Altcoin

Ethereum Dominance rises as other altcoins deteriorate.

Credit : ambcrypto.com

- The dominance of Ethereum is rising whereas different altcoins proceed to battle.

- ETH nonetheless experiences robust downward stress and dangers a dip beneath $ 2K.

Since reaching a neighborhood spotlight of $ 3.7k firstly of January, Ethereum [ETH] has fallen significantly. After an outbreak of this downward pattern a month in the past, ETH was confronted with resistance at $ 2.8k, which led to a withdrawal.

Regardless of these struggles on its value charts, Cryptoonchain Has observed that ETH -Dominance has continued to rise.

Ethereum Dominance Progress continues

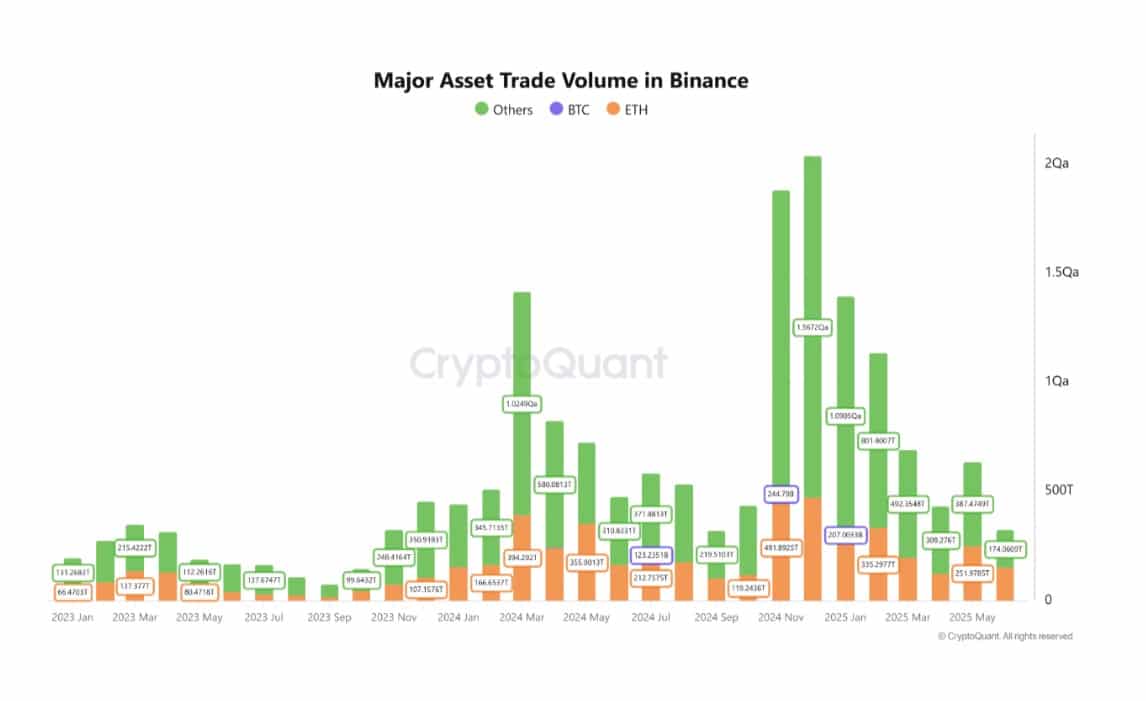

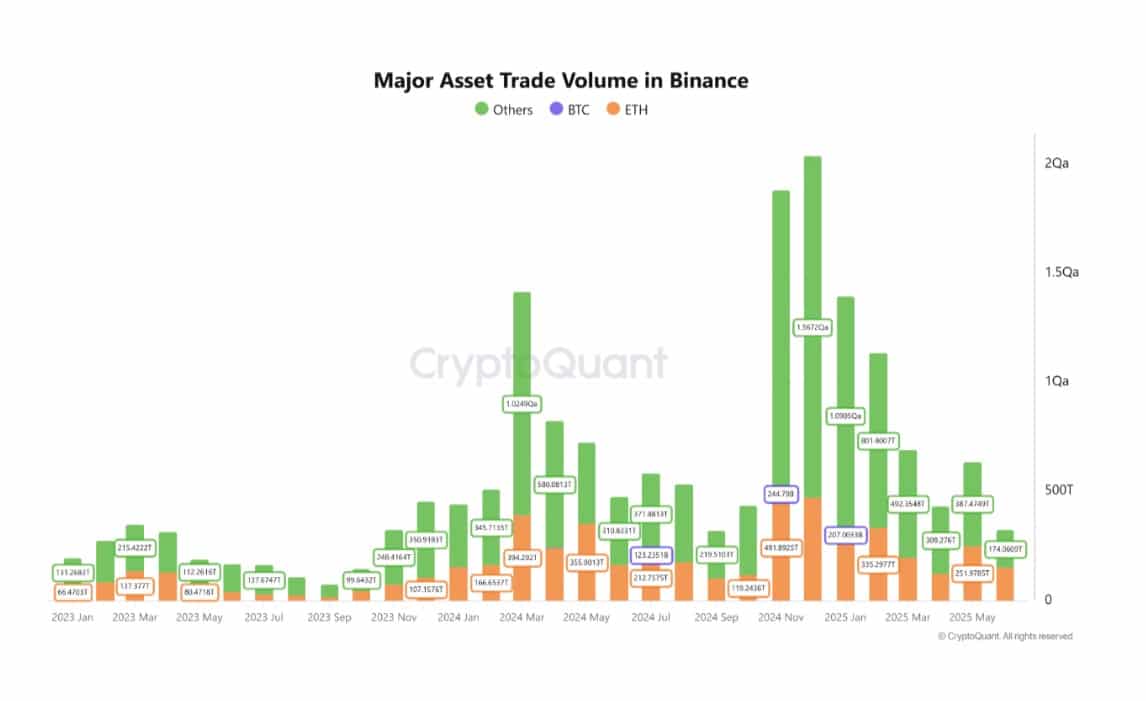

In response to Cryptoquant, Ethereum has established a substantial a part of the market on the premise of information from January to Might 2025.

This enhance in ETH -Dominance is especially powered by a big lower within the quantity of different altcoins.

Supply: Cryptuquant

In distinction to the expectations of the market, the commerce of Ethereum has not stimulated the current enhance. From 2024 to 2025, the commerce quantity of ETH remained comparatively steady, ranging between 300 trillion and 490 trillion.

Altcoin buying and selling quantity, however, peaked at 1,5672 quadrillion in November 2024, however fell sharply to 387.47 trillion in Might 2025. The share of Altcoin transactions fell from greater than 1 quadrillion to lower than 400 trillion, which mirrored a big deterioration.

This pattern means that traders get liquidity from dangerous tasks. A part of that capital appears to have been diverted to Ethereum, seen as a comparatively safer various.

Supply: Coinglass

That’s the reason the dominance of Ethereum just isn’t primarily the results of its progress, however slightly the retreat of his rivals. Though ETH just isn’t rising significantly, it stays very favorable in comparison with different smaller cash.

