Ethereum

Ethereum: Can rising adoption offset whale sell-offs?

Credit : ambcrypto.com

- ETH accumulation has fallen in latest weeks.

- ETH skilled a optimistic pattern final weekend.

Ethereum [ETH] has skilled vital volatility in latest months, with on-chain metrics sending blended indicators. Knowledge exhibits that some Ethereum whales have halted their accumulation, indicating a attainable shift in sentiment amongst giant holders.

Regardless of this, Ethereum lately recorded a four-month excessive in community progress, a optimistic indicator of elevated exercise and adoption on the community.

Ethereum whales cut back on accumulation

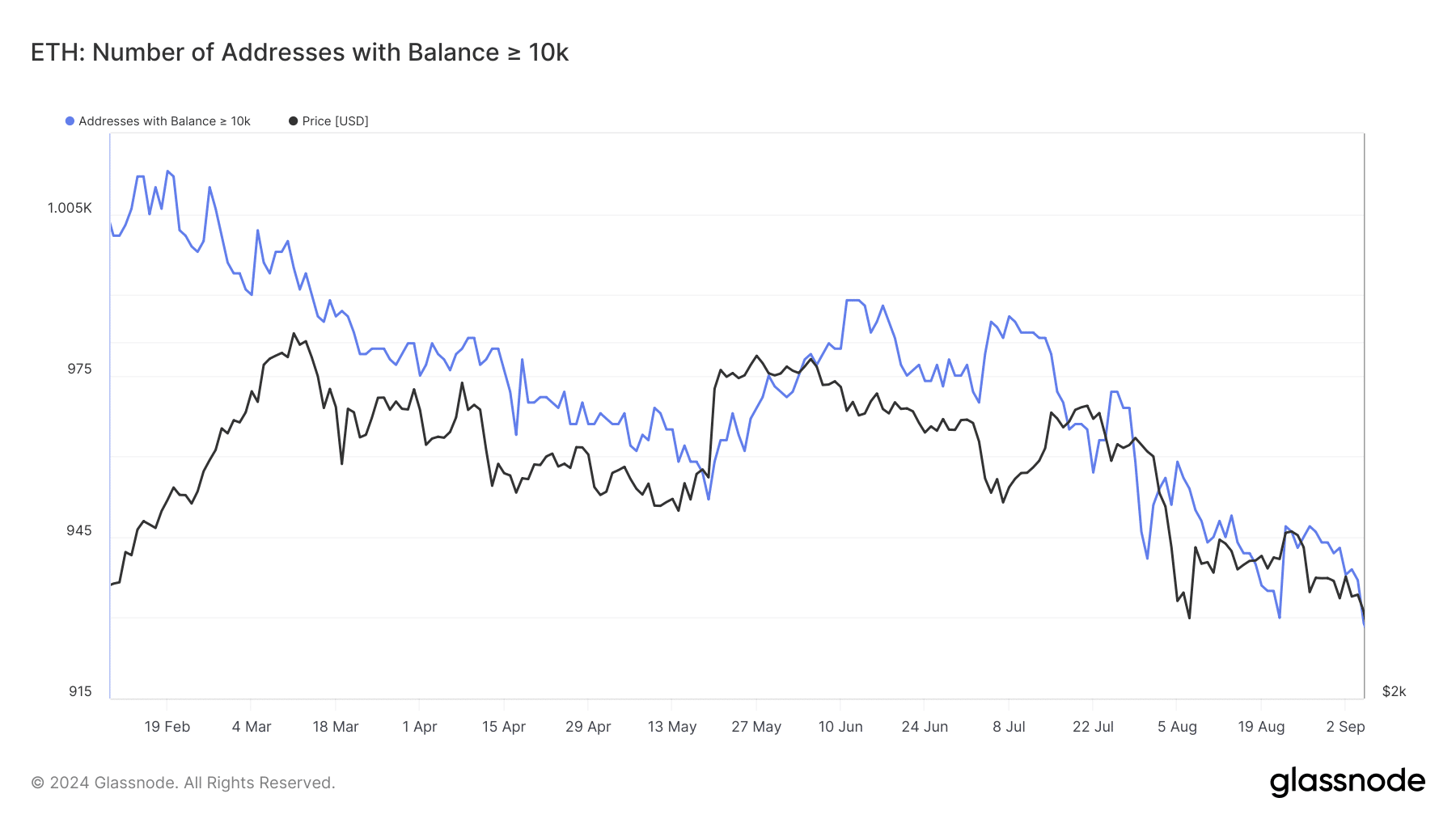

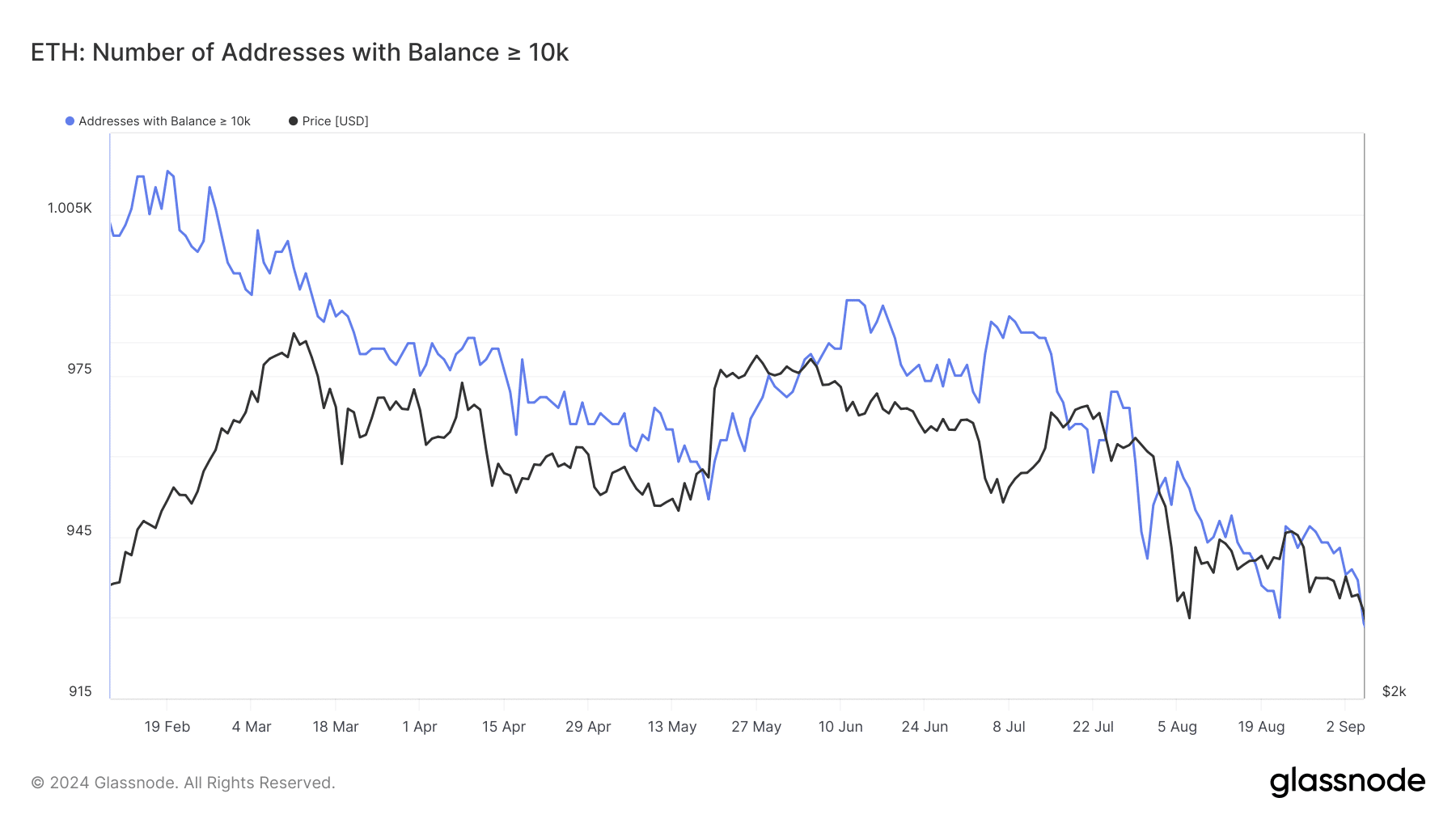

An evaluation of Ethereum addresses on Glass junction reveals totally different reactions to latest value actions throughout totally different classes of holders. Addresses holding 10-100 ETH have remained comparatively steady, indicating no vital sell-offs or new accumulations.

Nonetheless, extra vital actions had been noticed at bigger addresses. For addresses holding 1,000-10,000 ETH, accumulation stopped in the direction of the tip of August.

There has additionally been a noticeable decline in possession since then, which signifies redistribution or sell-off. This shift means that mid-range whales are decreasing their publicity.

Supply: Glassnode

Moreover, bigger addresses holding 10,000 ETH or extra have scaled again their accumulation even sooner.

Information present that these addresses stopped accumulating round July, and just like the 1,000 ETH addresses, they’ve additionally redistributed or offered their holdings since then.

