Ethereum

Ethereum ETF records $84.6M weekly inflow, but trails Bitcoin

Credit : ambcrypto.com

- Ethereum ETFs noticed inflows of $84.6 million, however nonetheless lag far behind Bitcoin ETF inflows.

- Regardless of worth declines, Ethereum remained above its 50-day shifting common, indicating near-term bullish momentum.

The Ethereum [ETH] In keeping with latest knowledge, ETFs have skilled the most important inflows in additional than a month.

Regardless of this, ETH ETF inflows nonetheless lag considerably behind Bitcoin[BTC]reflecting a stronger choice for Bitcoin ETFs.

First weekly inflow since August

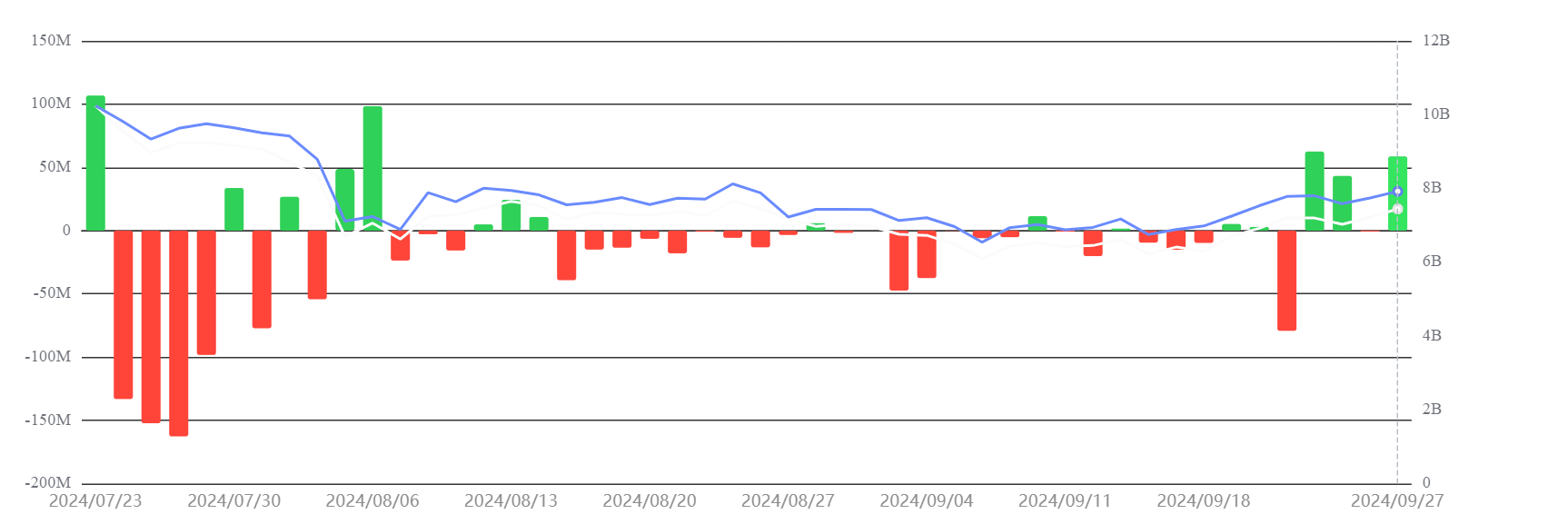

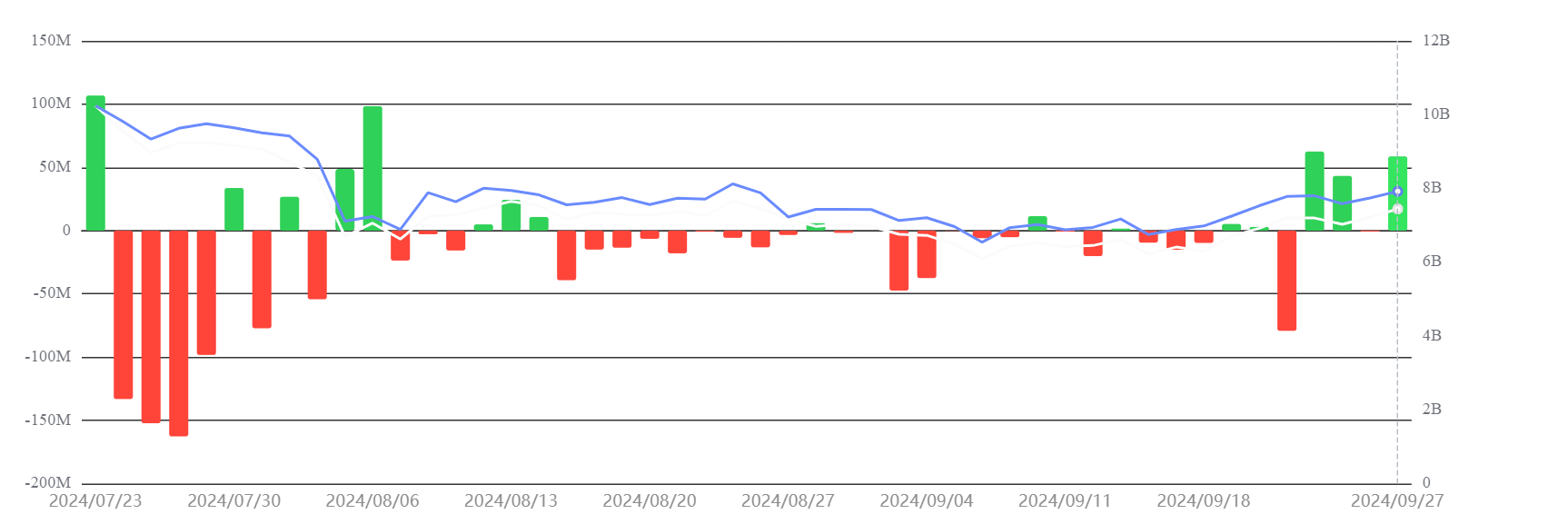

Information from SosoValue reveals that Ethereum ETFs noticed inflows of over $84.6 million final week, with constructive inflows recorded on three out of 5 buying and selling days.

That is the best weekly influx since August 9. Nonetheless, regardless of this development, Ethereum ETF volumes stay nicely beneath Bitcoin ETF efficiency.

Supply: SosoValue

By comparability, Bitcoin ETFs recorded a whopping $1.11 billion in inflows in the identical week, with inflows occurring daily.

This was the most important weekly Bitcoin influx since July 19.

Ethereum ETF nonetheless lags behind Bitcoin

The Ethereum ETFs started buying and selling within the US on July 23, about six months after Bitcoin ETFs.

Within the 5 weeks following the launch of Ethereum ETFs, the funds noticed web outflows of roughly $500 million, whereas Bitcoin ETFs recorded web inflows of greater than $5 billion.

Bitcoin’s first mover benefit is likely one of the causes for this disparity.

The joy surrounding Bitcoin’s ETF launch has generated important inflows, whereas ETH’s ETF launch, whereas promising, has generated much less buzz over time.

Moreover, the worth distinction between the 2 property comes into play: Bitcoin owns greater than 50% of the crypto market cap, whereas Ethereum holds about 14%.

