Altcoin

Ethereum Bows to Selling Pressure – 2 Factors Helping the Bears

Credit : ambcrypto.com

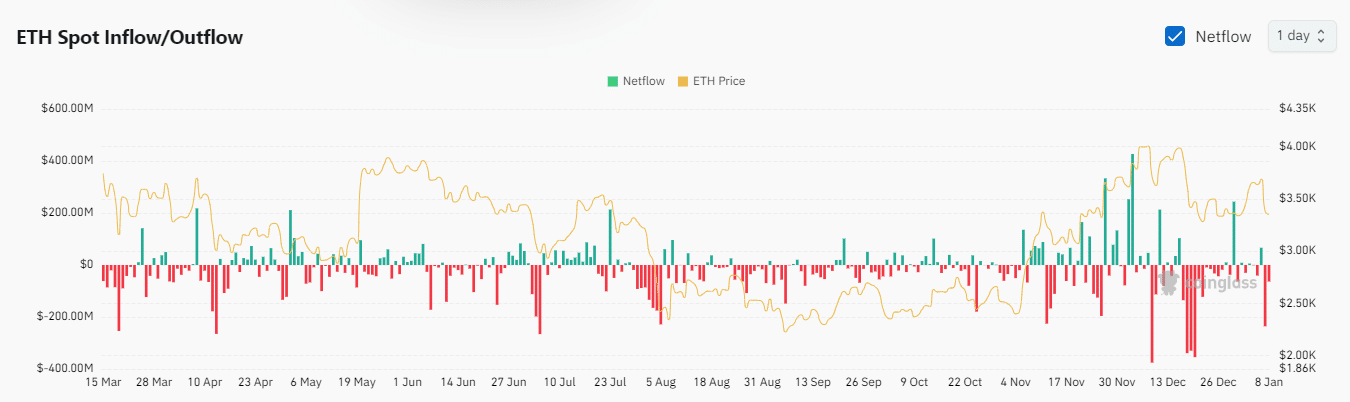

- Spot flows, together with ETFs, turned unfavourable, erasing latest beneficial properties.

- Why there was a latest short-term shakedown and what’s subsequent if whales make a comeback.

An surprising wave of promoting stress has worn out Ethereum’s latest beneficial properties [ETH] reached within the first few days of January.

There have been a number of causes behind the promoting stress, together with leverage and spot outflows, amongst others.

ETH spot ETF outflows have been maybe probably the most putting signal of promoting stress. It initially began this week with an influx value $128.7 million on January 6, constructing on the January 3 influx.

This may occasionally have created a false sense of reduction, and resulted in a FUD-filled selloff after the ETFs rotated on January 7.

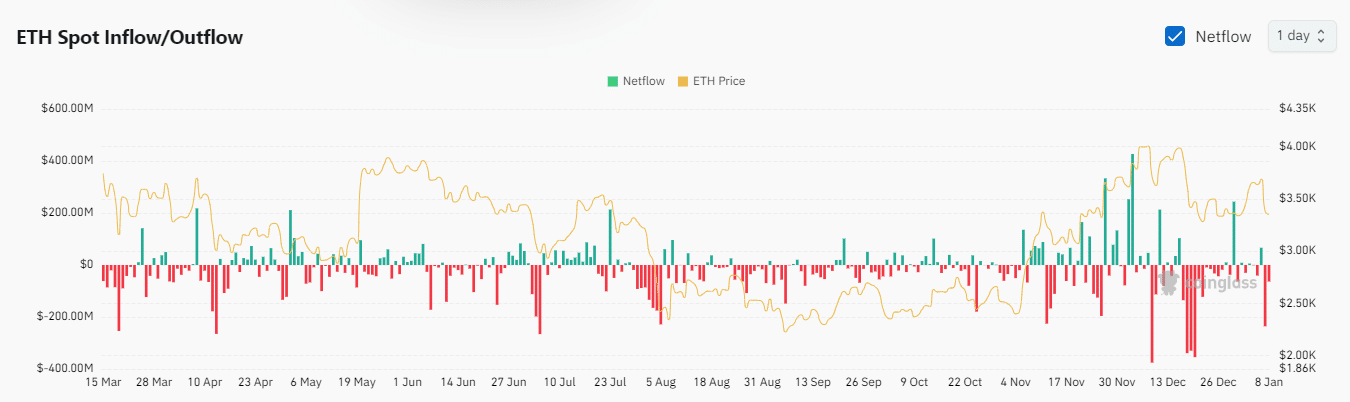

In distinction, Bitcoin ETFs have been nonetheless optimistic over the previous 24 hours, regardless of the alternative consequence on ETH’s aspect. This was a mirrored image of the dominance state of affairs.

