Ethereum

Ethereum buyers ‘return’ to buy the dip

Credit : ambcrypto.com

- Ethereum registered losses of two.70% within the final 24 hours

- As traders flip round to purchase the dip, Ethereum has to reclaim $ 2,350 for a possible rally

Prior to now two weeks, Ethereum [ETH] has seen some excessive volatility on the graphs. Throughout this era the worth of ETH has risen to an area spotlight of $ 2.7k. Quite the opposite, the interval has additionally fallen beneath $ 2,000 for the primary time since November 2023.

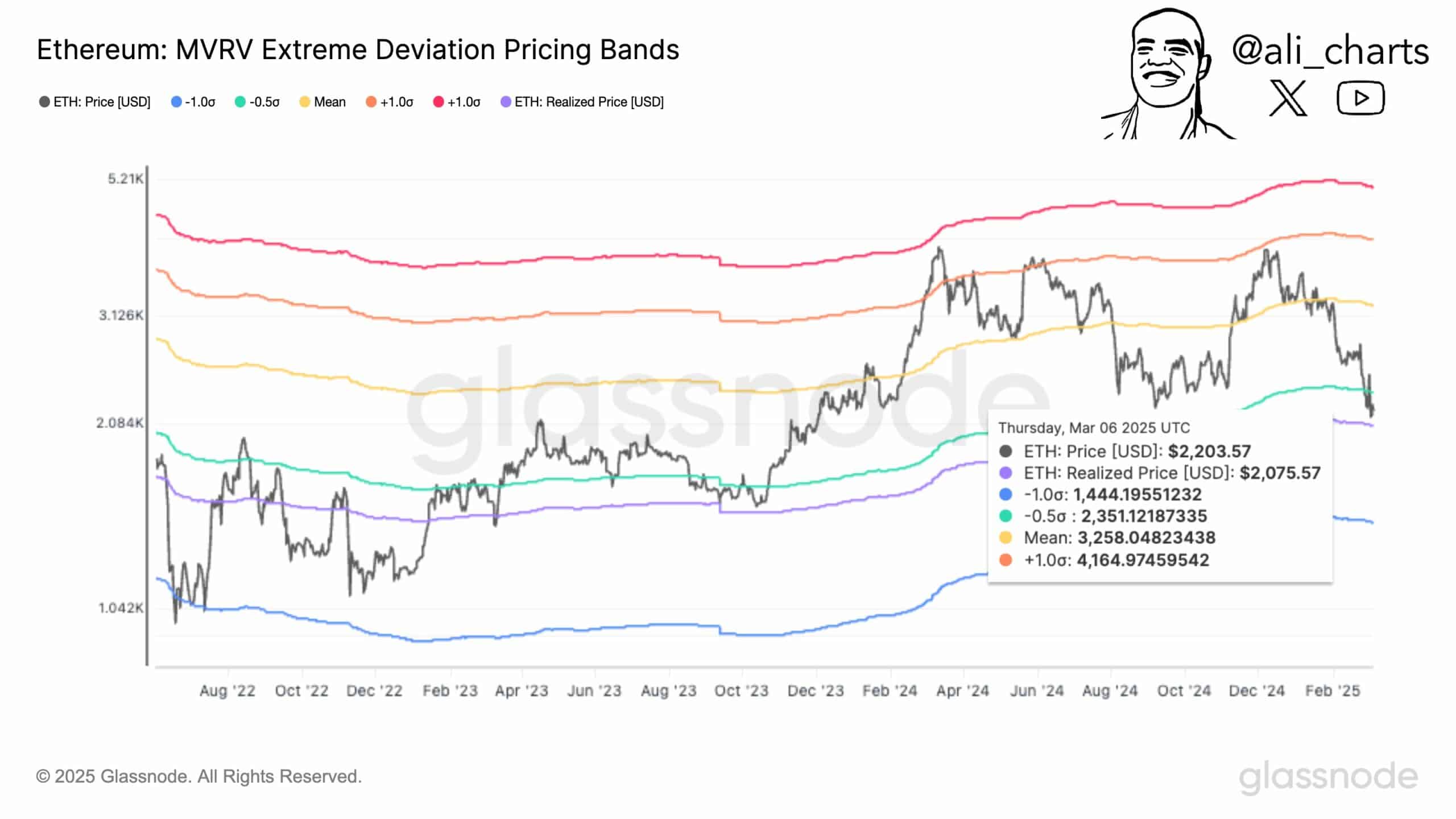

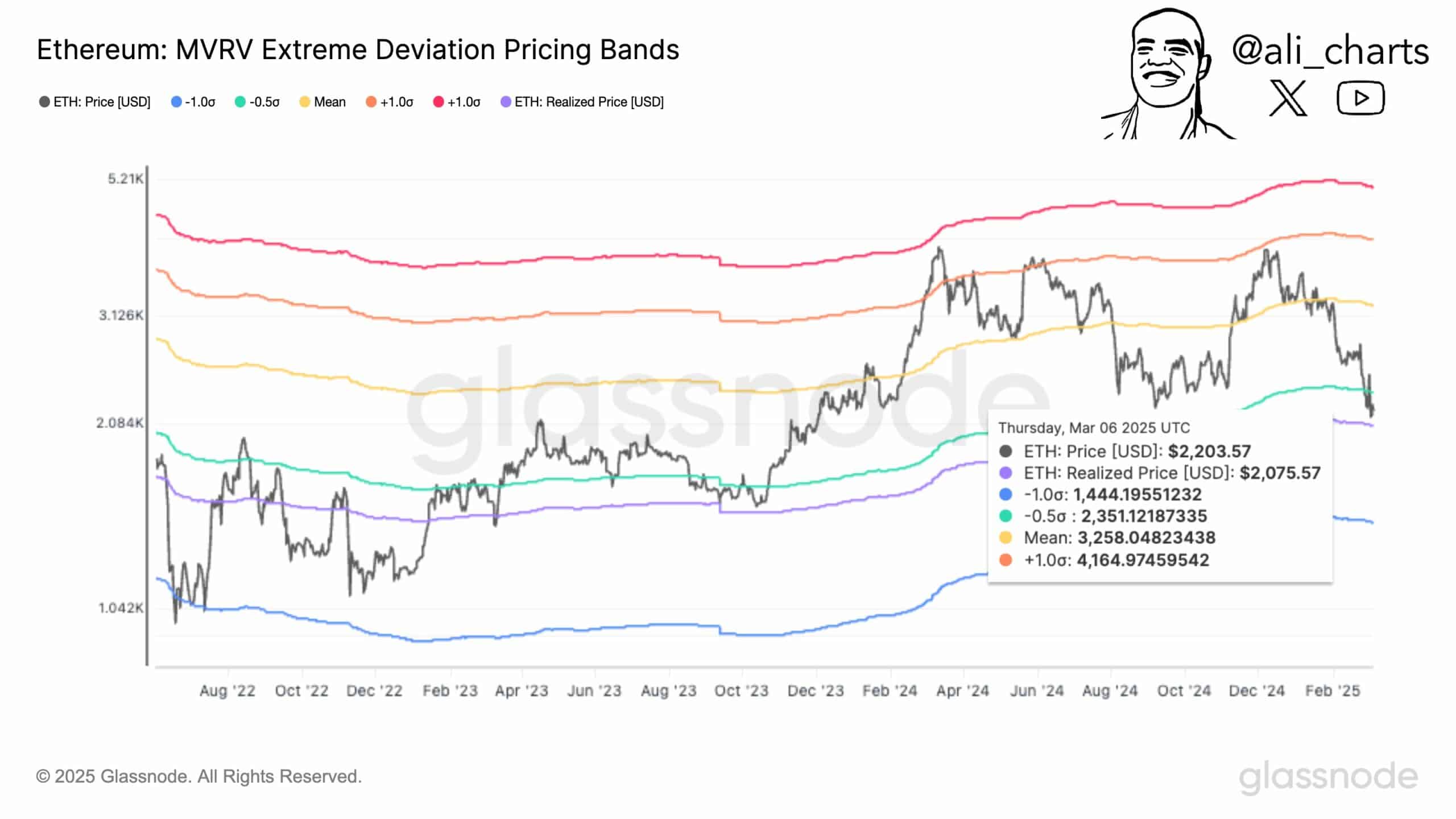

The most recent value fluctuations have had essential stakeholders share totally different opinions, with some nonetheless optimistic about ETH. One in all them is Ali Martinez, the place the crypto analyst refers to a possible rally to $ 3,260 that quotes value tires and the MVRV.

