Ethereum

Ethereum dips below its realized price amidst bearish sentiments

Credit : ambcrypto.com

- ETH has fallen by 29% up to now month.

- Ethereum drops below the value realized whereas Bearish hold sentiments.

The final day, Ethereum [ETH] has skilled a robust downward stress and falls to achieve the extent of October 2023 of $ 1754.

Since then, nonetheless, the Altcoin has achieved a average restoration to achieve $ 1876 from this writing. This meant a lower of 29.01% in latest months.

Supply: Glassnode

As ETH fell, it fell beneath the realized worth for the primary time in two years. This lower means that common traders now hold ETH on non -realized loss.

The autumn from Ethereum to this stage dangers capitulation, as a result of lengthy -term holders begin promoting in panic who worry additional deterioration.

Equally, the lower means that ETH experiences extraordinarily bearish sentiment, by which traders proceed to promote, resulting in sturdy downward stress.

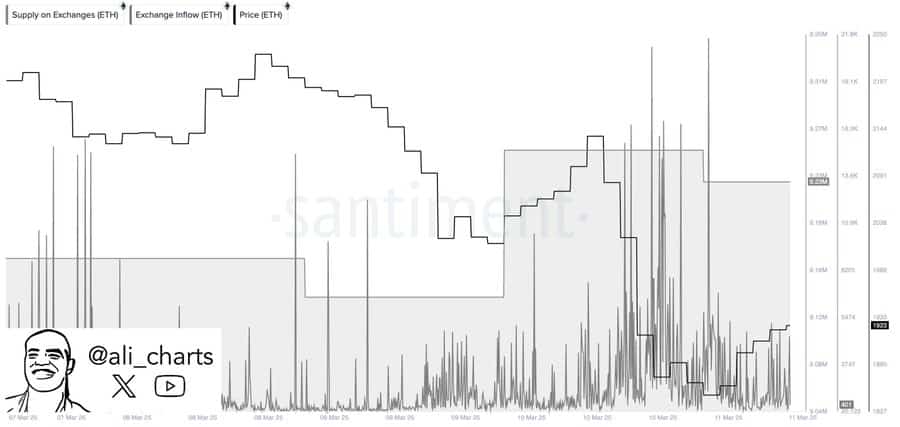

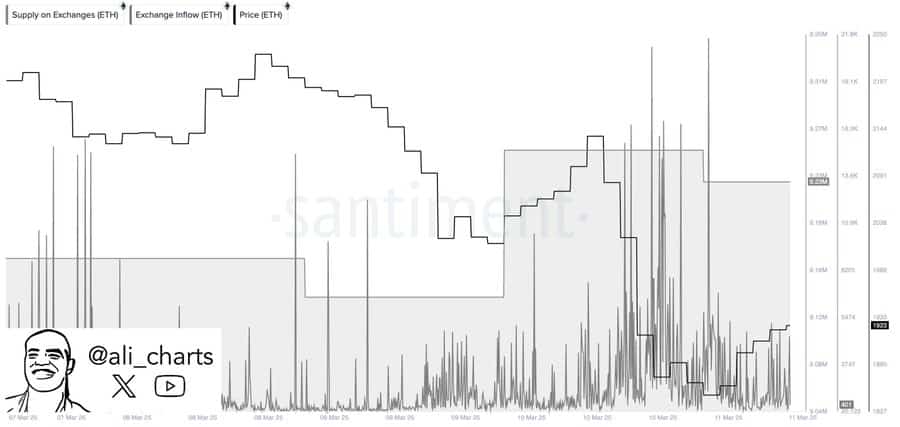

Supply: Ali_Charts/X

Taking a look at trade flows, it appears that evidently this dip comes from appreciable gross sales actions. As such, ETH has registered a optimistic trade influx up to now two days with greater than 100k ETH tokens which were despatched to exchanges.

This means that traders have actively offered the Altcoin to scale back their losses.

As such, the markets have registered two consecutive days of Optimistic Trade Netflow. When this turns into optimistic, this implies that there’s extra influx to trade than withdrawals that replicate sturdy arary sentiments.

