Altcoin

Ethereum drops more than 10% – Can ETH contain the $ 2,000 line?

Credit : ambcrypto.com

- The worth of Ethereum drops 10.40%, virtually $ 2,000 assist, whereas whales accumulate 330,000 ETH, which alerts a possible rebound.

- The subsequent motion is dependent upon holding on to this degree; A breakdown may cause additional liquidations

Ethereum [ETH] Caught in a bearish spiral, has dropped 10.40% final week and the essential degree of assist of $ 2,000 is approaching.

The final lower of 10.40% has expressed concern amongst buyers, as a result of macro-economic strain and market-wide sale proceed to weigh on belongings.

Whereas merchants go away their positions within the quick time period, massive Ethereumwalfissen have chosen a counter -approach, which implies that 330,000 ETH is collected in simply 48 hours.

This divergence between value motion and whale habits raises an vital query – are we witness from the beginning of a deeper correction, or is that this a strategic battery part for a possible rebound?

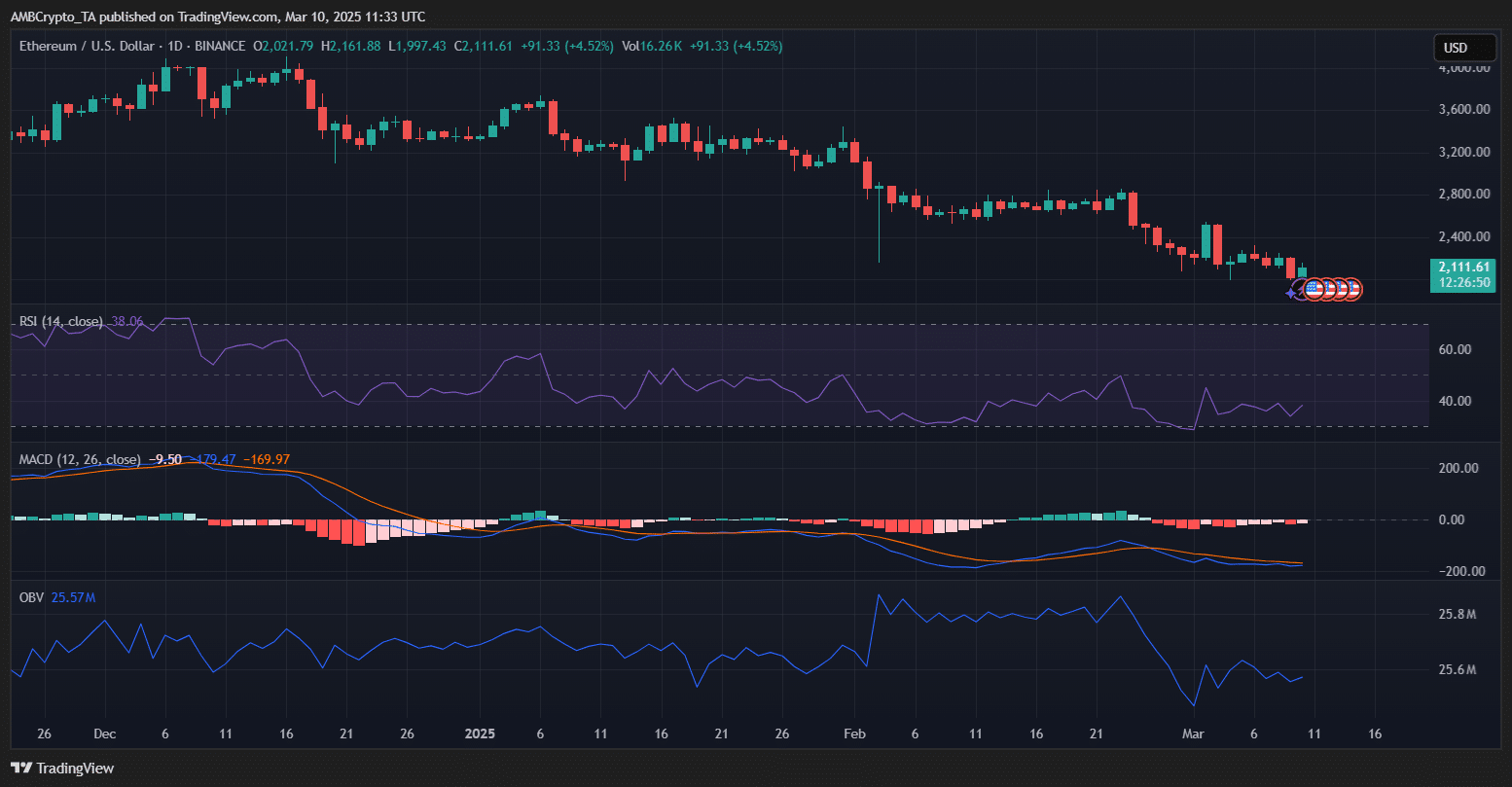

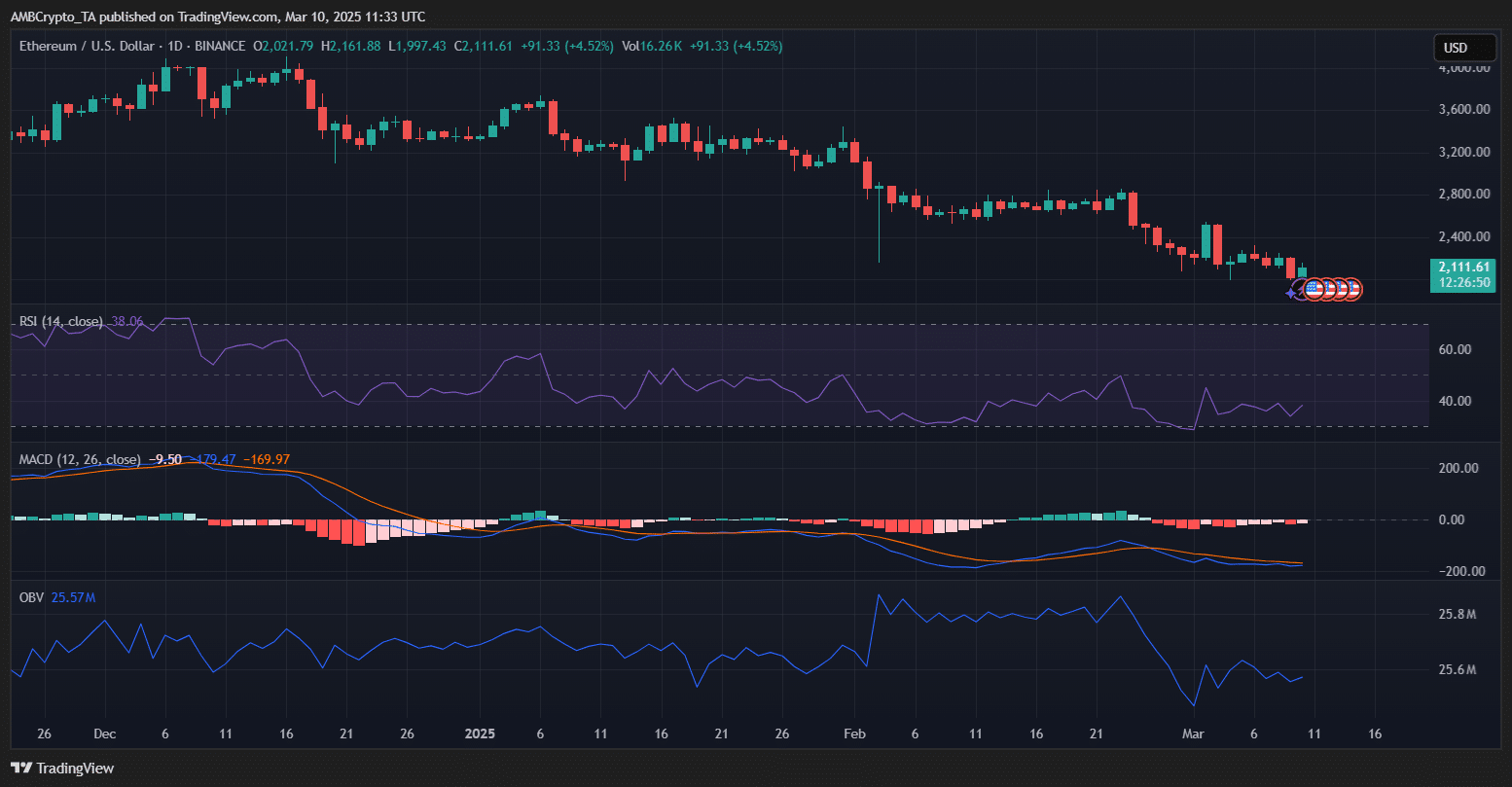

Ethereum value views and vital ranges

The latest weekly lower of 10.40% of Ethereum is mirrored in vital technical indicators that sign Bearish Momentum.

The RSI was at 38.06 on the time of the press, which is approaching the over -sold space, which means that the gross sales strain was dominant, however might come up a possible reversal if consumers withdraw.

Supply: TradingView

The MACD indicator remained in a adverse space, with the MACD line at -9.50 and the sign line beneath zero, which strengthens the fixed bearish pattern.

Furthermore, the BBV confirmed a slight lower, which signifies diminished buy exercise and a weaker demand.

Ethereum should include the assist degree of $ 2,000, as a result of knowledge from the previous means that shedding this zone might activate the activations of trials.

Nevertheless, if consumers profit from the present whale recording, a restoration to $ 2,200 may be attainable.

Whale accumulation: an indication of belief or warning?

The worth of Ethereum has fallen significantly, Yet data reveals in chains These massive holders have collected 330,000 ETH for the previous 48 hours.

There’s a sturdy enhance within the stability of portfolios with greater than 100,000 ETH, which signifies strategic purchases by buyers with a deep bag.

Supply: X

These main gamers may be establishments, lengthy -term holders or market makers who place themselves for potential value fluctuations.

The timing means that whales could purchase the dip, count on a restoration or cowl towards additional volatility.

Traditionally, such whale accumulation preceded value rebounds, however with Ethereum floating across the crucial degree of $ 2,000, the following step will rely upon whether or not shopping for strain maintains or forcing broader market circumstances a unique leg.

On-chain statistics and market sentiment

Supply: Cryptuquant

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now