Altcoin

Ethereum Dominance Declines – Is ETH Ready for Recovery or Decline?

Credit : ambcrypto.com

- Ethereum’s dominance is declining whilst its general market capitalization will increase.

- ETH remaining above all weekly transferring averages signifies energy.

Ethereum [ETH]the second largest cryptocurrency by market capitalization, is dealing with challenges in sustaining its dominance within the broader crypto market.

Though the entire market capitalization of cryptocurrencies, excluding stablecoins, is on an upward development in the long run, ETH’s share of this market is declining.

Presently, Ethereum’s market dominance is simply above 15%, indicating that ETH could possibly be at a pivotal level. With ETH’s market capitalization presently fluctuating from $546 billion to $316 billion, the battle to regain dominance is elevating questions.

Supply: IntoTheCryptoverse

A rise within the whole market capitalization whereas ETH’s inventory falls may point out a divergence, which regularly indicators a reversal or continuation of a development. The uncertainty of whether or not ETH will transfer larger or decrease stays a crucial subject, however what do different metrics say!

ETH stays above weekly SMAs

Ethereum is holding regular at its weekly easy transferring averages (SMAs), providing a bullish outlook. ETH stays above the main SMAs together with the 8SMA and 20SMA, indicating sturdy momentum.

That is an encouraging signal that Ethereum may proceed its restoration, because it has recovered from a deep drop when the worth reached $2,100.

ETH’s skill to carry above these SMAs signifies that each the short-term and long-term upward tendencies stay intact on a weekly foundation. Nonetheless, merchants ought to stay cautious because the upcoming fourth quarter is predicted to convey volatility.

Supply: IntoTheCryptoverse

Regardless of a dip in ETH’s market dominance, these indicators assist the concept that Ethereum continues to be on a bullish path.

