Ethereum

Ethereum breaks key price level – Is ETH’s rally just getting started?

Credit : ambcrypto.com

- ETH traded above the realized worth, with the lengthy -term revenue and an institutionally pushed rally

- Binance leads ETH quantity as institutional purchases reveals renewed belief after Pectra Improve

Ethereum [ETH] has exceeded a vital threshold-the market worth has been moved above its realized worth, which has proven a shift in sentiment amongst holders in the long run.

Nowhere is that this clearer than on Binance, the place rising buying and selling volumes and an elevated revenue to renewed beliefs, deeper liquidity and the restoration of Ethereum of market management.

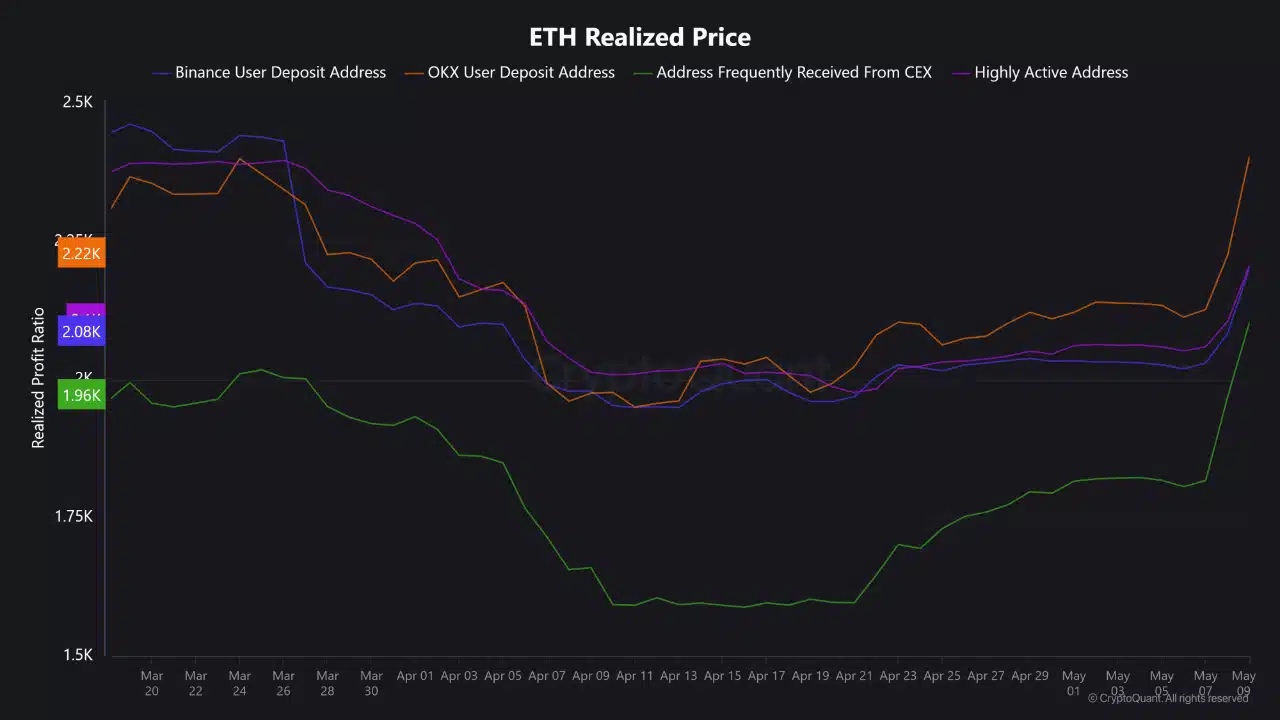

Lengthy-term ETH holders at the moment are in revenue

On the time of writing, Ethereum acted above his realized worth of $ 1,900. The common ETH holder, particularly these in accumulation addresses, was in revenue.

This acts as a marker of Trust in long -term investors. When worth is realized above, that is traditionally correlated with a stronger conviction amongst holders and a shift within the psychology of the dealer.

Supply: Cryptuquant

The graph reveals that the accumulating portfolios underneath $ 1,900 started to accumulate and the present costs that affirm positions. This threshold -flip typically signifies renewed capital influx, particularly of establishments and swing merchants who wish to profit from Momentum.

As a result of this outbreak takes place regardless of weak participation of the retail commerce, this implies that bigger traders stimulate the transfer.

Furthermore, it strengthens that the ETH rally is supported by strategic accumulation, moderately than pure hypothesis.