Can Ethereum gather as much as $ 3,260 within the charts?

In his evaluation, Martinez famous that the prevailing market circumstances $ 2,350 left behind as an important stage of resistance for the Altcoin.

Supply: X

Due to this fact, if ETH breaks out of this stage and strikes above it, it may trigger a substantial shopping for momentum and take a look at the next vital stage round $ 3260. Retaining this stage can have a psychological impact by confirming a bullish pattern shift. This might tempt traders to purchase the Altcoin and take lengthy positions.

In line with Martinez, the costs of Ethereum that fall beneath the MVRV has created an ideal shopping for possibility. Traditionally, shopping for at this stage has often yielded essentially the most returns – a pattern that has continued since 2016.

Supply: Cryptuquant

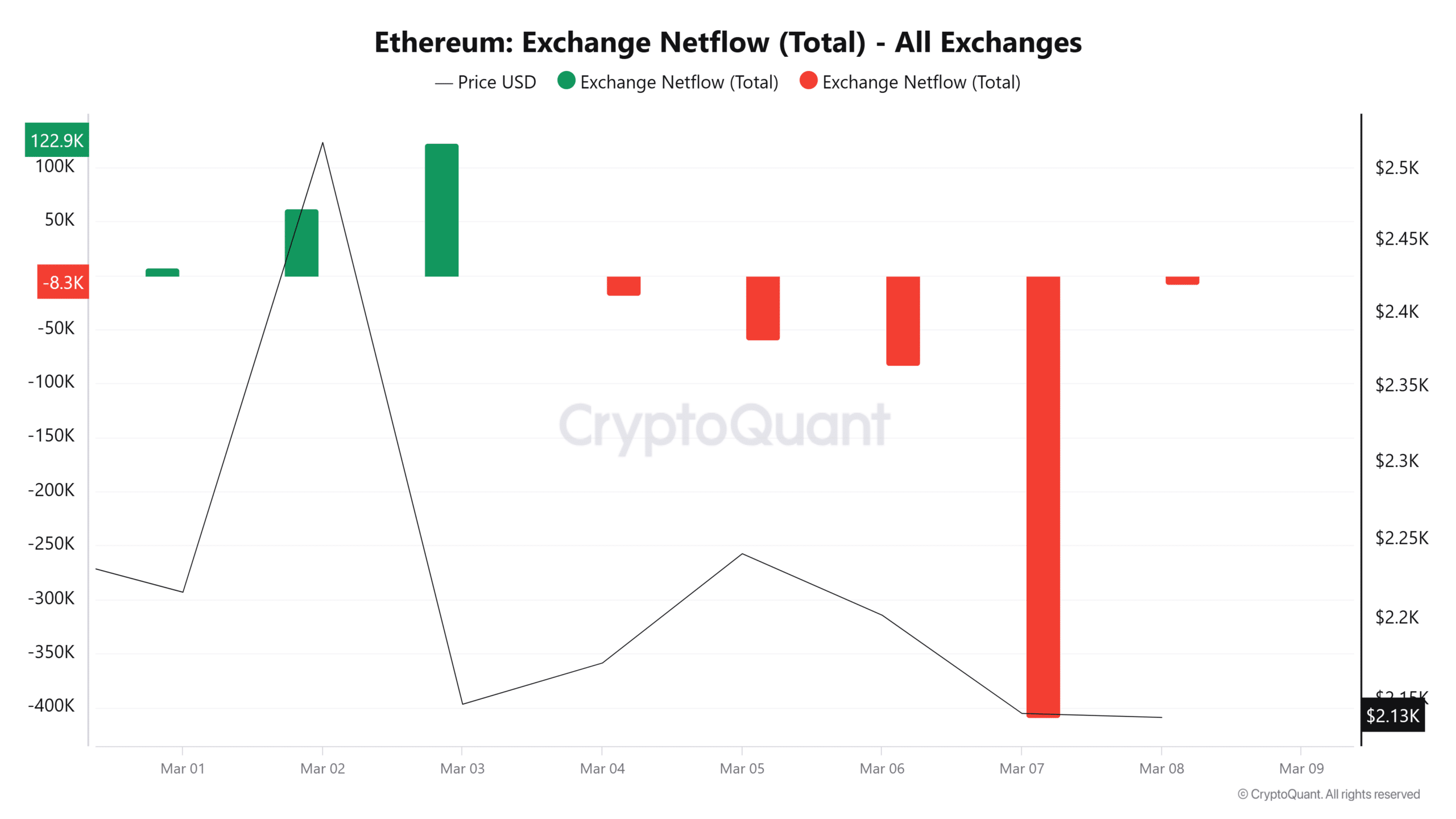

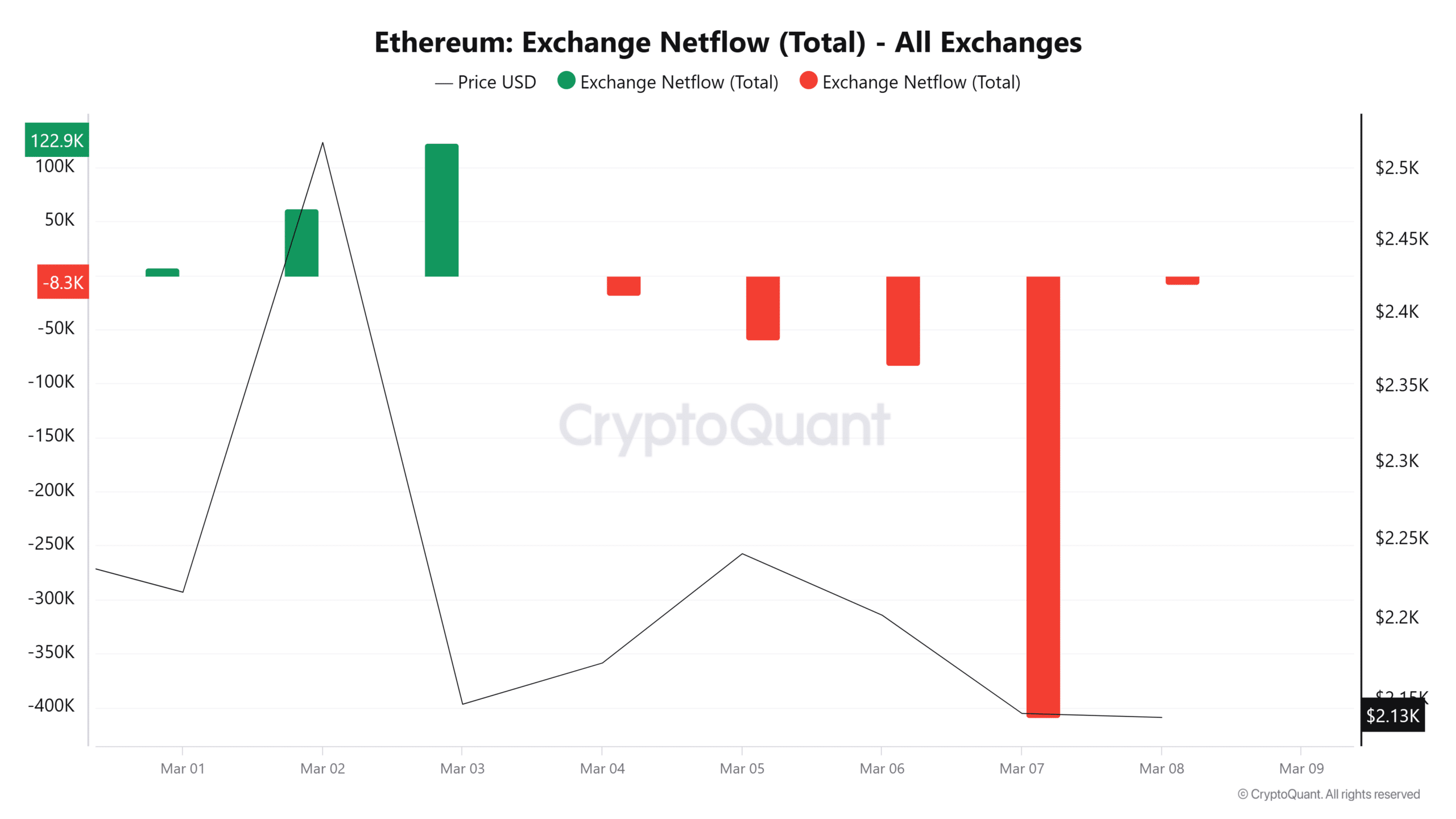

Due to this decline, plainly traders have turned to purchase the dip.

