Ethereum

Ethereum bulls have a decision to make as ETH drops below $3.8K

Credit : ambcrypto.com

- Shopping for strain on ETH has remained excessive in current days.

- Technical indicators supported the potential for a value enhance.

As market circumstances remained bearish, Ethereum [ETH]like most different cryptos, additionally witnessed corrections.

The most recent pullback has now develop into a take a look at for the bulls because the king of altcoins failed to interrupt the $3.9k resistance.

Ethereum bulls below strain

ETH witnessed a value correction of over 3% within the final 24 hours, pushing its value beneath $3,000. On the time of writing, the king of altcoins was buying and selling at $3,760.02 with a market cap of over $452 billion.

As the value of the token fell, the Ethereum Basis took a step. Spot On Chain not too long ago posted one tweet exhibiting that the Ethereum Basis simply offered 100 ETH for 374,334 DAI.

This introduced their complete ETH gross sales in 2024 to 4,366 ETH for $12.21 million at a median value of $2,796.

To see if this gross sales pattern was dominant available in the market, AMBCrypto checked different information units.

Happily, not all buyers offered their holdings, which might assist bulls spark a restoration and permit ETH to cross $3.9k once more.

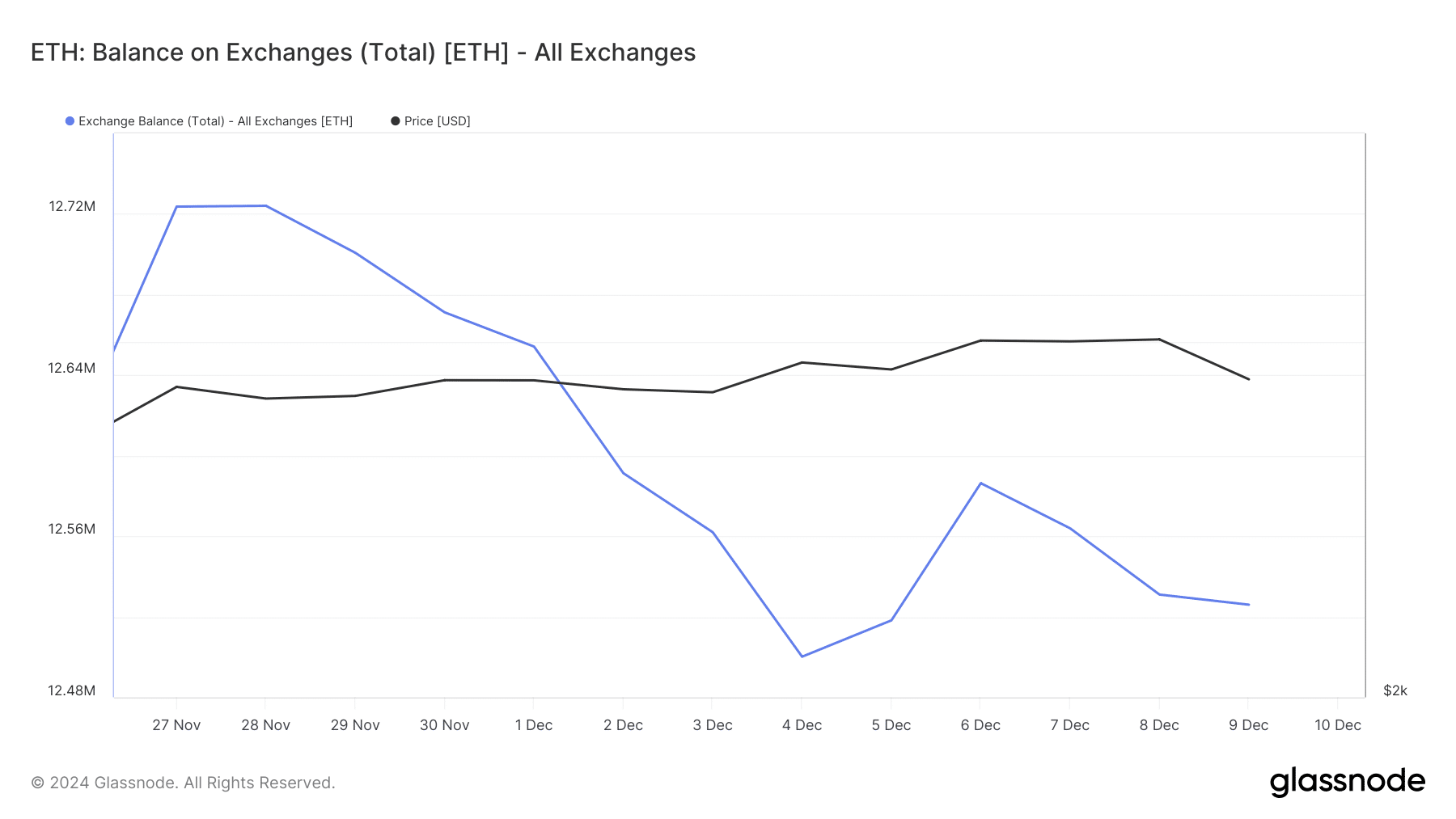

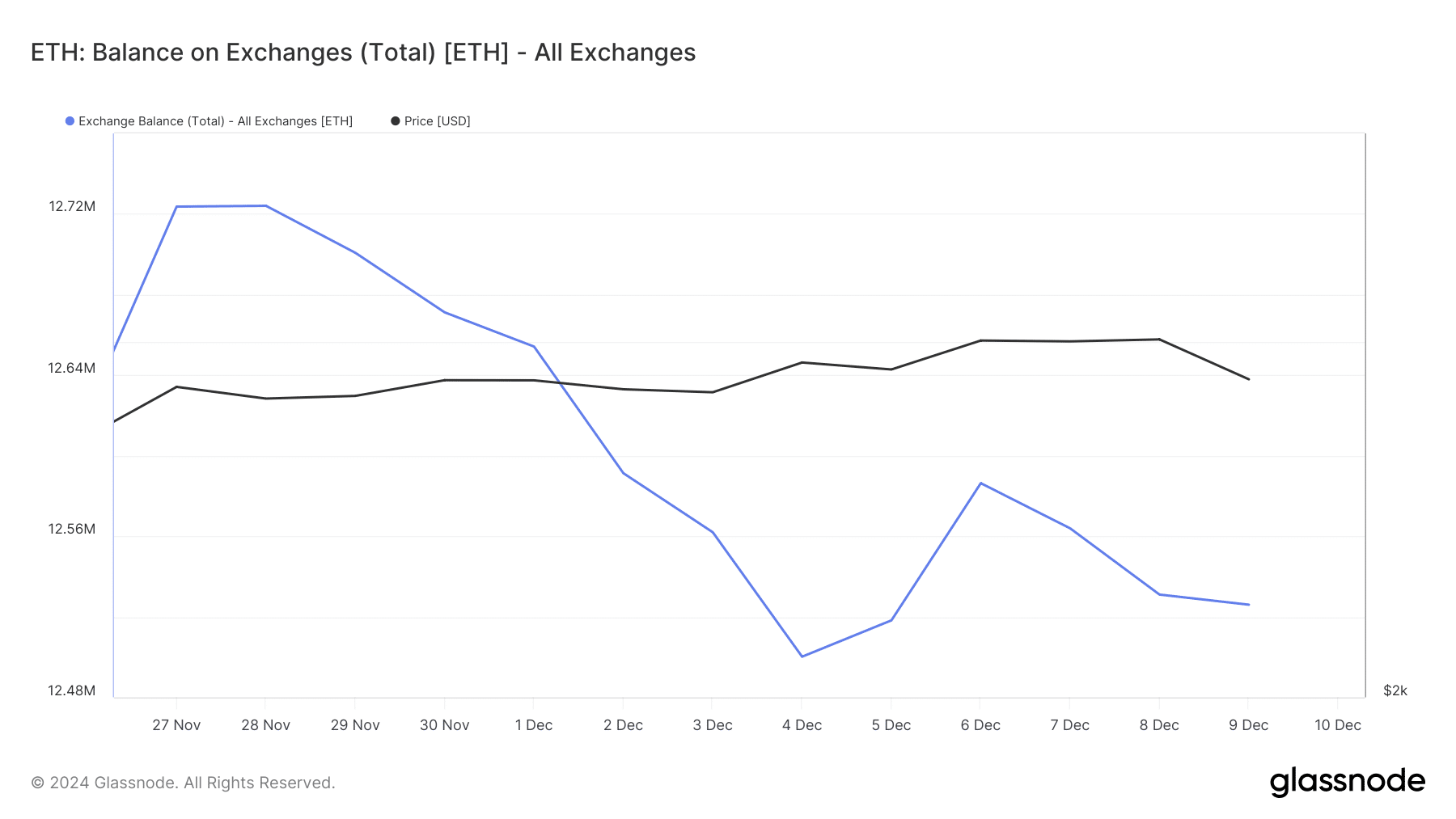

This pattern was evident within the drop in ETH balances on the exchanges over the previous two weeks.

