Altcoin

Ethereum compensions fall by 70% – will it cause an increase in activity?

Credit : ambcrypto.com

- The reimbursement of Ethereum and the rising accumulation can point out the beginning of a marketbound

- Lower in ETH Trade Reserves on a possible provide squeeze and coming value rally

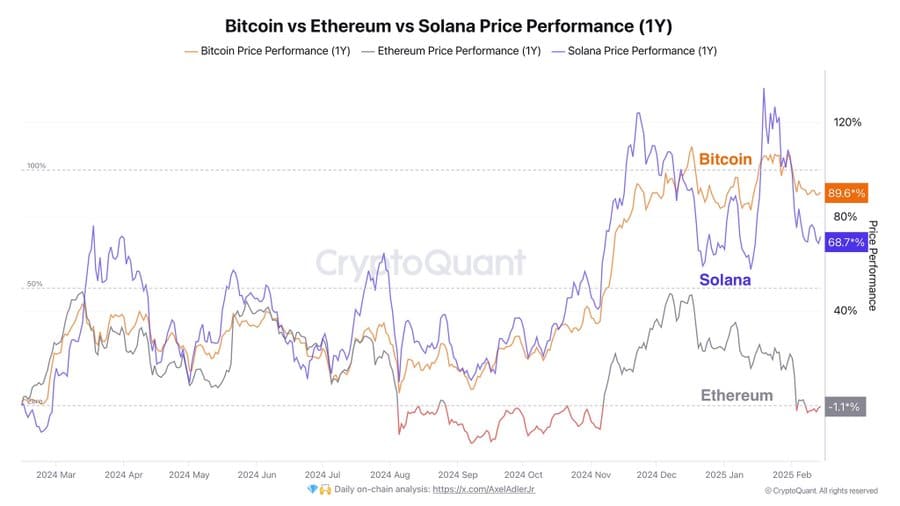

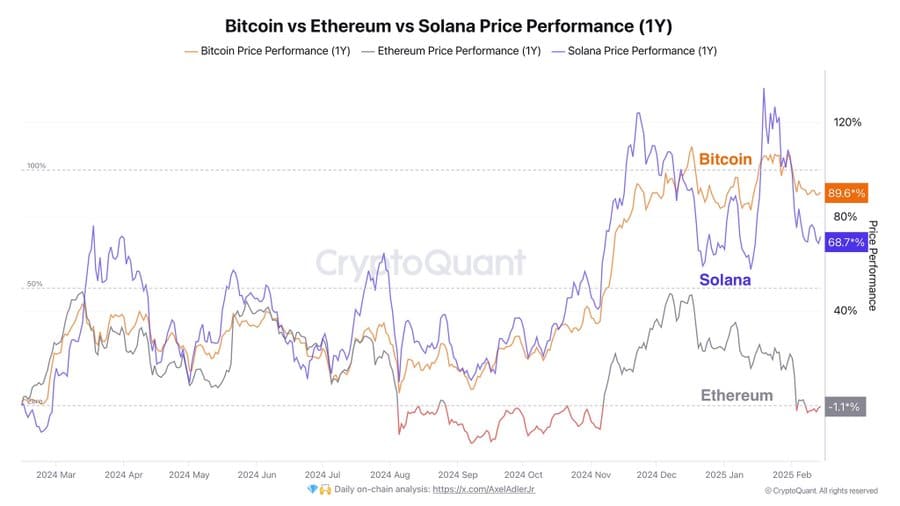

Ethereum [ETH] Has suppressed lower than a 12 months in comparison with his colleagues. Nonetheless, new knowledge on chains could point out a attainable shift. Whereas ETH has fallen 1.1% on an annual foundation, Bitcoin [BTC] and Solana [SOL] have made an unlimited revenue.

Now two essential developments – the autumn of transaction prices and accumulating accumulation – could be drawing of the rising belief of buyers.

Can this point out the beginning of a revival of Ethereum?

The decrease reimbursements affect community exercise and acceptance

The transaction prices of Ethereum have This week fell by more than 70%With complete each day prices now at $ 7.5 million, a lower of $ 23 million just some weeks earlier. This lower follows a current enhance in fuel restrict, which successfully expands the block capability and reduces congestion.

