Ethereum

Ethereum battles whales and resistance: Can ETH avoid a market meltdown?

Credit : ambcrypto.com

- Whales have continued to promote and huge by-product merchants are confronted with large liquidation losses when ETH is falling.

- Strong provide previous to ETH and gross sales strain is in peril of pushing the worth of the actively decrease.

Ethereum has not favored latest market exercise [ETH]. Up to now week alone it fell by 12.75%, with the chance {that a} additional drop looms because the market sentiment turns into an increasing number of bearish.

Ambcrypto found that whale gross sales exercise may not be the one catalyst for a market drop, as a result of a possible liquidation cascade may cause a query, inflicting the worth of ETH to cell.

Whale and potential liquidation can affect the ETH

Up to now 24 hours, ETH actions of merchants who examine a exceptional provide additionally determine-also generally known as whales-a attainable sale.

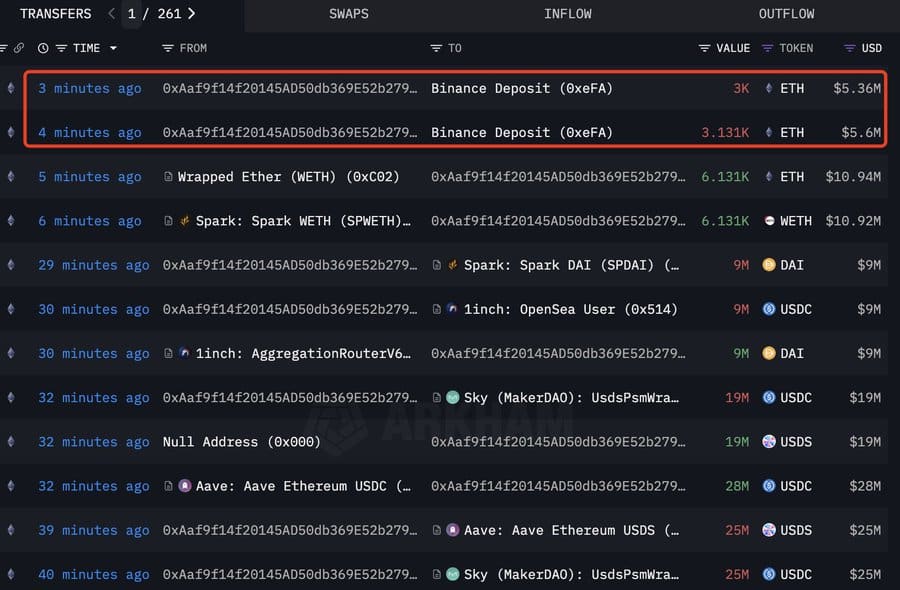

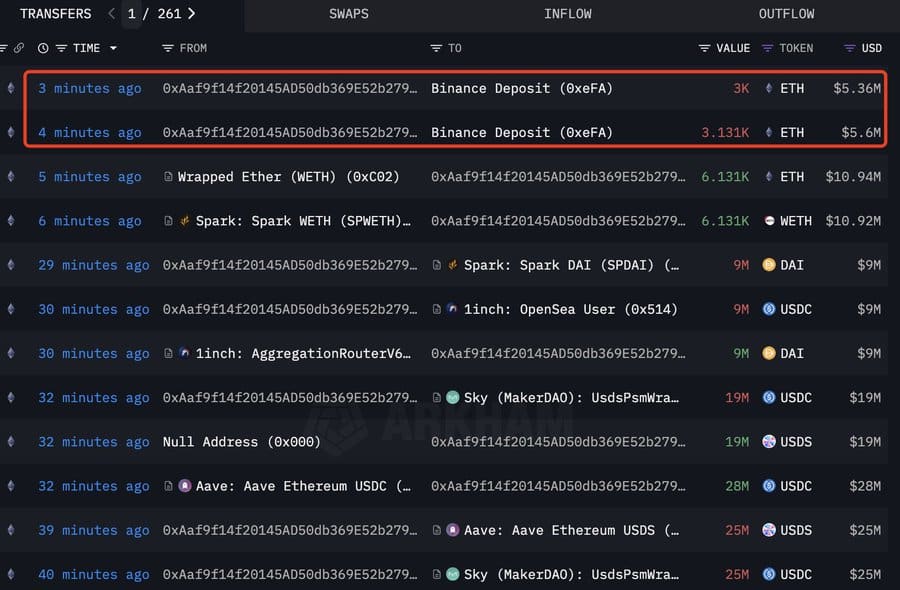

Throughout this era, Lookonchain reported {that a} whale of 6,131 ETH price $ 10.94 million had moved their property to Binance, a centralized cryptocurrency alternate.

