Ethereum

Ethereum ‘breaks’ 14-day streak, but is $3000 really on the cards?

Credit : ambcrypto.com

- If the value of ETH falls to $2,705, lengthy positions value virtually $323 million might be liquidated

- In line with one professional, Ethereum’s market cap will surpass Bitcoin’s market cap inside the subsequent 5 years

The broader cryptocurrency market recorded a big rally following the Fed Chairman’s announcement of a doable rate of interest lower. Ethereum (ETH) was no completely different, with the world’s second-largest cryptocurrency by market cap breaking the 14-day consolidation zone and turning bullish.

The Ethereum Breakout and the Ranges to Come

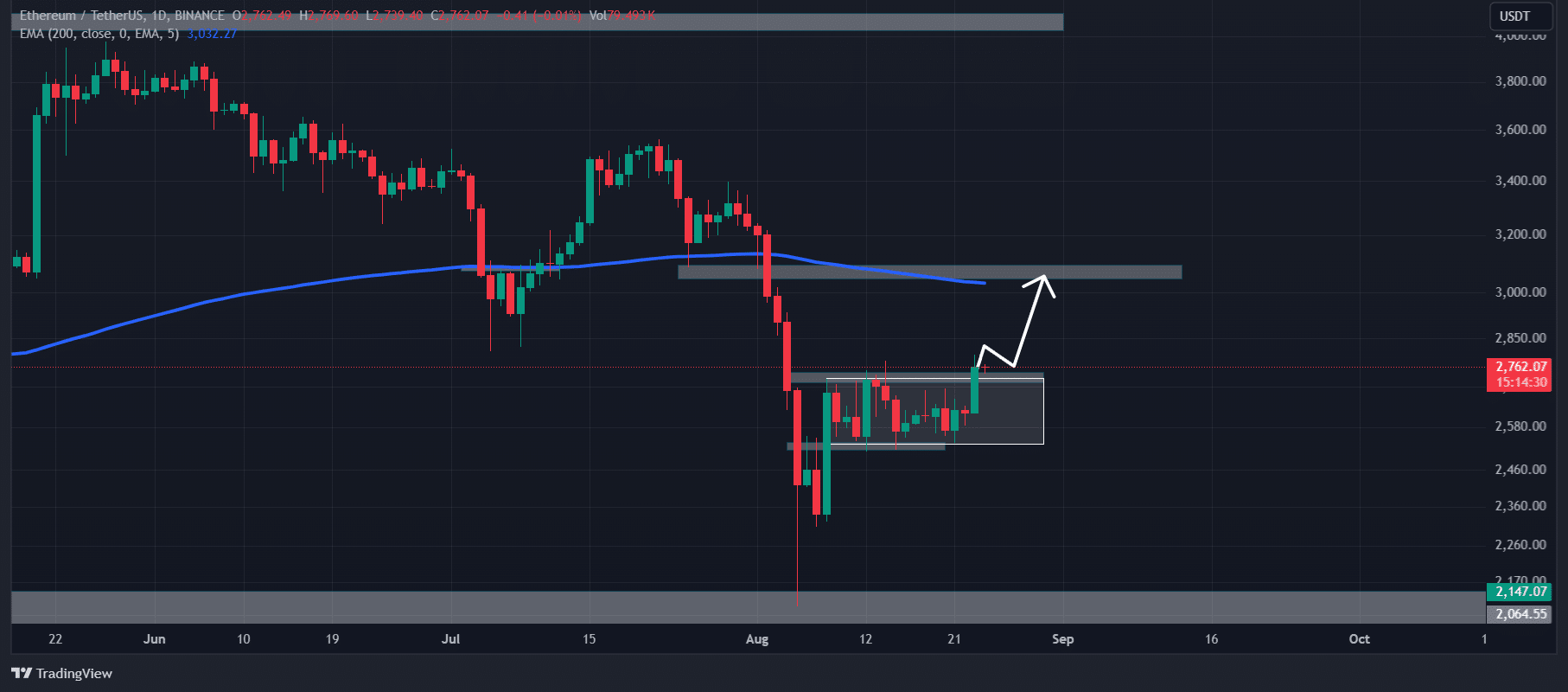

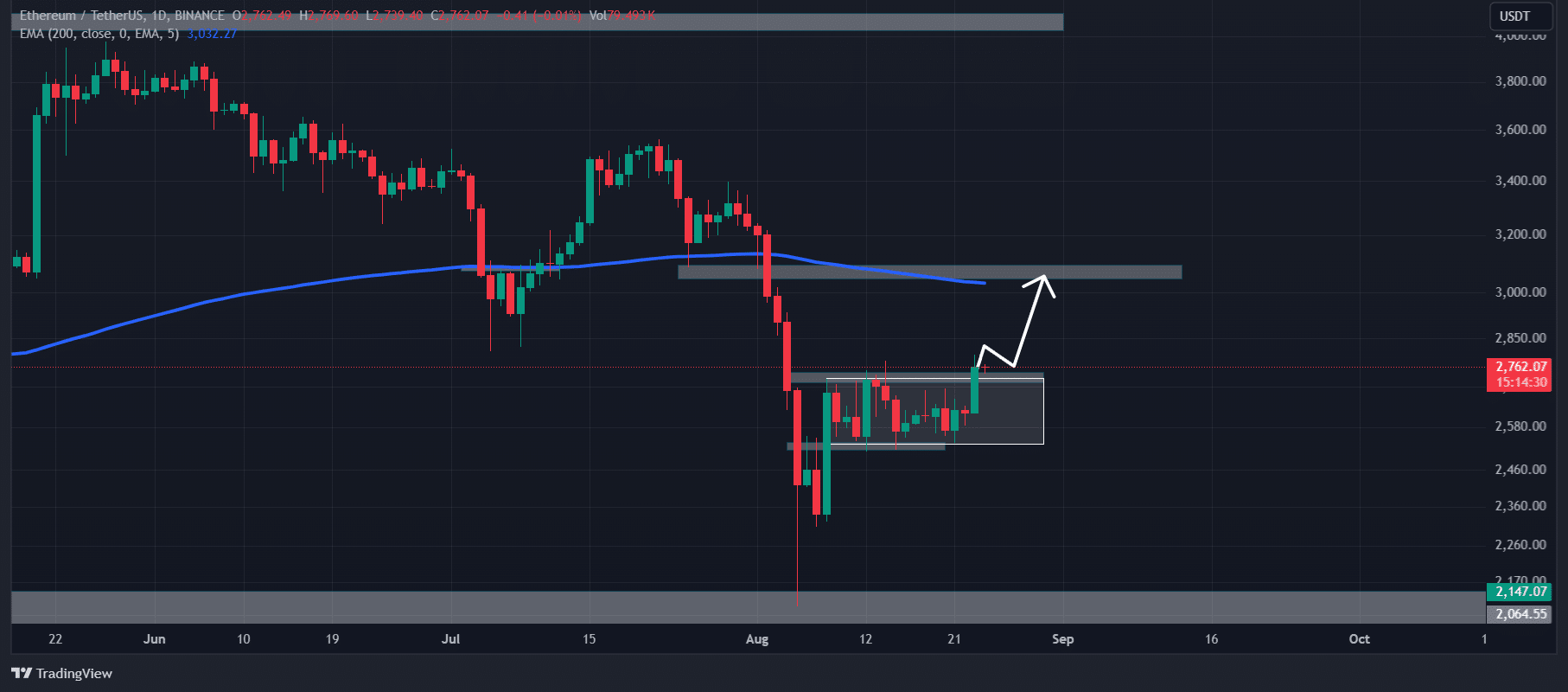

Between August 8 and August 23, ETH consolidated inside a decent vary between the $2,730 and $2,725 ranges. Nonetheless, after the Fed chairman’s rate of interest lower announcement, the financial institution broke out of this zone and closed a day by day candle above $2,760.