ETH ETF outflows amounted to $86.8 million on January 7. This matched the whole unfavourable money flows seen on the inventory exchanges over the identical interval. Outflows peaked at $235.66 million on this date.

Supply: Coinglass

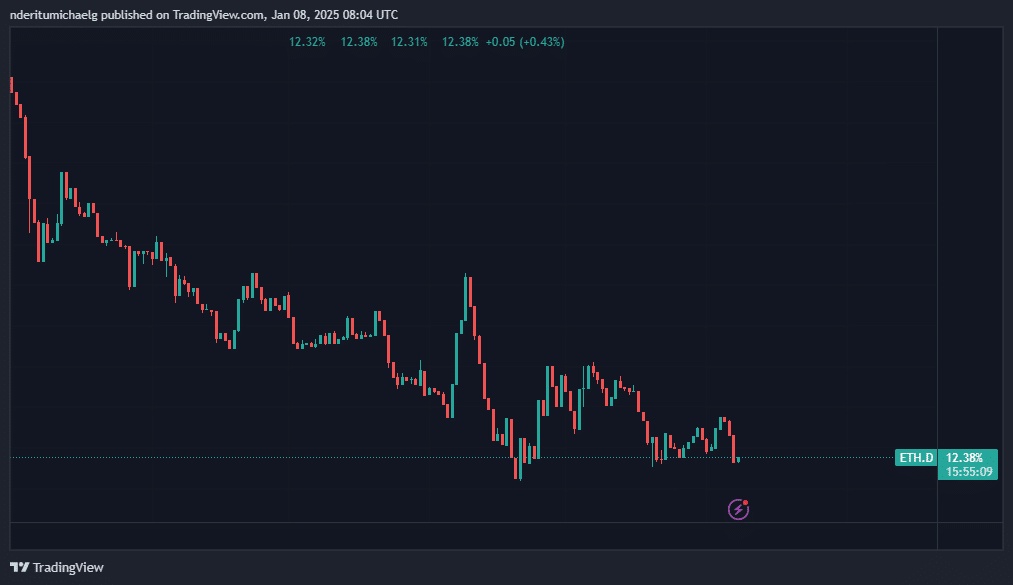

ETH dominance is falling, however may very well be able to reverse

The latest promoting stress has negatively impacted ETH’s dominance, which rose to 12.87% earlier over the weekend. Nevertheless, the newest flip of occasions meant that the rate of interest was solely 12.32%.

ETH may make one other try to attain greater dominance from its present ranges. It’s because the identical zone beforehand expressed help.

Supply: TradingView

The identical ETH dominance help additionally matches the help retest on ETH value motion. However is the newest pullback over, or will the worth drop be even decrease?

