Ethereum

Ethereum developers and investors alike worry of poor leadership

Credit : ambcrypto.com

- ETH has fallen by 47% prior to now yr.

- The poor efficiency of Ethereum left the Altcoin left behind at BTC as a result of it slowly misplaced its lead.

For the reason that starting of 2025, Ethereum [ETH] has needed to cope with appreciable struggles. As such, the Altcoin that was as soon as introduced as a bitcoin is [BTC] Challenger is struggling to compete with smaller cash.

These poor efficiency has attracted the eye of vital stakeholders and common media. In line with a current Bloomberg reportEthereum is confronted with probably the most difficult interval whereas taking its second decade of operations.

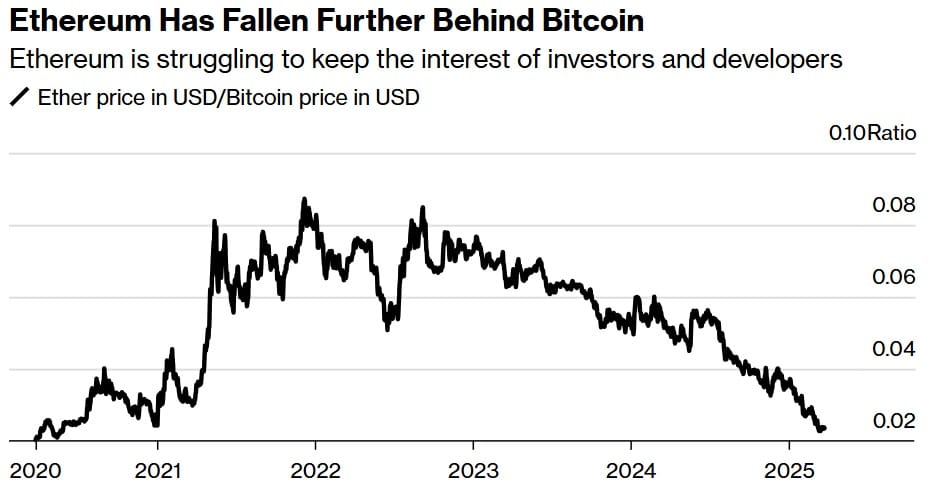

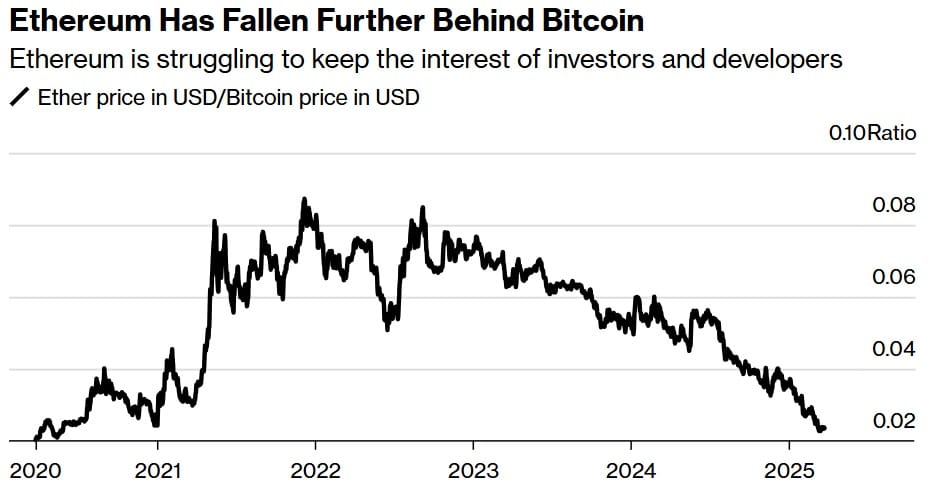

Supply: Bloomberg

As such, Ethereum builders have fleeed, early followers are offended and the token has began at each BTC and its smaller opponents.

Though Ethereum stays the second largest crypto with a market capitalization of $ 221 billion, ETH has fallen significantly. ETH has fallen by greater than 44% YTD and drops from $ 3.6k in January 2025 to $ 1.8k.

