Ethereum

Ethereum buyers are buying with a negative netflow of 150k ETH

Credit : ambcrypto.com

- ETH fell beneath $ 2K once more after he stayed above this degree for 2 days.

- Ethereum -buyers purchased aggressively, with a damaging Netflow that reached 150,000 ETH.

Previously three days, Ethereum [ETH] Noticed a shift in Fortuinen, reclaiming $ 2K. Within the midst of this pattern is the next buy exercise.

In keeping with CryptoquantEthereum noticed a damaging Netflow of greater than 150,000 ETH on derived exchanges.

Supply: Cryptuquant

Such a big outflow signifies a diminished gross sales stress, since traders transfer ETH to chilly storage or Defi. That’s the reason the big outflow of elevated accumulation signifies giant entities that point out bullish sentiments of those traders.

This accumulation by giant entities is additional demonstrated by the current whale gross sales exercise.

In keeping with Onchain -lens, A whale drew 8,313 ETH again price $ 16.46 million from Binance after two months of inactivity. After this transaction, the whale now has 11,197 ETH price $ 22.17 million.

Supply: Onchain -Lens

When whales begin to accumulate, it signifies a robust bullish sentiment, indicating that they imagine that the present costs are undervalued and possibly return rapidly.

Persistent accumulation by good cash typically will increase market confidence and attracts an elevated demand from speculative patrons.

What it means for ETH

Regardless of the rising demand of enormous holders, ETH costs proceed to wrestle.

The truth is, ETH has fallen beneath $ 2k on every day graphs and reached a low level of $ 1,963. This implies that different market contributors stay bearish and are much less optimistic about potential worth restoration.