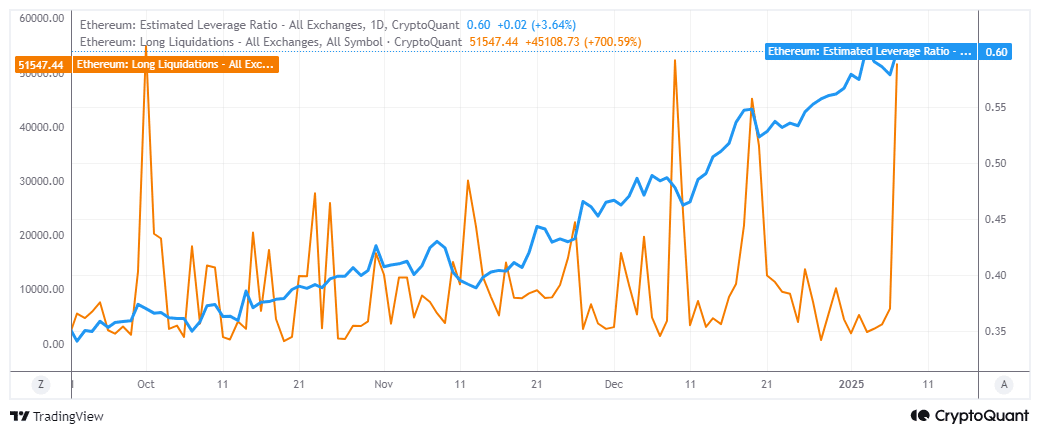

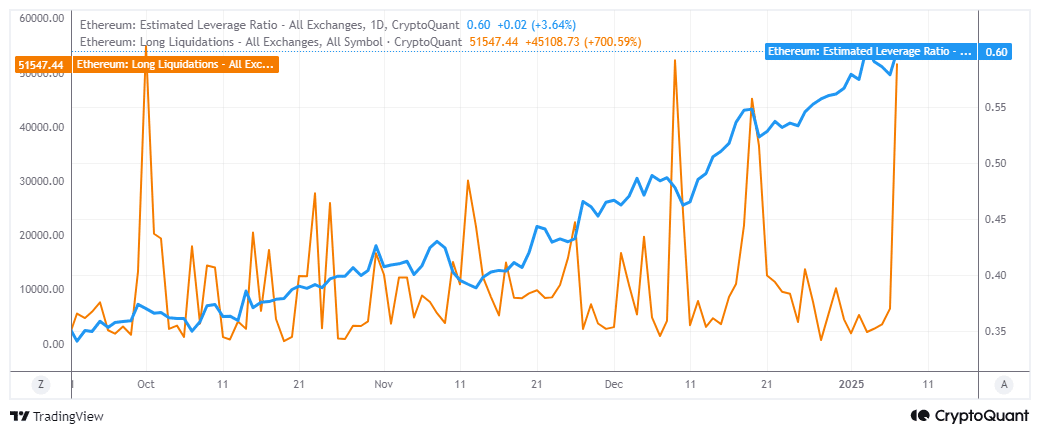

Lengthy leveraged liquidations possible performed a job within the newest wave of promoting stress seen over the previous two days.

Curiosity in leverage has elevated in latest months. The variety of lengthy liquidations has elevated by greater than 700% since January 3.

Supply: CryptoQuant

Greater than $173 million in liquidations have been noticed up to now 24 hours. This means that the newest rally within the first week of January might have been a preparation for a leverage shakedown.

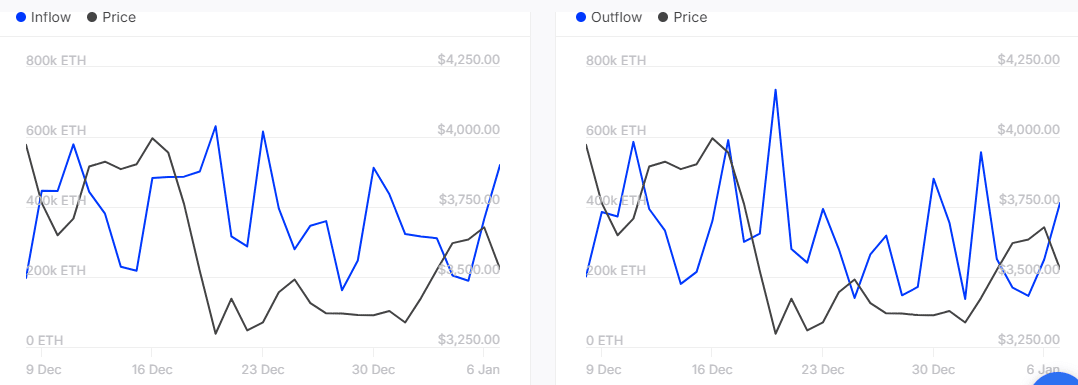

Will ETH get well within the second half of the week? That is believable due to one key commentary that will present perception into the subsequent step. Whales have been offered since early January.

Learn Ethereum’s [ETH] Worth forecast 2025–2026

Nevertheless, latest information reveals that these have piled up over the past dip.

Supply: IntoTheBlock

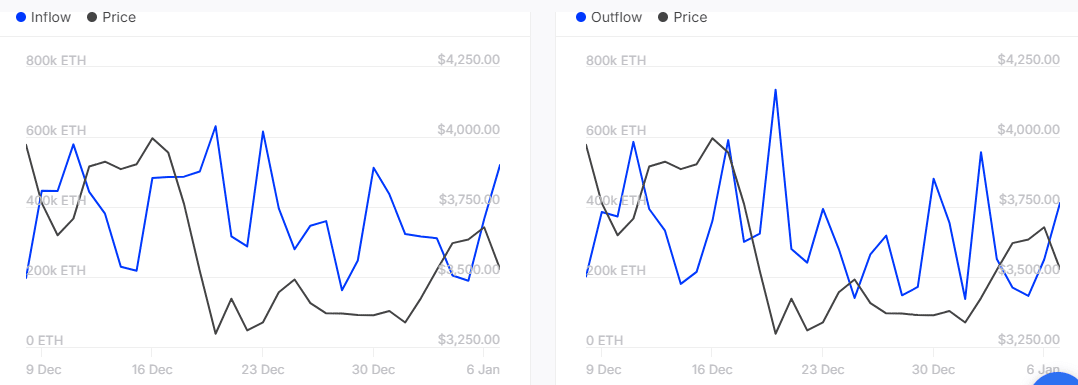

ETH whales collected 519,620 ETH on January 7, whereas the outflow on the identical day was decrease at 411,300 ETH. This confirmed that whales have purchased the dip and will doubtlessly assist with a mid-week restoration.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now