Supply: TradingView

This breakout and the candle closing above the zone might sign a bullish outlook for ETH. That is regardless of it buying and selling beneath the 200 Exponential Shifting Common (EMA).

Primarily based on the value motion and technical evaluation, there’s a good probability that the altcoin’s value might rise to $3,000 – the subsequent resistance degree.

On the time of writing, ETH was buying and selling across the $2,760 degree, having risen greater than 3.5% in 24 hours. In the meantime, buying and selling quantity elevated by 40% over the identical interval. It is a signal of elevated dealer participation following the announcement of the breakout and charge lower.

Ethereum’s important liquidation ranges

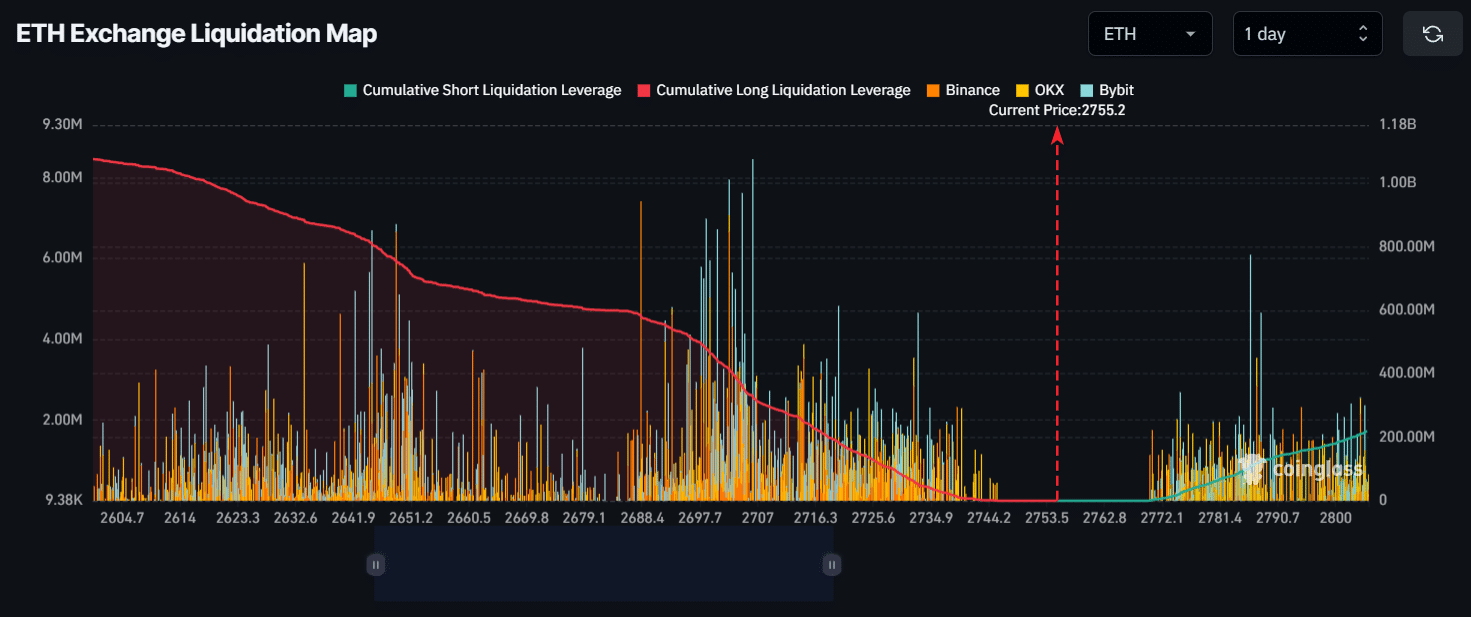

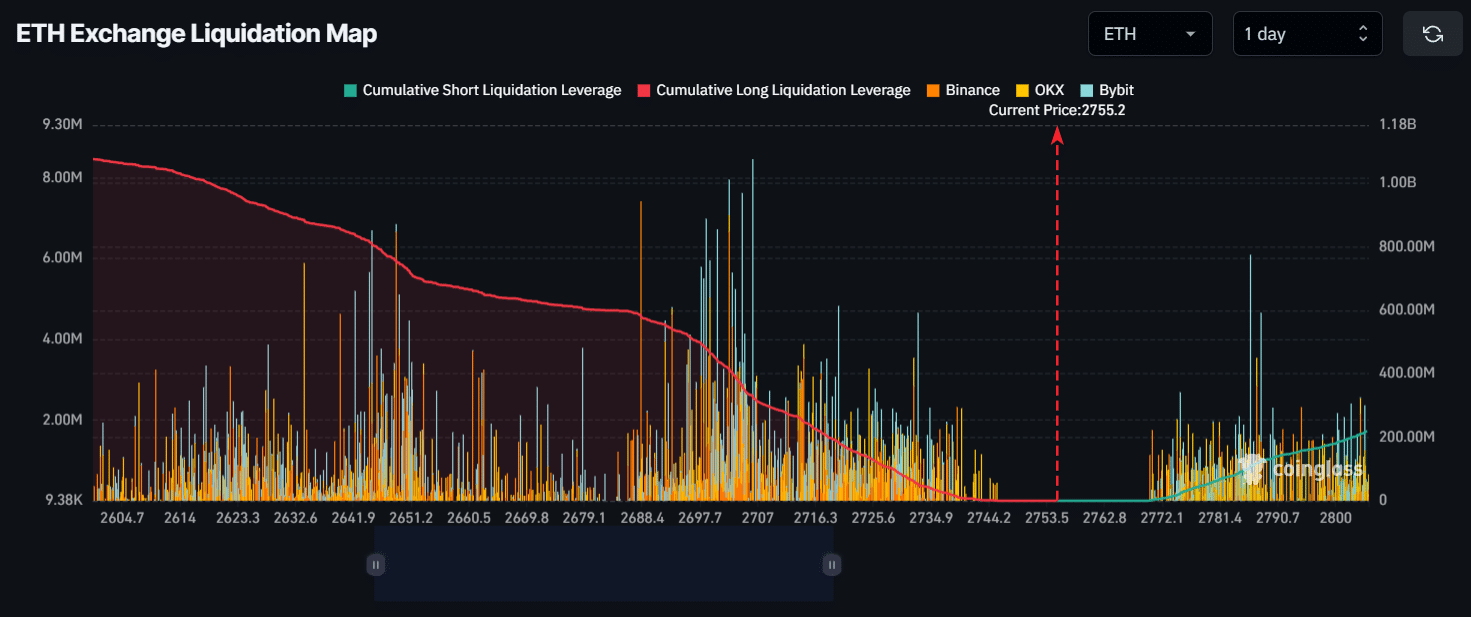

On the time of writing, key liquidation ranges had been round $2,705 on the low facet and $2,786 on the upper facet. That is the case as a result of merchants have excessive leverage at these factors, in response to on-chain analytics agency CoinGlass.

Supply: CoinGlass

If sentiment stays bullish and ETH’s value rises to $2,786, brief positions value almost $111 million might be liquidated. Conversely, if sentiment modifications and the value falls to $2,705, lengthy positions value virtually $323 million might be liquidated.

Primarily based on the leverage positions, it’s clear that bulls are again out there. It is a probably constructive signal for Ethereum and its holders.

Crypto consultants’ opinions on ETH

Amid this bullish outlook, lately, 1confirmation Founder Nick Tomaino shared. He believes that Ethereum’s market cap will surpass Bitcoin’s market cap inside the subsequent 5 years, which is roughly 4x. Within the publish on X, Nick mentioned:

“BTC has a transparent story (digital gold) that establishments have now purchased into. Ethereum is the chain on which the world’s most gifted builders are constructing the decentralized web, and ETH is the digital oil that powers it.”

For the reason that launch of the Spot Ethereum exchange-traded fund (ETF) in the US, the speed of adoption has elevated considerably. Furthermore, ETF merchants have additionally proven nice curiosity in it.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024