Ethereum

Ethereum climbs 65% – But is this rally more than just hype? Analyzing…

Credit : ambcrypto.com

- Ethereum’s OI and whale influx rose, which signifies institutional conviction behind the current rally.

- ETH studying and technical methods level to a possible outbreak above $ 2,714 whereas shorts are pressed.

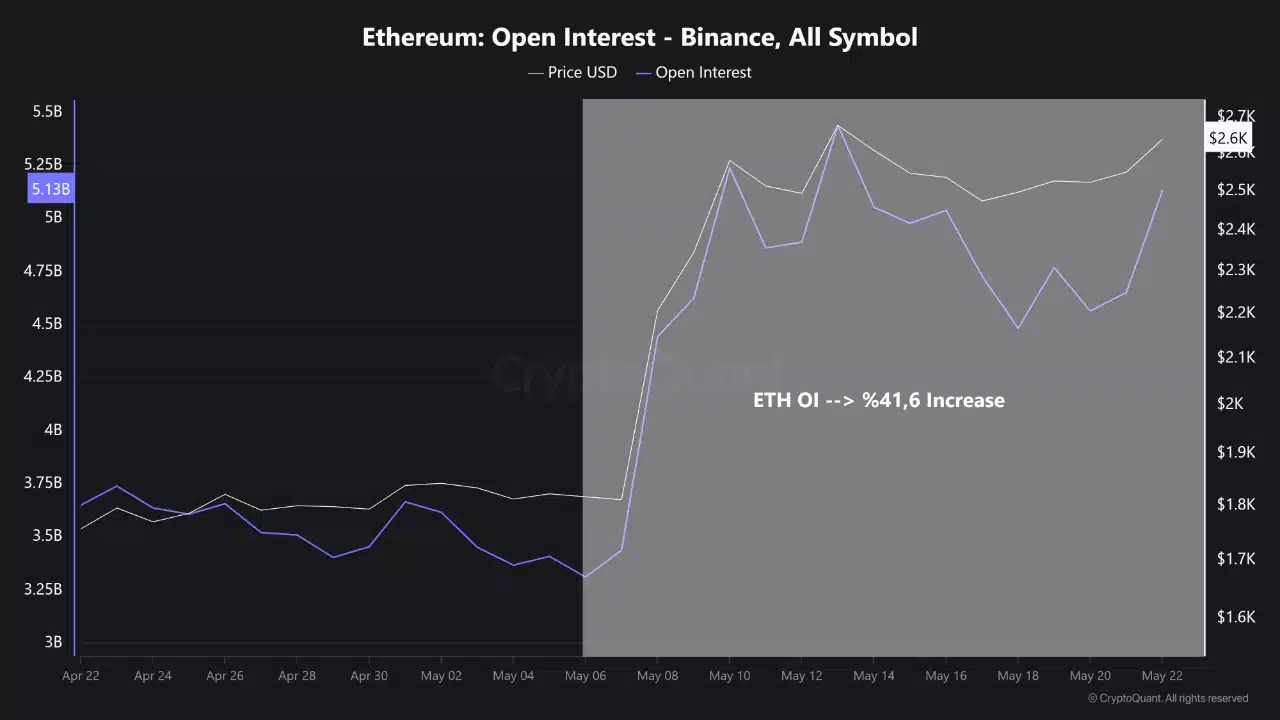

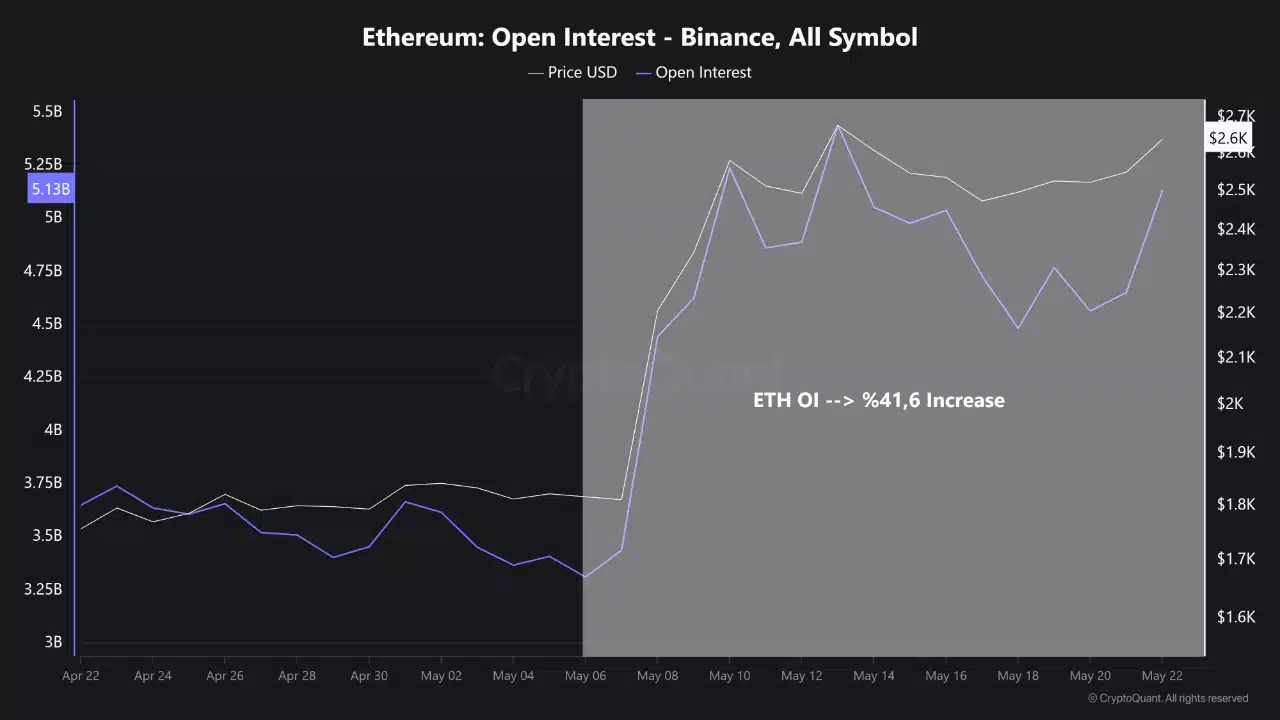

Ethereum’s [ETH] Futures Market has proven outstanding energy previously month.

Open curiosity (OI) on Binance rose from $ 3.6 billion to $ 5.1 billion – 41.6% – with the overall ETH OI in all inventory markets now close to $ 17 billion.

This enhance signifies a robust institutional and by-product conviction behind the ETH assembly.

It’s important that this motion will not be speculative; It’s in step with a worth enhance of virtually 65% from $ 1,600 to $ 2,663.72.

That’s the reason the current enhance in Ethereum appears greater than a short lived peak – it displays a structurally supported rally that’s supported by strong participation within the derivatives market.

Supply: Cryptuquant

Whale influx accelerates

In simply seven days, the main holders of Ethereum rose by 22.8percentwith an enormous enhance of 30 days of 1057.08percentand a bounce of 90 days of 392.80%.

This Golf suggests persistent accumulation of institutional entities and lengthy -term holders.

Furthermore, the timing of this influx corresponds to the outbreak of Ethereum above $ 2,600, which confirms that the deep pocket traders proceed to wager on the pinnacle.

Supply: Intotheblock

Whereas the buildup persists, the ETH alternate reserves have elevated by 3.93%, a complete of $ 51.17 billion. Normally rising reserves could point out the upcoming gross sales strain as extra ETH turns into accessible at commerce festivals.