Once we take a look at the season index of Altcoin, it reveals that the entire Altcoin market has decreased. This metric has fallen from 88 to 12 between December 2024 and June 2025, which signifies a weakening Altcoin market.

Is there an impression on the ETH value motion?

Though the dominance of Ethereum has risen significantly, its progress has been problematic. Since then, the demand has problem maintaining with the market on the chain.

Supply: Santiment

On the time of the press, the NVT ratio rose from Ethereum to 1041, indicating a big overvaluation of the community.

Which means that the exercise on the chain is low in relation to the value, which means that the present ETH costs will not be supported by the natural demand.

Traditionally, such decoupling – the place the worth of the worth exceeds the precise community use – the sign market tops are sometimes and are adopted by corrections.

If this pattern continues, ETH can return to higher adapt to the actual demand, pointing to a speculative market atmosphere.

Regardless of the rising market dominance of Ethereum, lengthy -term holders are nonetheless in crimson.

The MVRV-Lang/quick distinction additionally remained adverse and has been the case within the final 4 months, which signifies persistent enter for ETH traders in the long run.

Supply: Santiment

A adverse worth right here means that holders have a better non-realized revenue within the quick time period than LTHS. For instance, those that acquired ETH between December 2024 and February 2025 are normally dropping.

Which means that, regardless of the rising affect, ETH doesn’t register vital steps to the profit, whereas different altcoins proceed to dive. Within the prevailing market situations, ETH appears to be overvalued and should return to satisfy the precise demand.

If a retrace comes ahead, we might see ETH fall beneath $ 2K. Nonetheless, if speculators proceed to maintain the market, Ethereum will proceed to get well and tries to reclaim $ 2.5k.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024