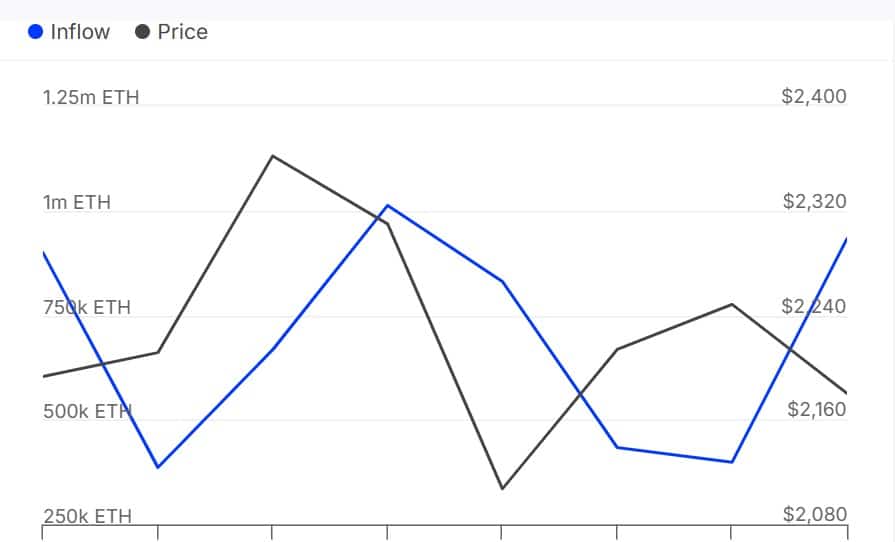

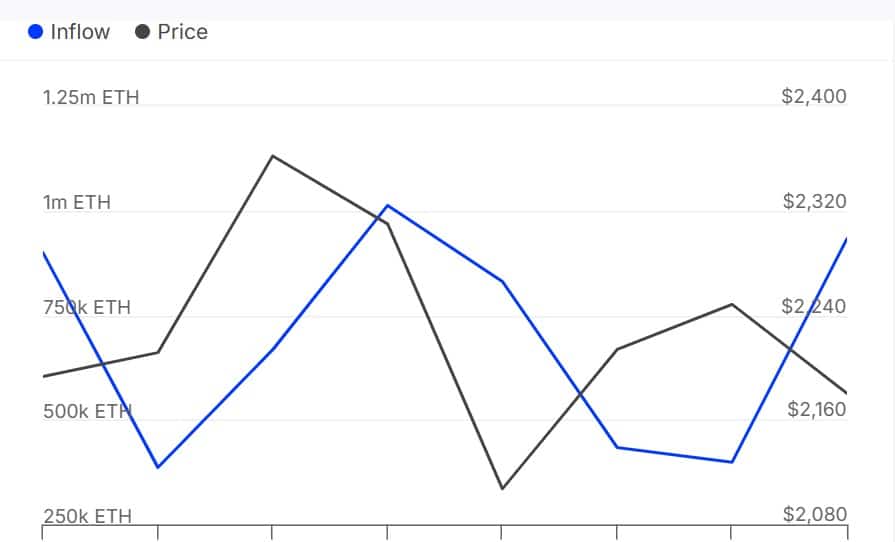

This shopping for exercise will be confirmed by the alternate community flows of Ethereum which have remained unfavourable for the previous 4 days. A unfavourable netflow signifies that patrons dominate the market, with extra alternate outings than influx.

Supply: Intotheblock

whale exercise, this buy exercise is extra widespread with whales. In line with Intotheblock, Ethereum -Walvissen are again out there which have collected greater than 932.79k ETH -Tokens previously day.

Likewise, the Netflows had been from massive holders to 474.89K. This urged that there have been extra capital flows from whales than out. When whales flip to accumulation, this refers to sturdy bullish sentiments as a result of they anticipate the worth that may return. This might make the dip an ideal shopping for possibility.