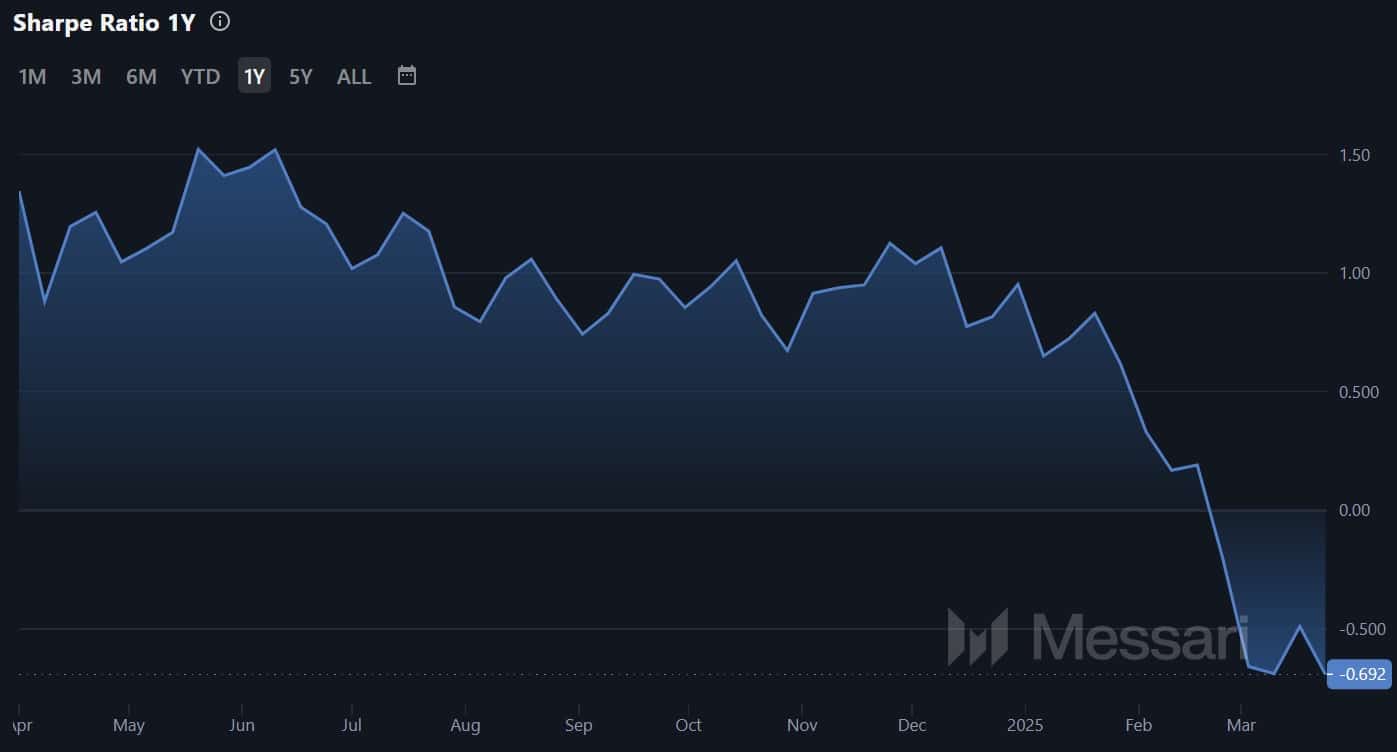

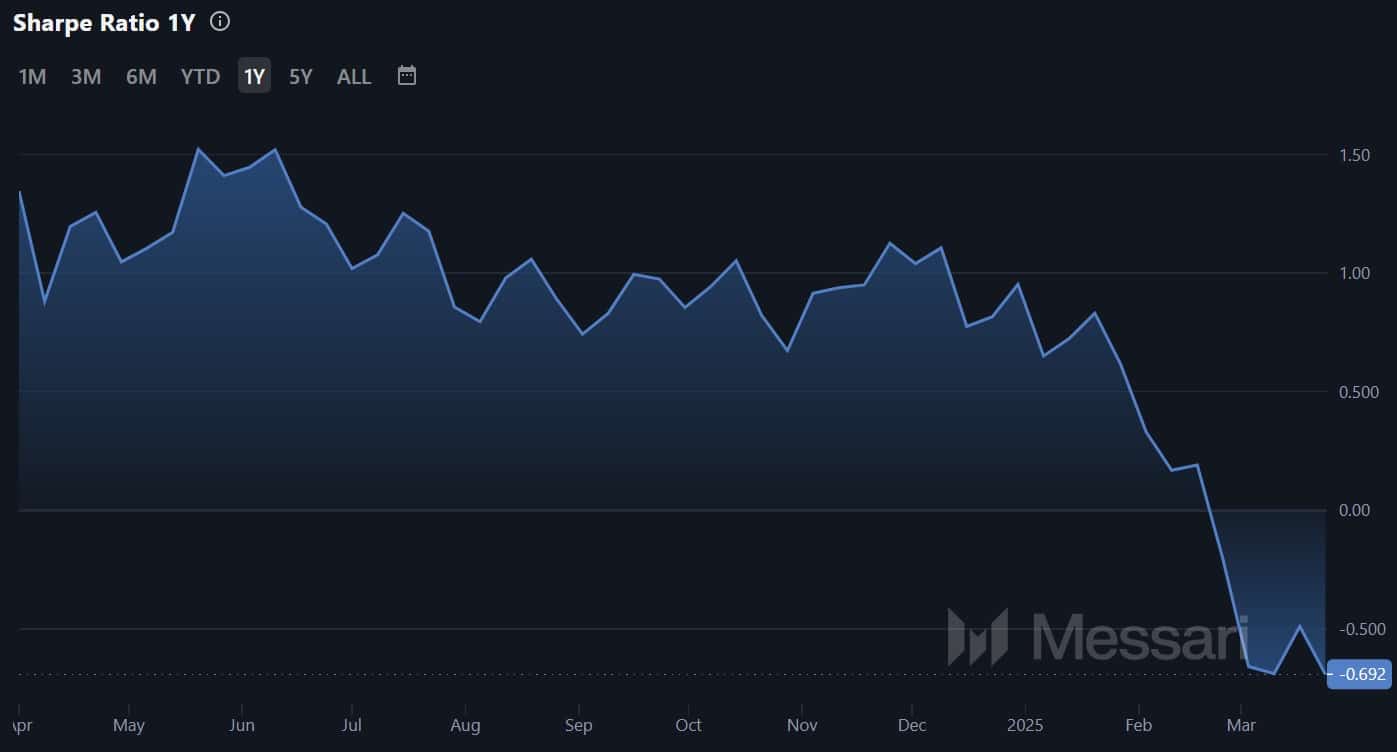

Supply: Messari

The Altcoin has taken care of this decline because of the worst quarterly lower for the reason that Bears market in 2022. Up to now yr, though BTC has risen by 30%, Ethereum has fallen by 47percentand is slowly dropping its lead over opponents.

This has resulted in its market dominance as much as 7.9% of 17% prior to now yr. So his opponents have grown quicker and for a very long time.

For instance, the variety of energetic builders on Ethereum-related software program fell by 17% in 2024. [SOL] Noticed a powerful enhance in energetic builders.

Solana has subsequently grow to be a well-liked hub for Memecoins with the community with a development of 83% on an annual foundation.

This will also be seen towards different cash, equivalent to Ripple’s XRP. Though ETH has fallen prior to now yr, XRP has risen by 249% on its worth charts, with market capitalization rising from $ 30 billion to $ 127 billion.

Supply: Messari

With the fixed poor efficiency of ETH, the Altcoin has grow to be very unattractive for buyers. Trying on the Sharpe ratio of ETH prior to now yr, it has fallen to -0.69.

Which means funding returns haven’t solely been taken, however it has grow to be a dangerous funding in comparison with threat -free property.

What occurs to Ethereum?

In line with an important stakeholders, one of many elementary challenges that affect Ethereum is management. In his evaluation, Ryan Watkins famous that the management of Ethereum was unable to profit from the earlier momentum.

He seen,