Binance takes the lead

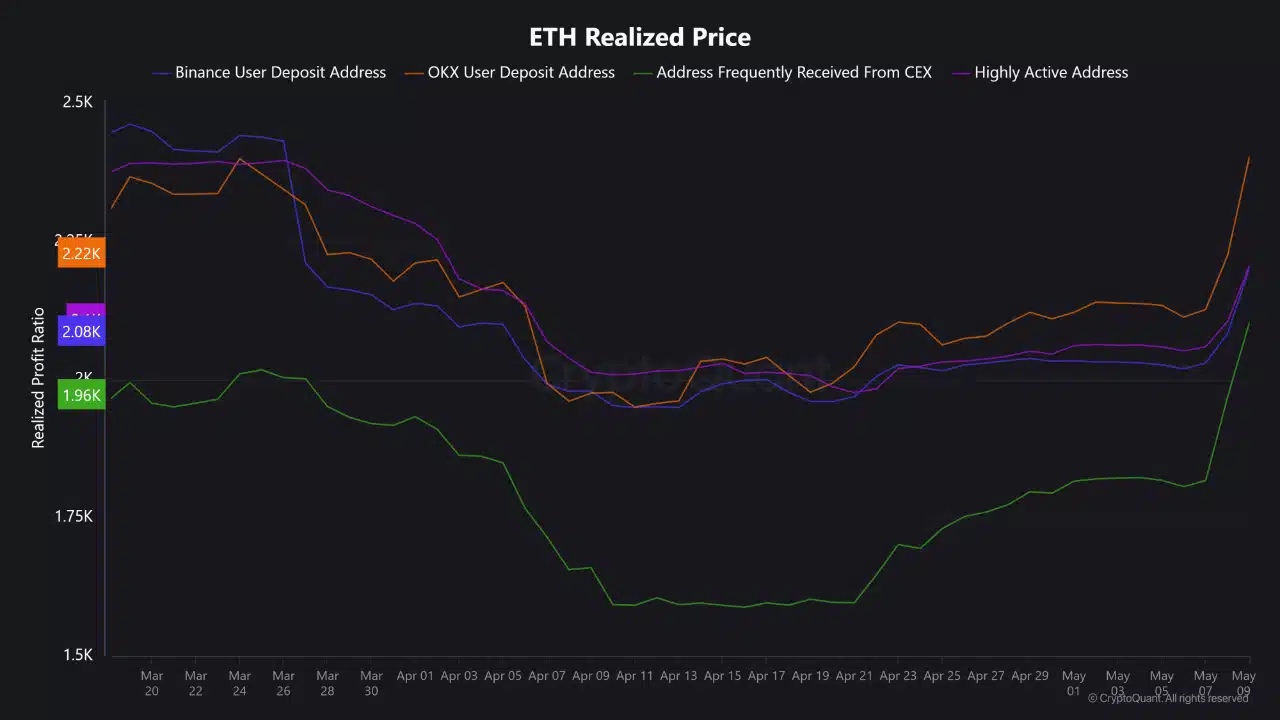

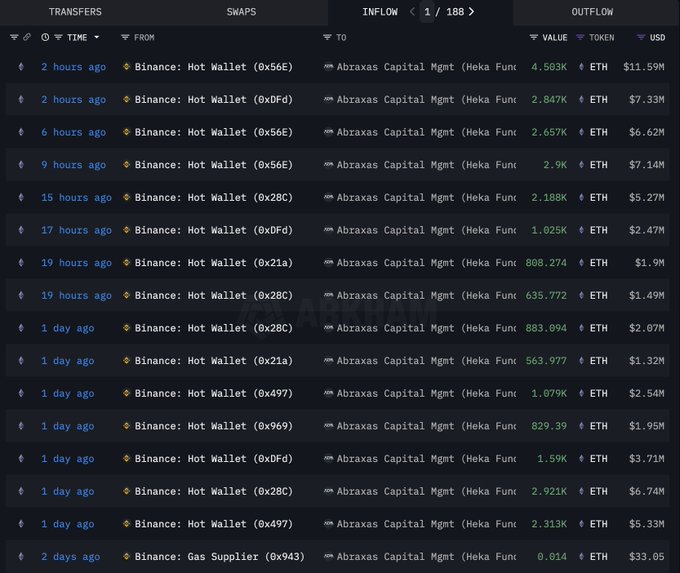

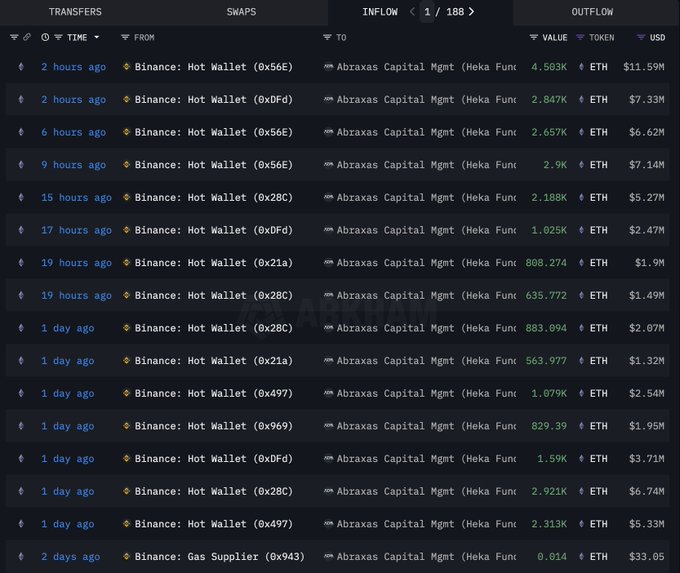

Latest consumption and outflow exercise confirms Binance as the middle of ETH commerce. The change registered the best ETH transaction quantity amongst all platforms, with the influx specifically in the course of the worth enhance.

Supply: Cryptuquant

The information illustrates that Binance customers have gathered closely in the course of the DIP of ETH and now notice that the revenue as the worth recovers above their common enter. It is necessary that this dynamic doesn’t mirror for the weak spot of the market – it reveals strategic once more in steadiness on a platform recognized for top liquidity.

An example Is the aggressive accumulation of ETH of Abraxas Capital not too long ago by way of Binance.

Supply: X

Ethereum’s worth forecast

The rise in Ethereum to $ 2,600 corresponds to the launch of the Pectra improve, which in all probability added Momentum to the latest Bullish Golf.

Nonetheless, technical indicators present {that a} quick -term cooldown can comply with. The RSI has damaged the Overbought threshold, which is now above 80 – a degree that’s traditionally related to withdrawal.

Supply: TradingView

Within the meantime, the MACD supported Out Momentum, which means that any correction will be quick or shallow.

With ETH commerce at $ 2,518 on the time of the press, the market construction Bullish stays, however can present consolidation for the subsequent 24-48 hours as a result of merchants digest each the rally and the improve information.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now