Nonetheless, this enhance could as a substitute be a mirrored image of the rotation, by which merchants pour ETH for publicity to derivatives or to cowl positions.

ETH is confronted with a big impediment for $ 2,714

Ethereum traded round $ 2,663, simply shy of a robust resistance bond between $ 2,714 and $ 2,741. The stochastic RSI was above 79, which signifies overbought situations, whereas Bollinger tires sign a decreased volatility.

A decisive closure above $ 2,741 would in all probability open the door for a breakout rally to $ 3,000. Nonetheless, not breaking this zone may cause a short-term retracement to $ 2,581.

That’s the reason ETH is at a crucial technical second that the method may dictate for each itself and the broader Altcoin market within the quick time period.

Supply: TradingView

Shorts are pressed

Spinoff knowledge confirms the rising bear capitulation.

On 23 Could, ETH -Liquidations confirmed quick positions price $ 17.88 million that was worn out over commerce festivals. Binance and Bitfinex led the liquidations, whereas lengthy positions have been solely good for $ 12.56 million.

This steady squeeze has strengthened the Rally of ETH, particularly as a result of open curiosity and whale Netflows each assist the transfer.

Supply: Coinglass

Can ETH $ 2 2,714 break and activate the subsequent Altcoin Golf?

Ethereum appears nicely positioned to interrupt over the resistance of $ 2,714, supported by robust statistics on the chain and derivatives.

The sharp rise within the flaw cream movement, steady quick liquidations and a rise of 41.6% in OI verify a strong bullish momentum. Though reserves have risen barely, this has not weakened the broader Bullish Setup.

That’s the reason a profitable outbreak above $ 2,714 would in all probability mark the beginning of a brand new Altcoin rally, with ETH being in cost.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now