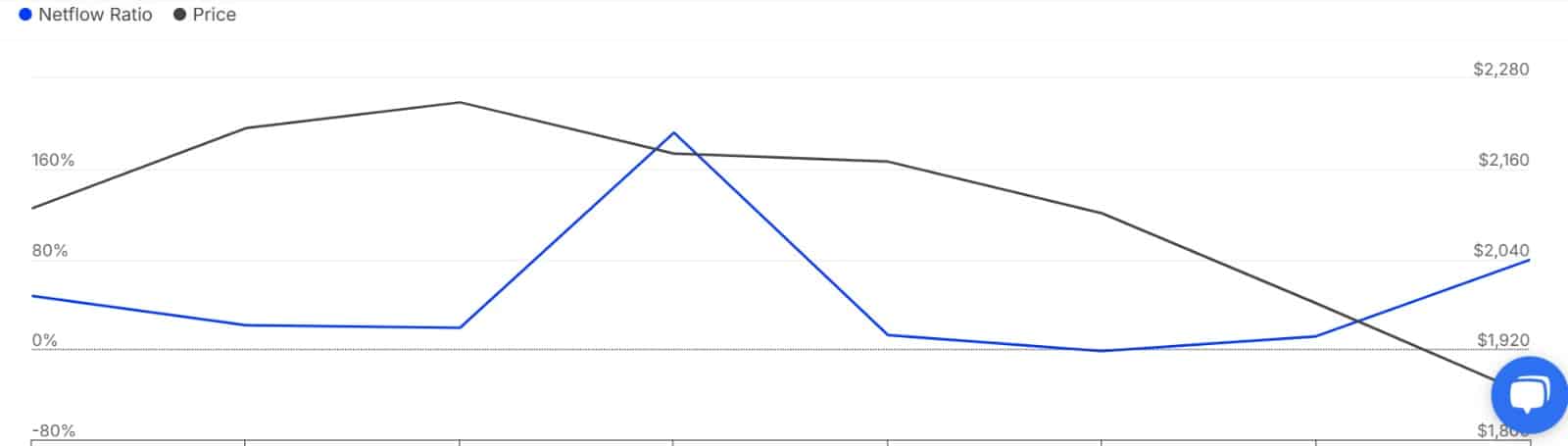

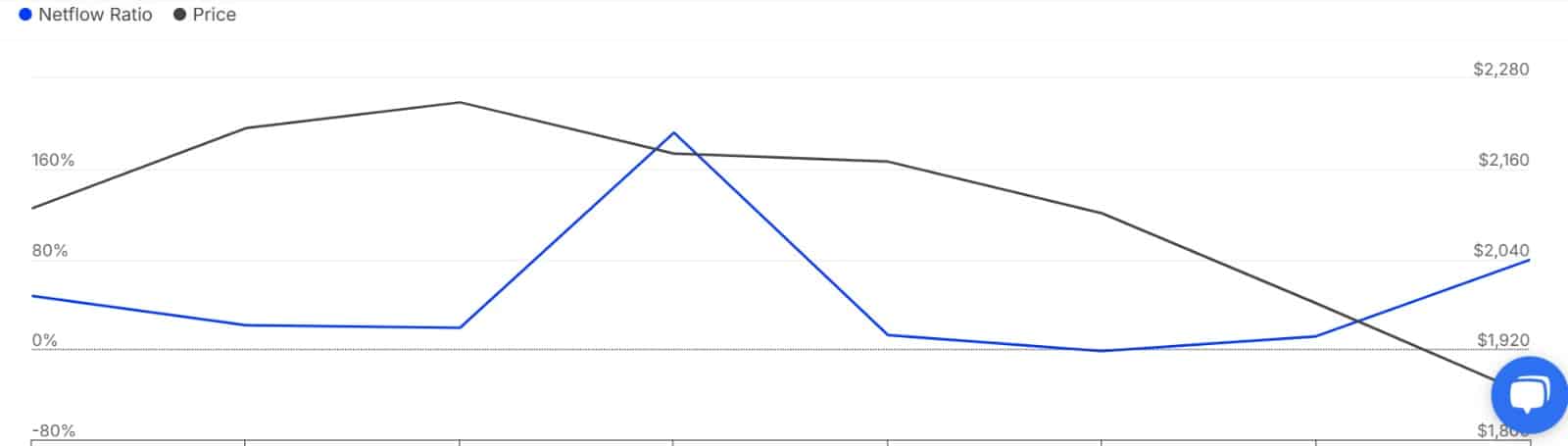

Supply: Intotheblock

This sentiment can be frequent with whales. In actual fact, the big holders of Ethereum De Netflow -Ratio rose within the final day to achieve 79%.