Good whales profit

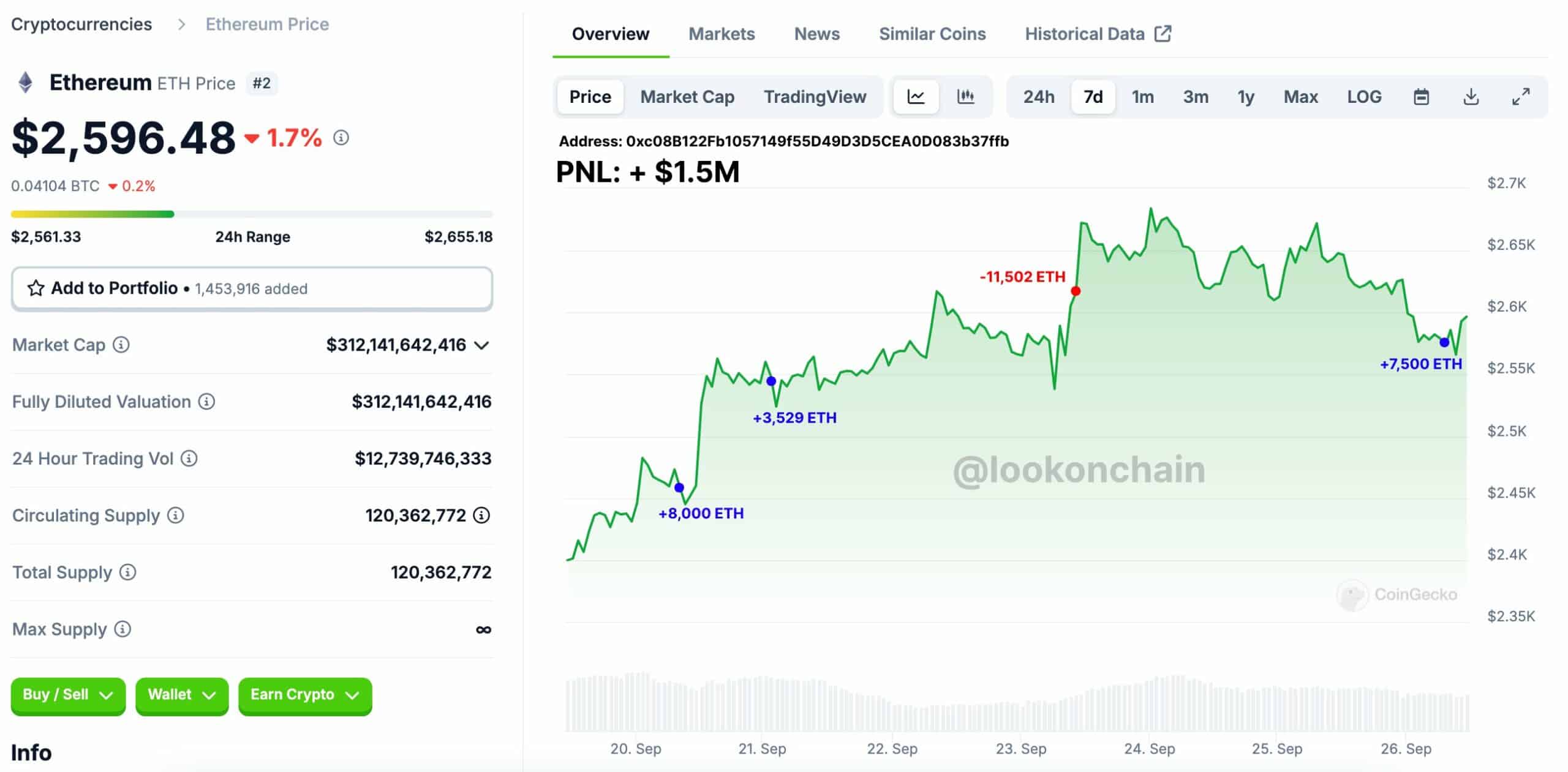

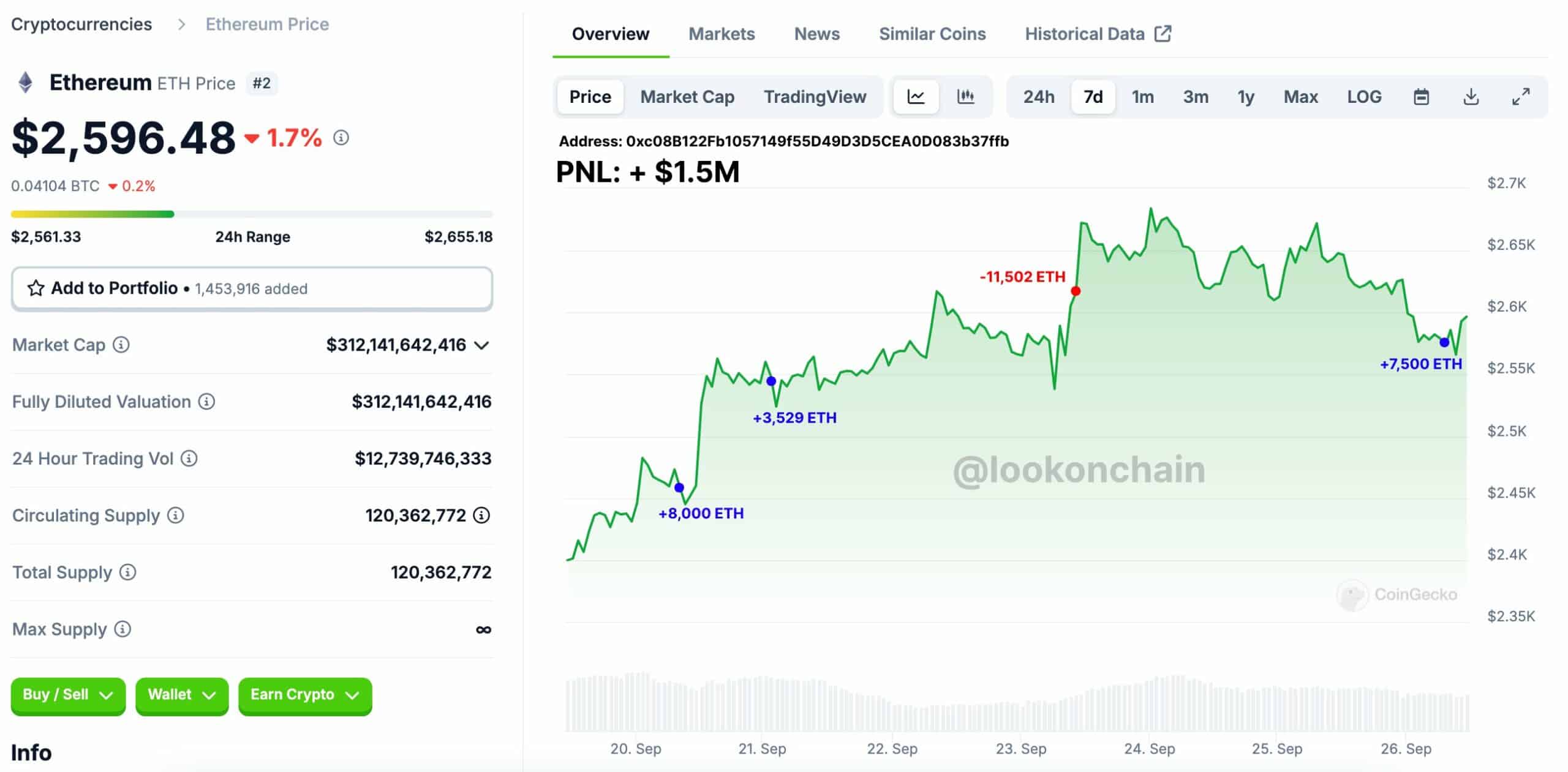

Good whales are benefiting from these swings, offering additional assist for a bullish outlook. Some good merchants have made important earnings by shopping for Ethereum throughout dips.