Supply: Cryptuquant

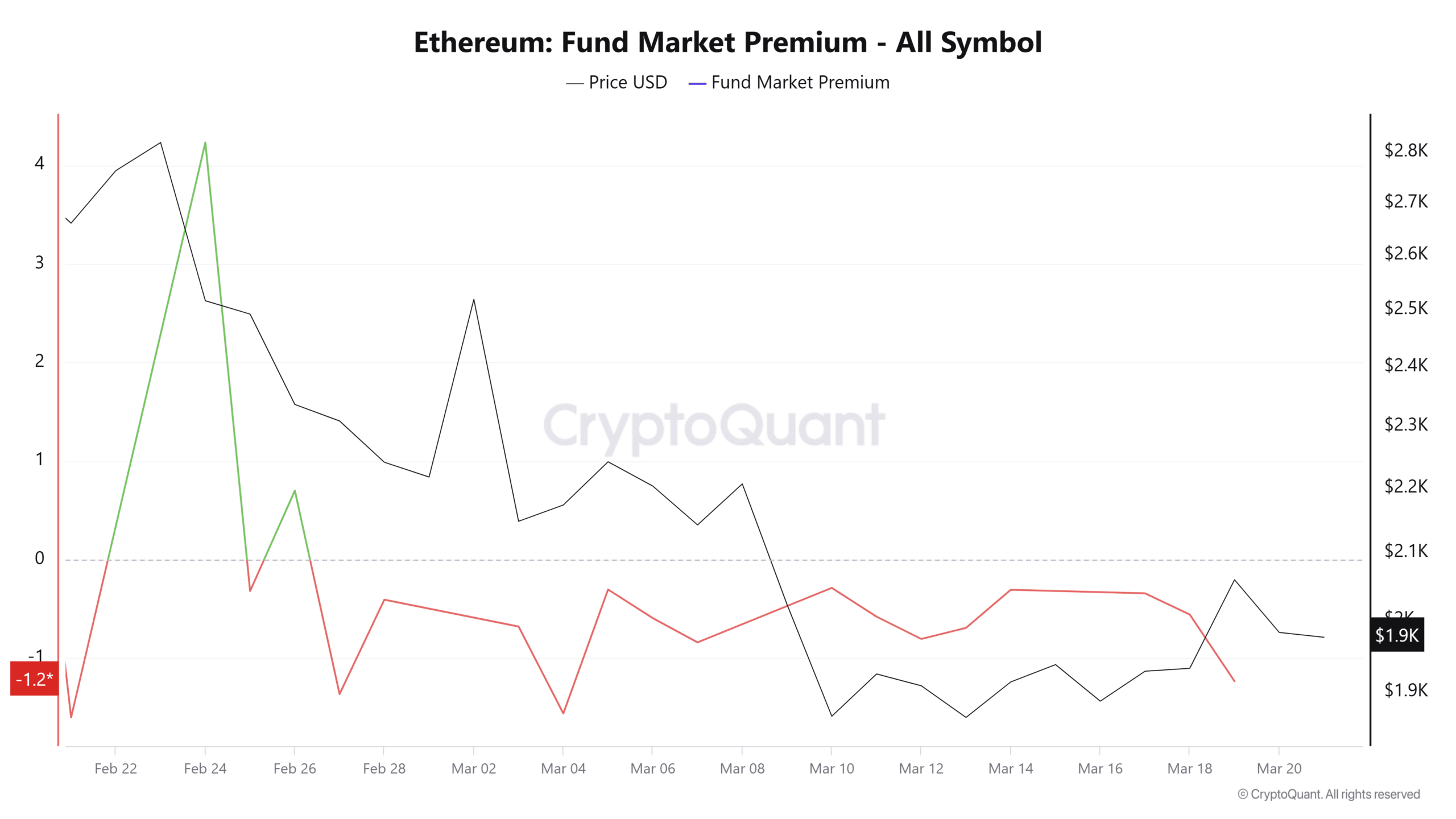

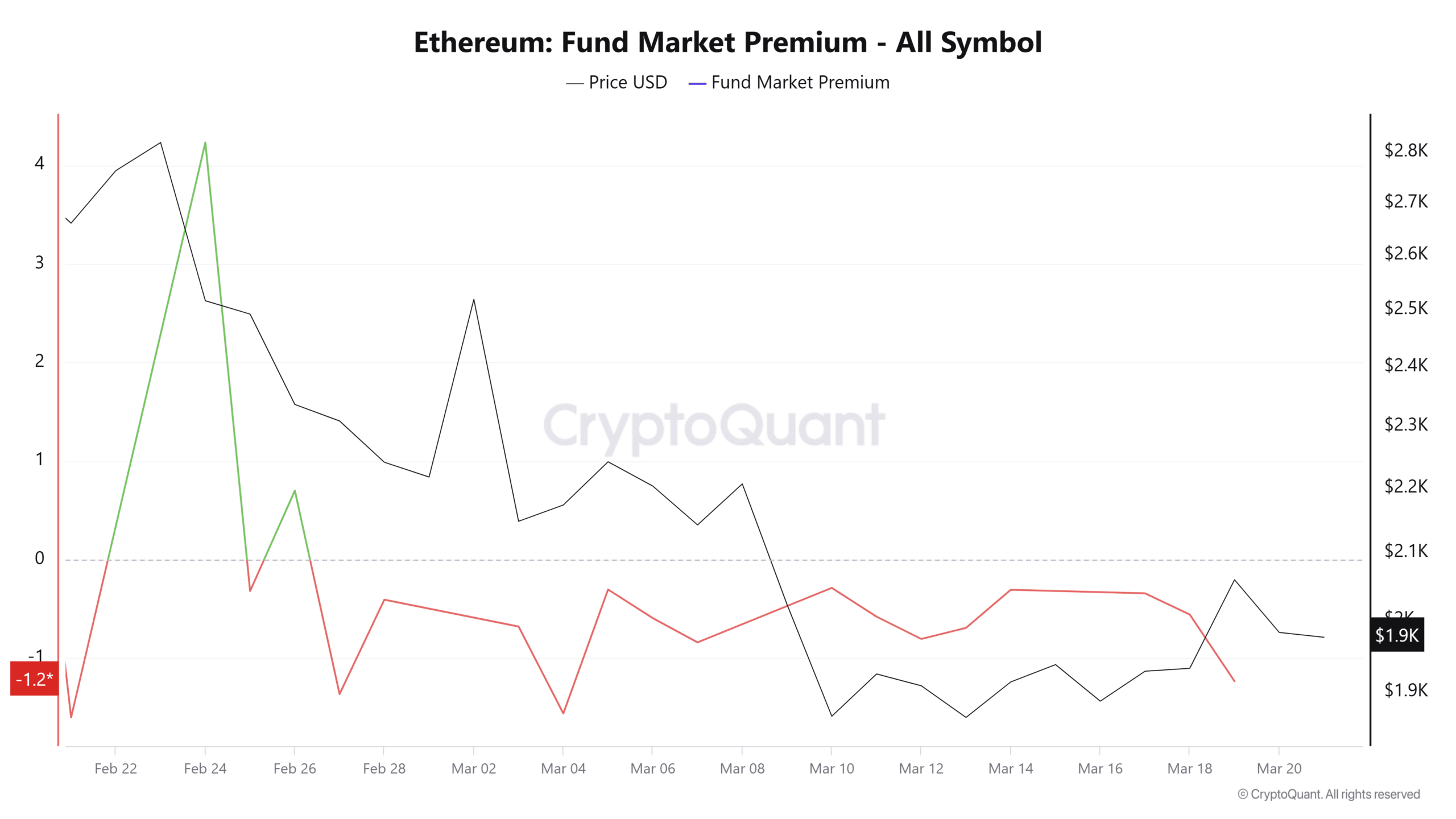

Ambcrypto Beerarish Market sentimented when the Ethereum market premium remained damaging prior to now week.