Traditionally, decrease prices are correlated with a better community use. Throughout earlier reimbursement, in 2021 and mid -2023, for instance, each day energetic addresses and transaction officers will rise.

If this sample applies, Ethereum might see a renewed enhance in actions within the chain. Nonetheless, what’s essential is whether or not this enhance within the exercise interprets into persistent demand as a substitute of speculative broadcasts within the quick time period.

Signalert the sharp fall in ETH trade reserves A provide?

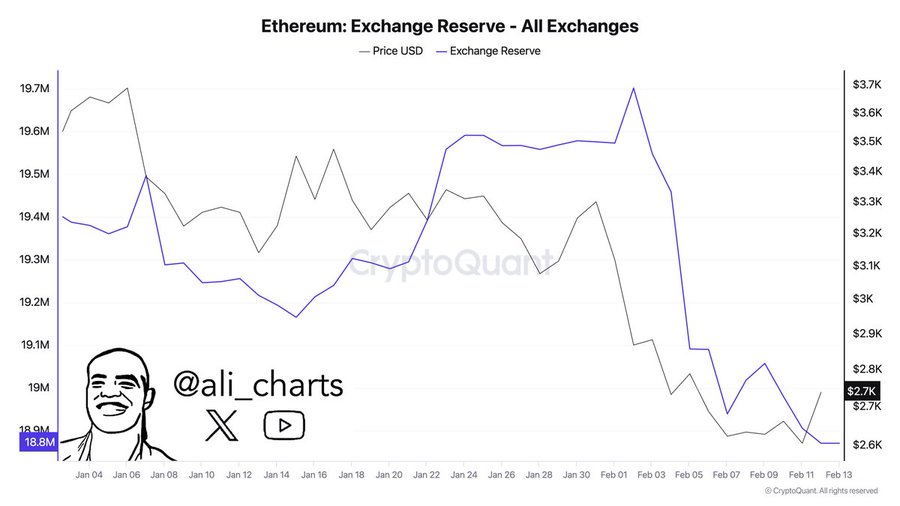

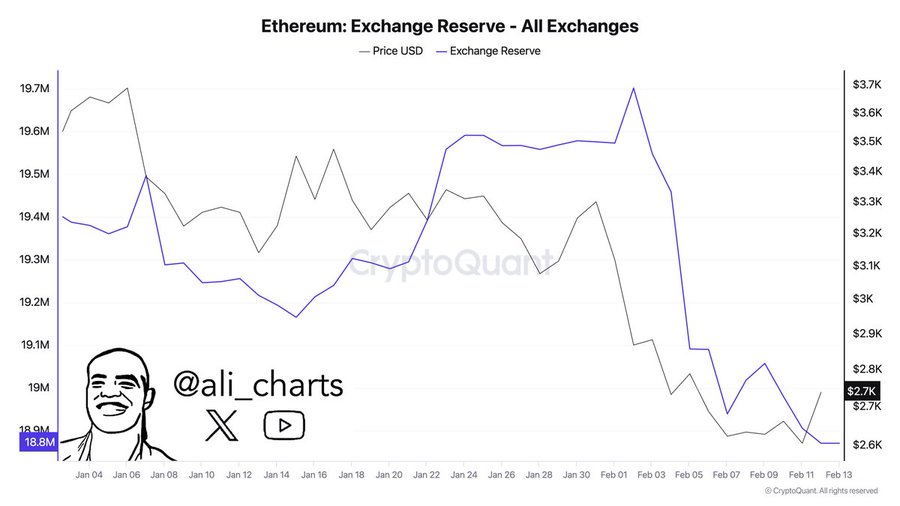

Ethereum Trade reserves have fallen sharplyFrom 19.7 million ETH in early January to 18.8 million ETH in simply 10 days.

Such a pointy decline is an indication that buyers transfer belongings to self -coasts, making the speedy inventory accessible for promoting.

Supply: X

Traditionally, such sharp drawings have typically preceded value rallies. The final comparable lower within the trade reserve occurred in This autumn 2023, which was adopted by a value die of 35% in the course of the subsequent two months.

