Ethereum

Ethereum dominance hits post-COVID lows: Is ETH losing to Bitcoin?

Credit : ambcrypto.com

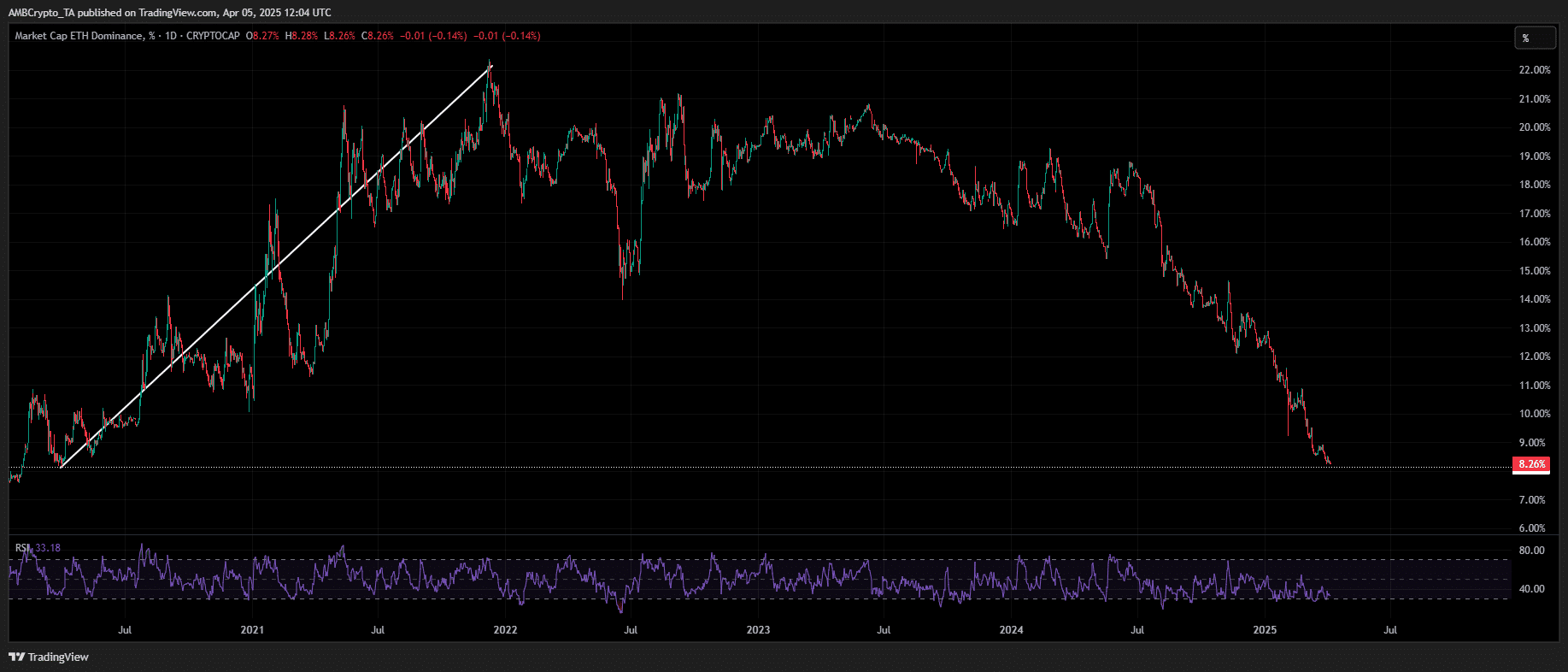

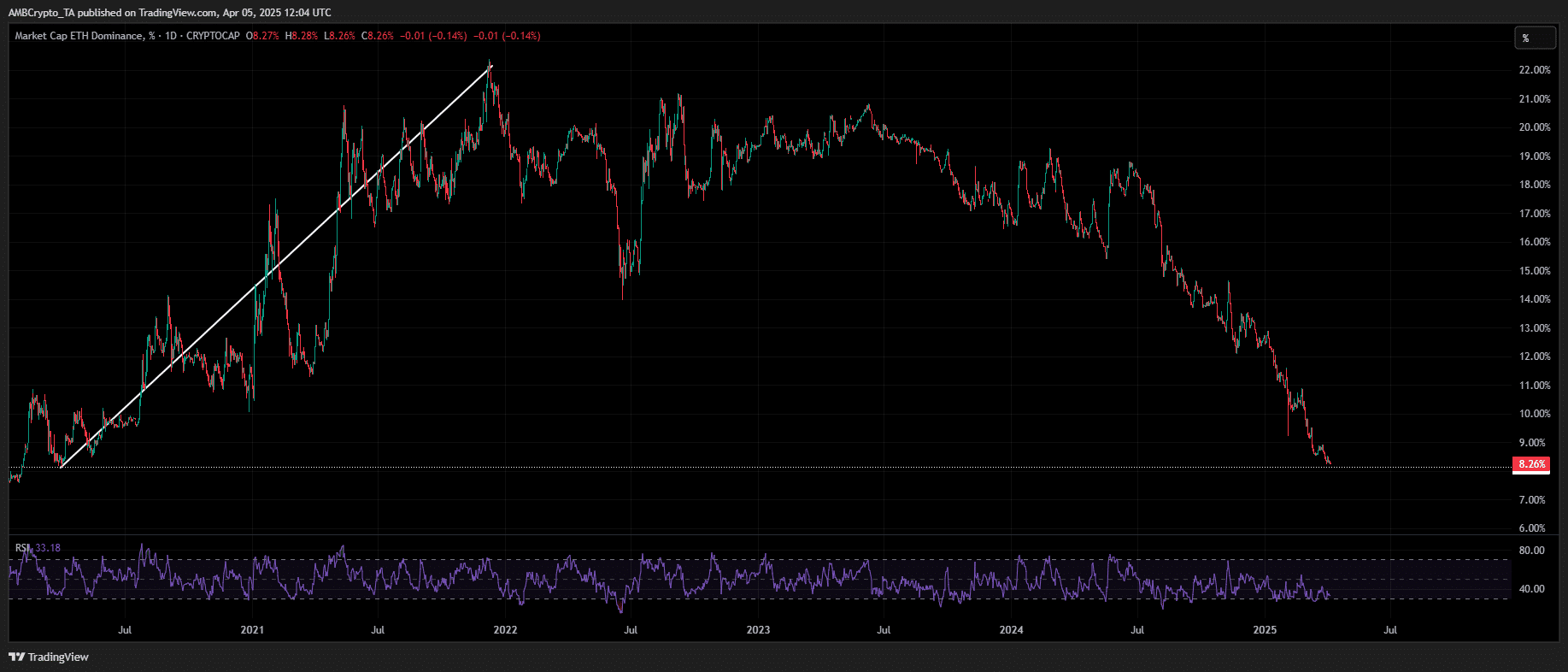

- Ethereum Dominance has collapsed right into a low of 5 years of 8%.

- The information from Ambcrypto present that the dominance of Ethereum has fallen since mid -2024, regardless of a bullish cycle.

Ethereum [ETH] emerged as one in all Q1’s largest high-cap underperformers.

Though his value lower in Focus stays, a extra worrying metric is its market dominance, which has fallen to a low -five -year low of 8%.

In reality, it’s the statistics that the degrees have witnessed who final witness in the course of the market cycle induced by COVID.

On the time, Eth Dominance organized a pointy Q2 restoration, which prompted a double digit foot to the bottom.

This time, nonetheless, essential technicalities are various RSI stays anchored in over-sold territory and can’t be reset regardless of ETH commerce at a lowest level in two years.

Supply: TradingView (ETH.D)

It’s clear that the risk-off sentiment from Ethereum stays elevated, suppressing new entry into the retail commerce and limiting the upward momentum. Given the present situations, a dominance shell of 2020 fashion appears unlikely.

Furthermore, a broader structural shift is evident, along with the statistics and technical chains.

Ambcryptos evaluation of the graph above emphasizes Ethereum’s persistent dominance-Close to pattern since mid-2024, regardless of a historic bullish macrocycle.

Vital catalysts-included post-ranging capital rotations, the Trump assembly and the three tariff reductions of the Federal Reserve-Hebben don’t ignite significant restoration.

Regardless of this metal wind, ETH closed the 12 months with a modest annual revenue of 47%.