A seamless damaging premium signifies that traders shut positions sooner than new patrons arrive, which suggests a choice to promote with a reduction as a substitute of holding on. Whereas patrons take part, the vendor’s exercise stays excessive.

Supply: Cryptuquant

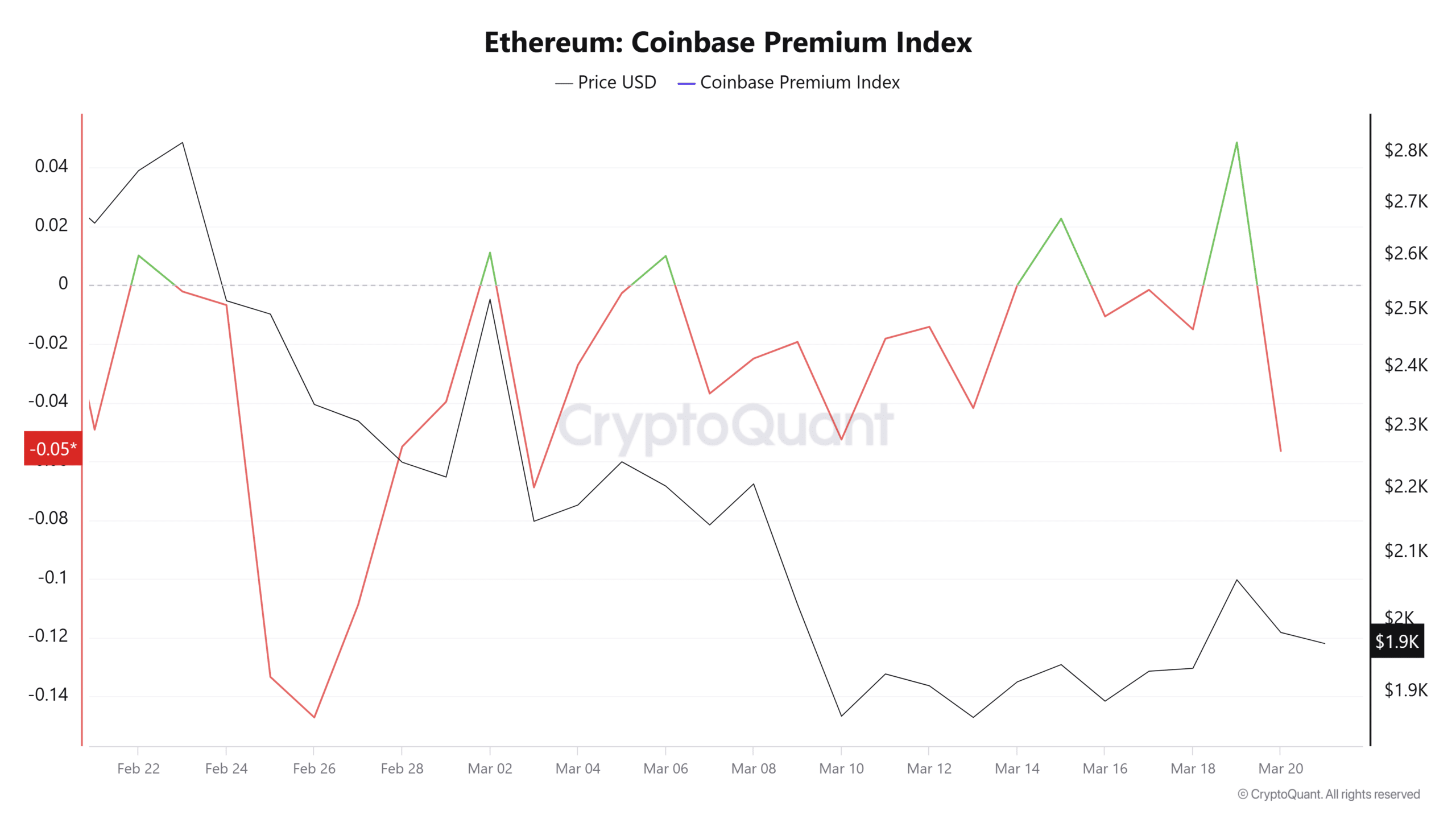

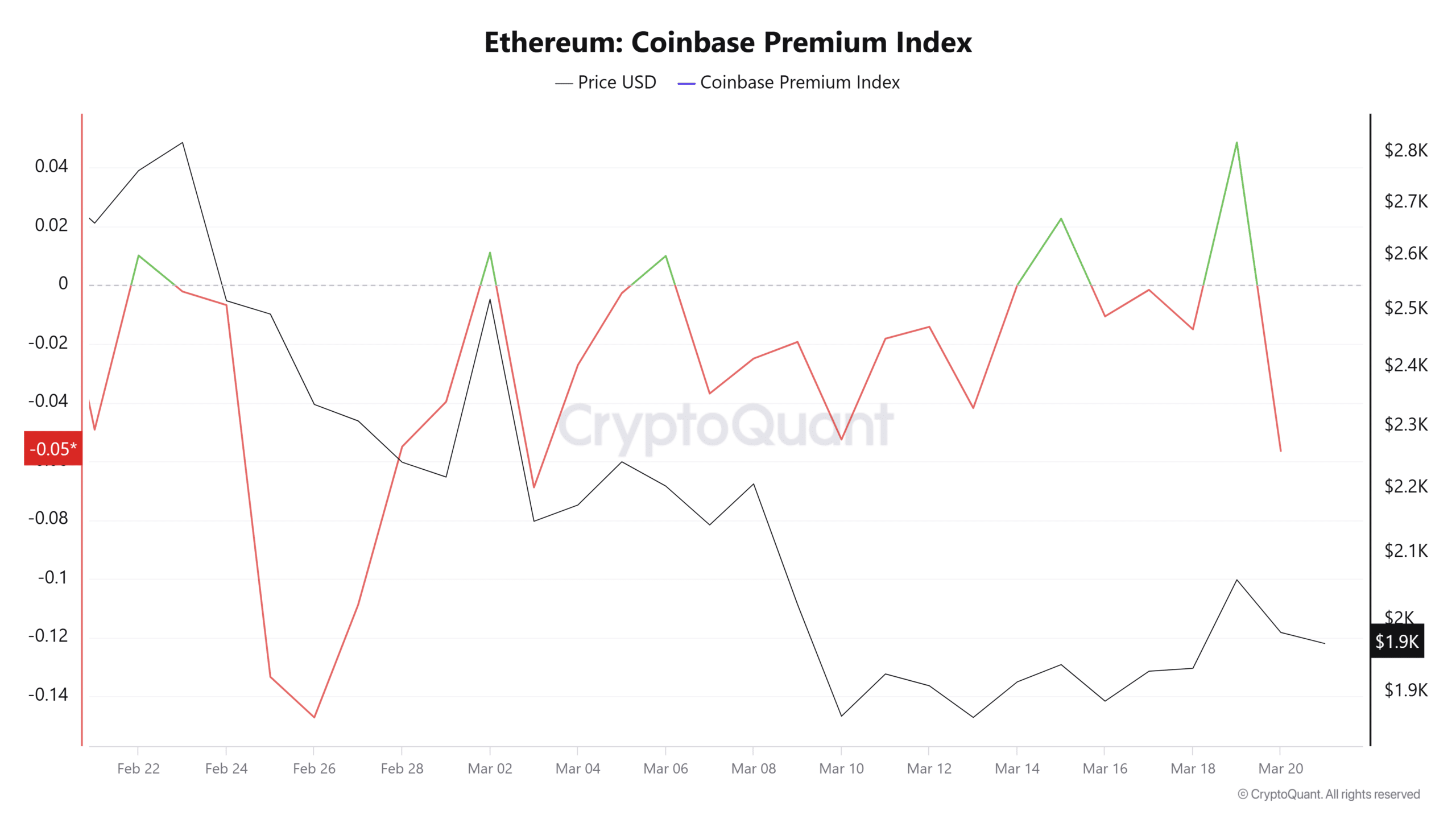

Bearish Sentiments are notably pronounced amongst American institutional traders. The Coinbase Premium Index, at the moment at -0.05, signifies lively sale by Coinbase traders, which displays a outstanding lack of market confidence.

This sentiment places Ethereum underneath appreciable downward stress.

Regardless of elevated damaging netflows and whale retirement, Ethereum’s demand stays weak. The continual tug of warfare between patrons and sellers might be restricted to a consolidation vary.

Beneath the present circumstances, Ethereum will most likely commerce between $ 1,862 and $ 2,100.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024