If this value pattern continues, Ethereum could be confronted with a proposal. Particularly when the demand returns along with decrease reimbursements.

Technical indicators present an absence of bullish momentum

Supply: X

Regardless of the advance of on-chain statistics, nonetheless, on the time of the press, Ethereum was still down 1.1% yoj. It was left with Bitcoin (+89.6%) and Solana (+68.7%).

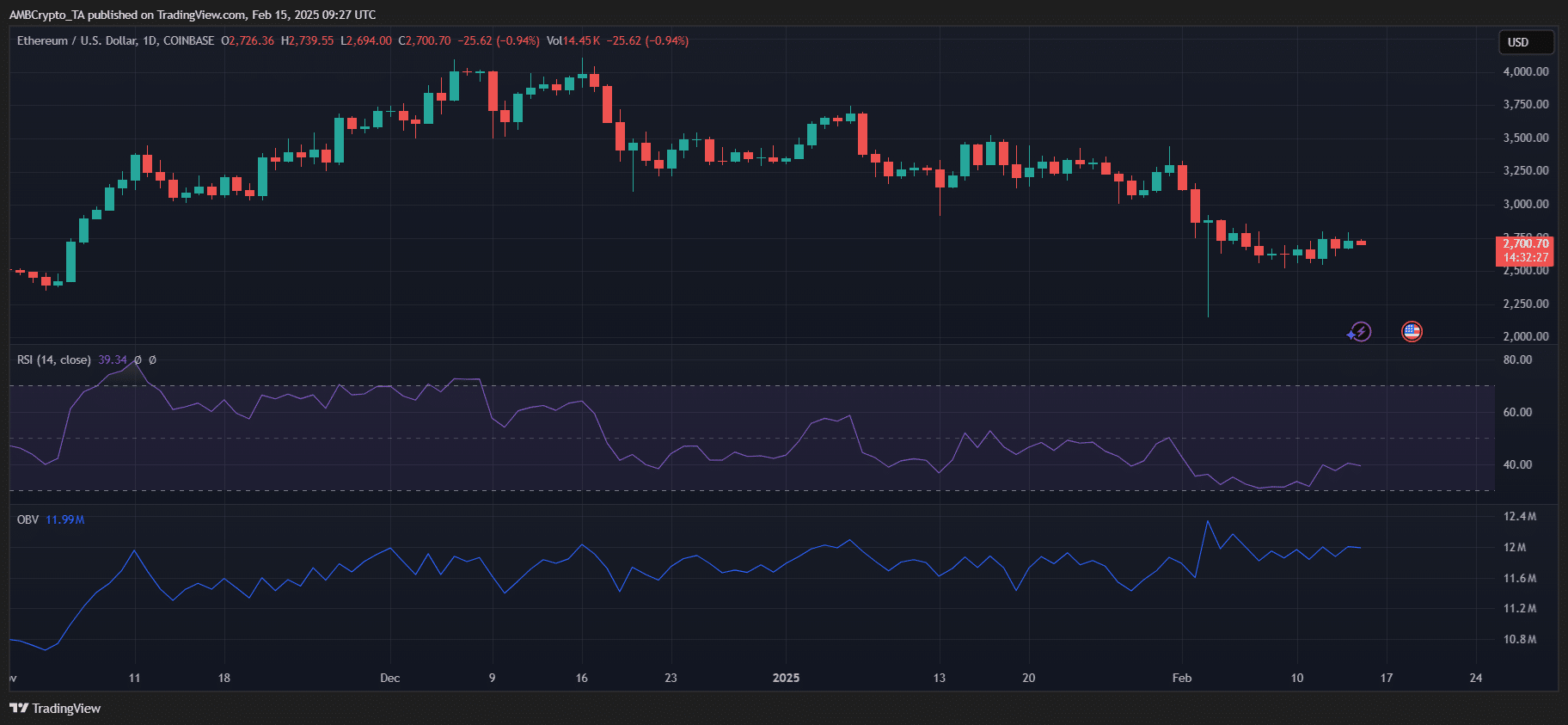

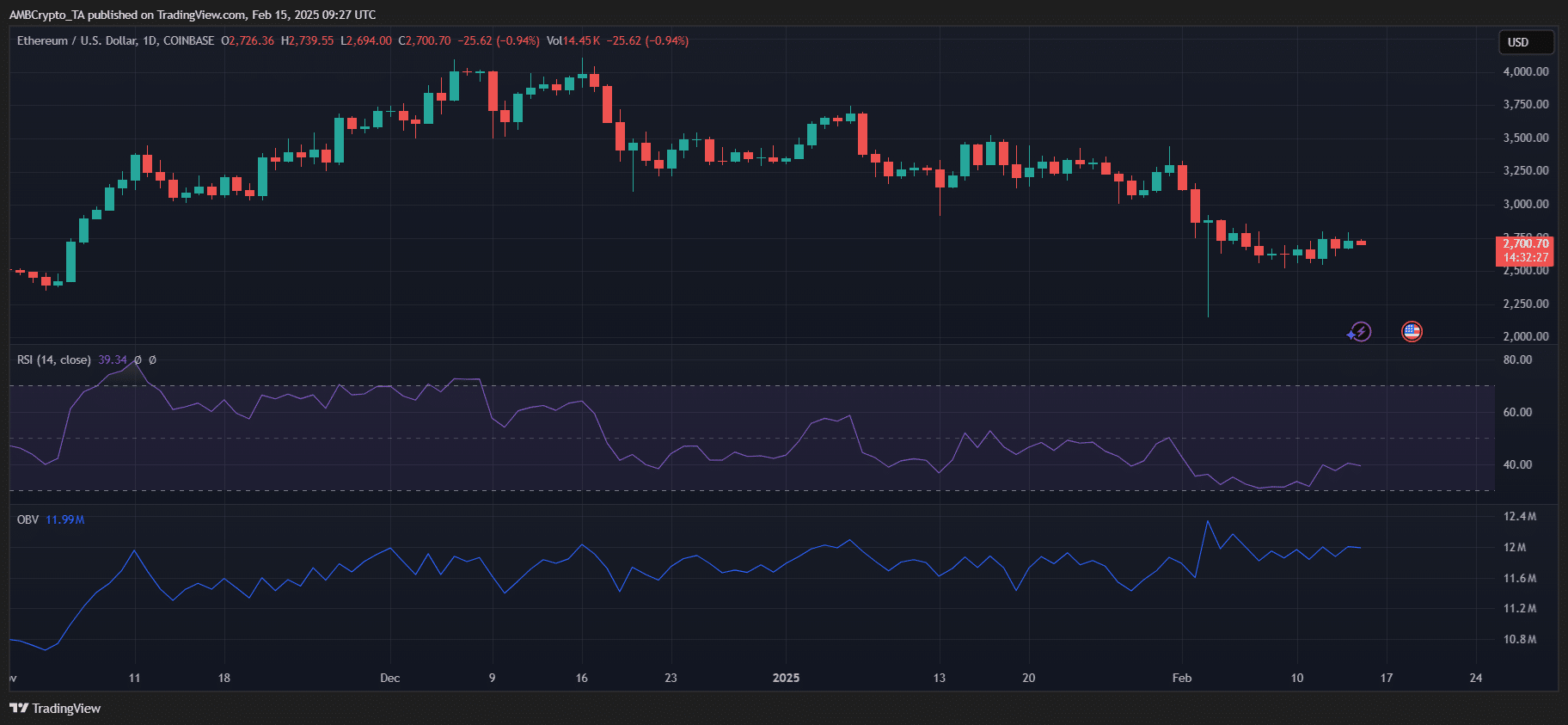

Supply: TradingView

Latest knowledge additionally emphasised a robust resistance round $ 2,800, with ETH struggling to interrupt above it regardless of growing accumulation. The RSI was at 39.34, indicating that though Ethereum could be virtually over -sold circumstances, it mustn’t get a bullish momentum but.

Furthermore, the OBV confirmed an absence of sturdy buying stress – an indication that though the provision has been tightened, demand has to rise.

To interrupt out ETH, it wants a decisive push past the vary of $ 2,800- $ 2,900 supported by an growing quantity. If this fails, a retest of $ 2,500 stays a chance for a protracted -term benefit.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now