The ETH worth drops as September ends

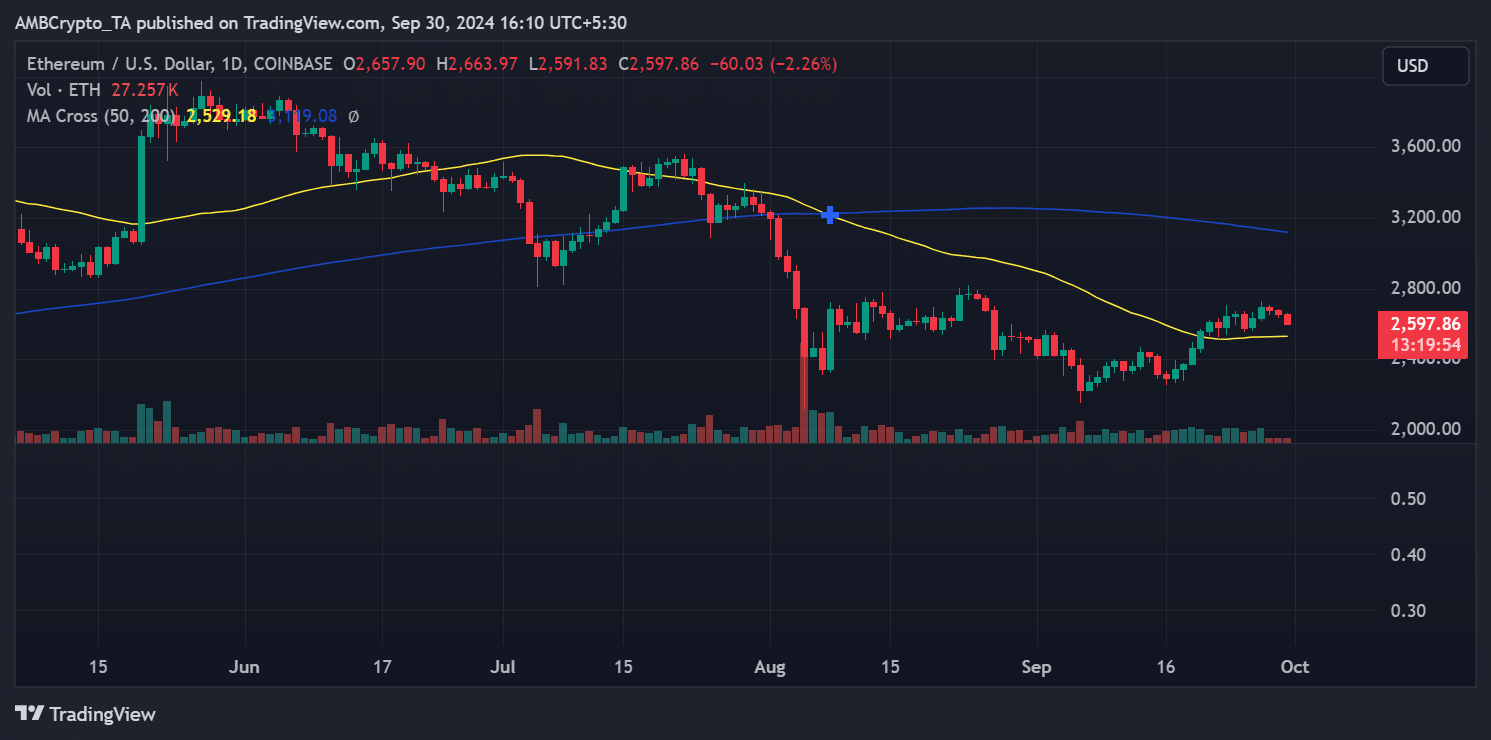

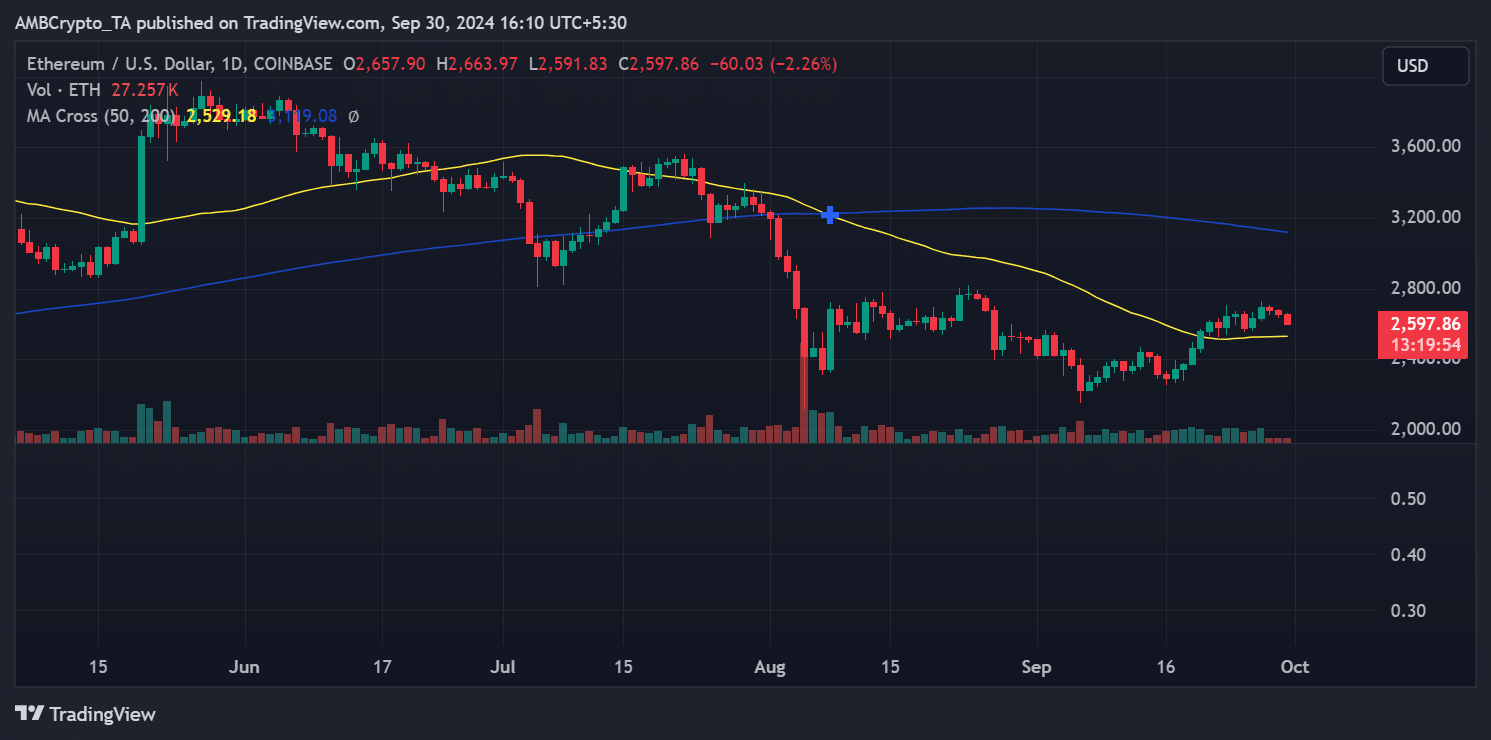

In latest days, the worth of Ethereum has fallen beneath the $2,600 stage.

On the time of writing, Ethereum was buying and selling round $2,597, down greater than 2%. Regardless of the decline, ETH stays above its 50-day shifting common, indicating a near-term bullish development.

Supply: TradingView

The Relative Energy Index (RSI) stood at round 53, reinforcing the bullish outlook of the shifting common.

Life like or not, right here is the ETH market cap by way of BTC

Whereas the Ethereum ETF has seen notable inflows after a sluggish interval, it continues to lag far behind Bitcoin ETFs by way of quantity and investor curiosity.

Components equivalent to Bitcoin’s first mover benefit and market dominance play a key function on this development. Regardless of the latest worth declines, Ethereum stays in a bullish place and stays above key technical indicators.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now