Often, when an lively from a non-public pockets is moved to a centralized, this means an intention to promote. If this sale begins utterly, ETH will most likely expertise an ideal value decline.

Supply: Arkham Intelligence

The potential drawback of ETH is a contract of 125,603 ($ 229 million) with a danger of liquidation. Positions which are stored on a maker by two whales could be strongly closed if ETH reaches $ 1,787.75 and $ 1,701.54 respectively.

If this occurs, it could ignite worry available in the market, which influences by-product merchants to open extra brief positions, whereas spot merchants promote their ETH to forestall a downward spiral, which additional worsens the demand Squeeze.

Bearish sentiment would prevail

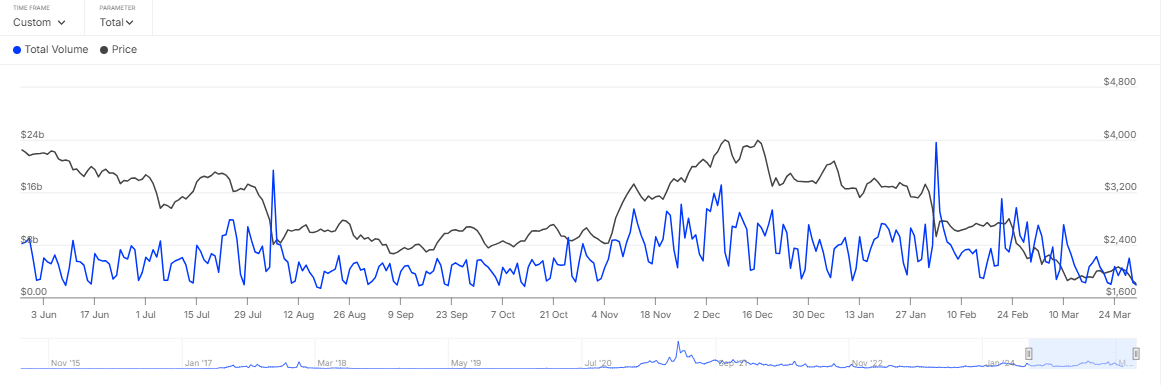

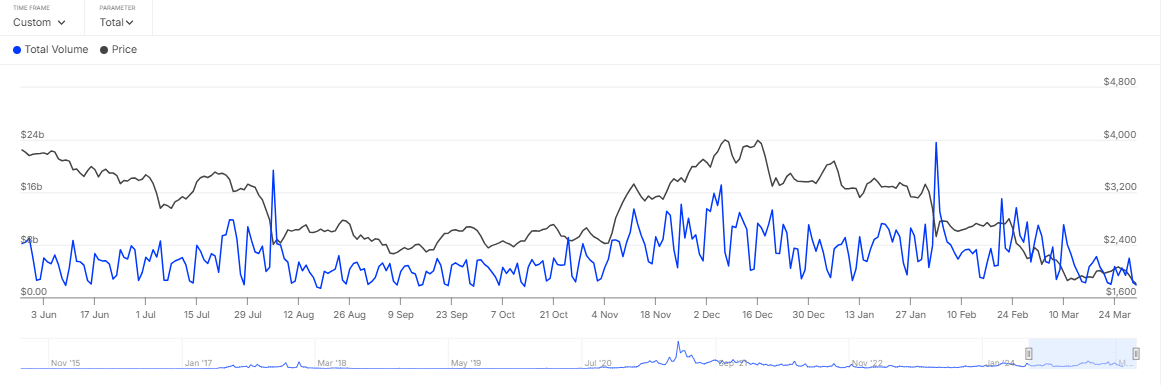

Within the final 24 hours there was a big transaction exercise at giant merchants – outlined as those that commerce between 0.1% and 1% of the entire property.

