Ethereum

Ethereum Could Surge To $15K As Institutions Pile In: Research

Credit : www.newsbtc.com

In response to Fundstrat Analysis, Ether might climb a lot larger earlier than the top of 2025, with worth targets starting from $ 10,000 to as excessive as $ 15,000.

Associated lecture

Present reviews Ether Steprogged round 60% within the final 30 days and reached a 4 -year excessive level close to $ 4,770 in early commerce, whereas different protection positioned the token at $ 4,694 and seen a rise of 78% on a stretch of eight weeks.

These actions have pushed Ether near his peak of all time and fund managers take information.

Fundstrat -Targets and Reasoning

In response to the Chief Data Officer Tom Lee from Fundstrat and head of digital property analysis Sean Farrell, institutional forces and new guidelines are vital elements.

They level to Stablecoin work and tokenized initiatives which can be primarily constructed on Ethereum, and so they point out regulatory efforts such because the Genius Act and the SECs so -called Project Crypto As elements that may speed up the transfer from Wall Road to Blockchain rails.

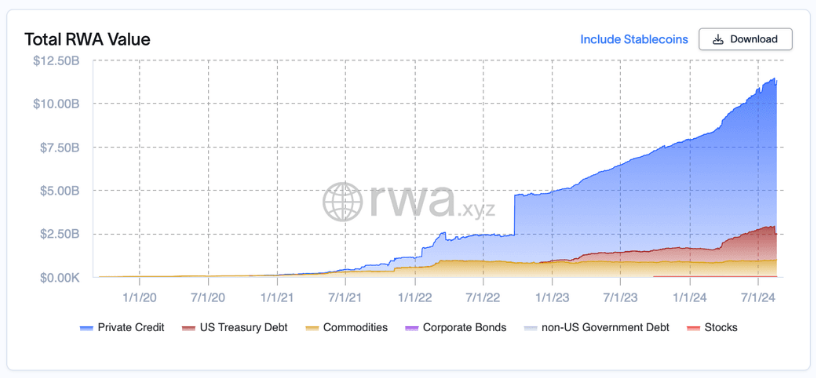

Primarily based on knowledge, Ethereum has a commander of a 55% share of the $ 25 billion Actual-World assets-tokenization sector, a stat that Fundstrat makes use of to argue for a broader institutional acceptance.

Institutional demand and enormous patrons

Experiences have introduced giant -scale enterprise accumulation that varied analysts say it’s amassing the inventory of the market.

Bitmine Immersion Applied sciences has reportedly added round 1.2 million ETH for the reason that starting of July, which signifies that the corporate has round $ 5.5 billion in Ether in its books. Enterprise inventory (BMNR) has been risky, with some protection that factors to a soar of 1,300% for a brief interval.

Fund strate And different observers say that such enterprise treasury, mixed with contemporary ETF flowsMight create a structural bid for ETH if shopping for is maintained.

Rachael Lucas, a crypto analyst at BTC markets, described these positions as strategic and in the long run and stated that they take away “substantial liquidity” from buying and selling swimming pools.

Market momentum and worth claims

In response to Fundstrat, Ether performs higher than Bitcoin this 12 months. One set of numbers positioned ETH’s year-to-date revenue at 28% in opposition to the 18% of Bitcoin, whereas different reviews extra just lately confirmed an ETH enhance of 41% YTD and Bitcoin with 30% YTD, with BTC commerce nearly $ 121,000 in that snapshot.

Primarily based on reviews, the analysts of Fundstrat ETH regard as one Large macro trade Proceed to stimulate query in the course of the subsequent 10 to fifteen years as institutional and regulatory traits.

Analysts warn that elevated targets want persistent, giant influx to turn into actuality. Be careful for the tempo and consistency of ETF flows, disclosure protectors of corporations and all regulatory actions round stablecoins and guardianship guidelines.

Associated lecture

There may be additionally a sensible care: giant, concentrated purchases can sharpen the markets shortly, however also can reverse if sentiment shifts or change liquidity wants.

In response to Fundstrat evaluation and public feedback, the Bullish Case for Ether turns into clear and supported by particular figures: $ 10,000 to $ 15,000 targets, enterprise treasury with hundreds of thousands of ETH and fast latest revenue.

Featured picture of meta, graph of TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September