Such an enormous peak means that whales actively ship their participations to trade in preparation to promote.

When the influx of whale trade will increase, this means an absence of market confidence by which giant holders worry in the long run for extra losses.

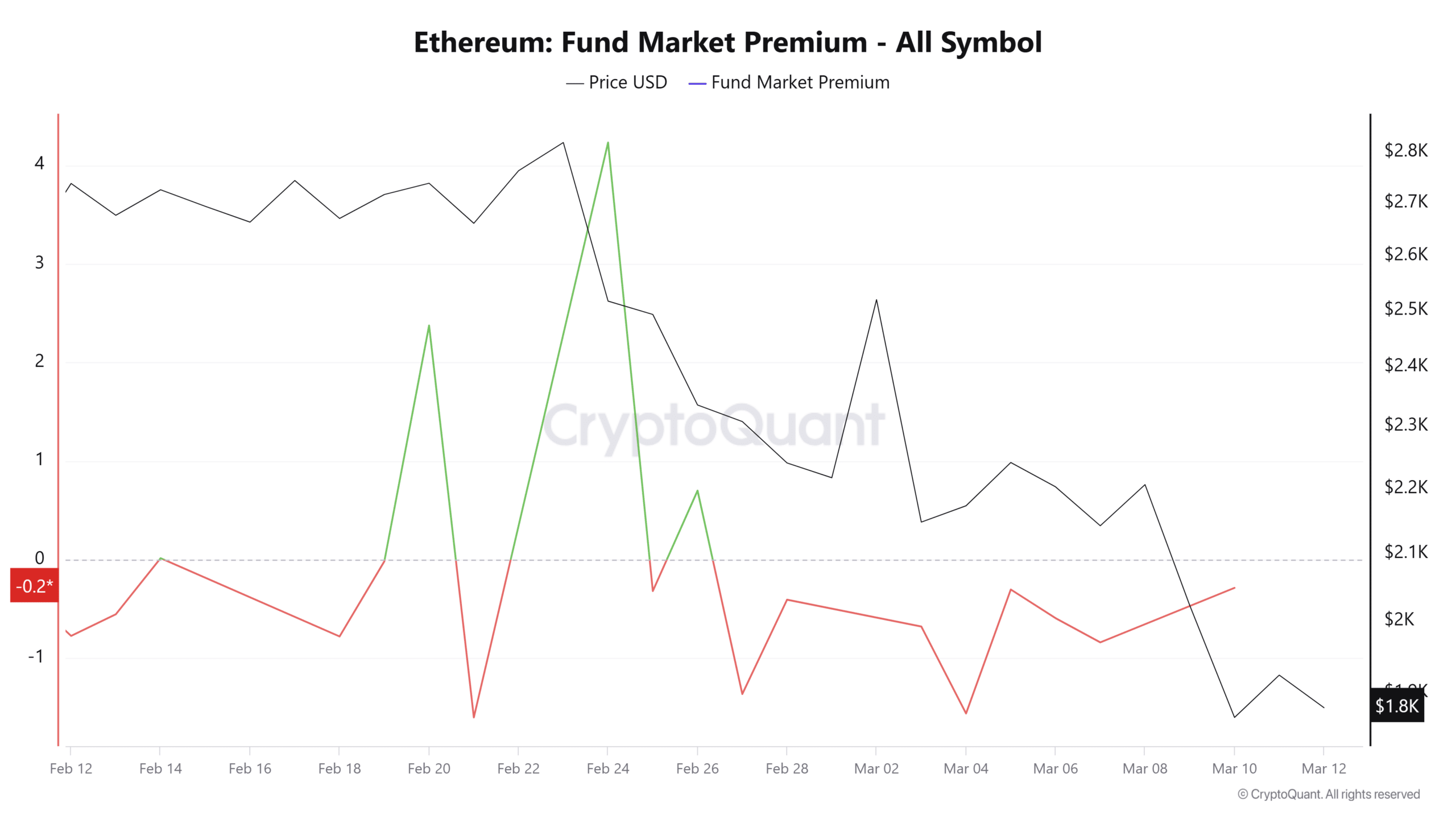

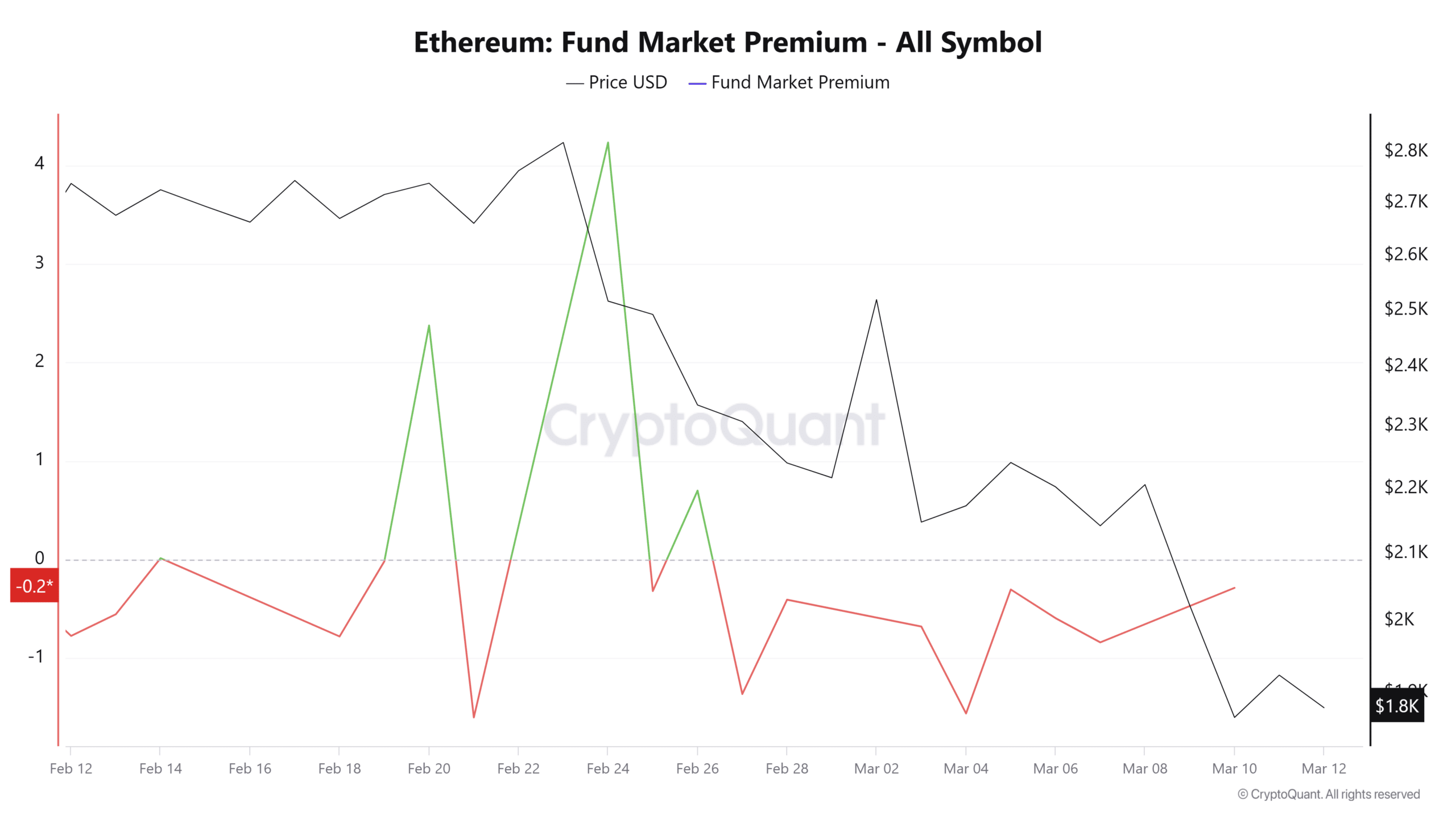

Supply: Cryptuquant

Lastly, the market premium of Ethereum has remained destructive for an extended -term interval. Traders have remained bearish and there’s a low institutional or whale query to ETH.

So markets see a risk-off sentiment.

What’s the subsequent step for ETH?

The present market situations place ETH for extra losses on its worth charts, until optimistic occasions carry speculative demand for a rebound.

Nevertheless, when costs fall beneath the value realized, it affords an ideal shopping for choice and it has provided a substantial return traditionally.

Thus, with sturdy ararish sentiments that use available on the market, EH $ 2058 has to reclaim what the value realized is for a possible reversal of prime. If this stage will not be recovered, the following assist for the Altcoin is $ 1440.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September