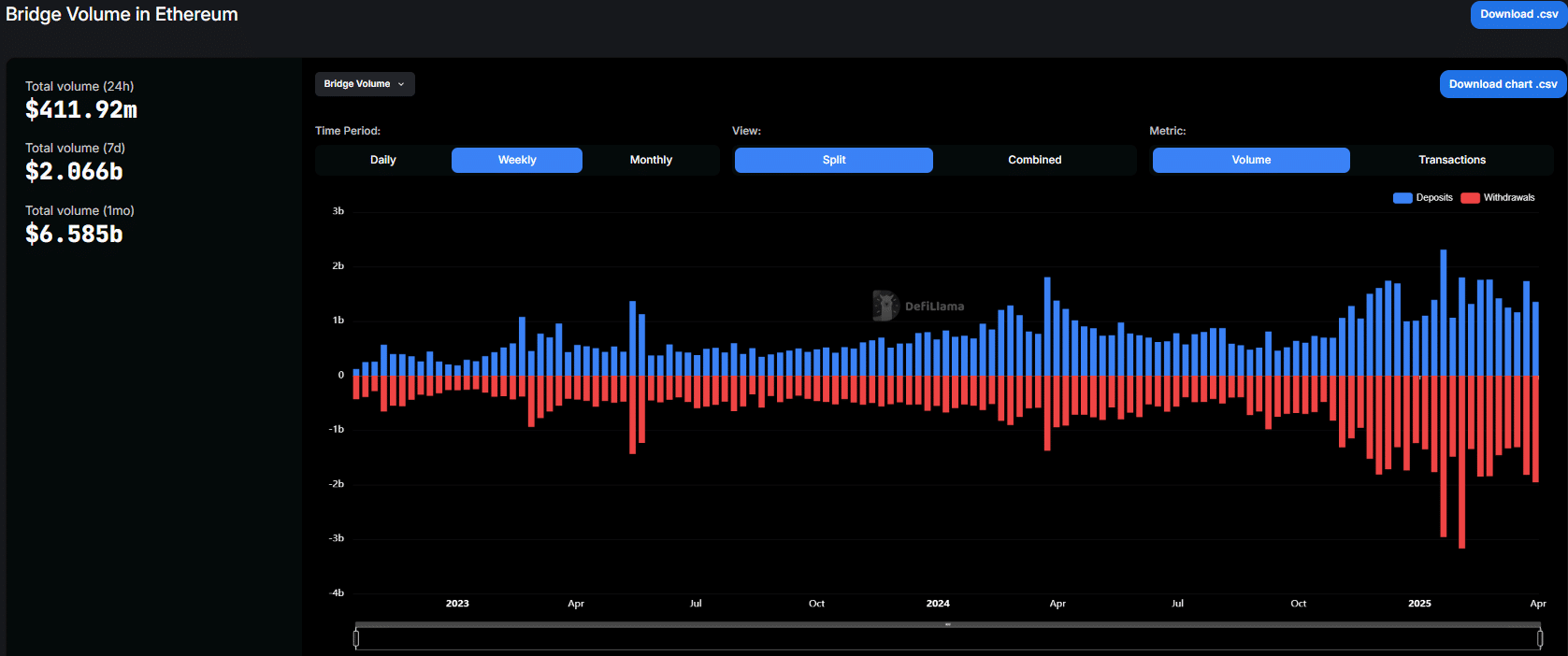

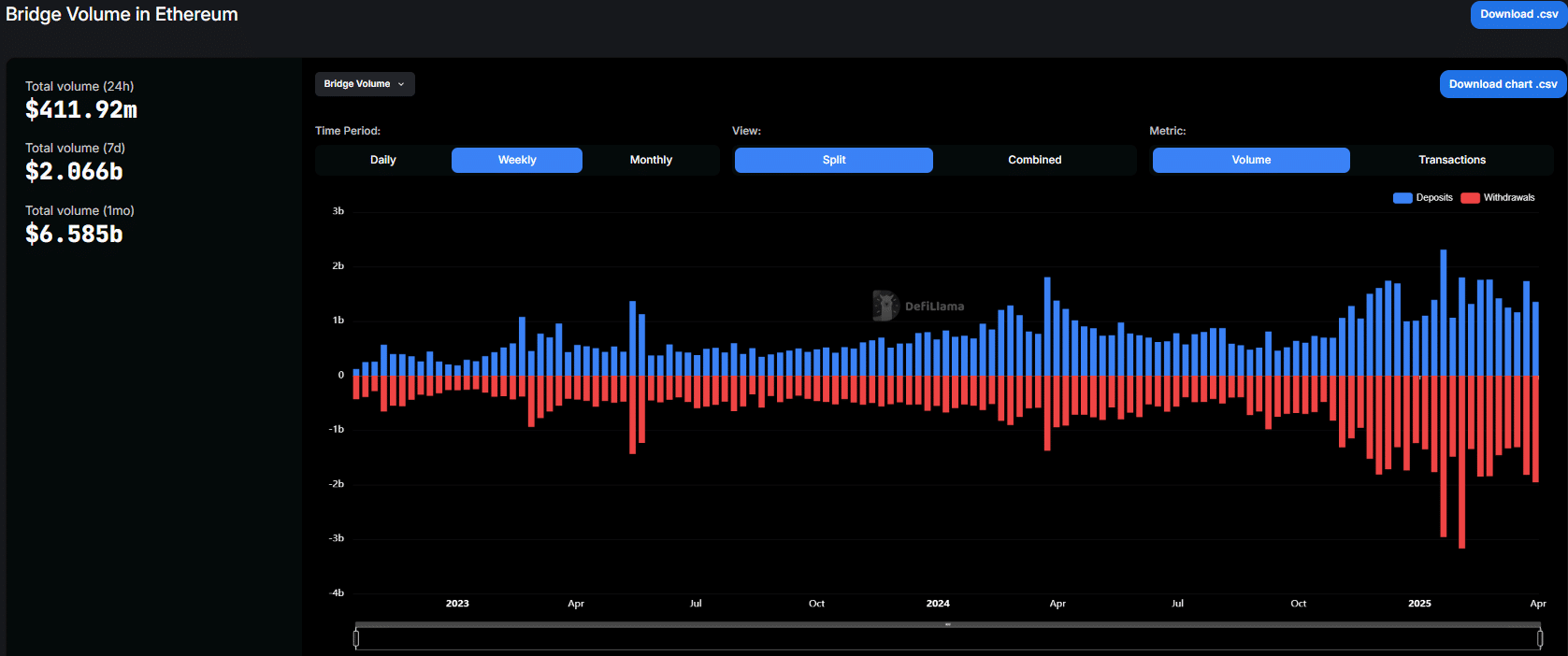

Bridge information provides a special context layer. For the week that ended on March 30, Ethereum registered $ 1.957 billion in recordings at $ 1,353 billion in deposits, which resulted in an outflow of $ 603 million.

Supply: Defillama

For instance, on January 19, Ethereum registered almost $ 2.96 billion in weekly recordings, the very best within the present dataset.

Even within the midst of this exodus, nevertheless, the magnetism of Ethereum for brand new capital stays unparalleled. This obvious contradiction could be a reflection of capital rotation inside the ecosystem.