Supply: Intotheblock

In line with information from Intotheblock, these main merchants have taken about $ 1.87 billion in ETH. This motion might be dominated by whale sellers, as a result of the worth of ETH fell 1.85% in the identical interval.

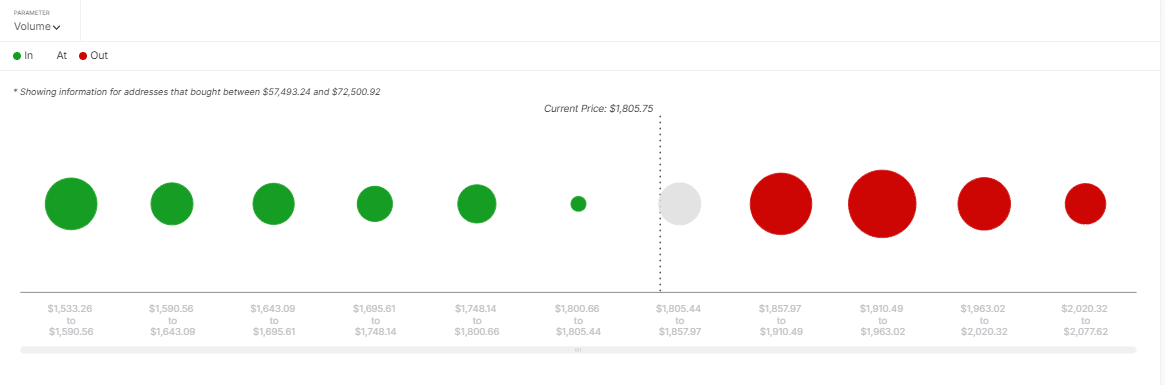

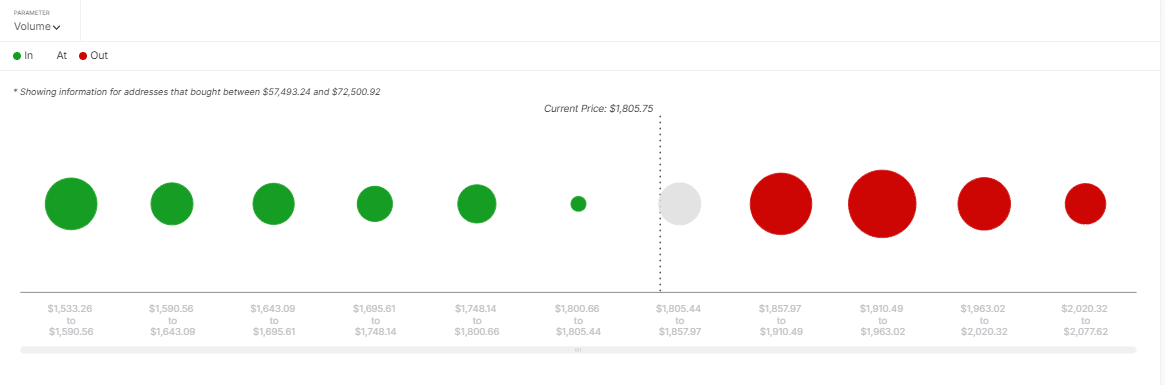

Ambcrypto has analyzed market choices, must gather ETH as an alternative of continuous its bearish development. With the assistance of the in/from the cash round value statistics, the evaluation exhibits that ETH is confronted with mass resistance that goes up.

Between $ 1,857.97 and $ 1,963.02, a complete of seven.89 million ETH gross sales orders of 5.82 million addresses that will exist at this stage, that may restrict upward motion and even forcing the worth decrease.

Supply: Intotheblock

For now, the transaction quantity in the marketplace has continued to fall. The quantity of ETH that’s traded within the final 24 hours continues to fall, which displays an absence of curiosity and willingness to actively commerce.

At the moment, with 614,000 ETH that’s traded, a peak in token switch – whereas value and sentiment bearish stay – promote extra merchants than earlier than, which additional contributes to the decline.

With extra information units that Beerarish situations current than bullish, the slender danger of ETH stays larger than the possibilities of an upward motion.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now