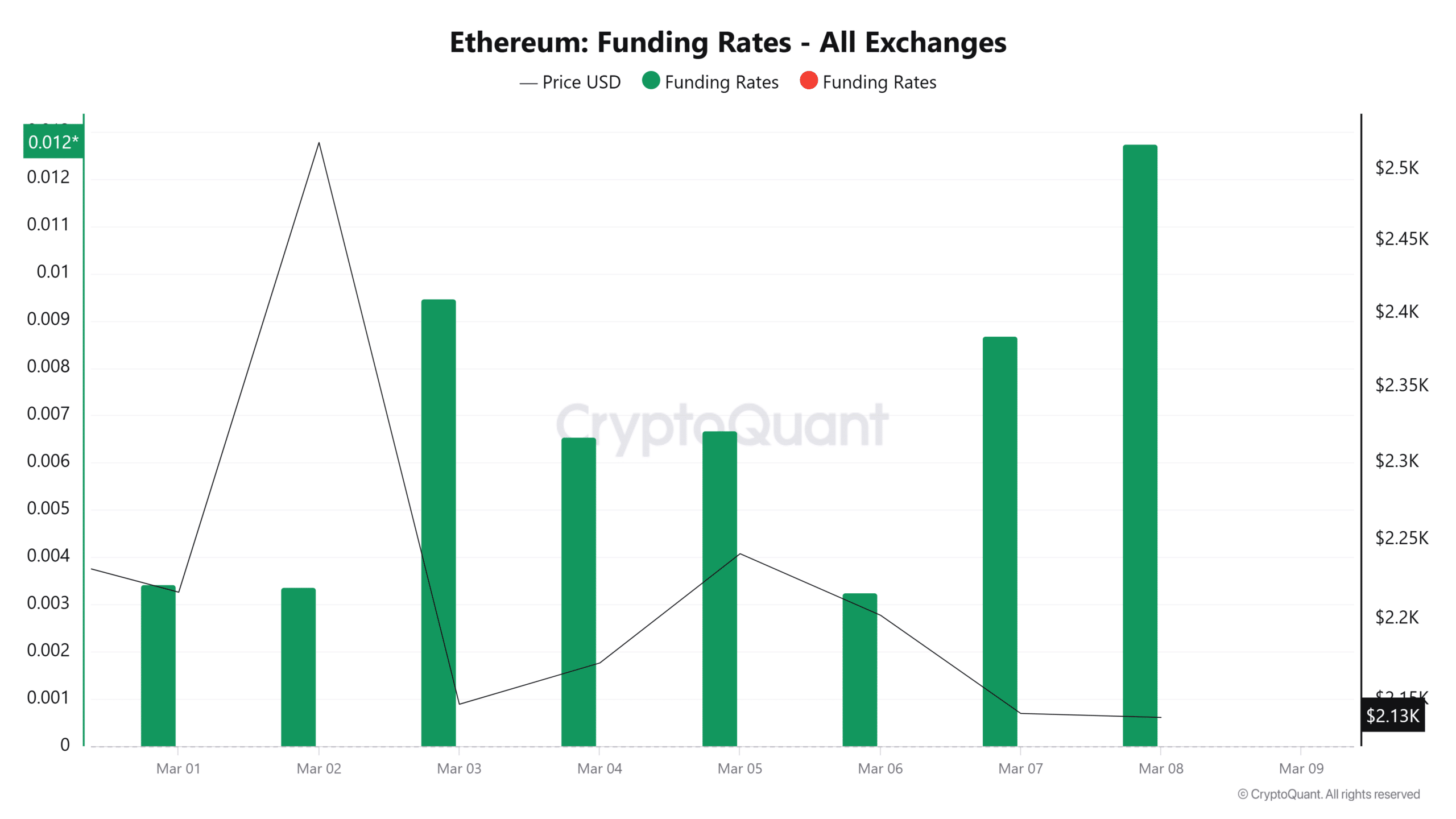

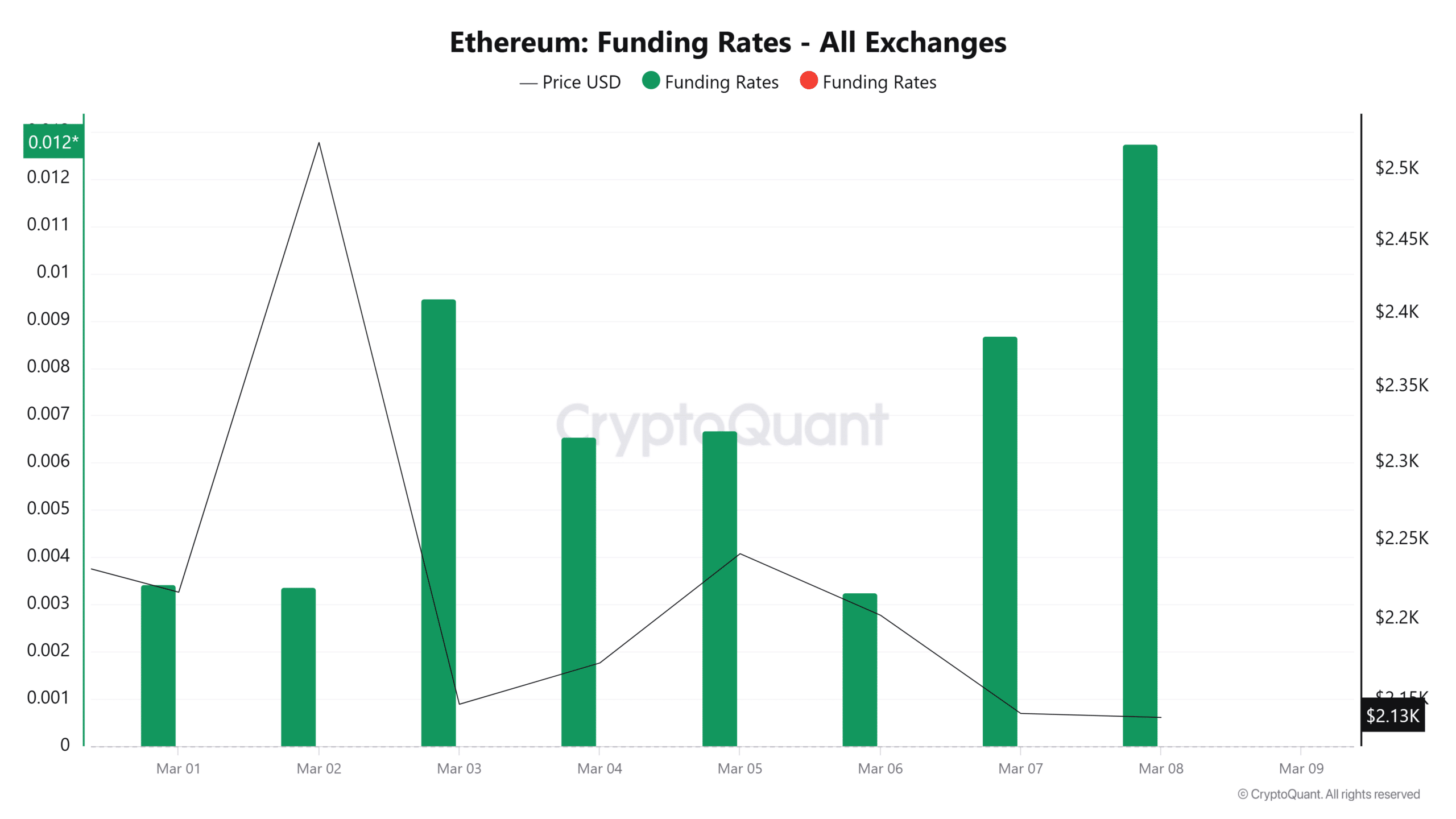

Supply: Cryptuquant

This bullishness will be additional confirmed by the rising financing velocity, with the identical climbing to a weekly excessive level of 0.01.

When the financing charge will increase, which means merchants pay financing prices to introduce their lengthy positions. As a result of this improve is supported by elevated accumulation, he supported a possible value rally.

What for the ETH value motion?

In conclusion, the patrons of Ethereum have come in the marketplace – each whales and retailers. With sellers who appear exhausted, ETH will be nicely positioned for restoration. If the query was noticed previously day, we may see ETH reclaim from $ 2,325 and take a look at a rally to $ 2.7k.

Nevertheless, if the transfer by Bulls fails, we’d see that the Altcoin continues to behave between $ 2,114 and $ 2,300. To achieve the degrees predicted by Martinez, it should first reclaim $ 2.7k and $ 3K – unlikely within the quick time period, until macro -economic knowledge turns into favorable.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now