One whale, 0xe0b5, has persistently traded ETH since August 12, with a 100% success fee over eight trades. This whale purchased over 10,000 ETH price over $26 million and bought at larger costs, incomes over $1.56 million in revenue.

Supply: Lookonchain

One other whale, 0xc08B, purchased 11,529 ETH price over $28 million for $2,485 and bought it simply three days later for $2,618, making a revenue of $1.5 million.

These actions present that main merchants imagine in Ethereum’s potential for larger earnings, regardless of its current dominance struggles.

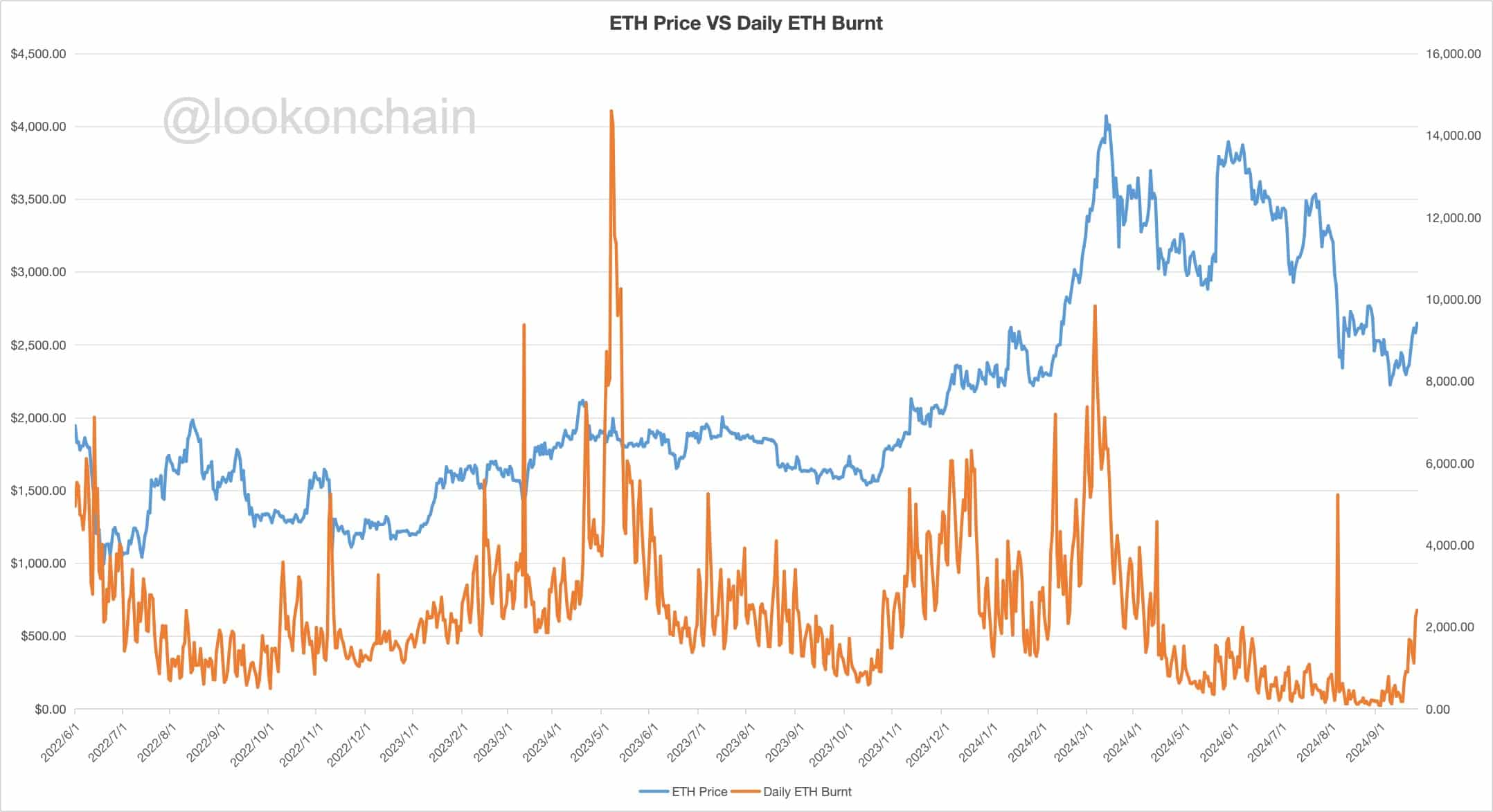

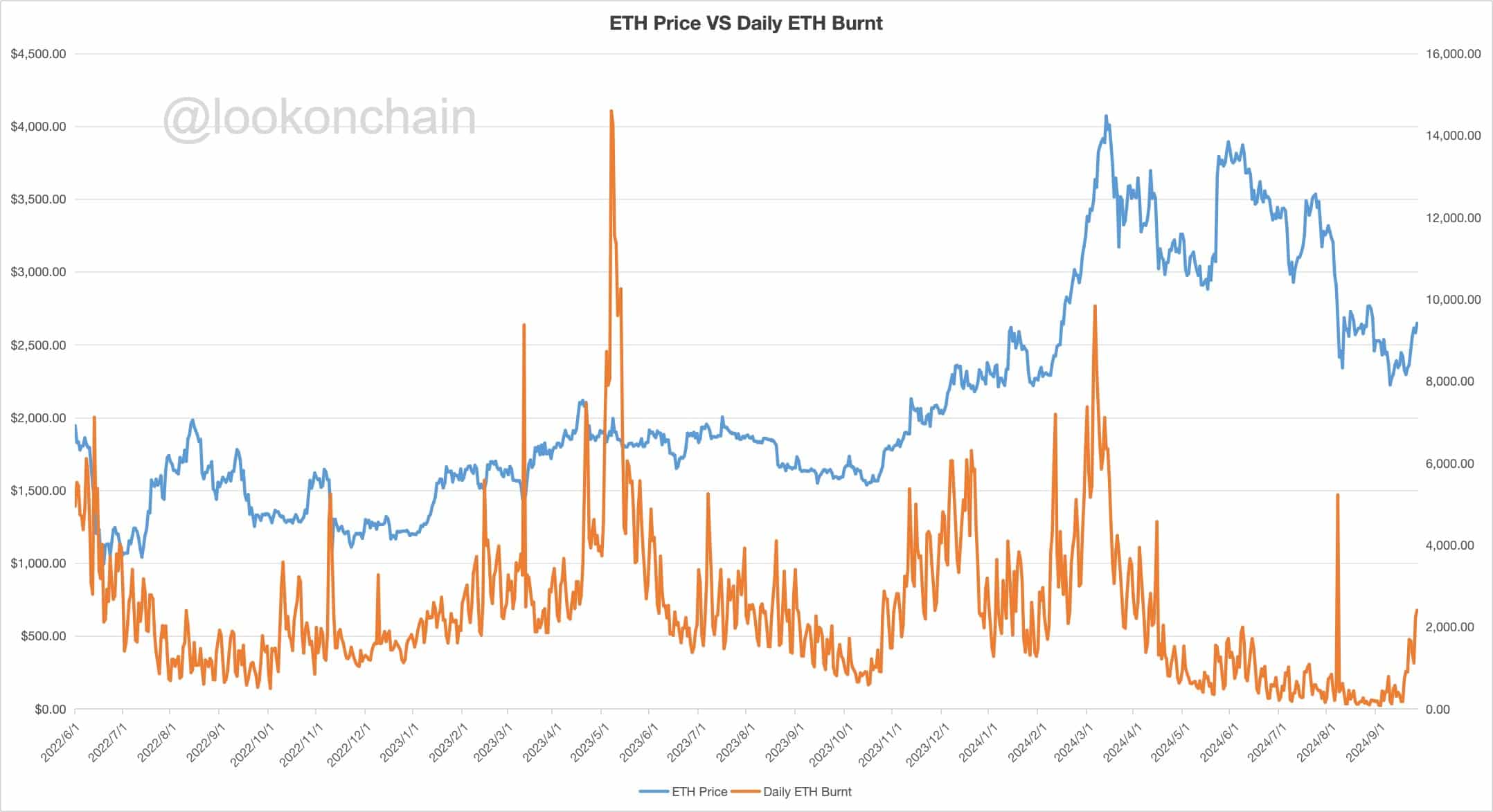

ETH burned day by day is rising

Moreover, the day by day quantity of ETH burned has elevated by 163% over the previous week, offering one other constructive sign for Ethereum’s future value.

The ETH value and day by day ETH burn chart present a transparent sample, with the quantity of ETH burned rising earlier than the worth rises in January and October 2023.

This burning of ETH reduces the entire provide, which may drive up the worth if demand stays secure. Because the burn fee will increase, the probability of the worth of ETH rising additionally will increase.

Learn Ethereum’s [ETH] Value forecast 2024–2025

Supply: Lookonchain

Regardless of present market dominance challenges, ETH’s sturdy efficiency at key technical ranges, whale exercise, and rising burn fee point out that Ethereum’s value will proceed to rise.

These elements level to a bullish future for ETH, though its market dominance could also be waning.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024