Ethereum

Ethereum drops, but whales scoop 540 mln ETH – Accumulating or exiting?

Credit : ambcrypto.com

- Whale Wallets raised holdings to 16.793 million ETH as a result of Change Netflows confirmed a robust enhance within the outflows.

- A USDT influx of $ 398 million and $ 540 million ETH outflow on the identical day sign aggressive repositioning by giant buyers.

Ethereum [ETH] Did to $ 2,492 and misplaced 3.73% in 24 hours, after a rejection close to the $ 2,800.

This pullback even unfolded when Walvisportfeuilles stepped on accumulation and Stablecoin influx enhance, pointing to strategic repositioning behind the scenes.

Nonetheless, sentiment within the quick time period stays fragile.

Whereas some merchants appear to go away with losses, exercise on chains exhibits strategic construction. This divergence creates uncertainty across the subsequent motion of ETH, as a result of necessary technical ranges come into play.

Doubling down or signaling LUTION?

Walvisportfeuilles with 10k-100k ETH have elevated their participations to 16.793 million ETH, which suggests a robust accumulation.

On the identical time, Change Netflows confirmed a pointy weekly peak of 84.22% in ETH outflows, which strengthened a bullish long-term picture.

Nonetheless, one whale not too long ago offered 10,543 ETH at $ 2,476, with a lack of $ 2 million in simply two days.

This lonely dump, though putting, doesn’t essentially undermine the broader accumulation pattern. That stated, it displays the fixed discomfort on a risky market.