The ability is aware of earlier than the value does

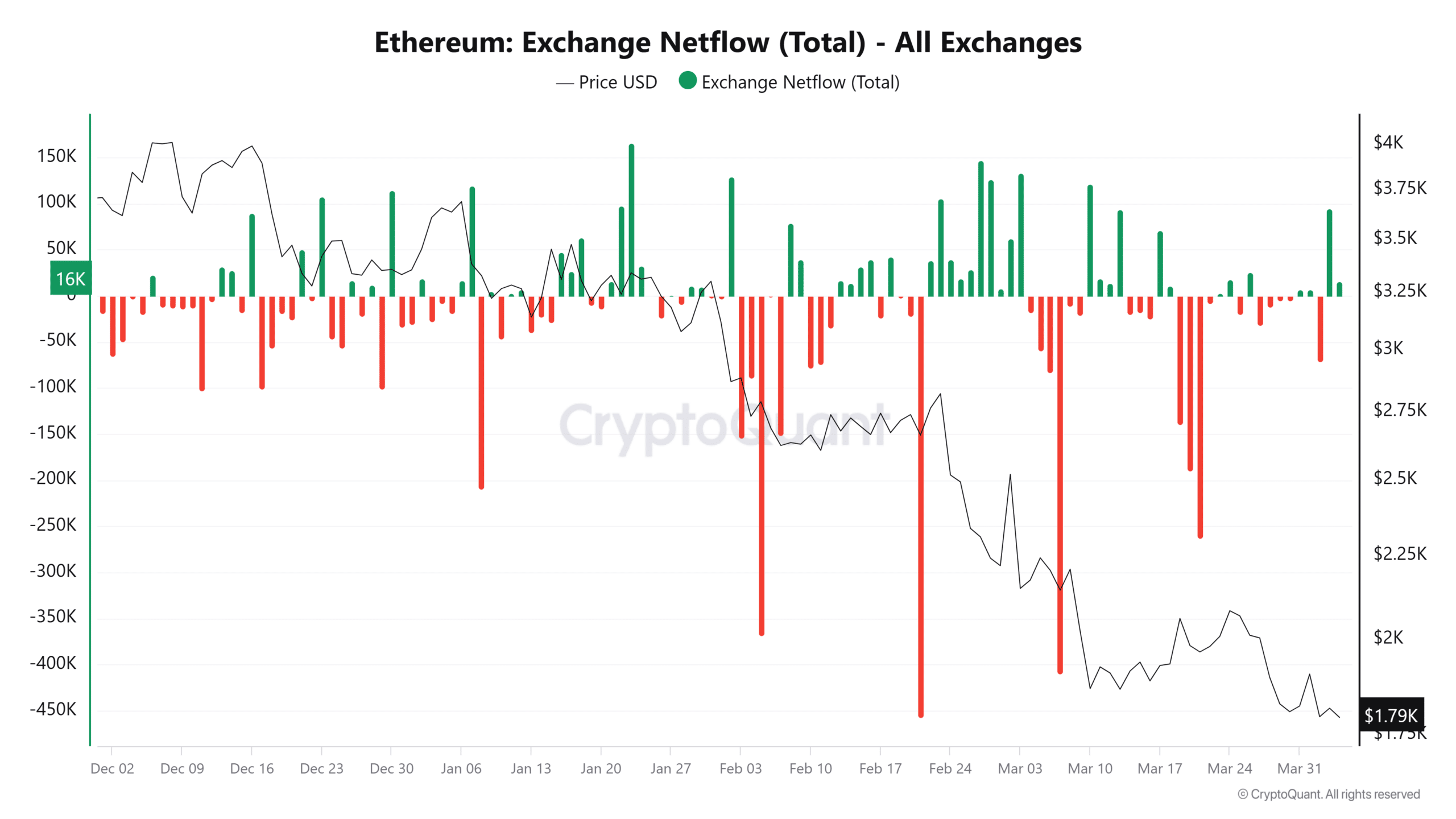

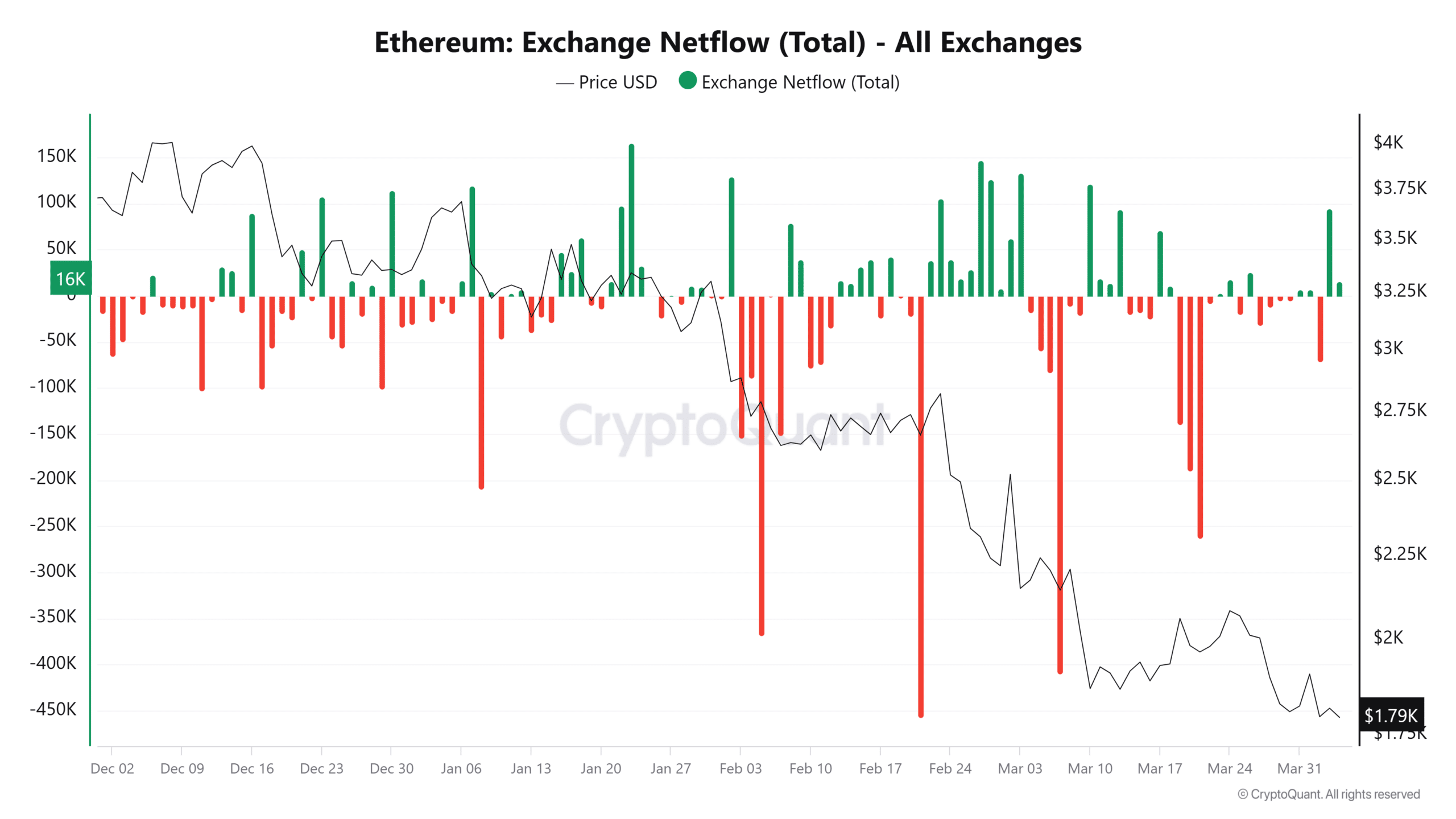

Day by day Netflow conduct affords a deeper context.

Supply: Cryptuquant

Between December 2024 and April 2025, the value of Ethereum fell by 50.6%, from $ 3,630 to $ 1,794.

On January 8, ETH fell to $ 3,326 as 208k ETH ECHALGES – signaling Panic. The February 23, then again, noticed a rebound of $ 2,819 along with a 105k ETH consumption, pointing to strategic accumulation.

It appears that evidently it reinforces a nicely -known rhythm that inflow and out not solely observe the value; They typically go for it.

As well as, on the finish of March, Vitalik Buterin unveiled a future-oriented “multi-proof” low-2 mannequin that mixes optimistic, zero-knowledge and tee-based verification.

Whether or not this evolution can compensate for present outflow traits remains to be to be seen. However, such architectural upgrades typically take the time to affect sentiment. Markets are likely to reward confirmed stability about speculative enhancements.

Ethereum stays Defi’s liquidity spine – orders web flows, transaction quantity and developer exercise with higher dominance.

Whereas BSC, Solana and Avalanche bleed capital, Ethereum and Arbitrum take up greater than 90% of the constructive influx, indicating a flight to trusted chains.

Out or not, ETH doesn’t go anyplace

Regardless of steady outflows, the simultaneous influx of Ethereum displays a fancy however resilient ecosystem.

In a market the place belief floats capital, Ethereum nonetheless holds the crown and with low-2s that ripen shortly, that grip appears to be like stronger than ever. For now.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024