The latest progress of the Ethereum community provides optimistic indicators

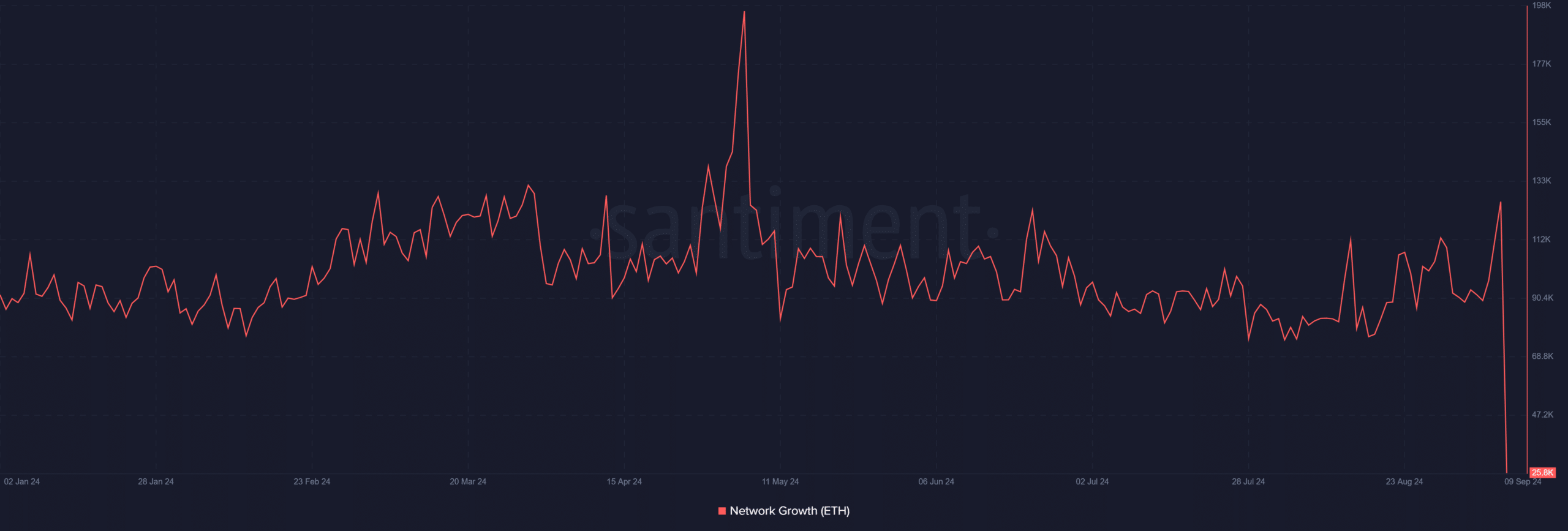

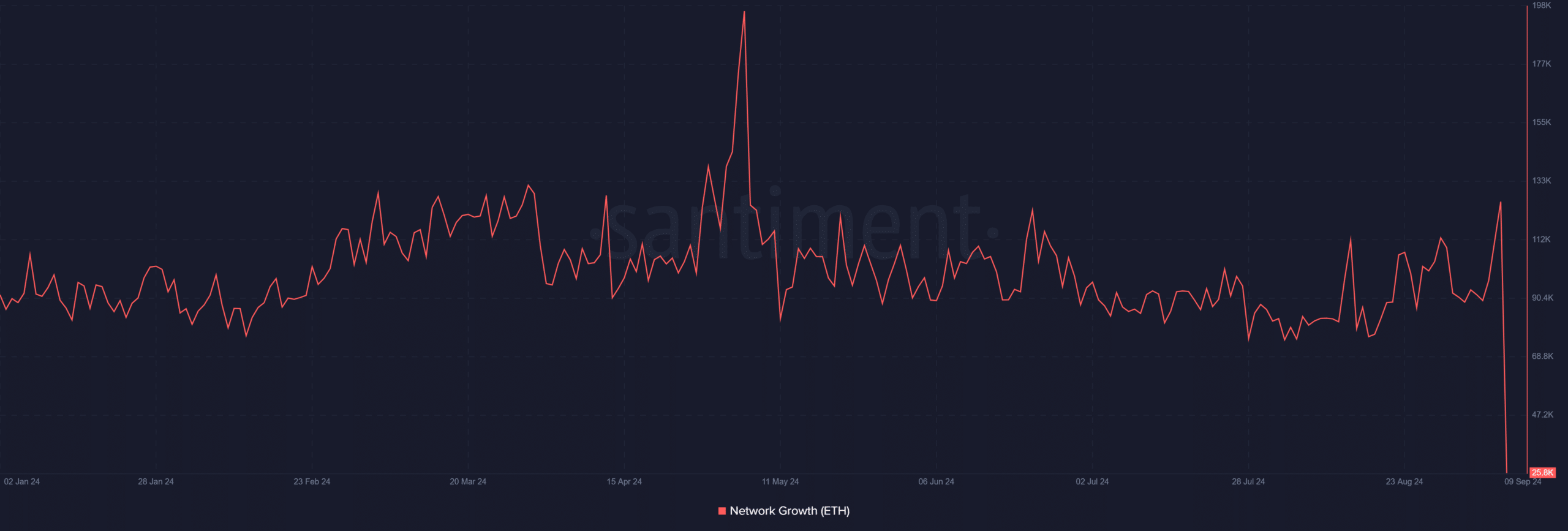

The latest decline in whale deal with accumulation could possibly be interpreted as a unfavorable indicator for Ethereum, signaling warning amongst giant holders. Nonetheless, the optimistic progress of the community in new addresses affords a extra optimistic outlook.

Supply: Santiment

In accordance with information from SantimentEthereum lately hit a four-month excessive in every day new addresses, rising to over 126,000. That is the best degree since June and is notable as a result of it occurred on a Sunday.

There may be often much less community exercise on at the present time.

ETH ends the weekend on a optimistic observe

An Ethereum evaluation on the every day chart exhibits optimistic value motion over the weekend. On the finish of buying and selling on September 8, ETH noticed a 1% improve and was buying and selling round $2,297.

This adopted a 2% improve within the earlier session. On the time of writing, ETH is within the $2,300 value vary, up lower than 1%.

The latest spike in community progress, marked by a rise within the variety of new addresses, highlights the rising curiosity in Ethereum, even amid market volatility.

Whereas whale accumulation has declined, the rise in community participation means that smaller buyers or newcomers have gotten extra lively within the Ethereum ecosystem. This renewed curiosity may assist steadiness the general market dynamics.

Learn Ethereum (ETH) Worth Prediction 2024-25

The interplay between slowing whale exercise and rising community progress will likely be essential in figuring out Ethereum’s future value actions and community energy.

If smaller buyers proceed to point out curiosity, this might offset among the downward stress from lowered whale accumulation, doubtlessly supporting ETH’s value within the close to time period.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024