Supply: Cryptuquant

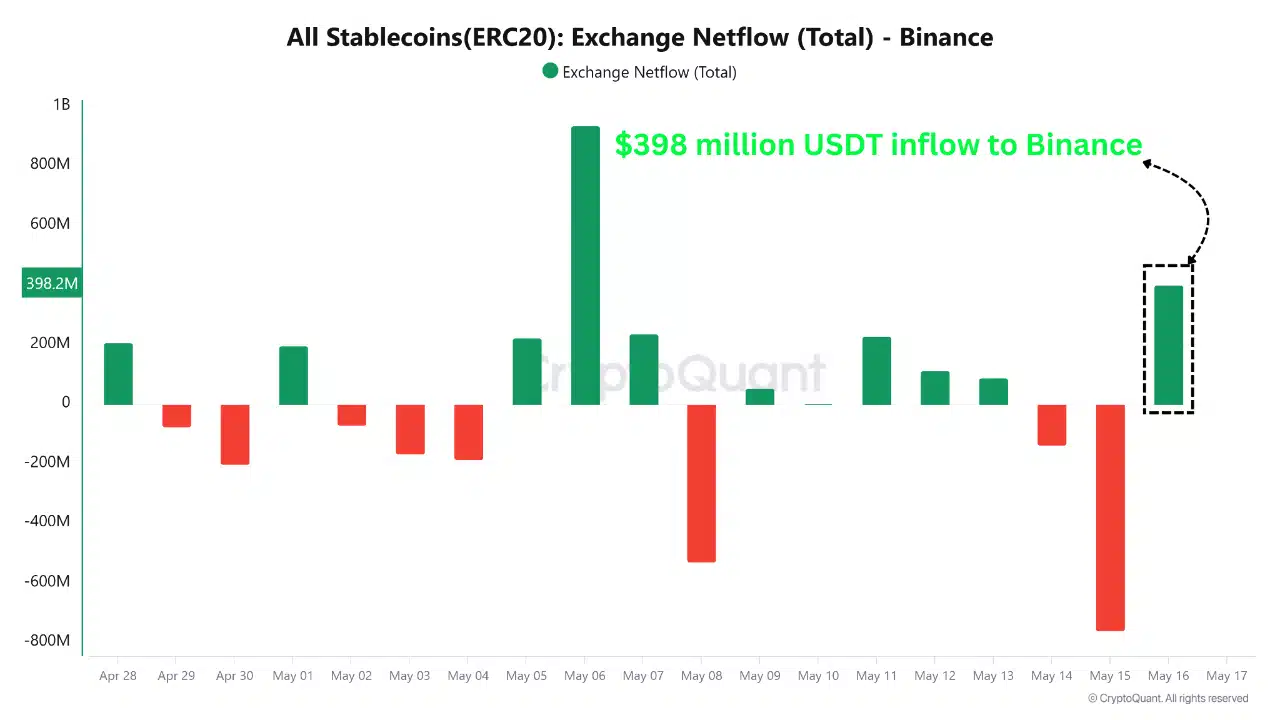

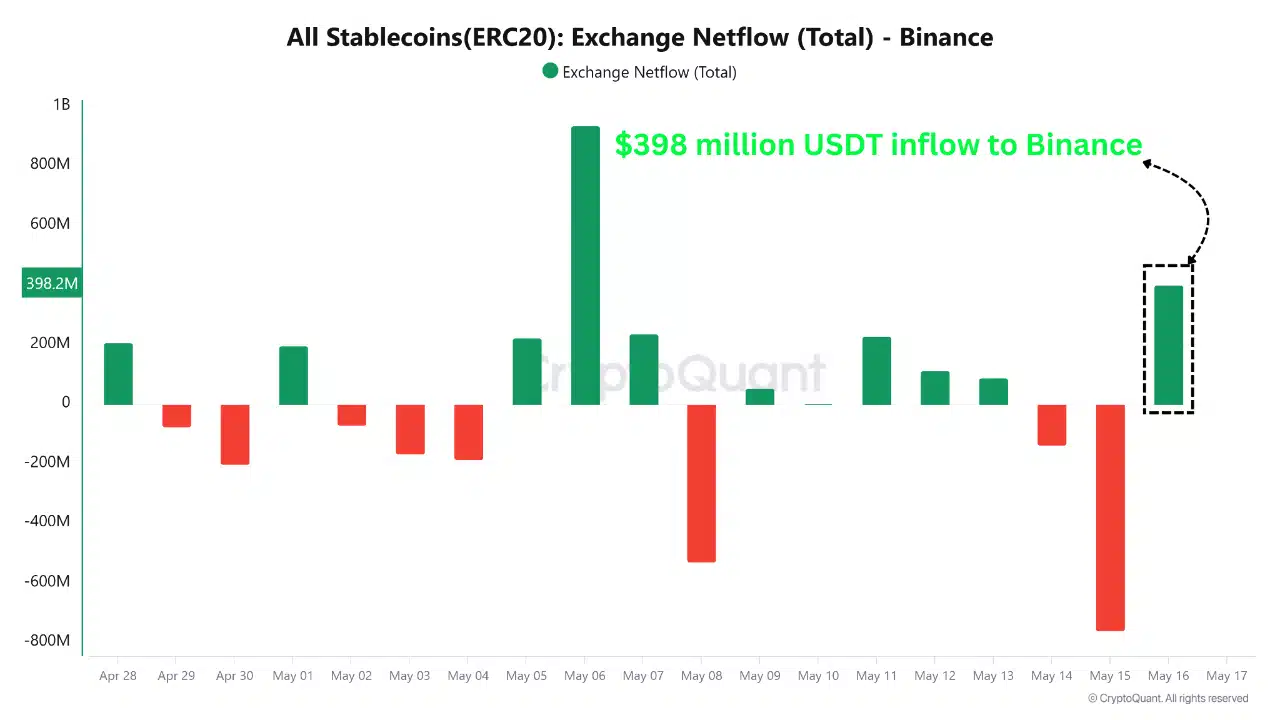

What does $ 398 million do in USDT and $ 540 million in ETH sign?

Knowledge on chains revealed an necessary shift: $ 398 million in Tether (USDT) flowing In Binance, whereas $ 540 million in ETH was withdrawn from centralized festivals on the identical day.

This marks the most important ETH-Netto withdrawal of someday because the starting of April, indicating that enormous holders will most likely transfer property to chilly storage or deployment environments.

Within the meantime, the large USDT influx means that whales arm with dry powder to gather extra ETH because it acts inside an noticed accumulation vary.

Supply: Cryptuquant

In fact this double motion refers to greater than coincidence. It means that whales circling with precision.

Extra customers come to a member of Ethereum, current customers cease

Apparently, the Ethereum community noticed a rise in new addresses of 18.73% final week. Nonetheless, energetic addresses fell by 3.18%, suggesting that current customers have withdrawn.

This divergence means that though the lengthy -term curiosity in Ethereum is rising, the dedication within the quick time period cools down.

Due to this fact, though new customers take part, current current might wait on the sidelines. This conduct is commonly seen throughout transition market phases when buyers hesitate earlier than the subsequent large transfer.

Supply: Intotheblock

Ethereum’s open curiosity drop With 3.29% to $ 16.02 billion, which emphasizes a discount in speculative positions.

Merchants appear to make Leveraged bets after the latest value rejection at $ 2,800. This decline displays the risk-off sentiment as volatility peaks.

Nonetheless, it may additionally point out that the market is reset, in order that weak arms are deleted earlier than the subsequent leg.

Is ETH Discovering Assist or Storage at necessary FIB ranges?

Ethereum not too long ago turned $ 2,629, tailor-made to the two,618 Fibonacci extension earlier than he withdrew.

The present value is floating close to $ 2,492, sitting between crucial assist and resistance zones. Stochastic RSI exhibits impartial momentum with values on 61.31 and 51.47.

That’s the reason ETH can consolidate earlier than a directional outbreak.

Value promotion round this FIB degree should be carefully seen. If bulls above $ 2,292 (FIB 1,618) retain, the upward continuation stays potential.

Supply: TradingView

Regardless of as we speak’s lower, Ethereum exhibits robust whale assist and rising stablecoin influx. Though the quick -term volatility has brought on insulated outputs, broader statistics point out accumulation.

If consumers defend the present ranges, a rebound to $ 2,800 stays potential.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now