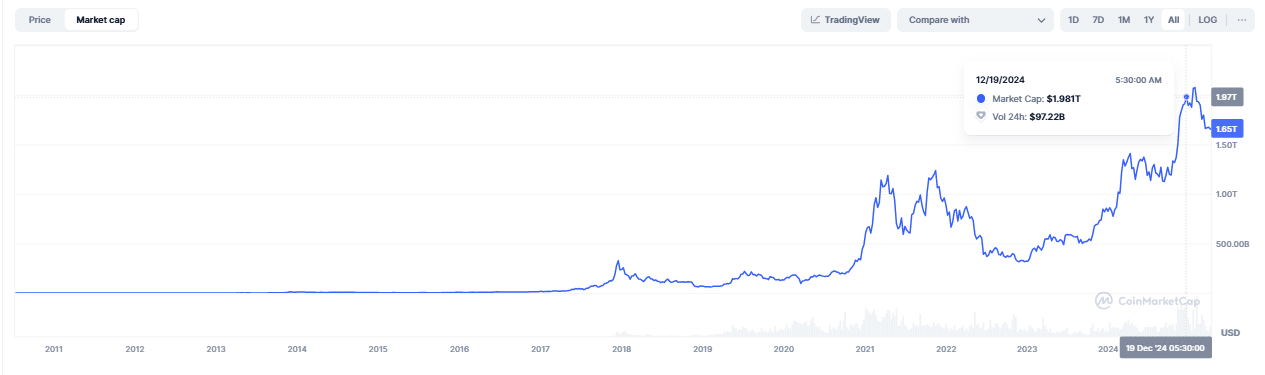

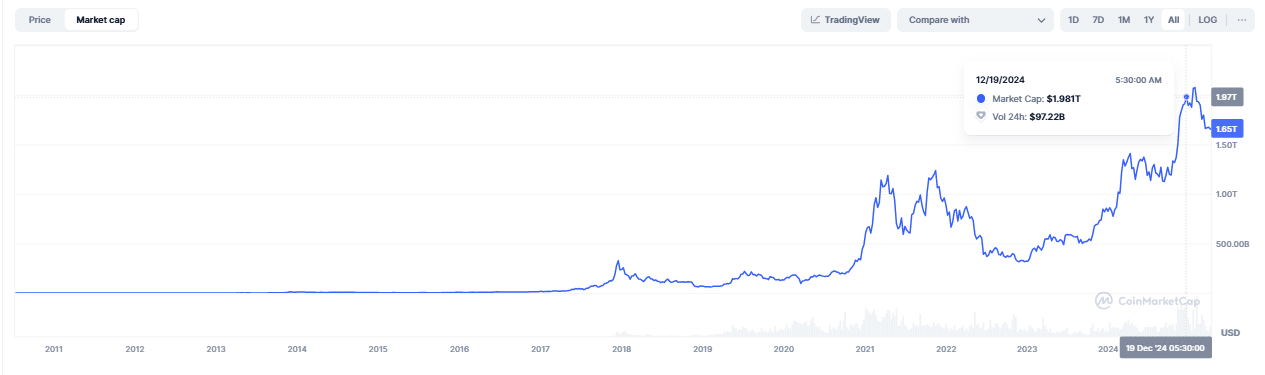

The dominance of the market, nonetheless, was eroded by 4%, withdrawing to 12% by This autumn 2024, which underlines on persistent “relative” weak spot towards wider market developments.

Ethereum -Dominance falls towards macro developments

Whereas the dominance of Ethereum was eroded in 2024, Bitcoin’s Market Dominance (BTC.D) rose from 54% to 61% towards the middle of the This autumn, which implies that the entire market capitalization of BTC for the primary time in historical past the entire market capitalization of $ 2 billion within the historical past of $ 2 biloth.

Supply: Coinmarketcap

This shift underlines the relative weak spot of ETH, powered by aggressive capital strotations in Bitcoin, fueled by macro-driven threat place and speculative precedence of a possible “Trump pump”.

A comparable imbalance of capital move has now been unfolded. The institutional demand for Bitcoin has been dominated since March, whereas ETFs proceed to flee, which signifies a weak conviction.

As macro insecurity will get deeper, institutional liquidity Will dictate market stability. Bitcoin more and more confirms its position as a risk-off belongings.

Within the meantime, Ethereum continues to lose the market share five-year dominance low in strengthening the story of persistent capital rotation away from ETH.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now