Supply: Glassnode

Hyblock Capital facts revealed that ETH’s gross sales quantity dropped to 9.6 after peaking. For starters, a quantity nearer to 0 signifies much less promoting strain, whereas a worth nearer to 100 signifies excessive promoting strain.

Nevertheless, the whales selected to maneuver in the wrong way. Based on CFGI.io’s factswhale sentiment reached 61.5% – an indication of main whale motion for gross sales.

Will ETH bulls reverse the bearish pattern?

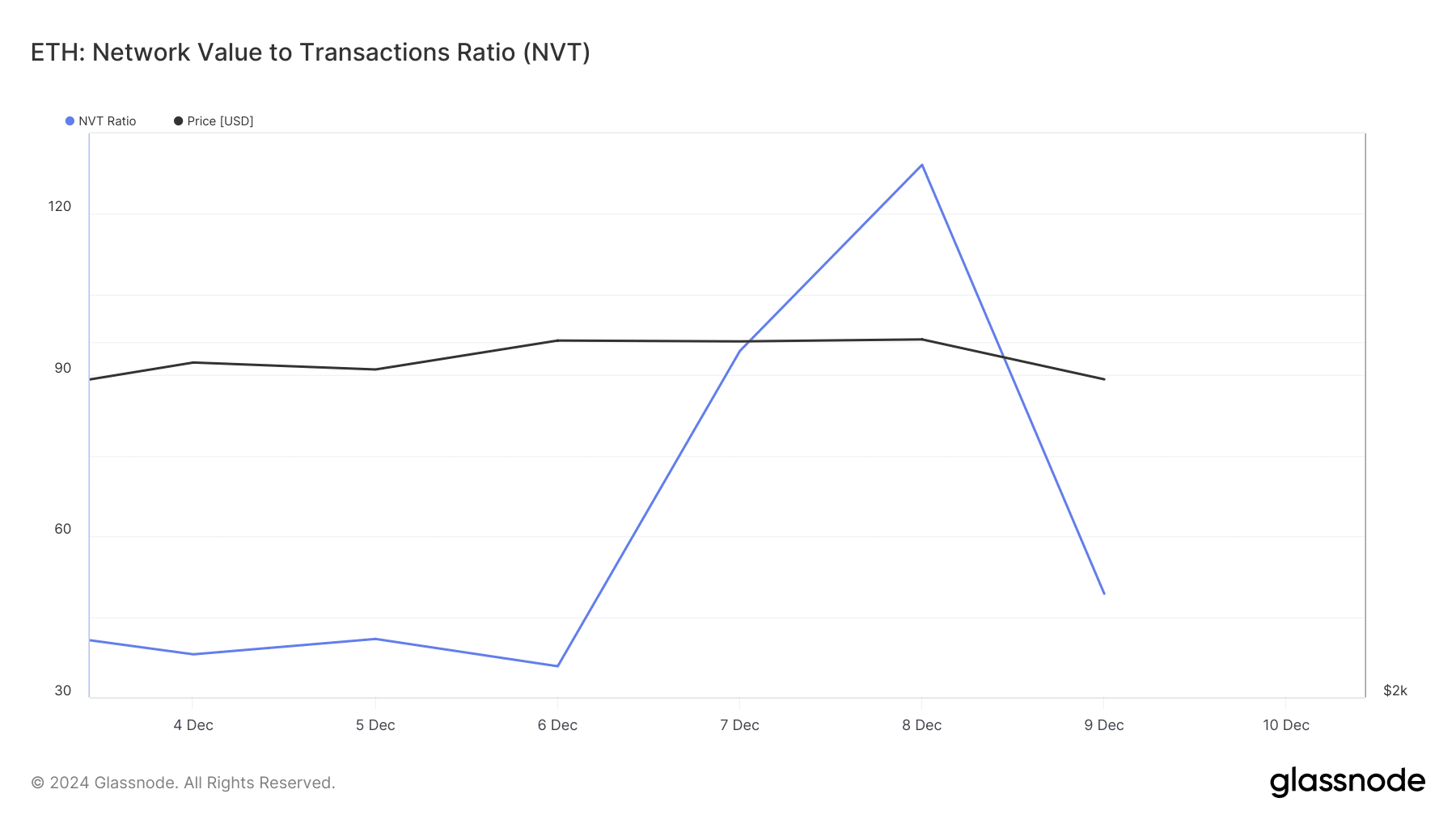

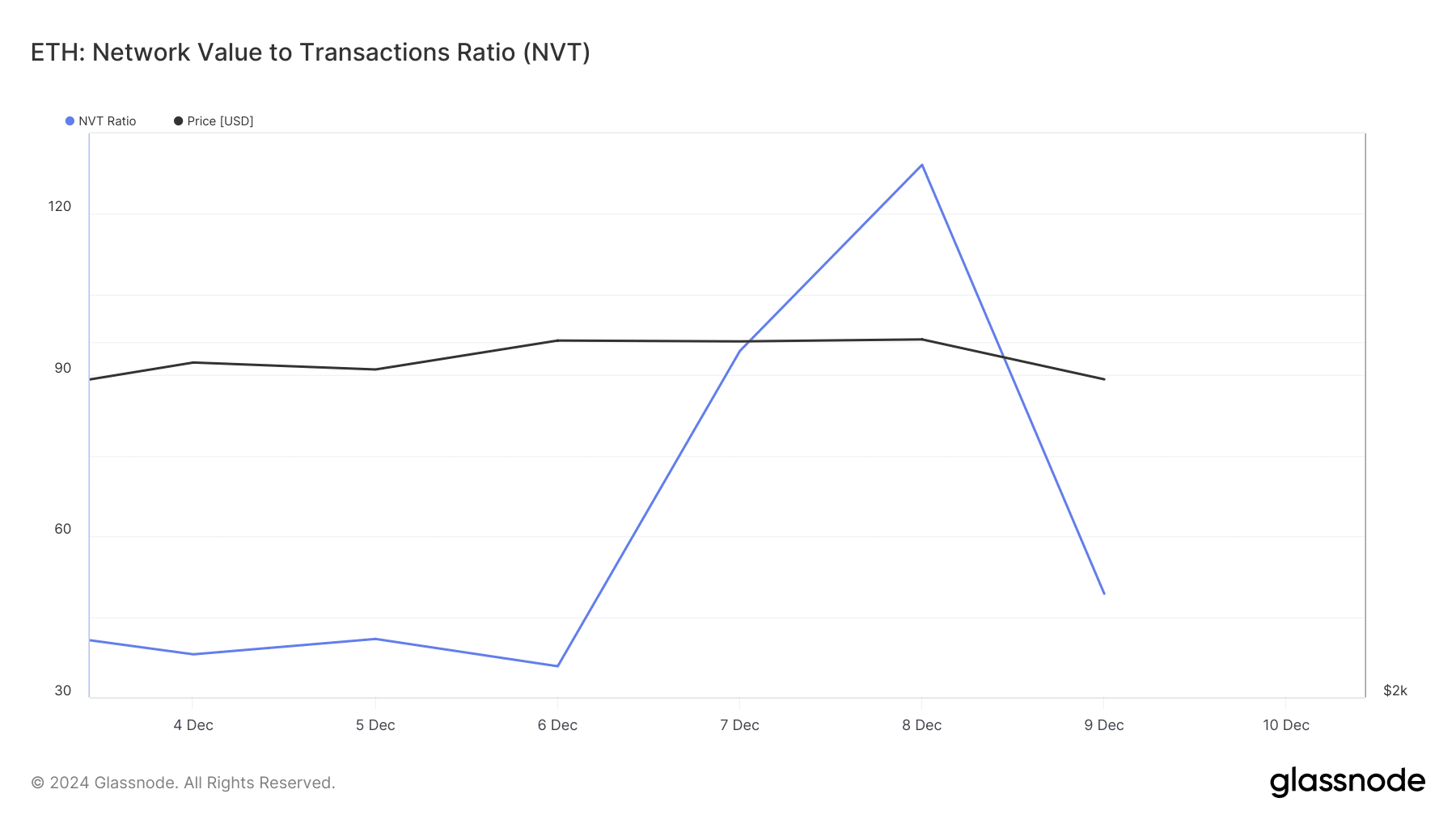

Though whales determined to promote, ETH bulls might nonetheless handle to push the token’s value increased. Ethereum’s NVT ratio recorded a decline in current days.

When the measure falls, it means an asset is undervalued, indicating a value enhance within the coming days.

Supply: Glassnode

Other than this, AMBCrypto additionally found that ETHs Long/short ratio elevated within the 4 hour time-frame.

This meant that there have been extra lengthy positions available in the market than quick positions, which normally signifies rising bullish sentiment round a token.

Some technical indicators additionally urged that Ethereum bulls might make a comeback. For instance, the technical indicator Relative Power Index (RSI) registered a slight enhance.

Learn Ethereums [ETH] Worth prediction 2024–2025

The Chaikin Cash Movement (CMF) additionally rose. An increase within the CMF signifies that purchasing strain is rising and the market or asset could also be coming into an uptrend.

Subsequently, Ethereum bulls might efficiently go the take a look at and assist the value of ETH rise once more within the quick time period.

Supply: TradingView

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?