“It is all about development and management – if the Ethereum ecosystem would stay the identical with or surpassed, his colleagues, none of those above would matter.”

This management adoption was additionally seen by Bloomberg, who blamed the founding father of Ethereum Vitalik Buterin, failing to adapt to alter.

Below his management, Ethereum is caught in early visions on decentralization that doesn’t bundle forces with politicians, and lobbying in Washington DC whereas different gamers be a part of a pro-crypto authorities.

Buterin has remained essential of politicians, making them or considered one of them crypto cash. BUTERIN has left this imaginative and prescient of a totally decentralized blockchain within the chilly whereas different gamers be a part of forces with governments.

What for ETH now

In line with Ambitrypto’s evaluation, Ethereum was on a powerful downward stress on the time of the press. The Altcoin traded at $ 1839 and marked a lower of two.11percentlast day.

Equally, ETH has fallen by 8.39% on weekly playing cards, which means robust unfavorable sentiments.

Supply: TradingView

Trying on the graphs of ETH, the Stoch RSI indicated a possible continuation of this downward development. Since making a bearish crossover 5 days in the past, Stoch has fallen to 14.6 because of a powerful downward momentum.

Subsequently, if the exterior elements noticed above stay unfavorable, the dip may proceed. An additional drop ETH may fall to $ 1761. For a bullish prospect to rise once more, ETH should reclaim and retain above $ 2K.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now